Arete's Observations 3/12/21

Market observations

"This Is F**king Crazy" - US Equities Whipsaw Dramatically At Cash Open

https://www.zerohedge.com/markets/fking-crazy-us-equities-whipsaw-dramatically-cash-open

“As one veteran trader exclaimed on a particularly frantic call this morning ‘this is f**king crazy... the whole market is trading like WSB penny stock...’”

Stocks had a roller coaster day on Monday, with the S&P 500 up over 1% at one point, only to finish down about 50 basis points. Tuesday was off to the races with the S&P 500 up about 1.4% and the Nasdaq up 4%. This extremely volatile trading, which continued through the week, is a far cry from the nice regular incremental gains of 20 basis points each and every day a couple of a few years ago.

Rise of the retail army: the amateur traders transforming markets ($)

https://www.ft.com/content/7a91e3ea-b9ec-4611-9a03-a8dd3b8bddb5

“When newcomers discover Robinhood, and decide to use the zeitgeist US trading platform to punt around in stocks, many of them have questions. Chief among them, it seems, is ‘what is the stock market?’.”

“A Deutsche Bank survey found that almost half of US retail investors were completely new to the markets in the past year. They are young, mostly under 34. And they are aggressive: much more willing than those more experienced in stock markets to borrow to fund their bets, to make heavy use of options to fire up wagers on stocks, and to use social media as a research tool to find trading ideas.”

“The motto of the Reddit crowd is YOLO. ‘You only live once’ is not a motto for saving for retirement,” says Jordi Visser, chief investment officer at Weiss Multi-Strategy Advisers, a hedge fund. “I don't think enough people take to heart what these words mean. This millennial crowd wants to invest in the long shots, not save.”

One of the bigger stories over the last several months has been the increasing participation of amateur/retail investors. Many of these newcomers are young and source their investment information from, shall we say, nontraditional sources. The graph from DailyShot.com below shows Millennials have a strong preference for Youtube to inform investment decisions. Another graph (not pictured) shows Gen Z with similar preferences, although Tik Tok also ranks highly.

While some hail this newfound accessibility as the “democratization of finance”, I call it something very different. When I think of democratization, for example, I think of vendors such as Calcbench, which I use. Calcbench uses XBRL to make corporate financial information easily accessible in spreadsheets for a price that is an order of magnitude cheaper than that of predecessor sources for similar information. But alas, who needs numbers to crunch when there are better stories on Youtube?

While the impact of amateur/retail trading can be overstated at times, it does appear as if most of it is discretionary and focused on select stocks or sectors. This new trading cohort does seem to be behind some big stock moves. It will be interesting to see if the newcomers might also be behind some forced selling in the future.

Labor

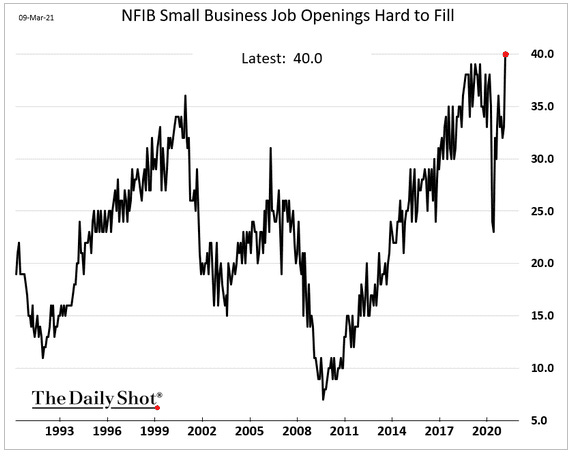

The NFIB is showing small businesses are having a record hard time filling certain job openings. One interpretation is the economy is off and running and wage inflation will follow right behind it. With more than 10 million people still out of work though, another explanation is the labor force simply does not have the requisite skills for today’s work …

The long road to putting America back to work

“Putting the country back to work will require vast amounts of retraining and career shifting, as former bartenders learn to code and former cruise ship workers look for jobs at data centers. The U.S. is still unprepared to take that on at scale.”

“Job training and reskilling will be an essential part of America's post-pandemic bounce back, but neither of the two COVID relief bills passed during the last year earmarked any money for it.”

