Arete's Observations 3/26/21

Market observations

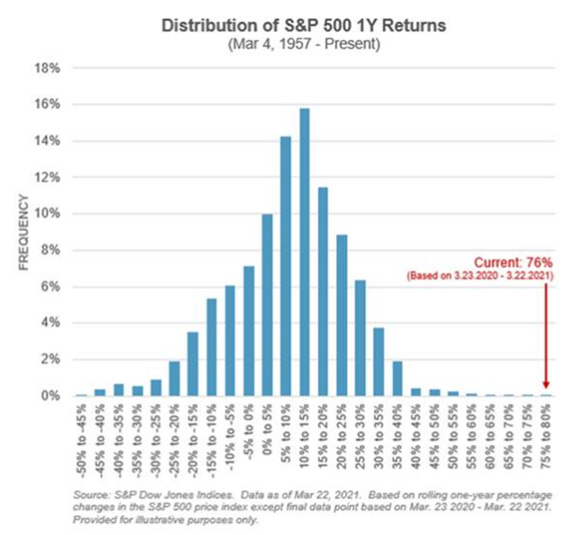

John Authers reported for Bloomberg this week, “We have just finished the best 12 months in the history of the S&P 500”. An amazing year it has been for sure. The incredibly strong year for stock returns elicits very different responses from different people though. People with a working knowledge of statistics view such extreme numbers as outliers. Others, however, tend to extrapolate past excesses into the future. This happened with house prices in the mid-2000s, and it seems to be happening with stocks now …

Investor psychology is shifting to risk in a big way

“Money is flooding into U.S. equities, stock mutual funds and ETFs as more traders and investors follow the bullish calls from Wall Street banks and the Fed.”

“Investors have clearly embraced the concept of TINA (There Is No Alternative [to U.S. equities]) as fund flows have nearly evaporated for government bonds ($0.06 billion), muni bonds ($1.1 billion) mortgages ($0.3 billion) and global emerging market assets ($0.1 billion). Money market funds saw $9.9 billion in outflows, BofA's data showed.”

Clearly, increasing concerns about inflation are chasing more investors into stocks at the expense of bonds. Of course, for new stock enthusiasts this overlooks the excessively high valuations of stocks and the potential for devastating drawdowns. Apparently, that will be a concern for another day.

Economy

Almost half of small businesses fear closing before end of Q2

https://www.axios.com/small-business-closures-96c8301c-57e9-4181-9cc8-2f852810a4bb.html

“Almost half of all businesses (45%) said they were "highly concerned" about their ability to keep the lights on, including close to two-thirds of all beauty salons (63%) and caterers (63%).”

“41% of all small business owners say they only have one month or less of cash reserves (up from 32% in February). 49% were not able to pay March rent (up from 38% last month). 74% report significant problems receiving their PPP funds, while only 26% say the PPP provided their loans quickly and easily.”

Just a quick reminder here that even with vaccines rolling out, restrictions being lifted, and warmer weather getting people out, the situation is still extremely tenuous for many small businesses. While it would be a mistake to assume they all will fail, it would also be a mistake to assume they don’t still have very significant hurdles to overcome to return to any sense of normalcy.

Education

Efforts to modernise economics teaching are gathering steam ($)

“A survey of American lecturers last year found that their methods, which rely on lectures and assigned textbook reading, had barely changed in 25 years.”

“Textbooks themselves can lag behind the practice of economics. A study by Jane Ihrig of the Federal Reserve Board and Scott Wolla of the Federal Reserve Bank of St Louis found that at least three of six leading texts published since the start of 2020 misrepresented monetary policy.”

This article was written in regard to the teaching of economics but applies much more broadly than that. Dated texts increasingly run the risk of not keeping up with current practices, especially in a field like economics where monetary officials are dreaming up new interventions on a real-time basis. Part of the reason is professors are disinclined to adopt new texts quickly because it means more work for them.

While balancing historical theory and context with the current environment is inherently a difficult challenge for instructors, the failure to even try very hard causes a couple of big problems. The biggest problem is students are left ill-prepared to step into jobs upon graduation and be productive. Another problem is slow adaptation to change loses the respect and attention of students because the teaching loses relevance for them. That is a shame because often it is the history and context that prove more valuable later in one’s career.

