Arete's Observations 2/5/21

Market observations

After a tough time last week, the market came back infused with the same old “buy the dip” mentality to reach fresh highs. Volatility from the Gamestop short squeeze was sooo last week.

Pot stocks boom as industry sees prohibition ending

https://www.axios.com/marijuana-stocks-legalization-074ae9d1-127f-46a9-b084-8fd043efadf8.html

“The marijuana ETF MJ rose 9.8% on Tuesday and has gained 47.9% year to date. Individual companies have seen even more impressive bounces so far this year … Cannabis medical research standout Tilray's stock jumped by 23% on Tuesday and is up 184.4% year to date.”

While the prospect of decriminalization is certainly creating a tailwind for marijuana stocks, the enormous price moves also seem to reflect a fair amount of ebullience as well. Regardless, I can’t seem to get the Peter Tosh song, “Legalize it”, out of my head.

Almost Daily Grant’s, Monday, February 1, 2021

https://www.grantspub.com/resources/commentary.cfm

“While SPAC promoters push deals out the door, history suggests that less-than-stellar performance awaits the investors currently pushing prices higher. A paper last November from professors Michael Klausner at Stanford Law School and Michael Ohlrogge at New York University School of Law found that blank-check concerns produced sharply negative one-year post-merger returns throughout the ten years through 2019, with losses ranging from about 10% for the 2010 vintage to more than 70% for the 2014 cohort.”

“It’s very strange,” Klausner commented to Bloomberg last week. “I fundamentally don’t understand why these things exist.”

Not only does interest remain strong in industries like marijuana, but also in investment vehicles like special purpose acquisition companies (SPACs). As Grant’s reports, “(SPACs) have enjoyed a 6% average gain on their first day of trading so far this year”. As the historical evidence also shows, however, the longer-term returns are nowhere near as exciting.

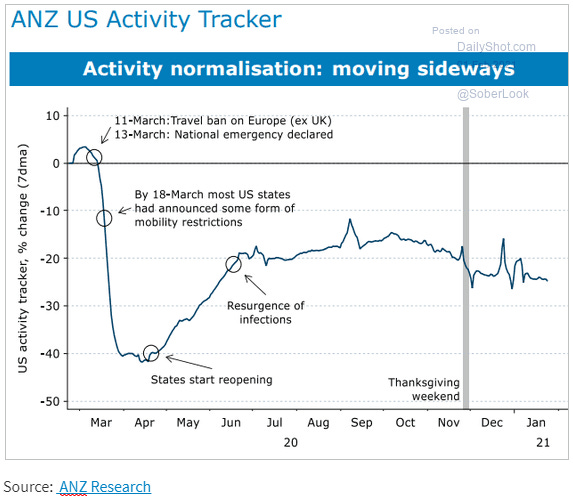

Economy

The high frequency data make clear that economic activity continues to soften after hitting a relative peak at the end of the summer. With the emergence of more infectious coronavirus strains and in the absence of a clear direction for fiscal policy, I still believe economic recovery will be slow and arduous.

That said, some prominent voices expect the economy to pick up considerably later in the year. The key factor to watch will be the degree to which excess money gets in the hands of people who will spend it – namely households and small businesses. I am still leery of this prospect, but it definitely bears watching.

Companies

McKinsey set to pay $550m to settle opioid claims by US states ($)

https://www.ft.com/content/85e84e12-6dda-4c91-bde4-8198e29a6767

“Its (McKinsey’s) consultants had urged Purdue directors to consider whether to ‘turbocharge the sales engine’, according to a lawsuit brought by the Massachusetts attorney-general, encouraging them to direct sales representatives to visit doctors with a record of prescribing large amounts and pitching opioids as giving patients ‘the best possible chance to live a full and active life’.”

“One July 2019 email disclosed in the litigation showed a McKinsey partner discussing talking to its risk committee about ‘eliminating all our documents and emails’.”

McKinsey is an important company partly because it is the consultant to kings, or at least corporate CEOs. As such it is also a leader in shaping business practices around the world. It also recruits the best and the brightest from all the top business schools perennially offering among the best starting salaries to those seeking to monetize their prodigious talents.

Primarily the company is involved in professional enabling. CEOs decide what they want to do, and McKinsey comes in to provide the business nous and smooth salesmanship to convince the board and/or other relevant parties that the plan should be implemented.

