Arete's Observations 1/29/21

Market observations

Normally I use this section to highlight some peculiarity that says something about the market. With the non-stop drama of GME over the last week being more exciting than anything on Netflix, however, I’m going to expand the section this week. What is happening says a lot about the market – but also a lot about society in general.

Reddit traders look to pummel Wall Street's old guard

“A sign of the mania: GameStop, which has emerged as the poster child for the Reddit options trading frenzy. Its stock was halted nine separate times by the New York Stock Exchange because of outsized volatility.”

“GameStop ‘represents nothing more than the gamification of Wall St by tech firms that make 'trading' so available., its [sic] shameful....but they all need to get burnt so that they learn what they don't know,’ long-time equity broker Kenny Polcari tweeted.”

There are a number of things interesting about the trading in GME (and other stocks) beyond the “really crazy behavior” Jeremy Grantham uses to identify bubbles.

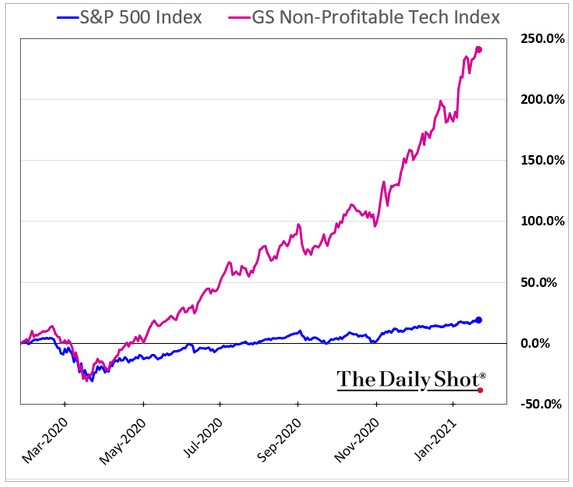

For one, not only are traditional metrics like valuation ignored, but such metrics are actively derided and often targeted. For example, the best performance has occurred among tech stocks with no profits.

Further, the greatest interest among aggressive individual investors, as evidenced by the biggest increases in call option activity, have been among stocks with high momentum, high volatility, and high short interest. In short, investment merits are being mocked.

So, it is fair to say, this market behavior is about way more than the ebullience of individual investors.

Interestingly, a great deal is revealed about the sentiments and motivations for such activity in social media threads. A great place to get some background is the report, “What is off-Wall-Street and off-off-Wall-Street?” by Brent X. Donnelly on the Epsilon Theory website.

While there is plenty of material to choose from, the subject of cryptocurrencies seems to trigger some of the greatest passion. A couple of the more moderate posts on the subject are listed below and clearly reveal many of the underlying sentiments:

Source: Twitter

Several things become immediately apparent. There is an enormous amount of anger. There is a generational war being waged. There is severe disaffection. There is virtually no desire to have a conversation about it. It is better to be pure of belief than to be correct. There is little room for those who may be sympathetic or even supportive.

These investors are aggressive, often act in concert, and often attack those who disagree with them. With the insurrection at the Capitol being so recent, it is hard not to see the many parallels in behavior and beliefs. Indeed, John Authers noted that some are now dubbing the short squeeze on GME the “French Revolution of finance”.

There are plenty of other parallels too, but what ties them all together is the distinctively political motivations behind the trading. As the following comment highlights, this extraordinary market activity is at least as much political as it is financial …

Source: Twitter

Implications for investment strategy

In an important sense, it is refreshing to see “little guy” retail traders taking on institutional hedge funds and winning. I think it is also refreshing to see people who were especially affected by the mismanagement of the 2008 financial crisis find a voice and protest.

I also don’t have any problems at all that much of this is being laid at the feet of the Fed. The Fed has gone out of its way to create a landscape in which very aggressive trading can blossom and it shouldn’t be any surprise at all that they have succeeded …

How GameStop exposed the market

https://www.axios.com/stock-market-gamestop-reddit-exposed-d7eb06e2-f6c7-4aa8-99d7-24a51df27fa9.html

The Fed "has created space and created a comfort level for market participants to be aggressive in their actions and they’re being aggressive in their actions."

This assessment came from Vincent Reinhart, Chief Economist for BNY Mellon Asset Management (and staffer at the Fed and husband of Carmen Reinhart who co-authored the book, “This time is different”). He is right and certainly brings to mind Minsky’s hypothesis that stability breeds instability. Now we are seeing it. This presents a nontrivial problem for the Fed: Aggressive and unpredictable trading will vastly complicate policy making.

The implications are far broader than just making things harder on the Fed, though. The targeting of GME, for example, was based on the prevalence of short positions and against any notion of thoughtful investment analysis. As a result, the trading actions that induced the short squeeze have more than a whiff of vigilante justice.

