Arete's Observations 3/19/21

Market observations

Stripe's giant funding shows how size no longer matters

https://www.axios.com/stripe-digital-paynments-fundraising-9b456aec-7619-4d72-a5ed-7f97f3ffd9ed.html

“Digital payments giant Stripe yesterday announced $600 million in new funding at a $95 billion valuation, making it the most highly valued U.S. ‘unicorn.’ Why it matters: Because it no longer matters.”

“Today, no one's blinking … This isn't a reflection on Stripe … Instead, it's that outsized outliers have become routine. Each one larger than the last, in a deafening, Fed-fueled cyclone.”

The sentiment here captures an important feature of markets today. In the normal course of one-upmanship, the sequential records and huge numbers have become so routine as to have lost effect. While this is likely to cause some major problems later, for the time being, party on Wayne.

Demographics

The severe cost of the world’s baby bust ($)

https://www.ft.com/content/4c599439-a051-4ded-ba55-096a809729b9

“We are in a global baby bust of unprecedented proportions … The worldwide fertility rate has already dropped more than 50 per cent in the past 50 years, from 5.1 births per woman in 1964 to 2.4 in 2018, according to the World Bank. In 2020, the 20 per cent shortfall below replacement rate in US fertility, together with low net immigration, produced the lowest population growth on record of 0.35 per cent, below even the flu pandemic of 1918.”

This piece by Jeremey Grantham highlights some demographic realities which are hugely important and hugely underappreciated. Demographics is important because it creates a kind of silent tailwind (or headwind) to economic growth and inflationary pressures. Big swings in either or both of those measures often coincides with meaningful demographic swings.

Unfortunately, the news isn’t great. While the economy is recovering and returning to a more normal level of activity, the longer-term outlook is severely constrained by dismal population growth. Productivity growth also affects economic growth, but it also has been in decline and remains at very low levels.

As a result, any kind of sustainable population growth is likely to gravitate to something close to zero unless things change. Increased immigration could boost population growth but is subject to a great deal of political backlash. While this view may seem unduly pessimistic, it is certainly represented in the views of iGeners (see “Social trends”) who rank economic security among their greatest concerns.

Technology

The new rules of competition in the technology industry ($)

“The mutual toe-treading that ensues takes several forms. First, the companies are increasingly selling the same products or services. Second, they are providing similar products and services on the back of different business models, for example giving away things that a rival charges for (or vice versa, charging for a service that a competitor offers in exchange for user data sold to advertisers). Third, they are eyeing the same nascent markets, such as artificial intelligence (ai) or self-driving cars.”

I have highlighted the increasing rivalry among big tech companies before and this piece by the Economist does a nice job of summarizing the dimensions of the competitive landscape. The main point is that real competition from one another is likely to create a significant headwind for these companies and one that is underappreciated in growth estimates.

Ishiguro and the rise of techno-pessimism ($)

https://www.ft.com/content/f6772f08-450e-4490-9e3c-8ed455f19c8d

“In a young century, attitudes to technology have passed from credulous optimism to scattered misgivings to what is now a grinding bleakness.”

“Last month, Tobias Ellwood MP described the end of Google, Facebook, Amazon and Twitter as ‘one of the priorities of our age’. Not the reining-in, mind, but the end.”

I have also highlighted the potential for greater regulation among big tech companies before. It is easy to dismiss this concern because it has been an ongoing one and one that has achieved virtually no traction. That is changing, however, and the slow progress in the past belies a fundamentally different attitude to the endeavor now. Again, significantly energized regulatory efforts are likely to create headwinds for the big tech companies that are not fully appreciated in their growth estimates.

Social trends

iGen: Why Today's Super-Connected Kids Are Growing Up Less Rebellious, More Tolerant, Less Happy--and Completely Unprepared for Adulthood--and What That Means for the Rest of Us, by Jean M. Twenge PhD

iGen is basically the companion book to “The Coddling of the American Mind” which I mentioned in the March 5 “Observations”. Twenge describes the generation born between 1995 and 2012 (aka Gen Z) as the first generation to grow up with ubiquitous internet, smart phones, and social media. IGen has been shaped by all of those factors.

