Arete's Observations 11/6/20

Market observations

Through the twists and turns of election night, the narratives implied by futures markets changed three times. First was the narrative of the “Blue wave”, a Democratic sweep, which would presumably lead to a massive fiscal stimulus plan.

When those expectations were dashed, the market quickly moved to a new theme which involved a Trump win and a nearly split Senate. This was interpreted fairly positively as it would imply status quo and no big changes.

When those expectations were dashed, it became apparent that Democrats would not seize control of the Senate, but the race for president was too close to call. Since it would take time to count votes, uncertainty would prevail for some time. No need to worry though. Although a divided government would be handcuffed from producing significant policy responses, the Fed can be expected to step in to provide liquidity.

I think two things can be safely assumed. One is that a narrative can be developed to cast any situation in a positive light. Narrative is different than reality, however. The second is there is astonishingly little tolerance for anything that might be perceived as negative news.

Economy

One of the issues that has been conveniently glossed over since the pandemic first hit is how moratoriums on paying rent will get resolved. Moratoriums were a way of hitting the “pause” button and now it is about to be restarted.

To be sure, this is not universally bad news. About half of renters are in good shape for making payments and it is certainly a good thing for landlords that rents will resume. Further, many of the remaining renters will either find a way to make rental payments or negotiate rent to a more manageable level.

That still leaves a lot of renters who will likely be evicted. Taking a conservative estimate of 10% likely to be evicted on a total of 54 million renters leaves a total of over 5 million who will be forced out of their current home.

For one, that’s a lot of people. For another, it is likely to happen in a relatively short period of time. For another, the likely eviction rates are especially high in the populous states of New York and Texas. And finally, this is likely to be very disruptive for the people involved, for their families, for their employers, and for their friends and communities.

Mortgage industry

Safe as houses on a faultline

https://www.ft.com/content/b57dab33-efc9-4fab-8589-1b1caa144bee

“Thanks to the miracle of election year politics, Democrats and Republicans united around good-stuff-now-bad-stuff-later. Cheap Fed money, ‘forbearance’ for distressed voters, any reforms to be arranged after . . . after . . . by the next Congress. The agreed ‘Cares Act’ intended as a bridge from the pandemic to just past the election had a lot of defects from the mortgage industry’s point of view.”

“He says most mortgage servicers used that time window from prepayments and mortgage pay-offs to fund P & I advances. ‘This money, however, belongs to bondholders, and as a result (mortgage bankers) may need to use cash, including borrowing under warehouse lines (with banks) and bond debt to make the payments required under servicing operations’.”

I find this report by John Dizard interesting for a couple of reasons. One is it provides an unusually clear view into the mortgage industry. Apparently, “the mortgage banks have booked enormous six month profits, but could have many months, or even years, of drains on cash.” This explains why there were several IPOs through the summer and also why the last two have delayed IPO plans due to “market conditions”.

It is also interesting because it is an apt metaphor for many industries: good-stuff-now-bad-stuff-later. Now that the election is over, the bad stuff will need to be dealt with. The big policy decision earlier in the year was that problems could be forestalled until later in the year after the pandemic had faded. Now those costs are coming due … and the pandemic hasn’t faded.

China

In a beautiful play of the news cycle, China managed to sneak the major scoop of Ant’s aborted IPO in under the cover of US election chaos. As John Thornhill describes in the Financial Times, Ant is a significant force in finance. Not only is it “one of the world’s most dynamic digital finance companies”, but “Ant’s indicative market valuation of about $300bn had put it roughly on a par with the venerable JPMorgan Chase.”

The fact that the trajectory of such a prominent company can be altered so quickly and so definitively also reveals “both how capitalist China has become and how Communist it remains.” Buyer beware.

Government finance

Treasury Presentation to TBAC, Fiscal Year 2020 Q3 Report

https://home.treasury.gov/system/files/221/TreasuryPresentationToTBACQ32020.pdf

“Through Q3 FY2020, overall receipts totaled $2,260 billion, reflecting a decrease of $351 billion (13%) on a calendar-adjusted basis compared to the same period last year due largely to the extension of tax deadlines until July.”

