Arete's Observations 1/8/21

Happy New Year everyone!

It is the time of year when reports come out to sum up the past year and start prognosticating about the upcoming one. I am not a fan of most of these because they tend to be shallow accounts of the past or weak attempts to forecast, usually on the basis of linear extrapolation.

Since 2020 was such a newsworthy year, however, it is more deserving of a review than most. With major events arising on a regular basis and strong narratives attached to all of them, it often seemed like the year was one long, continuous shouting match.

That background presents an opportunity to assess the happenings with more perspective. As I reflected on the year over the holidays a few different insights emerged …

Year in review

Hindsight Capital’s 2020 was great. Wasn’t yours?

“But only a few assumptions were needed to make Hindsight’s trades: the pandemic would affect the economy, the West would deal with it far worse than Asia, and the main response would be cheap money. Throw in the implosion of OPEC+, which again could be seen coming, and it turns out most of these trades could have been put on without much hindsight at all.”

John Authers writes a column every year about what trades would have worked out best for the year in hindsight. It is whimsical but it also provides an interesting perspective.

When I first read the commentary for last year I sympathized with the argument. My first thought was that Authers made a good point. Some of the biggest moves in the market last year did not require amazing foresight.

Upon further reflection, however, I recognized the flawed assumption: There was no necessary reason for the pandemic to have had such a devastating effect on the economy. The coronavirus was not a new type of threat. It had been studied and public health protocols had been developed. Further, in the US and Europe and other developed countries the resources existed to address the threat.

Part of the problem was it took too long for the threat to be taken seriously. Interestingly, the story got a great deal of attention early on by several independent research outfits and blogs. The independents followed the story closely and by mid-February traced out what had all the makings of a serious global pandemic.

Also, interestingly, mainstream media fixtures positioned the story as a peripheral issue. As of mid-February, the coronavirus was mainly something happening in China and its effects were mainly about supply chain disruptions. There were also a few stray stories about outbreaks on cruise ships and later in February cases started appearing in Europe. The far bigger news at the time was the impeachment proceedings.

Why the Stock Market Isn’t Too Worried About Coronavirus

https://www.nytimes.com/2020/02/20/upshot/coronavirus-stock-market.html?searchResultPosition=59

“The toll on the global economy would be severe if the rate of infections does not abate and the death toll continues to rise,” Moody’s analysts wrote. “Extended closures in China would have a global impact given the importance and interconnectedness of China in the global economy. The financial market reaction seems to have been to mostly shrug off the impact, which may underestimate the risks.”

This story from the New York Times in mid-February is representative of the broad news coverage at the time. The coronavirus was causing a few inconveniences in China, sure, but nothing that couldn’t be shrugged off.

As a result, when infections did start showing up in the US most of the public and its government leaders were wholly unprepared to deal with them. Infections spread rapidly and New York City was soon overwhelmed. At the same time various levels of government were either silent on the issue or delivering a cacophony of mixed messages.

In order to buy into Authers’ assumption, one would have had to believe the broadly incompetent response to the pandemic was almost inevitable and that it would persist long enough to significantly impair the economy. Perhaps I was too optimistic at the outset, but nonetheless I was surprised by the low quality of leadership (in general) and the low level of pushback against that incompetence. But at least we had each other …

Dave Barry’s Year in Review 2020

https://www.washingtonpost.com/magazine/2020/12/27/dave-barrys-year-review-2020/?arc404=true

By May … “We are literally sick and tired of the pandemic. But amid all the gloom, there is a ray of sunshine: As we go through this harrowing experience — affecting all Americans, in both red states and blue states — we are starting to realize that our common humanity is more important than our political differences.”

“Ha-ha! Seriously, we hate each other more than ever. We disagree about everything — when to reopen the economy, whether to wear masks, whether to go to the beach, whether it’s okay to say “China” — everything. Each side believes that it is motivated purely by reason, facts and compassion, and that the other side is evil and stupid and sincerely wants people to die. Every issue is binary: My side good, other side bad. There is no nuance, no open-mindedness, no discussion. On the other hand, there is starting to be more toilet paper.”