One of the key characteristics of iGen is insecurity. iGeners, as a group, are demoralized, believing the system is rigged against them and they are not in control. They are “dissatisfied, disconnected, and distrustful of government” believing it does not do anything to serve their needs. As a result, they are very interested in economic security.

iGeners also have a great respect for individualism. Whether in regard to political beliefs, sexual preferences, or anything else, they believe people should be allowed to do what is right for them. They are very tolerant and practical. They respect people who are their own person and who do not bend to other influences.

Politically, this creates quite an interesting mix. Interest in economic security causes support for progressive policies such as student debt forgiveness. Respect for individualism and authenticity led to the greatest support for Sanders and Trump as political candidates. Individualism and dissatisfaction with government point generally to more libertarian ideals.

What does it all mean? The main thing is the notion that young adults prefer socialism to capitalism is a misleading comparison. IGeners don’t believe in government so they don’t believe in socialism per se; they do want help in becoming economically secure, though. Those are different things.

When (mainly older) people blow a gasket every time socialism gets mentioned they miss hearing the less literal intimation of the word. Teens and young adults are mainly just trying to navigate a world more fraught and with less opportunity than that of their forebears. By the same token, iGeners could help their cause by learning some history as to why the word “socialism” is such a hot button for many people who have actually observed and/or experienced it.

Politics

The Morning Dispatch: The Democratic Push to End the Filibuster ($)

https://morning.thedispatch.com/p/democrats-biden-filibuster

“McConnell took to the floor Tuesday to deliver lengthy remarks about the filibuster, painting an ominous picture of what Republicans would do without it. ‘Nobody serving in this chamber can even begin to imagine what a completely scorched-earth Senate would look like,’ he said. ‘As soon as Republicans wound up back in the saddle, we wouldn’t just erase every liberal change that hurt the country’.”

“It’s getting to the point where, you know, democracy is having a hard time functioning,” he [Biden] told ABC News in an interview on Tuesday …

Opinions on the filibuster seem to depend mostly on whether the opinion holder is of the same party as the one in power. Both Democrats and Republicans flirt with abolishing the rule when they are in power and endorse its sanctity when they aren’t.

In principle, the notion of inserting a speed bump into the legislative process to ensure some degree of collaboration is a sound one. In the context of hyper-partisan politics, egregious levels of debt, an economy beat up by the coronavirus pandemic, and monetary policy over-extended by nearly a decade, it will be important for Congress to be able to come together to address the challenges. The cost of being deadlocked, i.e., doing nothing, is extremely high. That points to some kind of compromise on the filibuster.

As to McConnell, the guy who typically operates quietly behind closed doors took an unusual tack by bellowing out a “scorched earth” playbook. At first glance it appears as if he finally came unhinged. Upon some reflection, however, this is probably classic McConnell.

Making such outrageous and inflammatory remarks serves two purposes for him. For one, it sends a shot across the bow of overly ambitious progressives. If they want war, they will get war. For another, it sends an indirect message to recalcitrant pro-Trump Republicans of the fury that can be wrought if you mess with the big guy. Those inflammatory remarks, however, are also sure to catch the attention of an American electorate that is increasingly dissatisfied with a government that does not reflect its interests.

Reopening

Jabs for jobs and Fab Fridays: welcome to the future of work ($)

https://www.ft.com/content/b31f2203-5a6f-4a75-ab5b-da193e9412c2

“They said, ‘Udi, you are in Israel, you’re at the end of the tunnel. What do you see?’” he told me last week. Alas, he had bad news. “I said to them, ‘I see another tunnel’.”

There is probably no better place to look to get an early indication of what re-opening will look like than Israel which is far ahead of every other country in getting its population vaccinated. The answer by one account is “sobering”, but at very least is qualified.

The problem is not everything changes the second a vaccine is administered. Furlough programs provide an incentive for people stay out of work until the programs are terminated. Incomplete distribution of vaccines means different rules for the vaccinated and unvaccinated. The bottom line is it is going to take time for things to return to any semblance of normality.