Politics

The Sweep: Was Trump Good for the GOP? ($)

https://sweep.thedispatch.com/p/the-sweep-was-trump-good-for-the

“So when you look at self-reported ideology — just asking people, ‘Do you identify as liberal, moderate, or conservative’ — you find that there aren’t very big racial divides. Roughly the same proportion of African American, Hispanic, and white voters identify as conservative. But white voters are polarized on ideology, while nonwhite voters haven’t been. Something like 80 percent of white conservatives vote for Republicans. But historically, Democrats have won nonwhite conservatives, often by very large margins. What happened in 2020 is that nonwhite conservatives voted for Republicans at higher rates; they started voting more like white conservatives.”

“So as Democrats have traded non-college-educated voters for college-educated ones, white liberals’ share of voice and clout in the Democratic Party has gone up. And since white voters are sorting on ideology more than nonwhite voters, we’ve ended up in a situation where white liberals are more left wing than Black and Hispanic Democrats on pretty much every issue: taxes, health care, policing, and even on racial issues or various measures of ‘racial resentment.’ So as white liberals increasingly define the party’s image and messaging, that’s going to turn off nonwhite conservative Democrats and push them against us.”

Sarah Isgur caught my attention with words that resonate deeply with me: “There’s nothing I love more than being proven wrong with great data.”. She summarizes work done by David Shor (who worked on the 2012 Obama campaign) that outright rejects her thesis of “everything is turnout” for the 2020 election.

What Shor found instead is that white voters sort more on ideology than nonwhite voters. Further, “Most voters are not liberals.” As a result, as the Democratic party has drifted left by emphasizing more polarizing ideology, it has left many less liberal nonwhite voters stuck in the middle. Many of those chose Republican last year.

An important conclusion is this analysis exposes the “foundational cracks in the Democratic Party’s coalition”. For all the problems the Republican party has right now, the Democrats have their fair share as well.

Reopening

The remote revolution spreads beyond tech

“Ford is offering permanent telework as an option to all of its white-collar workers who are able to complete the tasks of their jobs remotely. That's about 30,000 (16%) of its 186,000 employees.”

I suspect we will be seeing a lot more announcements like this one by Ford. I also suspect they could end up being more disruptive than immediately apparent. The higher up the corporate ladder one goes, the harder it is to match up employer with employee because of all kinds of constraints. Relieve those constraints, many of which are geographical, and employees can start working where they want and with whom they want. Companies with toxic cultures and/or bad people managers could face an exodus of people who suddenly have better options and don’t have to put up with it any longer.

Axios-Ipsos poll: America reemerges

https://www.axios.com/axios-ipsos-poll-america-reemerges-3a91de84-f8ec-46d2-b6b6-d57ae5ecf204.html

“But it's the unvaccinated who are returning to activities outside the home at the highest rates. 52% of unvaccinated Americans reported seeing friends and relatives outside the home in the past week, compared with just 41% of those who'd been vaccinated.”

Perhaps it is pandemic fatigue or perhaps the warmer spring weather, but activity levels are increasing the most among those who are not vaccinated. Another hypothesis is that with a substantial portion of the most vulnerable people now vaccinated, unvaccinated people can be more comfortable they won’t cause problems for others. Insofar as this is the case, it means the vaccines will have a disproportionately positive impact on activity.

Emerging markets

Turkey In Turmoil Again: Erdogan Fires Second Central Bank Chief In 4 Months, Sparking Foreign Capital Panic

“In other words, the new head of the CBRT is not only an ideological carbon copy of Erdogan (which explains his ascent to the monetary throne), but is a firm believer in Erdoganomics. Which means that last week's rate hike will be prompted reversed, perhaps as soon as Sunday, leading to yet another episode of ‘Turkey in Turmoil’, and all out current account panic as foreigners pull all their money from Turkey now that the country has lost any last trace of credibility …”

Turkey Isn't the First Domino in an Emerging Markets Bust

“Recep Tayyip Erdogan, Turkey’s increasingly autocratic premier, inflicted a vintage emerging markets crisis on us over the weekend. Four months after ousting his previous central bank governor, he fired Naci Agbal, who had raised rates by 200 basis points last week, and replaced him with Sahap Kavcioglu, who apparently agrees with Erdogan’s novel theory that higher interest rates cause inflation.”

