Arete's Observations 2/19/21

Market observations

Historically, one of the better indicators of market frothiness is equity inflows. Recent numbers show those flows are hitting record highs.

Equity inflows have information content because they represent a shift in investor base; flows into (retail) equity funds implies flows out of institutional portfolios. Since retail investors (as a whole) have a greater tendency to chase performance, higher flows usually come closer to the end of a rally. Those (usually poorly timed) flows are also the reason why many portfolios underperform common indexes.

Source: Zerohedge

Another interesting observation is the recent outstanding performance of most-shorted stocks. The historical graph highlights some useful points. One is that the most-shorted stocks have typically underperformed. They are picked on for a reason. Another is that it is not uncommon for most-shorted stocks to have brief periods of outperformance coming out of a recession.

Finally, there is no period in the last 35 years in which the most-shorted stocks have outperformed to such a degree as they have in the last year. This move represents a clear break from historical patterns and an even clearer break from anything resembling fundamental reality.

Source: Bloomberg.com

VVIX - the bid that won't go away, Feb 12 2021 at 14:12 ($)

“Vix of Vix remains well bid. Note that the spread between VVIX and VIX is now getting rather extreme. Last time such a big divergence was visible was just before markets sold off a year ago. Back then, vol markets were not distorted by Fed as they are now, but nevertheless it is important watching the widening gap between VVIX and VIX.”

Just like in a movie when creepy music forebodes something bad happening, so too are volatility measures portending something that is not quite right. There is no need to overreact at this point, but investors should get their senses dialed up and be extremely attentive here.

Finally, 10-year Treasury yields popped up to 1.27% on Tuesday and continued higher again on Wednesday. Since rising bond yields put pressure on the Fed to raise rates they will be watched very closely by investors.

Economy

Why January's blowout retail sales report matters

https://www.axios.com/january-retail-sales-analysis-caadec17-1c3f-4f4b-9e92-6eb7be5af2c2.html

“January's U.S. retail sales report showed a 5.3% gain, the third-largest month-over-month increase on record, trailing only the booming numbers seen in June and July, as states opened up after nationwide shutdowns because of the coronavirus pandemic.”

“The retail sales report also suggests that Americans may be in better financial shape than previously believed and have more confidence in the economy — or in the government to deliver more benefits.”

The good news is the retails sales report for January was unusually strong. While many pundits are using the report to raise forecasts for the year, there are plenty of mixed signals. For one, how much of the spending was driven by stimulus checks – and the expectation of more “free money” to come? Also, the top spending categories were electronics and appliances and furniture and home furnishings. Was this mainly one-time spending to outfit homes as offices and schoolhouses?

Source: Twitter

Other factors cast doubt on the prospect that January spending portends a sustained state of sunnier economic skies. For example, US debt has continued to rise and is now considered to be at extreme levels. Also, jobless claims on Thursday were higher than expected and still extremely elevated. It’s great to see progress but there is still a lot of adversity to overcome.

Electric utilities

Blackouts spread beyond Texas as frigid weather knocks out power plants ($)

https://www.ft.com/content/4d07eedc-b3ec-417e-8cb1-5895178c9f9b

“The cold spell is proving a particular test for Texas’s freewheeling electricity model. Generators are paid only for the energy that they sell, not for keeping capacity in reserve for times of stress. Electricity retailers compete fiercely for customer business, unlike utility monopolies that operate in some other states, and can adjust prices according to market conditions.”

Between three and four million households in Texas suffered through blackouts this week as unusually cold winter weather played havoc with the electric grid. As such, the bad weather also highlighted the weakness of the state’s policy toward electric power: In the tradeoff between lower costs and higher reliability, the state chose lower costs.

This tradeoff is never an easy one to make, but it is also one in which rare but impactful events often get underestimated. It isn’t necessarily a problem if a few million people in Texas are willing to effectively do winter camping for a few days during a winter storm in exchange for lower electricity costs. It is a problem if most people are unwilling or unable to accept such hardships.