Dave Barry is his usual hilarious self in this 2020 review. He has a way of capturing the essential truths and sad realities all the while wrapping them in an amusing and entertaining package. One of those truths is the degree to which the country has become divided. I think it is hard to overstate the importance of this reality and the severe obstacle it presents to constructive public policy solutions.

I was surprised by the magnitude of this division too. I am a firm believer in the capacity of human beings to do amazing things when they put their minds to it. What I observed was a widespread refusal to work together for the common good. I understand there are reasons for distrust, and I agree with many of them, but there are also problems with distrusting everyone.

Disagreeing with certain aspects of a society does not justify renouncing it altogether. After all, the one’s existence outside of society tends to be “solitary, poor, nasty, brutish, and short”. Apparently, a good number of people are going to need to relearn this lesson.

Finally, one of my favorite year-end pieces is the “Year in review” by Dave Collum. I enjoy this letter because it addresses issues that often fall outside of my main focus and because it contains perspectives that are different from my own.

Mainly, however, I appreciate this particular letter because Collum is a scientist and applies his considerable analytical and research skills to important news stories. While I consumed a great deal of Wall Street research earlier in my career, over the last several years I have found myself gravitating more to independent writers and researchers with strong credentials because they are, well, independent and smart.

Collum opened my eyes to several important aspects of the climate change debate in his 2019 review. In doing so, he changed my mind on several items and that is one of the highest compliments I can bestow on anyone.

Market observations

Bitcoin and other cryptocurrencies revealed a great deal about the investment landscape throughout 2020. The tight relationship between bitcoin and Nasdaq through most of the year suggests bitcoin was mainly trading on the same liquidity theme as stocks. The break in the fourth quarter reveals that the liquidity theme went into hyper drive – which also happens to be when the US dollar started another leg lower.

Economy

Axios Markets: Majority of Americans pulled money from retirement in 2020

“Nearly 60% of Americans withdrew or borrowed money from their IRA or 401(k) during the coronavirus pandemic, a new survey from Kiplinger and digital wealth management company Personal Capital found.”

“Nearly one in three (32%) respondents said they withdrew $75,000 or more from a retirement account, while 58% of those who took loans borrowed between $50,000 and $100,000.”

One of the more prominent data points since the pandemic hit last year is the savings rate. Shortly after widespread lockdowns were implemented in March the savings rate shot higher. Although it has come off from those highs, it still remains much higher than it had been before the pandemic.

A frequently made argument is that all of this incremental saving will turbo boost economic growth once spending patterns normalize. I think this misses the bigger picture. As with many arguments that promote a positive narrative of growth, it only looks at one side of the story. The other side is that many Americans are so desperate for cash that they are raiding their own retirement funds.

Further, as can be seen from the graph, the money being withdrawn from retirement accounts is not being used for extravagant purposes either. Rather, it is being used to cover regular expenses, presumably because current income is not sufficient to cover them. It may also reflect the fact that many expenses such as rent and mortgage payments have been deferred but will soon be coming due. It is hard to reconcile this phenomenon with the idea of an economy on the cusp of breakout growth.

Media

1 big thing: 📺 The real competitor to Trump TV

https://www.axios.com/newsletters/axios-media-trends-ab4c5593-f192-4f4e-aeae-e7b94322b66d.html

“The bottom line: For large swaths of the population, credibility in 2020 is about authenticity instead of objectivity. The Blaze's offering, designed to feel authentic instead of authoritative, leans into what people are willing to pay for.”

There is going to be an interesting story about what happens with conservative media after the inauguration and Axios does a good job of ferreting it out. The bigger picture development I find fascinating (and troubling) is the trend for media consumers to be willing to pay for authenticity over objectivity. The higher value in this day and age is more to come across as being heartfelt than being right.

Personally, I think this is a dangerous development. One of the lessons I learned from studying Greek philosophy in college was the allegory of the chariot which is about the importance of people being able to control their passions. Increasingly, however, it seems people prefer to unleash their passions and allow reason to take a back seat.