Unfortunately, McKinsey is also a cesspool of ethical deprivation and skullduggery. This is a problem that extends far beyond the walls of a single consultancy. For one, the company has broad influence. If it is pushing a strategy to turbocharge the sales of opioids to one company, it’s a safe bet it is being pitched to every other pharmaceutical company as well. For another, many McKinsey consultants go on to become CEOs themselves. As a result, the McKinsey culture is deeply embedded in corporate America.

Finally, the dearth of ethical constraints by white collar professionals as a business model is exactly the kind of thing that spawns distrust of professionals and higher learning across the entire population.

Source: Twitter

Coronavirus

Young and middle-aged adults responsible for most COVID spread

https://www.axios.com/young-adults-coronavirus-spread-a998cf65-fcf3-472b-a1ed-e29938356351.html

“Adults aged 20-49 were responsible for the vast majority of virus transmission last year, even after schools reopened in the fall, according to a new study published in Science.”

This probably isn’t much of a surprise but, nonetheless, clarifies the risks and challenges of managing the coronavirus. One big point is school-age children do not present a significant risk for transmitting the virus.

Geopolitics

Source: Twitter

What a difference a few months and a credible monetary authority can make! Last year I identified all sorts of ways Turkey could be a spark in a global powder keg. While that is still true in many respects, the risk of currency controls in Turkey being the spark has subsided considerably.

Public policy

Children Need to Be Back in School Tomorrow ($)

https://www.nytimes.com/2021/01/28/opinion/coronavirus-schools-unions.html

“The broader data on school closure is horrendous. Mental health problems have increased. Many children have simply vanished from official oversight. Schools in Hillsborough County, Fla., started the year missing 7,000 students. The children who are attending aren’t learning much. A Stanford study suggested that the average student has lost at least a third of a year’s worth of learning in reading and three-quarters of a year’s worth of learning in math.”

“The third fact is that teachers unions don’t seem to have adjusted to the facts. In Washington, Chicago and elsewhere, unions have managed to shut down in-class instruction … The union says its members won’t go back to work so long as the city’s positive test rate is above 3 percent. Where did it get that threshold as the basis for its negotiating stance? It pulled it out of thin air.”

Occasionally I like to run through thought experiments to challenge and clarify my own thinking and to provide perspective for observations I make. Along those lines, if I were the human resources manager for the United States, I could argue the greatest asset the country has is the intellectual capital of its people. With that being the case, I would argue the number one public policy objective ought to be to invest in education and training and everything that facilitates those goals (e.g., safety, healthcare, nutrition).

Such an exercise makes strikingly clear how comprehensively we are failing not just our children, but the country’s future. I am not going to argue such things are easy to do and I’m not going to admonish any particular organization for failing in a particular effort. It’s hard. I will be critical, however, when it appears as if people aren’t even trying. Unfortunately, the pandemic and related responses have laid bare just how distant our current efforts are from the objective of educating kids.

Joe Biden should be doing more that really helps workers ($)

https://www.ft.com/content/9ee5034a-e1a8-4e23-940f-a4a4e51f4b6d

“The new administration’s ‘immediate priorities’, per the White House website, ‘include actions to control the Covid-19 pandemic, provide economic relief, tackle climate change, and advance racial equity and civil rights, as well as immediate actions to reform our immigration system and restore America’s standing in the world’. Jobs, wages, labour, education, taxes and healthcare reform are relegated to the margins. Reforms to rebalance an off-kilter economy that is leaving too many behind, such as antitrust enforcement, financial-market regulation and industrial policy, go unmentioned.”

“Selling unrelated policy priorities as jobs programmes is a bipartisan tradition, and should always face a simple test: If the unrelated priority vanished, would the policy still make sense for its economic benefits?”

Strictly from the perspective of planning the most effective public policy, it is easy to consider controlling the pandemic and providing economic relief as priorities. It is a lot harder to consider climate change and immigration reform as “immediate priorities” in anything other than a partisan sense. Not that they aren’t important, just not as immediate in the midst of a pandemic.

By the same token, jobs, wages, education, and healthcare are all urgent issues, especially in the throes of the pandemic. Putting those crucial issues on the backburner sounds more like a capitulation than it does a serious effort to improve well-being.

This is the main point: While Democrats and Republicans have different preferences, the common thread is neither one seems very determined to establish policy initiatives primarily aimed at making things better for the country as a whole. The most obvious effect is such distractions lower the chances of underlying problems getting solved. Another effect is such distractions significantly increase the chances that energy is diverted from critical issues to peripheral partisan preferences.