In this particular case, one of the main culprits was that gas plants were not required to be winterized. Another culprit, however, is the electricity pricing system which does not provide compensation for maintaining reserve capacity. Such policies effectively serve as insurance against unusual events and therefore increase overall system reliability. Different regions have different treatments for reserve capacity and Texas chose the “no insurance” route.

Source: Twitter

Ignoring Energy Transition Realities

http://gorozen.com/research/commentaries/4Q2020_Introduction

“Not only will these [green energy] proposals cost trillions, but policy experts and investors will soon realize that none of these options will address the very CO2 problem they are designed to solve.”

“Low load factors and ‘buffering’ of intermittency results in poor ‘energy return on energy Invested’ (EROEI). As much as 25–60% of the energy generated in a renewable system is consumed internally, compared with 3% for a modern gas plant.”

We might as well start talking about green energy since it is clear the Biden administration is making it a priority. One of the critically important issues is the long-term effectiveness of green energy. Because most “green” energy is relatively inefficient in its energy conversion, the waste in producing and distributing it can easily offset intended benefits.

If the goal is to simultaneously reduce CO2 in the atmosphere and maintain a comparable standard of living, there will need to be a thoughtful energy transition plan. Fossil fuels work better for some applications and alternative energy better for others. This point seems to be missed by zealots on both sides of the debate.

Politics

Confining Themselves to Irrelevancy ($)

https://gfile.thedispatch.com/p/confining-themselves-to-irrelevancy

“Wasserman found similar correlations [of voting patterns] between other ‘upmarket’ establishments (Apple stores, Lululemon, Urban Outfitters) and ‘down home’ businesses (Tractor Supply, Bass Pro Shops, or Hobby Lobby). If the AOC of Charleston [WV} spills her organic kombucha on her MacBook and wants a Genius Bar appointment, she’ll be disheartened to learn that the Apple store locator doesn’t even have West Virginia in its drop-down menu. But Tractor Supply has five convenient locations throughout the state.”

“Yeah, yeah. I know politics is also about big ideas, policies, cultural symbolism, yada, yada, yada. But before all that, it’s about frick’n numbers. And both parties are being run into the ground by innumerate ideologues.”

In this piece Jonah Goldberg critiques the efforts by progressives to grow their numbers in D.C. by finding candidates in places like West Virginia. I highlight the piece partly to illustrate the desperate condition of both political parties, partly to show that I am an equal opportunity, non-partisan grump when it comes to politics, and partly because it is hilarious.

More seriously, given the massive divisiveness in the Republican party right now the Dems should be making hay by expanding the appeal of their own party. If only. As it stands, it looks like both parties are more concerned with novel ways to inflict self-harm than anything else.

Coronavirus

Hedge fund Element warns of deep economic blow from new virus strain ($)

https://www.ft.com/content/6c1b58fd-615d-493c-9b0c-6673d94dd8f9

“Investors and policymakers are failing to grasp how deeply the new variant of coronavirus will damage the European economy, Element Capital, one of the world's largest macro hedge funds, has warned. Expectations for economic growth need to be cut as the B.1.1.7 coronavirus variant spreads beyond UK borders, and lockdowns across the continent could extend months beyond current estimates, the fund's head of markets Colin Teichholtz said in an interview.”

This is a very fair point. The Eurozone economies are weak, and the area is way behind on vaccinations. If virus variants really start taking hold in some regions, it doesn’t take much imagination to picture the entire Eurozone falling permanently behind the US and China regions. That would affect debt sustainability and currencies – and on and on. In short, this is the kind of thing that we might look back on ten years from now and say this is when the unravelling started.

Public policy

Vaccine papers, please!

https://www.gzeromedia.com/vaccine-papers-please

“Are vaccines passports a good idea? People, governments, and companies want to know who might set off a new COVID wave and who is safe. But are we moving toward a Brave New World where the holders of vaccine passports become an unfairly privileged class of people?”

“Second, even if the system works well, it will inevitably discriminate against people who, through no fault of their own, are still waiting to be vaccinated. That could mean younger and healthier people who are ineligible until later stages of the vaccine distribution process or those who are eligible but don't yet have enough information or access to vaccination sites. And those who decide not to get vaccinated because they believe it's dangerous would also pay a price in terms of mobility and employment under a system like this.”