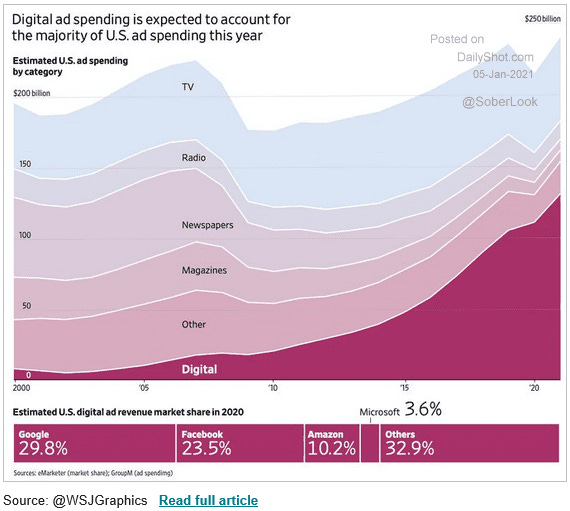

Reason is also taking a back seat for lack of funding. As advertising revenue for many traditional media sources have lost share to digital ads, so too have the monies to fund authoritative journalism eroded over time. I fear the trend to eschew authoritativeness and reason for authenticity and passion bodes poorly for effective governance and human progress in general.

Currencies

Is China About To Devalue The Yuan: Local Banks Start Dumping Yuan

https://www.zerohedge.com/markets/china-about-devalue-yuan-local-banks-start-dumping-yuan

“Chinese banks always start intervening in FX when Beijing is seeking to telegraph to the world that it is now displeased with the strength of its currency, and any further gains will not be tolerated.”

“In other words, a sighting such as this, is usually a clear and present signal that a far more aggressive devaluation is imminent.”

The rally in US stocks since last summer has occurred in tandem with a decline in the US dollar … which has also coincided with a rise in the yuan. In other words, much of the rally in stocks can be explained by currency moves.

Such moves often create their own constraints, and, in this case, a rising yuan impedes China’s export-driven economy. With warning shots being fired in the currency market, it now appears as if China is no longer willing to allow the yuan to rise. Whatever future intervention materializes is likely to affect the dollar and by extension, US stocks.

Public policy

America’s dangerous reliance on the Fed

https://www.ft.com/content/bcb8d4d9-ca6d-45b7-aafc-9e9ecf672a5b

“Even if they do not trigger high inflation, the Fed’s extraordinary interventions will come with steep price tags … The most visible threat, however, is to US political stability.”

Ed Luce primarily writes about politics which is what caught my eye about this story. Although allegations that Fed actions may also affect the political landscape are not new, it is new to see them broached in a more explicitly political forum. It will be interesting to see if the Fed’s unconventional policies start raising more political hackles.

Politics

Insurrection Day Was Easier for Markets Than Us

“I sit down to write this at the end of a day of historic political drama in the U.S. Friends in New York feel as shocked by today’s events as they were by 9/11 — and having also lived through that, I tend to agree. In Congress, politicians drew parallels not only to 9/11 but to Pearl Harbor, and to the burning of the Capitol by the British army during the War of 1812.”

“I am not alone in finding it hard to muster enthusiasm for offering up market analysis. It seems inappropriate somehow.”

The storming of the Capitol by protesters on Wednesday was surreal and historic. John Authers captured the occasion as well as anyone.

Years ago, investors gave up any notion of linking stock prices to underlying cash flows. Then investors gave up any serious concern about rising inequality. With the latest episode, investors furiously bid up stocks (with the Russell 2000 up over 4% on Wednesday) despite the halls of democracy being overrun. It makes me wonder what we as a country won’t do to prostitute ourselves for a few more points on the S&P 500 index.