And just like that, Turkey is back in the news flow! All the confidence that had been regained under the competent and credible leadership of Agbal at the central bank vanished in an instant (captured by the drop in the Turkish lira, below) when he was fired without notice. Edward Al-Hussainy reported in the FT that the sacking of Agbal, “really makes Turkish assets untouchable for some time.”

This creates a real problem since external financing requirements significantly exceed foreign exchange reserves. Further, as Robin Brooks noted on Twitter (below) the currency weakness has spilled over to other emerging markets which are dealing with their own problems. As a result, the turmoil places Turkey back near the top of the leaderboard for flashpoints most likely to cause a systemic crisis. Time to watch some wheeling and dealing.

Source: Twitter

China

With its interests in flames, what will China do in Myanmar?

https://www.gzeromedia.com/with-its-interests-in-flames-what-will-china-do-in-myanmar

“Over the weekend, protesters demanding the return of democracy in Myanmar burned down and looted Chinese-owned businesses in Yangon, the country's main city. China's embassy then asked the junta to restore order. In a few hours, the generals obliged: soldiers killed scores of demonstrators, and martial law was declared.”

What’s Behind China’s Dangerous Incursion into the East China Sea ($)

https://vitalinterests.thedispatch.com/p/whats-behind-chinas-dangerous-incursion

“China’s increasingly worrisome marine incursions are discussed at length in a white paper published by Japan’s Ministry of Defense in 2020. The Japanese military outlined the CCP’s alarming maneuvers in the waters surrounding the Senkaku Islands.”

One of the emerging news themes is the increasing connection between “conflict” and “China”. Whether the country is asking the military junta in Myanmar to help protect its commercial interests, or intruding on Japan’s territorial waters, or deploying armed maritime militia to threaten the Philippines, China is expressing progressively greater comfort with ruffling the feathers of neighbors. Picking so many fights with so many different opponents seems to be an odd strategy.

China Talks Start Chilly ($)

https://morning.thedispatch.com/p/the-morning-dispatch-china-talks

“Each of these actions threaten the rules-based order that maintains global stability,” Blinken said. “The United States’ relationship with China will be competitive where it should be, collaborative where it can be, adversarial where it must be.”

“Their Chinese counterparts—State Councilor Wang Yi and Chinese Communist Party foreign affairs chief Yang Jiechi—didn’t take kindly to those remarks. They hit back with what Blinken later characterized as a ‘defensive response,’ which critiqued U.S. involvement in China’s ‘internal affairs’ and sought to draw a moral equivalence between the two countries.”

Most accounts of the meeting characterized it as two sides figuratively trying to poke the other in the eye. This begs the question as to what the purpose of the meeting was. Blinken claimed, “We … wanted to lay out very clearly our own policies, priorities, and worldview, and we did that”, but that sounds thin. Rusty Guinn, on the other hand, has his own ideas …

Hot and Cold

https://www.epsilontheory.com/hot-and-cold/

“Two political belligerents are now engaged in a foreign policy whose objective is to thwart through all means short of firing weapons the expansion of influence, the establishment of additional international military infrastructure and the expression of territorial control over contested lands, sea lanes or airspace by the other.”

“The point is that most of us are under the impression that a protracted conflict with China – even a cold war-style geopolitical struggle – will increase national unity. This is the old saw about politicians looking for an external enemy to unite around, and it is usually true, even if we usually mean it cynically. Not this time.”

Guinn’s analysis creates more context for understanding the incidents and leads to the conclusion that “We are in a cold war with China”. As such, we can expect more similar incidents and we can also expect the narrative machine to heat up on these. It will be interesting to watch how and when the market reacts. I can’t imagine too many scenarios that will pave the way for lower risk or increased global trade.

Public policy

Biden's New Deal: Re-engineering America, quickly

https://www.axios.com/biden-filibuster-agenda-history-05be3812-6ee0-414b-ae71-b6dfa37d8df4.html

“President Biden recently held an undisclosed East Room session with historians that included discussion of how big is too big — and how fast is too fast — to jam through once-in-a-lifetime historic changes to America.”