It is probably good to start having this conversation about vaccines. Because there are few scenarios in which everyone in the world is vaccinated it is useful to consider how, and under what conditions, activity should resume as increasing numbers of people do get vaccinated. Passports would allow freedom of movement to those who got vaccinated but would discriminate against everyone else.

While it will be fiendishly difficult to establish the fairest policy, it is easy to determine the outcome: Activity won’t return to normal until and unless the majority of people get vaccinated.

How herd behaviour drives action on r/WallStreetBets ($)

https://www.ft.com/content/971df303-726a-4bdf-93eb-9a9e848f7109

“Social contagion is a well-documented phenomenon: people adopt others’ behaviour, from smoking to product purchases. r/WallStreetBets was able to channel this into financial decision-making, attracting those with a particular taste for high-risk bets on stock-specific options that are often at odds with rational economic theory.”

This is both an old story and a new story. It is old in the sense that since the beginning of time people have gone to great lengths to hack human behavior and decision-making so as to figure out ways to sell them more stuff. Back in the day, ambitious marketing mavens decided to put the Super Sugar Bombs cereal on the lower shelves at the grocery store so kids could see them and demand them. Today, social media is being used to coalesce opinions and herd them in a certain direction.

This has always been a cat and mouse game but it also increasingly one with moral consequences. As behavioralists become better at knowing how people make decisions and technology becomes better at hitting the various buttons, in many situations it is just not a fair fight for most people. I’m not a big fan of lots of regulations, but I’m not a big fan of entire industries structured around manipulating behavior either.

The Glory Of Going Viral - A Fraud Promoted By Big Tech

https://www.zerohedge.com/technology/glory-going-viral-fraud-promoted-big-tech

“Big tech and social media have a lot to be gained by promoting a few powerful myths. The idea they empower individuals is a biggie. This dovetails with the idea you might suddenly become something far more than you were. All this seems to feed the same pleasure endorphins that people experience when playing the lottery or gambling.”

This is an interesting piece. It takes observations most of us have made and draws an interesting conclusion: Tech is doing more than just capturing our attention; it is also transforming many activities effectively into gambling exercises. Democratization is a euphemism for gambling in a game with bad odds. This doesn’t seem like the kind of thing that helps build a strong society.

China

China's political power grows with its capital markets

“Thanks to a mandate for outside investment and its strong rebound from the coronavirus pandemic, China’s financial markets are drawing record high chunks of global capital — particularly from U.S.-based investors — and are poised to keep growing.”

“As more money flows to China’s markets, its political leaders will have a clear mechanism to increase the country’s political power, giving China another potent weapon to challenge the United States’ position as the world’s financial superpower.”

I’m surprised this hasn’t become more of a story yet: Increasingly there is a conflict between the narrative of terrific investment opportunities in China and the geopolitical reality that the country desperately needs US dollars coming in to keep its insolvent financial system afloat. It’s interesting the US has been so docile on the issue thus far. One can make a case that China is figuratively building a geopolitical “wall” with the US and at the same time is making the US pay for it.

Inflation

Rabobank: We Soar In 2021 Then We Crash Back Again In 2022

https://www.zerohedge.com/markets/rabobank-we-soar-2021-then-we-crash-back-again-2022

“Yes, higher oil pushes up US breakevens and hence a lot of the ‘reflation trade’ momentum. But does anybody believe that pushing up energy bills 10,000% is what people mean when they conceive of ‘reflation’? I bet an hour of good ‘ol Texas electricity that Joe Public is thinking of higher wages – not oil, gas, electricity, rent, or food prices as a sign of ‘recovery’.”

“Yes, we have major US fiscal stimulus, and significantly north of $1 trillion is likely to flow into the economy soon, it seems. Yet none of this is going into productive investment like the power grid, or any green new deals, just into consumers’ and states’ pockets; and none of it changes the structural balance of power between labor and capital.”