“Through Q3 FY2020, overall outlays were $5,004 billion, reflecting an increase of $1,648 billion (49%) over the comparable period last year.”

The first point on this is fairly self-evident: The government is hugely outspending revenues. Not only is the deficit through Q3 $2.7 trillion, but the deficit is greater than revenues year-to-date. If this were a company, you would view the operating results as extremely unfavorable.

Another point is that this blunt analysis can be revealing. Numbers in the media often get distorted and massaged in order to justify narratives about the meaning of the numbers. There are no such illusions in the report, just the facts. Since the report is easily and freely available, it can be a useful source of insight into government finances.

Finally, because the TBAC is comprised of senior executives from major finance firms, its reports often reveal clues as to imminent problems and potential solutions. While this often involves some “reading of the tea leaves”, it can provide unique and fairly unbiased insights.

Politics

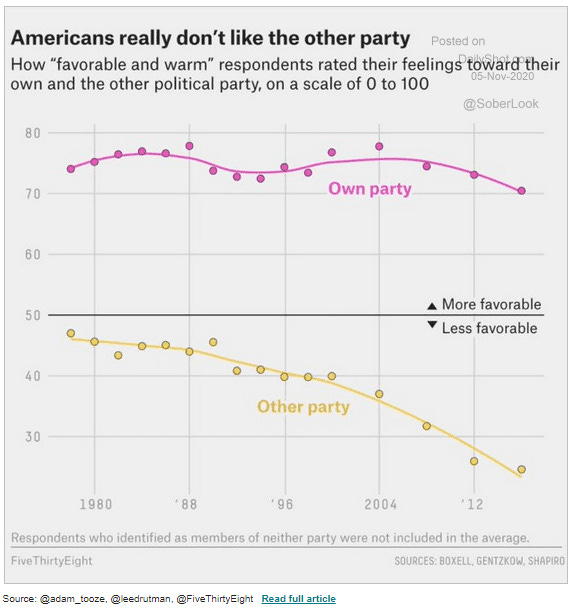

While I am sure most people are glad to have the election behind us, it did provide a reflection on our society that is revealing. One thing we learned is the polls did not have a good read on the election. Another thing we learned is the country is extremely divided. This division is captured well by the following chart. As it illustrates, members of a political party “really don’t like the other party.”

The evidence of increasing animosity can be seen everywhere but especially on social media. The tweet below highlights this by characterizing votes for Trump as a collective “we hate you” aimed at progressives. Of course, plenty of Biden votes were cast with similar sentiments. Regardless, the main point is that many people voted against something they hated rather than for something they really believed in.

I find the political divisiveness and the acrimony that often accompanies it fascinating if somewhat depressing. Why does this happen when it so obviously undermines the ability of a society to make good decisions? For those who share the same curiosity, I would strongly recommend the book The Righteous Mind by Jonathan Haidt and a whole series of articles from Epsilon Theory starting with Things Fall Apart.

One thought that strikes me is I wonder if the increasing divisiveness is related to the poor performance of the polls? Could it be that many Trump supporters have such disdain for “mainstream media” that pollsters cannot access them through normal channels? Could it be that sources of information and channels of communication are also cleaving and becoming more specific to political affiliation? If so, it would explain much of the growing gap between opposite sides of the political spectrum. It is worse than people talking past each other; they are having entirely different conversations.

For now, anyway, it is fair to conclude that the election was a rejection of the extremes of both parties. The majority of Americans did not want more Trump, but nor did they want a wave of progressivism.

Demographics and leadership

The Big Succession

https://diff.substack.com/p/the-big-succession

“We’re living at the end of an aging sonic boom, when one-time increases in life expectancy kept some people around and in power for a decade or more longer than they historically would have lasted.”

Byrne Hobart raises an interesting twist to the discussion about generational differences: one-time increases in life expectancy are forestalling generational transition. Whether in business, politics, or other arenas, X-ers and Millennials have had to wait much longer to succeed forebears and gain power and authority.

My hypothesis is the one-time delay in succession is exacerbating generational differences. Those delays forestall the changes in representation that can better reflect changes in priorities and changes in values. As a result, I think it is fair to expect change to happen faster and more dramatically.

