Arete's Observations 3/5/21

Market observations

Clash of the central bankers

https://www.axios.com/bond-yields-central-bankers-clash-bb52ec68-7a77-4a64-9434-1f185b8a4984.html

“The Reserve Bank of Australia (RBA) bought $4 billion of government bonds Thursday in order to stem falling prices, matching the record high from March 2020 when it began its quantitative easing (QE) program.”

While it is not much by itself, the move by RBA to increase its QE program combined with comments from the Bank of Japan indicating an inclination to keep rates low was just enough to reassure investors about rising rates and send stocks rocketing on Monday.

Blain: The Bond Market Is A Bully

https://www.zerohedge.com/markets/blain-bond-market-bully

“This kind of nervous behaviour is exactly what happens at the top of a market cycle. The next move might still be higher – on the basis of a strong Covid recovery with few inflationary signals… Or it might be accompanied by popping bubbles and mean reversion in prices. I am not a chartist, but plenty who are think the signals point lower.”

“It’s an interesting moment when the market starts to pay more attention to what a Chinese regulator is saying rather than listening to yet more ‘whatever it takes’ nonsense from the ECB, or promises of more juice from the Fed. Something has changed.”

A couple of nice insights come out of this note by Bill Blain. The first is tops of market cycles are characterized by exactly the kind of erratic, unsettled action the market has exhibited over the last several weeks. If it feels like it could spring a lot in either direction, that is because it can.

The second point is the increasing prominence of China. I have argued for a long time many US investors are too US-focused and I still believe that to be true. If you are looking for things that could throw a wrench into the market, you need to look all over the world.

Economy

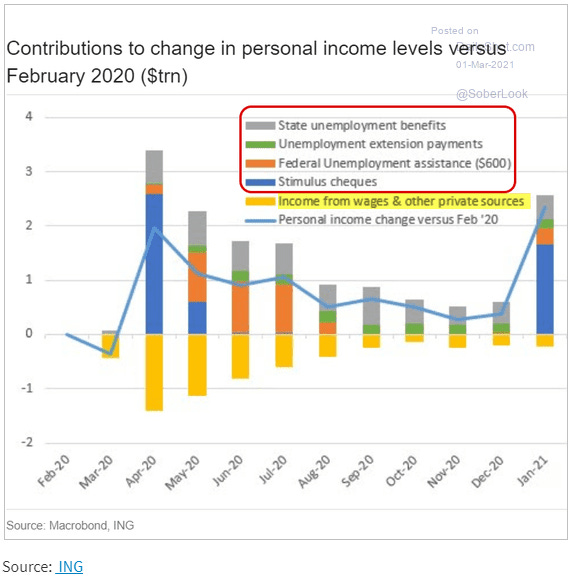

The first thing to notice on the chart below is the significant increase in personal income in January. This is the “good news” many commentators are touting. Another, closer, look at the chart reveals all of the increase comes from government programs; income from wages and private sources was actually down. This is closer to a true read of sustainable income levels and, as such, is the more important determinant of future spending plans.

27% Of All Household Income In The US Now Comes From The Government

https://www.zerohedge.com/markets/27-all-household-income-us-now-comes-government

“This means that excluding the $2 trillion annualized surge in govt transfers, personal income excluding government handouts actually declined by $22.3BN from $15.696TN to $15.673TN, hardly a sign of a healthy, reflating economy.”

The graph below captures the same phenomenon in a slightly different way. It shows the historical relationship between prime-age employment and wages. Framed as such, it is extremely easy to see that private wages from the last three quarters deviated substantially from historical norms and therefore should be treated as less than completely reliable (due to fiscal policy infusions).

US personal income from private sources declines again ($)

https://thedailyshot.com/2021/03/01/us-personal-income-from-private-sources-declines-again/

“the saving rate skyrocketed to 20.5% from 13.4% of disposable income. This implies a consumption multiplier close to $0.20 for every $1.00 of government transfer. This does raise serious questions about the wisdom of another giant stimulus.”

While the wad of money thrown at the pandemic has managed to keep personal income artificially inflated, that money has very limited traction to improve the economy. Most people understand these are not permanent benefits and therefore save them for when they are needed.

Anyone who is very familiar with driving on snow and ice knows that “going big” by gunning the accelerator is not only not a great way to get from point A to point B but is also quite likely to land you in a ditch somewhere along the way.

Debt

Property and the pandemic: the great reckoning that never seems to arrive ($)

https://www.ft.com/content/084f94e8-84a8-4966-a38b-fcb0b5e6171e

The can is being kicked down the proverbial road on an unprecedented scale, according to Radow. “What happens when it stops rolling?” he asks. “That is the answer we all want to know.”