Investment advisory

Most Read FA-IQ Articles in 2020

“#1 Ex-Merrill Lynch FA and NFL Linebacker Gets 40 Years in Prison (01-07-20)

#2 Edward Jones's Training Program Put My Life at Risk: FA (07-01-20)

#3 Ex-Wells Broker Accused of Unprofessional Conduct Barred from Industry (05-26-20)

#4 Finra Bars Broker Fired Over Personal Email Use, Client's Initial on Form (07-13-20)

#5 Ex-NFL Player Pursues Claims Against Ex-FA Even After Settling With Firms (05-18-20)

#6 FA Accused of Running Ponzi Scheme Charged with Murdering Client (11-19-20)

#7 Wells Fargo Fires a 'Sizeable Group' of Salaried FAs; More Cuts Expected (10-15-20)

#8 Ex-UBS FA: Branch Manager Said We Were Too Old and Needed to Retire (08-25-20)

#9 UBS to Close U.S. Private Bank; Advisor Attrition, Client Exits Predicted (07-27-20)

#10 Finra Suspends Ex-Morgan Stanley Rep Over Pre-Signed Docs (05-27-20)”

#1 Ex-Merrill Lynch FA and NFL Linebacker Gets 40 Years in Prison (01-07-20)

“He prayed with people before he took their money …”

I just want to highlight a couple of quick but important points here. One is there is still an astonishing amount of bad behavior in the investment advisory business. Part of this is simply due to the fact that there are a lot of advisors. There are bound to be some bad apples.

However, there are still a lot of incentive structures that can tempt even competent and well-intended advisors. Commission structures, for example, create incentives to suggest trades more frequently than necessary. Further, the desire to appear successful often pressures advisors to pursue nefarious means of generating income.

The two things investors can do to best protect themselves are to minimize conflicts of interest and to apply scrutiny. Because strong markets can hide a lot of problems, those problems often don’t come to light until the market finally declines and well after the fact. It’s best to take a close look now and make sure everything is in order before it’s too late.

Inflation

The popular version of recent pricing phenomena is being referred to as reflation. According to that narrative, loose monetary policy is gently nudging the economy back to healthier growth. Confirmation can be found in rising commodities prices and higher spreads between short-term and long-term interest rates.

From my vantage point, the reflation thesis is too simple and does not explain some other important happenings. For example, the graph below shows supplier deliveries declined significantly in the second half of 2020. The ISM report for December was strong but an important component of that strength was rising prices to deal with supply bottlenecks.

With containers stacked up at ports and pallets of goods piled up in warehouses, it takes longer and is costlier to fulfill orders. These problems have been further exacerbated by Covid-related travel restrictions and driver shortages. In other words, there is something of a train wreck in the supply chain. This speaks much more to costly inefficiency than to growing demand. As such, rising prices right now smack at least as much of stagflation as of reflation.

Implications for investment strategy

What can go wrong? Investors’ views on the big risks to markets in 2021

https://www.ft.com/content/1afc5e9f-f05d-48f5-a126-870ba70ce254

“The pandemic has completely reworked our free-market economic system based on competition, risk management and fiscal prudence. It has been replaced by cycles of increasingly radical monetary intervention, the socialisation of credit risk, and a national policy of moral hazard.”

Scott Minerd’s commentary above provides a healthy dose of reality for everyone who has gotten distracted by all of the dramatic stories over the last year and there are two very important implications.

The first is this is a situation of path dependence. This means there is no going back. There will be no return to normal. There was a period of time after the financial crisis in 2008 during which unconventional monetary policy could have been unwound and replaced by fiscal policy and economic initiatives. That time is past. We are now on a different and less desirable path.

Another implication is the market and economy have fundamentally changed from anything we are familiar with. All preconceptions about financial asset returns and economic growth must be discarded to account for new realities. One major implication from this is investing in financial assets will be a fundamentally different exercise. Investors whose retirement funds consist primarily of financial assets will need to fundamentally re-evaluate their investment plans.

Although the path ahead is likely to be chaotic and messy and challenging, it will also be rife with opportunity. This will involve differentiating between short-term trading and long-term investing and it will involve differentiating between gambling and investing. Investors who are flexible and can adapt to very different conditions will still have a fair chance to get ahead. Others not so much.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.