Unfortunately, ramping the economy back up will not be simply a measure of getting people back to work. Even more unfortunately, the policies and systems are not in place to provide the amount of retraining necessary to do so. As Anthony Carnevale, director of the Georgetown University Center on Education and the Workforce, put it, “We just don’t do this. We’re not a training nation." He called the shortcoming a "systemic failure” relative to what other nations do.

Economy

Workers are getting a really bad deal

https://www.axios.com/worker-productivity-pandemic-bbc7d9a7-2b1b-4608-92b0-84eb965f0eee.html

“The Labor Department reported Thursday that the productivity of American workers fell by a revised 4.2% annual rate in the fourth quarter, the largest decline in 39 years.”

“The productivity decline was due to an increase in output by 5.5% that was accompanied by a 10.1% increase in hours worked.”

The bottom line for workers is not a pleasant one: “Less people are working and those who are, are working more.” The bottom line for the economy isn’t really any better: Productivity is a key variable for sustainable economic growth and lower productivity points to lower growth.

Reopening

Do young people really need the office? ($)

https://www.ft.com/content/d7c8ce81-8e81-4d67-8104-4f6b3174958a

“I don’t want another class of young people arriving [remotely] that aren’t getting more direct contact, direct apprenticeship, direct mentorship.”

“The idea that proximity to experienced colleagues enhances junior workers’ skills was squashed by one 25-year-old who works in media. She confessed one reason she prefers working from home is that she no longer had to deal with the tasks that senior workers would delegate every time they passed her desk. The result? She could get on with her actual job and learn so much more.”

Given how deeply the pandemic and associated policies have affected people and how long many measures have persisted, it would be surprising if some things haven’t changed permanently. While I still don’t believe a complete reopening of the economy is imminent, I do believe a pathway is established on how to get there. As a result, it makes sense to start considering what the world will look like as the economy gradually opens up.

Companies are already beginning to make plans. The first quote comes from the head of Goldman Sachs and reflects a widely held notion that the office is an important learning environment for younger workers. In addition, the office is also an important source of socialization and a fertile environment to develop networks and learn how to navigate an organization, especially for younger workers.

On the other hand, offices are also sources of constant distractions and requests for menial tasks. Important in-person functions such as on-the-job instruction and constructive feedback didn’t happen before the pandemic so there is no reason to believe they will magically happen afterwards either. It seems like the perceived value of direct contact and mentorship depends significantly on whether one is the “giver” or “receiver”.

Vaccinations

The Spiritual Problem at the Heart of Christian Vaccine Refusal ($)

https://frenchpress.thedispatch.com/p/the-spiritual-problem-at-the-heart

“White evangelicals are the least likely to say they should consider the health effects on their community when making a decision to be vaccinated. Only 48% of white evangelicals said they would consider the community health effects ‘a lot’ when deciding to be vaccinated. That compares with 70% of Black Protestants, 65% of Catholics and 68% of unaffiliated Americans.”

“Given these stark statistics, if there is one thing that readers should take away from this newsletter, it’s that Evangelical vaccine hesitancy is both an information problem and a spiritual problem.”

David French does another spectacular job with this piece in providing a window of insight into the hesitancy of white evangelicals to get vaccinated. A glaring problem is white evangelicals are the least likely to consider the health effects on their community in regard to the vaccination decision. While religion can certainly be a great source of comfort and a notable source of good deeds, it also has its share of epic fails. This seems to be one of them: The spiritualism of white evangelicals precludes caring for other human beings to an important extent.

As French rightly describes, perhaps we can “persuade people that taking risks (or enduring inconvenience) on behalf of others should be a cardinal Christian characteristic.” Amen to that.

Public policy

Manchin's next power play

https://www.axios.com/joe-manchin-infrastructure-bill-c8408e99-17f3-4477-b5df-8e3d537c0bd9.html

“Manchin said he'll push for tax hikes to pay for Biden's upcoming infrastructure and climate proposal, and will use his Energy Committee chairmanship to force the GOP to confront climate reality.”

“Manchin said he'll block Biden's next big package — $2 trillion to $4 trillion for climate and infrastructure — if Republicans aren't included.”

I have been reporting since before the election there was virtually no scenario in which political power would be so one-sided as to facilitate massive and ongoing fiscal infusions. Joe Manchin has turned out to be the “swing voter” to prove the point.