Public policy

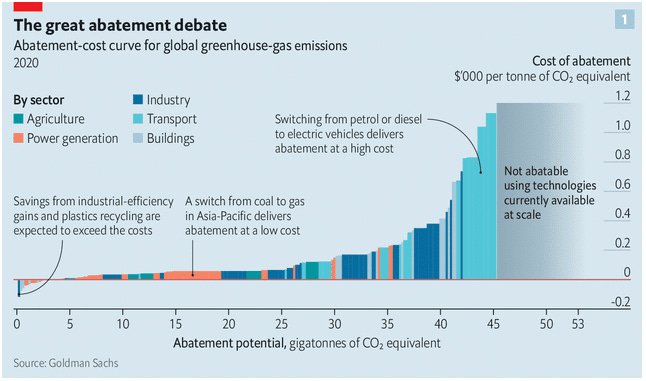

What is the cheapest way to cut carbon? ($)

https://www.economist.com/finance-and-economics/2021/02/22/what-is-the-cheapest-way-to-cut-carbon

“Such [abatement cost] curves have been computed by a number of forecasters over the years, including McKinsey and the Boston Consulting Group, two consultancies; Goldman Sachs, a bank; and Britain’s Climate Change Commission, which advises Parliament. As a rule, most show that the biggest bang comes from making buildings more energy-efficient, say by installing insulation or smart cooling and heating systems. Often these have negative costs: analysts think they will eventually save consumers money through cheaper bills.”

“The next-best bang for the buck tends to be replacing power plants that burn natural gas or coal with renewable-powered ones.”

“But the most expensive areas of the economy to decarbonise tend to be transport (planes and ships), heavy industry (steel and cement) and agriculture (cows belching methane). In these cases clean, cheap, scalable alternatives do not yet exist.”

In the great debate about how to save the environment and/or reduce climate change, plenty of bright shiny objects have been promoted as pathways to success. Importantly, electric vehicles have been right at the top of the list. The only problem is the relationship between the hottest ideas and the most effective ideas has gotten switched around in many cases.

In other words, if the goal is to create policies that would have the greatest effect on reducing carbon in the environment for the least cost, the starting point would be making buildings more energy efficient. Among the last things would be rolling out electric vehicles. The bad news is until more sensible priorities are promoted, it is fair to expect only slow and irregular progress on reducing greenhouse gas emissions. The good news is this is easily correctible: Just focus first on what works.

Source: The Economist

Inflation

America’s progressive revolution is not here yet ($)

https://www.ft.com/content/2b3e2c2d-6547-4884-aeb3-199560ba4bf7

“This is where the comparisons with Lyndon Johnson and — for heaven’s sake — Franklin Roosevelt start to break down. In enlarging the welfare state, those presidents were playing for keeps. Roosevelt’s universal pension scheme is the one that exists today. Johnson legislated for Medicaid, Medicare and even National Public Radio: all fixtures of US life in 2021. Perhaps Biden will get around to reforms of similar permanence and persuade voters to pay for them. Until then, it is frivolous to pass off his American Rescue Plan as anything of the kind. The principal components of its vast outlay — direct cheques, plus increases in tax credits and unemployment benefit — are all meant to expire.”

One of the most important variables in the inflation equation is that of fiscal policy. If a government continues to spend on things other than productive investment, and incurring debt to do so, there is a good chance the currency will eventually lose its value. While the American Rescue Plan is notable for its size, Ganesh rightly points out it does not compare with the outlays of Roosevelt and Johnson on the basis of permanence.

The degree of permanence is a key characteristic to watch. As soon as new fiscal spending plans become entrenched that would open the proverbial floodgates. For example, extended unemployment benefits could morph into Universal Basic Income. Increases in child tax credits could also prove popular enough to become permanent. While there are clearly pathways for spending to become more permanent, partisanship, especially as revealed by the squabble over the filibuster, considerably reduces such prospects.

Monetary policy

Dear Market, Don’t Worry, Be Happy. Yours, the Fed

“He [Jerome Powell] emphasized that unemployment remained too high, had been unequal in its effects, and upended many lives. He also predicted that we are likely to see higher inflation over the next 12 months, but that it will be ‘transitory.’ As a result, it wouldn’t meet the standard for the Fed to shift from its projected path on monetary policy.”

“Translated, Powell was telling everyone that the Fed now cares more about unemployment than inflation, and that there’s no need to worry that the likely inflation scare over the next few months as the great shutdown passes more than 12 months into the past will shake the FOMC into tightening monetary policy.”