A good example from the political realm is gay marriage. The issue was a non-starter for years and years and then, boom, it was done. The underlying change in social mores was stronger and more persistent than what had been reflected in public policy.

This dynamic is being reflected in trends like climate change, ESG, and a host of other popular topics. It will be interesting to observe when these things gain real traction and the degree to which they do.

Capital markets

Putting Passive Flows to Work in a Portfolio, Dan McMurtrie and Mike Green on Realvision

“And I actually think that this is-- the flows dynamic has become a dominant factor, not a secondary factor. And I think that's where everybody is kind of behind.”

“And so one of the things that happens here is that as you go more into value that is asset-oriented, book value ratios and things like that, you start to have greater and greater agency costs. Because why is a CEO-- if there is a coal mine that actually is worth all this money, and it's trading in this little equity stub, and the CEO makes 800 grand a year, why would he allow public market investors who have abandoned him to inherit all this money, versus call a guy at BlackRock or Blackstone-- sorry, Blackstone-- and do an SPV, and buy it, or do something else?”

The first half of this interview is about getting into the investment business, but the second half discusses the intersection of fundamental analysis, value investing, and markets that are dominated by passive flows.

The first point is that the dynamic of fund flows has progressed from an important and useful factor to become the “dominant factor” in determining returns. This isn’t to say that valuation and fundamental work aren’t useful, it’s just that those functions now take a back seat. This idea is hard and unpalatable to digest for investors who grew up in a different landscape – and I include myself in that category. The evidence is powerful, however, and McMurtrie makes a good point.

The second point highlights an important implication of the flows thesis which is that it obviates the reason for a lot of “value” companies to remain public. This is an excellent point and one I touched on in a blog post just over a year ago. In that post I pondered the question, “What if public stocks have become the detritus of the investment world?” You either get growth stocks priced far beyond reasonable growth potential or you get value stocks that no private buyer wants.

McMurtrie is right to raise these questions and is also right to challenge what value investing really means in this environment.

Implications for investment strategy

As I have mentioned several times now, the flow of money into passive funds is increasingly dominating market behavior. Because the flows are largely systemic, it is fair to expect the ongoing upward pressure on prices to persist until something upsets the balance.

What could cause selling pressure to overwhelm the constant drum of inflows to passives? Unemployment is one possibility, especially if it happens in more senior positions with people who have 401(k) plans. Once the job goes, so go the regular contributions. I have also mentioned minimum required distributions for IRAs which will become a progressively bigger factor as more baby boomers hit their early 70s.

The chart below provides yet another possibility. As unemployment persists, a new round of layoffs ensues, and pandemic relief benefits expire for 14 million people at the end of the year, many people are losing their source of income and instead must sell assets to cover their regular operating expenses. IRAs not only constitute such assets but are also generally comprised of liquid assets that can easily be sold. One more thing to look out for.

A divided electorate spells trouble for the US economy

https://www.ft.com/content/bad0c75d-24dc-4d3a-9f19-6cecfef4fb50

“The 2020 election has confirmed that the US remains a deeply divided country facing mounting challenges that threaten both this and future generations. Despite a collective wake-up call in the form of a severe health and economic crisis, the country seems both unwilling and unable to embark on the decisive measures needed.”

“What is at risk here is not just the longer-term oriented reforms seeking to limit another move down in productivity, yet more household economic insecurity, and a worsening in inequality. Also at risk is the short-term health and economic effort to help the nation recover from the considerable damage that the first Covid-19 wave left in its wake.”

The most overwhelming sense I had the morning after the election was just how deeply divided the country is. El-Erian articulates these sentiments well and also captures the important implications.

One implication is that division makes it harder to achieve or even address long-term objectives like increasing economic growth, reducing inequality, and increasing competitiveness. In addition, those divisions also make it harder to accomplish even short-term goals like managing Covid-19 and returning to the pre-pandemic economic trajectory.

El-Erian, concludes, and I believe rightly, “but the risk of economic and financial disruptions is rising considerably.” Nonetheless, strong market returns immediately after the election suggest these challenges are not being priced into stocks. While it is hard to anticipate what might cause this to change, it does not present an attractive opportunity for long-term investors.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, Areté’s Takes are designed to show both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.