The problem with vigilante justice, of course, is that what counts as justice is defined by the vigilantes. If their sense of justice is different from others’, or from society as a whole, then they are just a gang riding the Wild West. Worse, once they (figuratively) get some blood on their hands, they may acquire a taste for it and become more violent.

This obviously has consequences for others. For example, it probably doesn’t feel nearly as safe traipsing around the markets alone right now. In fact, many short sellers are recognizing the risk and substantially reducing positions. In a broader sense, higher uncertainty leads to higher volatility which leads to lower participation. None of this is good for markets. For better and worse the unusual market behavior fits neatly into the broader political environment …

The American republic’s near-death experience ($)

https://www.ft.com/content/c085e962-f27c-4c34-a0f1-5cf2bd813fbc

“As Yale's Timothy Snyder asserts: "Post-truth is pre-fascism, and Trump has been our post-truth president." If truth is subjective, force must decide. There can then be no true democracy, only gangs of rival thugs or the boss's dominant gang.”

Coronavirus

Vaccines have been oversold as the pandemic exit strategy ($)

https://www.ft.com/content/17c44c96-39f2-4ada-badd-d65815b0a521

“We had an open discussion in the group recently about why these variants were emerging independently in so many places,” Prof de Oliveira says. “We noticed a common factor about London, the Eastern Cape [South Africa] and Manaus [Brazil], where these three variants appeared: they were very heavily affected in the first wave of infection.”

“That first wave, the hypothesis goes, produced lots of people with antibodies that then gradually declined over time. In the second wave, some previously infected individuals who re-encountered the virus lacked sufficiently potent immunity to prevent reinfection or kill the virus quickly. In effect, Prof de Oliveira says, a person with waning natural immunity might play the same role as an immunocompromised patient.”

“That means not just vaccinating but fast testing, accurate and quick contact tracing, quarantine and isolation. In short, vaccination must go hand-in-hand with virus suppression, not become a substitute for it. A successful vaccine rollout will count for little if the country then becomes a crucible for resistant variants.”

Partly this is an interesting science story. There does seem to be a pattern behind the emergence of variants to the coronavirus. Partly too, this is a warning about viewing the coronavirus threat too simplistically.

I have mentioned before, and I am sure others have noticed as well, the tendency of many people to treat coronavirus safeguards as interchangeable rather than as incremental components of an ensemble response. The thinking seems to be: Either wear a mask or socially distance. No need to do both. Likewise, there seems to be an expectation that at some discrete point in time, the coronavirus threat will be over and normal life will resume.

The new findings on variants dispels such overly simplistic thinking. For one, the distinct potential for a country to “become a crucible for resistant variants” means it is unlikely for the coronavirus to simply go away as people get vaccinated. Further, it will take excellent planning and coordination which have been rare in coronavirus responses thus far. In short, it is still too soon to be looking past life with the virus.

Science

Two cheers for science’s Newtonian return under Joe Biden ($)

https://www.ft.com/content/5259776e-641b-4b53-a197-fdf72d366183

“What’s more, Mr Biden elevated the role [head of the Office of Science and Technology Policy] into a cabinet position for the first time in US history. In plain English, scientific geekery was promoted.”

“This [the appointment of a sociologist as deputy] suggests that the Biden team recognises that science policy cannot be effective unless there is proper appreciation of the social context in which it operates.”

Dave Collum: 2019 Year in Review

https://www.peakprosperity.com/2019-year-in-review-part-1/

“We are not just scientists but human beings as well. And like most people we’d like to see the world a better place, which in this context translates into our working to reduce the risk of potentially disastrous climatic change. To do that we need to get some broad-based support, to capture the public’s imagination. That, of course, entails getting loads of media coverage. So we have to offer up scary scenarios, make simplified, dramatic statements, and make little mention of any doubts we might have. This ‘double ethical bind’ we frequently find ourselves in cannot be solved by any formula. Each of us has to decide what the right balance is between being effective and being honest.”

As a person whose life has been made immeasurably better due to the tools of math and science, I am thrilled to see the status of science being elevated in public policy circles. Such a move is essential for ensuring proper analysis and competent decision making.

All of that said, the quote by Steve Schneider in Collum’s 2019 Year in Review also resonates deeply with me. Far too many times to count I have witnessed very smart people misrepresenting things in order to serve an agenda. It is a fine line and there are no simple answers, but I do believe people with higher education and special expertise have an obligation to use their knowledge in socially useful ways.

Perhaps nowhere is the phenomenon more prevalent than in the investment industry. Many people believe it is hard to make money. I actually don’t think that is true. In fact, I have thought for a long time that it is actually very easy to make money. All you need to do is learn a little more about an investment subject than most people and either lie or don’t tell the whole truth about it. If your conscience is permitting, it is pretty easy.

As politics has become more polarized it is not surprising that more scientists have made personal decisions that place more weight on being effective than on being honest. Such behavior is a shame because it has eroded trust in many of the tools that have fundamentally improved the well-being of humankind. Hopefully, that trust can be re-established.