The big monetary news of the week was the Fed’s meeting and official statement. Superficially the news was positive – the Fed recognized improvement in the economy and communicated its intent to keep rates low. Recognition that unemployment had “upended many lives” also cast the Fed in a “kinder, gentler” light designed to appeal to a broader audience.

Shortly after the announcement, however, yields started pushing higher again which signals the delicate position the Fed is in. The more it tries to put policy on autopilot, the more market participants are going to drive rates higher and “dare” the Fed to not react. Since the potential outcomes are extreme, this game of chicken is likely to continue pressing rate volatility higher.

Capital markets

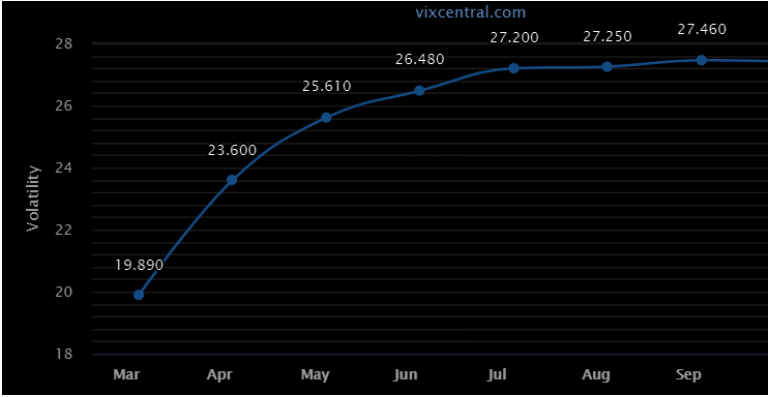

Bond and equity people going into the Fed meeting with different perceptions of "fear" ($)

Themarketear.com, March 16 2021 at 16:35

“We have seen a rather dramatic suppression of VIX. Volatility structure has come in big since early March. The short end of the curve has not been this cheap in a long time.”

Source: themarketear.com

“but bond vs equity volatility continued diverging and the gap is now very wide.”

Source: themarketear.com

Volatility can provide important informational content and the divergence between equity and fixed income volatility right now is telling. On the equity side, VIX is as low as it has been in a long time on the short side, but longer-term volatility remains much higher. The MOVE index, which measures fixed income volatility, has also diverged from VIX.

One interpretation, and I believe probably the best one, is equity investors are traipsing around without a care in the world while storm clouds are gathering overhead. Of course, the amount of risk this entails depends a lot on one’s particular situation, but the warning signs are there.

Implications for investment strategy

How to Spot a Bubble

https://www.hussmanfunds.com/comment/mc210315/

“Only a handful of instances in history overlap pre-crash conditions as well as they do at present … If you want my opinion, I suspect that a near-vertical market plunge on the order of 25-35% is coming, probably quite shortly, most likely out of the blue …”

“Suffice it to say that the ‘Fed backstop’ is largely in the minds of investors, and relies almost exclusively on the psychological discomfort of holding low-yielding base money.”

The first point is the more urgent: Market conditions have all the markings of a big selloff in the works. While there is certainly plenty of optimistic commentary, there always is at the top. Underneath the surface of indexes hitting new highs, however, is a great deal of turmoil with no obvious path to resolution.

The second point is a broader one. As easy as it may be to believe the Fed is omnipotent in keeping markets rising, the belief system in the Fed is especially fragile. It won’t necessarily take much of a shock to quickly (and dramatically) refocus investors from price appreciation to safety. Further, once this fragility becomes obvious, the Fed will be almost completely powerless to do anything. The implication of both points is to be careful out there.

On the point of being careful, I have mentioned before the prominence of the 60/40 portfolio and its requirement of uncorrelated returns between stocks and bonds. As the graph below illustrates, that correlation recently broke positive - which is not a surprise given rising interest rates from a very low base.

This has fairly significant implications for investors. For example, investors with 60/40 portfolios are going to start experiencing a much higher level of volatility. With one asset class no longer cushioning the other one, swings up and down will be magnified. Further, given the extended valuation of virtually all financial assets, expected returns also provide a bleak forecast.

Over very long planning horizons the most crucial portfolio need is uncorrelated returns streams. The reason is those uncorrelated return streams prevent devastating drawdowns. Since stocks and bonds are no longer doing that, there will be increasing urgency to find assets that can.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.