The implication is any future spending bill will require bipartisan support and therefore have both a very different look than the American Rescue Plan and a smaller scale than the $2-4 trillion headline number. This will be important to watch for investors who expect virtually unlimited government spending and a rapidly declining US dollar.

Early indications are the Biden team is leaning toward going through budget reconciliation process again for the next big spending bill. If Manchin is determined to block such unilateral efforts, someone will have to give ground.

Inflation

A. Gary Shilling’s INSIGHT, March 2021 ($)

“We continue to believe that the key to inflation/deflation will continue to be the balance between global supply of goods and services and worldwide demand.”

“As long as worldwide excess supply of products persists, so too will low inflation, if not deflation, in our judgment.”

While the analysis from Gary Shilling on inflation is not new it is worth keeping in mind in order to maintain perspective. When a lot of money is floating around it is going to look for a home somewhere. That “somewhere” is unlikely to be goods and services, however, unless and until there are sustained shortages. As to potential for shortages …

The Beer Distribution Game illustrates supply chain desperation ($)

https://www.ft.com/content/926c1dbe-e679-4783-975f-430c1d451ab8

“So what can account for the desperation along the goods supply chain? I believe it is the whiplash effect of the depletion of retail inventories during the lockdowns at the beginning of the pandemic. In the world of operations management, ie the systematic analysis of production and distribution chains, this is also called the Beer Game Effect.”

“At each stage the back orders and lags compound in what operations research formally calls ‘oscillation, amplification and phase lag’. Informally, it is sometimes called the bullwhip effect.”

The beer distribution game is a famous case study and one that I participated in at business school. The game provides useful insights with one being that delays happen in distribution chains. While this may seem self-evident, it feels very different when you are the one making decisions and being penalized if your inventory runs too low and you lose business. As a result, it is common for players to over-react to small perturbations in deliveries.

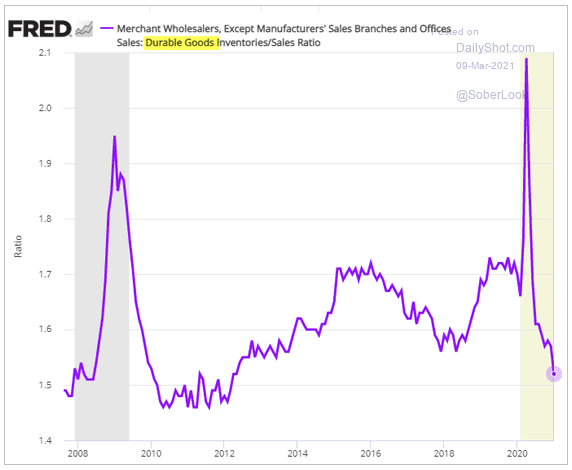

Dizard uses the game as an analogue for the sudden interest in commodities right now. While I believe there is a good longer-term case for commodities, I also believe Dizard is right short-term. The graph below shows inventory fluctuations are likely a major issue with price pressure in durable goods right now. The same can be said of lumber, machinery, and motor vehicles. This too shall pass.

China

Rabo: Up Until Now It’s Been All China: Now It’s Going To Be All The US

https://www.zerohedge.com/markets/rabo-until-now-its-been-all-china-now-its-going-be-all-us

“Now back to the fiscal: the US is going one way and China the other - what does that tell us about how well the globe can handle any real Building Back Better?”

“There is no such middle role in a K-shaped US economy, where fiscal stimulus is too much for some and not enough for others: so yields will shoot up and ultimately crash down again, and the USD will likely do the same – unless and until we get Fed yield curve control that is. Watch those stage pyrotechnics play out in awe.”

Don’t Look Now But The Chinese Currency Is Starting To Move

https://www.zerohedge.com/markets/dont-look-now-chinese-currency-starting-move

“today the PBOC announced it will keep growth of both money supply and aggregate financing broadly in line with that of nominal GDP. This is **STAGGERINGLY** contractionary given the last 12-month rolling aggregate financing figure was 35% y/y, the series average back to 2004 is 15%, and the most optimistic nominal GDP print one could expect would be 9%”

Michael Every from Rabobank raises a couple of useful points for investors in these two notes. First, before investors become too enthralled by the fiscal stimulus coming from the US, they ought to beware of developments in China as well. Offsetting US spending will be monetary policy in China that Every describes as “**STAGGERINGLY** contractionary”. I’m guessing the run in commodities isn’t going to last a whole lot longer.