Michael Every of Rabobank makes a couple of great points here about inflation. One is that it can be easy to lose perspective and treat inflation more as an obscure economic statistic than a real-world, quality of life phenomenon. When taken in the real-life perspective wages are way more important than the spot prices of a few commodities.

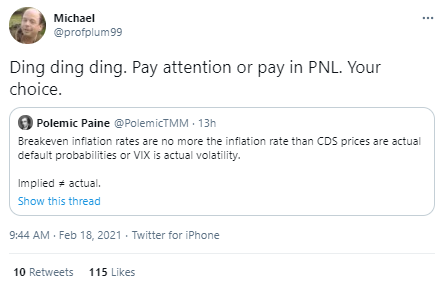

Source: Twitter

On a slightly different note, the graph below shows how stocks that should benefit from reflation are not keeping up with the changes in headline inflation expectations. It may be that it will just take some time for the stocks to catch up, but it may also be that the headline inflation number has jumped well ahead of the reality. The difference is an important one for investors.

Implications for investment strategy

The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis by Tim Lee, Jamie Lee, and Kevin Coldiron

“Central bank and government interference in markets has the effect of greatly prolonging the carry bubble, leading to a cumulatively larger waste of resources. Over time this will seriously destroy growth.”

“But it is clear that central banks have been agents for the transmission of carry into the explosion of inequality that we have experienced.”

“This combination [of high levels of indebtedness and low new bank credit growth] will also mean that the demand to hold money (in all its potential forms) — relative to income — will tend to be quite high.”

“the absolute end of the carry regime is likely to be marked by either systemic collapse that ends the dominant role of central banks or galloping inflation — or both.”

“The Rise of Carry” is an excellent book that I would recommend to almost anyone interested in the markets. Overall, it is very readable, although there are a couple of chapters that get a bit technical. Nonetheless, the mechanism of “carry” is critical for understanding the market environment and the risks it entails.

One of the key points is the critical role of the Fed in amplifying the carry regime and thereby increasing inequality and enabling the waste of resources. These are (not surprisingly) strikingly different assessments than we hear from the Fed. If more people were aware of the great harm being caused, there might be more pressure on the Fed to stop making the situation worse.

Perhaps the greatest takeaway, however, is the portrayal of market returns in a carry regime. In such a regime, returns gradually rise as volatility declines. At some point, a carry crash occurs and forced selling causes a rapid decline. This process repeats, at ever-growing amplitudes, until a grand finale when the entire currency and financial system collapses and a new one takes its place.

The carry regime creates quite a quandary for long-term investors. Characterized by a surplus of money and a dearth of economic growth, the main profit opportunity comes in the carry itself despite the ever-increasing disparity between stock prices and intrinsic values. These conditions create an alluring game for some period of time, but ultimately end with a tragic reckoning.

As a result, the carry regime is extremely dangerous for long-term investors saving for retirement but is amenable to those who can constantly monitor the markets and radically change exposures in a heartbeat. As Stanley Druckenmiller recently said, the current environment “could not be more exciting if you are a macro investor”. At least he is excited.

The battle ahead: war is coming for your money ($)

https://www.ft.com/content/427ef0a2-97ea-46ad-abde-c0a272f2e67e

“They [most global investors] think that currencies will always be hedge-able, tradeable, and portable as they more or less have been since the 1980s. No. I believe the coming generation of policymakers want to demote the financial class, and one of their methods will be the imposition of controls on capital flows. Even in the US.”

“Before the wars, typically, capital controls are imposed, and most global investors are not taking that probability into account.”

The high-level point made here is that the investment environment is changing in very fundamental ways. Namely, the fairly predictable, low volatility world than enables high frequency trading and long collateral chains is changing over to one of greater volatility and one that demands greater robustness. Think Formula One race car versus Land Rover.

One implication is fairly obvious; you need to slow down, a lot, and focus more on not crashing than running just a tad bit faster than super-fast. Another though, is you need to consider very carefully where your capital is and where it could get trapped if laws change. Don’t expect much of a warning.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.