Regulation

After the wild trading with GME and AMC and a few other stocks last week the powers that be decided something needed to be done about this reckless behavior. Elizabeth Warren complained that the “stock market doesn't reflect our actual economy” and Janet Yellen scheduled a cross-agency meeting to get some answers for the massive volatility in GME.

It is hard not to feel jaded by such statements. Is it encouraging that there seems to be some interesting in cleaning things up? Sure, yeah. Is it hard to imagine anything very constructive getting done? Absolutely. After the abysmal failings of regulation after the financial crisis which failed to eliminate any of the major problems like too much debt, too-big-to fail banks, moral hazard, etc. I won’t be holding my breath.

That said, this post by Scott Lincicome not only does a nice job of outlining the major discussion topics for the minimum wage topic, in particular, but also provides some good general public policy guidelines from Thomas Sowell …

Let's Talk About a $15 Minimum Wage ($)

https://capitolism.thedispatch.com/p/lets-talk-about-a-15-minimum-wage

“When evaluating a policy proposal, always ‘think beyond stage one’ and ask ‘and then what will happen?’ (via his Applied Economics)”

“There are no solutions, there are only tradeoffs … and you try to get the best trade-off you can get, that’s all you can hope for.” (via this 2005 interview)

Precious metals

Physical Premium To Paper Hits Record As Silver Market Tears In Two

One of the key factors in buying precious metals is the premium. The premium is essentially a commission the agent earns for transacting in the metal. In addition, it includes nontrivial costs for storage, transportation, and insurance, among others. As a result of these real costs, the amount of the premium relative to the underlying cost of the metal is significantly higher than commissions for stocks, for example.

In addition, the premium can fluctuate over time due to imbalances in supply and demand. Because supply tends to be fairly stable, big changes in premia normally happen when there are sudden changes in demand. This is exactly what happened recently as demand for silver rose substantially faster than the capacity of dealers to meet that demand.

The result was premia that were extremely high relative to the underlying cost of silver. With a premium of $14 on a silver coin worth, say $29.50, that is a commission of 47%. That 47% gets deducted from any expected return. The general lesson is transaction costs are very much a part of investing and high transaction costs reduce the attractiveness of the investment. The lesson for people interested in precious metals is it is most cost effective to accumulate over a period of time and to target purchases at periods of relatively low short-term demand (and therefore reasonable premia).

Source: Zerohedge

Currencies

One of the recurring subjects of this letter has been the contemplation of what might happen as the US dollar loses hegemony due to its purely fiat status and the eroding financial strength to support its value. This has been called the “Endgame” and a “reset” among other things.

This week, Russell Napier and Michael Howell discussed the subject in an online presentation, “Is this the end of the USD era and if so is this the start of The Great Reset?”. One of the key points Howell makes is that although it is hard to predict the outcome of the capital war between the US and China, he does expect money to move out of the US and therefore expects a period of currency volatility.

On its own this may not sound like much, but in the context of the book, “The Rise of Carry”, Howell’s outlook packs a greater punch. For starters, “the classic finance carry trade takes place in the foreign exchange market, when a trader borrows in a low interest rate currency and invests the proceeds in another, higher-yielding currency.” In other words, it is a currency trade.

Another insight from the book is recognition that the “relationship between volatility selling and leverage”, two key ingredients in a carry trade, work together to “make market dislocations inevitable”. So, by the transitive property of equality, carry trades (which are leveraged currency trades) inevitably lead to market dislocations in the best of times. If Howell’s prediction of unusually high currency volatility is correct, there may be very serious market dislocations. Don’t act surprised when it happens.

Capital markets

Robinhood Is Reportedly Raising Another Billion Dollars... On Top Of $4 Billion In Last Week

“Despite all the spin and hoopla that securities trading restrictions are being lifted and all is well in the wild wild west world of Robinhood's back office after raising $3.4 billion in fresh capital in the last few days and another $600 million in revolver drawdowns, Reuters is reporting that the free trading app has held talks with banks about raising an additional $1 billion in debt.”

“Actually you have raised $4 billion (including $600MM revolved) to fund capital shortfalls due to catastrophic risk management and disastrous back office operation.”

Three major capital raises in less than a week. Hmm, sounds a little suspicious. I don’t have any trouble believing Robinhood might need the capital – the increase in activity levels and volatility would absolutely warrant greater capital demands from the clearinghouse. These are fairly mechanical calculations, though. Maybe you screw up once, but several times in a row? It sounds fishy.