Also, because the two countries are on such different paths, there is likely to be a great deal of volatility in yields and currencies. Insofar as this volatility transpires, which I suspect it will, it will be extremely hard to manage large investment books with high leverage.

Capital markets

The Best Way to Rob a Bank

https://www.epsilontheory.com/the-best-way-to-rob-a-bank/

“I think that the collapse over the past week of Greensill Capital has a lot of systemic risk embedded within it, particularly as the fraudulent deals between Greensill and its major sponsors– Softbank and Credit Suisse – come to light.”

“Is this a Madoff Moment for the unicorn market? Honestly, if you had asked me a few weeks ago, I would have told you that a Madoff Moment was impossible in our narrative-consumed, speak-no-evil market world of 2021. Now I’m not sure. We’ll see, but I think this has legs.”

The unfolding episode with Greensill Capital is interesting and recalls the same kind of foreboding during the financial crisis the Bear Stearns hedge fund blowups and the Madoff scandal provided. In both cases excessively low rates enabled bad business models and outright fraud. It is only when conditions start changing that the chicanery gets exposed, or at least exposed enough to matter.

We’ll have to see how deep this goes, but the more that comes out, the worse it looks. Since the “Companies and Markets” section of Thursday’s FT was splattered with three stories on Greensill, it looks like more keeps coming out.

Implications for investment strategy

The Long Run Is Lying to You

https://www.aqr.com/Insights/Perspectives/The-Long-Run-Is-Lying-to-You

“Accounting for valuation changes when estimating long-term expected returns is not a new concept … Still, while not brand new, I think this is a gravely underappreciated area of research.”

“In particular, another underappreciated result is that when you estimate long-term expected returns accounting for valuation changes, you get a significant gain in the precision of your estimate (not just a different, less biased, estimate). How many of our well-known ‘facts’ about expected returns, risk premia, and popular investment strategies are substantially influenced by prior valuation changes that are very dodgy to assume will repeat going forward? Not to ruin the suspense but the answer is a lot.”

One of the core exercises of investment consultants and advisors is estimating expected returns to various asset classes and allocating assets accordingly. Cliff Asness throws a big wrench into this practice by highlighting the significant role valuation changes play in driving such estimates. In other words, expected returns derived solely from past returns differ substantially from those derived from past returns and adjusted for starting and ending valuations.

This is especially important after a multi-decade period in which interest rates have declined and US stocks have risen substantially. During that time, the valuations of stocks and bonds have also risen substantially which means past returns are extremely unlikely to repeat unless valuations keep on rising at the same pace. Since this is unlikely, the best estimate is that expected returns will be lower going forward.

Value's Long-Awaited Dawn May Finally Be Here

“My own hunch is that momentum may be a function of market institutionalization. Once markets are populated almost entirely by large institutions driven by their own incentives, groupthink takes hold more easily. Being judged against peers, and needing to avoid embarrassing performance relative to their benchmark rather than to get the top possible risk-adjusted dollar for clients, fund managers tend to herd together.”

“When I asked Paul Marsh, one of the authors, to explain what was going on [regarding momentum], he suggested that the problem with momentum is that ‘we don’t know why it exists, and it shouldn’t exist’.”

One of the conundrums of finance is the momentum factor (the tendency of winning stocks to keep winning and losing stocks to keep losing) is one of the most effective. As Paul Marsh notes, there is no good reason for it although the suggestions by John Authers are reasonable and probably have some explanatory value.

Another hypothesis, however, is that momentum is a function of the ongoing carry regime that I have mentioned several times in the last few weeks. In such regimes, central bank interventions serve to artificially moderate volatility. This not only creates an incentive to buy the dips, but also facilitates the liberal use of leverage.

The effect is that for some period of time, stock appreciation becomes self-fulfilling: Volatility goes down, stocks go up, even greater leverage can be used, and on and on. As a result, upward moves seem to last longer than they should, i.e., stocks exhibit momentum. If this hypothesis is correct, then central banks have yet another unintended consequence to tack on to their resumes.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.