“The historians’ views were very much in sync with his own: It is time to go even bigger and faster than anyone expected. If that means chucking the filibuster and bipartisanship, so be it.”

Politically, Biden does have a rare opportunity to go big, but it comes with a lot of potential drawbacks as well. In terms of public policy, I am most interested in assessing the degree to which spending will exceed funding, the degree to which new policy represents new recurring payouts, and the degree to which spending is on productive assets.

The answers to these questions will provide guidance as to how much inflationary pressure new policies might impose. What I read in this recent account is more boldness than I had perceived before.

Inflation

“China-like” growth expected in the US this year ($)

https://thedailyshot.com/2021/03/22/china-like-growth-expected-in-the-us-this-year/

“Bottom Line: The time to start considering a real shift to sustained inflation is when the lowest 20th percentile of prices – with those prices weighted evenly – begins to rise along with the upper 20th percentile.”

One of the things the statement (above) and the graph (below) highlight is the variance of inflationary pressures across different goods and services. In the debate about inflation, it is all too easy to over-simplify and think of inflation as a single uniform force and it is not. The prices of some goods and services go up and others go down.

This raises another useful point, however. After many years of barely noticeable inflation, expectations have been anchored at low levels. Now, with prices rising noticeably for several common items like gas, food, and building materials, awareness and expectations are shifting higher. Even though these items still constitute a minority of the consumption bucket, consumers are taking note and putting inflation on their radar.

I believe the predominance of price pressures is still deflationary for a lot of reasons. However, I also admit that inflation is increasingly being built into expectations and that is the first step on the way to more sustained inflation.

Capital markets

Bond market’s weird and scary 2020 breakdown is still a mystery

“the 10-year Treasury completed a bizarre rebound [on March 19, 2020], hitting 1.27%. On March 9, it had dropped to 0.31%, an all-time low. A gain of almost a full percentage point in barely a week, against the background of actions meant to keep yields low, qualifies as one of the weirdest moments in financial history. On the face of it, the market looked to have broken down. For some reason there had been massive selling of Treasuries at a time of extreme high risk, which would normally be exactly when investors would be expected to buy.”

“Getting to the bottom of that accident is proving maddeningly difficult … the key point that comes through from a new report, Nothing but the Facts: The U.S. Treasury Market During the COVID-19 Crisis … [is] there isn’t enough information about this vital market for us to work out with any certainty who sold, or why. That makes it harder to know how to stop another such accident in future.”

On the one-year anniversary of the Treasury market meltdown John Authers takes a look back and comes up disappointed. Gillian Tett went through a similar exercise in the FT and concluded, “the source of the March turmoil is not widely understood. This is unnerving if you want to devise policy to avoid a repeat.”

We do know in the midst of the Treasury turmoil the Fed was intervening and required multiple interventions before any kind of stability was reached. I have an image of passengers on a commercial flight discovering nobody is in the cockpit and then furiously trying to do something to keep the plane from crashing. I am pretty sure this fragility in the incredibly important Treasury market is not widely appreciated and I am also pretty sure a similar incident will happen again.

Implications for investment strategy

A majority of investors now say the market is "rigged"

“Nearly 50% of Americans now say the stock market is ‘rigged against individual investors,’ a new survey from Bankrate.com and YouGov shows, and surprisingly a solid majority of those investing in the stock market (56%) believe the market is rigged as well.”

“Those with higher levels of education were most likely to agree that the stock market was rigged, with 58% of those with a college degree or more saying the fix was in against mom and pop investors.”

In an influential 1970 paper on the market for lemons (aka defective used cars), George Akerlof highlighted the importance of asymmetric information. In the case of used cars, the salesperson knows more about the car than the prospective buyer. Since the prospective buyer also knows this and knows there is some chance the car is a lemon, it doesn’t make sense for the buyer to offer more for the car than would be a fair price for a lemon. Since not all used cars are lemons, the effect of this dynamic is to substantially reduce transaction volumes.

Increasingly, this logic also has relevance in regard to the stock market. If a large percentage of people believe the stock market is rigged, i.e., a “lemon”, they will either offer a suitably low price for stocks or simply refrain from transacting altogether. While this is unlikely to affect stocks in the short-term, if more and more people come to believe the market is rigged, it could meaningfully reduce demand, and therefore prices, for stocks.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.