Geopolitics

Putin’s nemesis

https://us12.campaign-archive.com/?e=5c7365da58&u=7404e6dcdc8018f49c82e941d&id=d8ac6be730

“While Navalny's level of support is rising, it's not (yet) enough to pose an existential threat for Putin. Russia's president is not as popular as he once was, but still enjoys an approval rating of more than 60 percent, controls a massive and loyal security apparatus, and has brought the entire business elite to heel.”

“Navalny's challenge is to put enough people on the streets to scare Putin's cronies and security men into thinking twice about continuing to support him — no easy feat in a country where political apathy is widespread, and fear of 1990s-style instability is real.”

The Zimbabwe Event

https://www.epsilontheory.com/the-zimbabwe-event-2/

“I think 2021 will be a Year of Civil War in weak states that are desperately poor.”

“I think 2021 will be a Year of Unexpected Regime Change in weak states that are relatively wealthy.”

Protests in Russia have been notable for their size and intensity. While protests in the US occurred in the pleasant climes of late spring and early summer, the protests in Russia have brought people out in sub-zero temperatures. That kind of commitment sends a strong message of discontent.

Ben Hunt picks up on a similar theme but from a different perspective. According to him, the coronavirus in kryptonite for weak states because they “do not have an effective political steam valve for popular discontent and elite conflict”. The logic is sound, and the early evidence is concerning to say the least.

Monetary policy

The End Game Ep. 14 - Paul Singer

https://ttmygh.podbean.com/e/teg_0014/

“I’m pretty sure they [central bankers] don’t understand it [the issues with asset price inflation]”.

“All one has to do is spend some time with the actual transcripts [of the Fed minutes], you know, it’s all in there … you read them and you’ll learn the personalities of different people and you’ll just see how epically clueless they are …”

The first quote is by Paul Singer of Elliott Management and the second is by Bill Fleckenstein. Both get at the same point: Central bankers are in over their heads. Evidence can be found in the minutes of Fed meetings which reveal how little Fed governors knew at the time of major market disruptions.

The reason for the shortcoming, proffered by Singer, is the complexity of the financial system, which caused by an explosion of derivatives, securitizations, and other innovations, has simply outpaced financial and economic theory.

As a result, the trust placed in the Fed by investors is misplaced. The fact that the Fed maintained crisis policies for nine years after the financial crisis and were not punished by it is due more to complacency and luck than efficacious policy. The effect is the Fed is getting trapped by its own policies but does not yet realize this. While these conditions do not alone prescribe any particular outcome, they increase the chances of both inflation and poor economic growth.

Inflation

Are We Entering a New Paradigm of Inflation?

http://blog.gorozen.com/blog/are-we-entering-a-new-paradigm-of-inflation

“Is there anything that we can glean or anything that we can look at in relation to those periods [where the price of commodities has been cheap relative to financial assets] that suggest that there's some kind of a commonality? It turns out that there is. In all four cases, you have had a change in what I would call the global monetary order.”

The “Endgame” namesake of the podcast series hosted by Grant Williams and Bill Fleckenstein (above) has focused on understanding the potential outcomes of excessively high global debt, inflated financial assets, extraordinary monetary policy, and poor economic growth. It is not coincidental that this is the same basic phenomenon Goehring & Rozencwajg discuss in this recent blog post.

One important point is these situations only come around once every few decades. Another is they represent massive turning points in the global monetary order. As such, they also represent major turning points in the fortunes of commodities relative to financial assets.

“The Wages of Fear”

http://www.convexitymaven.com/images/Convexity_Maven_Wages_of_Fear.pdf

“But as a public policy comment, middle-class citizens should be mad as hell that Government resources were directed at policies that widened the wealth gap. I will stipulate this was NOT the intention of the FED; and that Fiscal policies by both parties have been grossly insufficient.”

“Here is the main point: This past decade’s money printing was used to purchase assets; this next decade’s money printing will be used to fund an expansive Fiscal policy which will funnel money into the hands of people who will spend it. Thus, the Velocity of money will increase and produce inflation.”

This piece by Harley Bassman provides a very clear and readable explanation of money velocity and therefore the expected effects of monetary policy. He is absolutely right to highlight the importance of “funneling money into the hands of people who will spend it”.

As such, negotiations in Congress about a new pandemic relief package may provide a “tell” for investors. If negotiations are smooth and bipartisan, there may be a pathway for a more regular flow of fiscal stimulus. If, however, the package meets significant resistance from Republicans, spending for the foreseeable future is likely to be contentious and episodic. My bet is on the latter, but let’s see.

Another thing to watch will be the tolerance for systemically higher spending. If, for example, unemployment remains high and many people who would like to be working remain out of the labor force, it is distinctly possible pandemic relief funds get extended so regularly as to essentially become permanent basic income for many people. Such funds would most likely get spent and have a noticeable impact on prices.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls ($). All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.