Ben Hunt had exactly the same suspicions and, as always, did an outstanding job of articulating them. By (hypothetically) posing the following question to Robinhood CEO Vlad Tenev, Hunt exposes a great deal about how markets work:

Hunger Games

https://www.epsilontheory.com/hunger-games/

“Sir, are your internal controls so poor and your understanding of markets so rudimentary that you found yourself in violation of capital posting requirements to such a degree that your only option was shutting down client trades OR did the National Securities Clearance Corporation (NSCC) raise their capital posting requirements to a shocking and unprecedented level without warning?”

I strongly encourage reading this piece – it is eye-opening in many ways. The Robinhood episode is about a lot more than a few regulatory gaps. Namely, it is clear that most market activity is now effectively regulated by private market makers and not by government authorities. The survival of Robinhood indicates a strong interest by Silicon Valley investors to reap the rewards of gamified investing. Wall Street and Tech control the game - trade accordingly.

WSB, Credit Markets, Taiwan, and DCEP

https://www.radigancarter.com/dispatches/wsb-credit-markets-taiwan-and-dcep

“Well, when you have 500,000 new suicide bombers running around wanting to blow up hedge funds, and you just saw their first spectacular coordinated assault on Melvin, they take that very seriously.”

“Just like an IED needs a smaller high explosive to ignite the much larger but more stable main charge, that is exactly what WSB are doing by affecting credit market behavior. Yes, the credit market is more stable and yes it underpins the entire financial system of the world, which is why it needs another charge to set it off….like scaring fund managers to think they won’t be able to short, so they start the chain reaction of selling illiquid credit, resulting in gaps down and blowing out the credit spread.”

There are several things to like about this analysis but first and foremost is the identification of the major risk revealed in the whole Gamestop episode. The big risk is by making short selling extremely difficult and/or expensive to do, many funds will be deprived of a useful mechanism to manage risk. This phenomenon strikes credit investors the hardest because their long investments are also relatively illiquid. The de facto loss of hedge protection creates the necessity to “de-gross” by reducing overall exposure. This happened, at least for a short time.

I also like the military analogies. If you envision the trading activity as being carried out by a group of hapless underachievers who put their stimulus checks in the market through Robinhood, it sounds like a fairly silly, but fairly harmless thing to do. If, however, you are talking about “500,000 new suicide bombers running around wanting to blow up hedge funds”, that conjures up a very different image.

That different image is something a lot of people need to start waking up to: A lot of young adults are very seriously pissed off – and for good reason. While I can’t say (figurative) suicide bombing is the best way to send a message, I very much sympathize with opposition to an environment of public policy measures that has almost systematically redistributed wealth and opportunity away from younger generations.

Finally, I especially like the IED metaphor for the financial system. The idea that a small initiator charge sets off a larger stable explosive captures the character of the risk well. This is useful because many people see risk as one dimensional: Either it is there, or it is not. As a result, when people like myself describe the market as “risky” or “fragile”, and nothing bad happens after a period of time, it is easy to dismiss such concerns as being overly cautious.

The thing about the IED analogy is it highlights the presence of a “large stable explosive”. In the case of the financial system, this is debt in the presence of low interest rates. Stable, yes, but just as soon as an initiator charge goes off the whole thing goes off. This is what happened with subprime mortgages in the financial crisis. The initiator charge is forced selling in a system that can’t handle it.

Another way of looking at it is as a house with a gas leak. It is not a major problem as long as there is nothing to ignite it, but it is extremely dangerous because any little spark could set it off. The protocol for managing the risk of a gas leak is to evacuate the building immediately and to fix the leak as soon as possible.

The way the Fed is dealing with the risk of excessive levels of debt, however, is just the opposite. Rather than evacuating the house, it is inviting more people in by keeping rates low. Then, to manage risk, it is politely requesting “No smoking”. Crazy.

Implications for investment strategy

There is a lot that I could say here but much of it is well said in the Epsilon Theory piece I referenced earlier. For now, suffice it to say, it is best to engage in “games” (in the game theory sense) in which you have a fair chance to win. Increasingly, investing in the stock of public companies is not one of those games. The chances of ending up as a pawn in a higher-level game and ending up worse off for the effort are quite high. If you are going there, go in with eyes wide open.

Source: Twitter

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.