“The speedy rollout of effective vaccines has created a sense that there is, at last, light at the end of the tunnel if borrowers can endure just a bit longer until health restrictions are lifted and full economic activity resumes.”

With $146 billion in commercial real estate assets deemed to be in distress now, the potential for significant defaults and deflationary pressures looms as large as ever. I admit I am surprised these liabilities have been able to persist for so long. Regardless, the ultimate resolution of these assets will depend on when the economy reopens and how fast it returns to “normal”. As a result, the value of these assets depends on a lot of hope.

Politics

The Morning Dispatch: Getting Past Scarcity on Vaccines Plus: Reading the bond-yield tea leaves and Larry Hogan's 2024 feelers ($)

https://morning.thedispatch.com/p/the-morning-dispatch-getting-past

“I think we’re going to have a four-year battle for the soul of the Republican Party,” Hogan said. “I’m not going to be one of those ones that’s abandoning the party or giving up. … Whether we win this fight or not, time will tell. But it’s worth fighting for, because it’s the party that I believe in—that I’ve spent my whole life fighting for. And I’m not going to let brand new crazy people try to take it over.”

As an unabashed Republican governing in a Democratic state, Larry Hogan is an interesting character in the unfolding political drama. He describes the disunity in the Republican party in terms of warfare and expresses as much disdain for “brand new crazy people” as any progressive would. This could get interesting.

The Sweep: Voting, Explained ($)

https://sweep.thedispatch.com/p/the-sweep-voting-explained

“The number [of self-identified independent voters] has routinely hovered in the 30s as late as November of last year but had never hit above 47. As of this month, independents have hit an all time high—50 percent of those surveyed. Not surprisingly, Gallup also found another record breaker: 62 percent said the ‘parties do such a poor job representing the American people that a third party is needed’.”

As much as the Republican party seems to be ripping itself apart, there doesn’t seem to be a whole lot more cohesiveness in the Democratic party. The fact that voters increasingly feel as if neither major party reflects their interests is an important change.

Cities

The graph below is astonishing if truly representative. If major global cities like London have permanently lost over twenty percent of their 18–44-year-olds, the character of such cities will change significantly. It is only one city and one survey, but it sure highlights a big potential change in the post-pandemic era. As such, it also heralds a reconsideration of what “returning to normal” will really be like.

Coronavirus

The danger of a fourth wave

“The U.S. averaged just under 65,000 new cases per day over the past week. That’s essentially unchanged from the week before, ending a six-week streak of double-digit improvements … Although the U.S. has been moving in the right direction, 65,000 cases per day is … the same caseload the U.S. was seeing last July, at the height of the summer surge.”

The thirty-yard line seems too early for a touchdown celebration but that is effectively what the governors of Texas and Mississippi did this week by rescinding COVID-19 prevention protocols and opening businesses to full capacity while new case counts are rising in those states. We’ll just have to see how those moves turn out, but they certainly appear to be unnecessarily risky stunts.

Social Trends

The Coddling of the American Mind: How Good Intentions and Bad Ideas Are Setting Up a Generation for Failure, by Greg Lukianoff and Jonathan Haidt

I was interested in this book for two main reasons. For one, I read Haidt’s, “The Righteous Mind” and hugely appreciated his ability to explain how people with different political beliefs can view similar situations in very different ways. In today’s especially polarized and partisan world, it helps to understand where various hot buttons might be.

Another reason for having interest in the book is curiosity. As an older Gen Xer, I have been absolutely confounded by many of the behavioral patterns I see in Millennials and Gen Zers. Among those, I have been especially hard-pressed to understand patterns of what I view as a lack of resilience and a lack of independent thinking. I pick these two characteristics because I think they rank as a couple of the most important in the work world; I consider them virtues.

True to form, Lukianoff and Haidt opened my eyes. They describe an environment dating back to about 2013 in which a great deal of social disruption coincided with newly pervasive smart phones and social media to track it. Heightened awareness of such dangers and a “college resume arms race”, among other factors, have increased a sense of “safetyism” among paranoid parents and school administrations. Their reactions have been to limit the dangers teens and young adults might encounter.

In a practical sense, safety is pursued on an individual level by avoiding conflict and at an organizational level by establishing policies to promote third party conflict resolution. From these ostensibly well intended reactions, it is easy to see how resilience and independent thinking could be negatively affected.

I view this trend as potentially quite damaging to individuals and to the country as a whole. At an individual level, many young employees do not have the life skills (such as engaging in constructive conflict) to be productive at work without excessive management supervision, even if they are gifted intellectually. Many are only marginally employable. As much of a shame as this is, it means growth in economic productivity will struggle.

These trends are probably just as important at the political level. Namely, the overwhelming bias of public policy the last twenty years has been to benefit older generations at the expense of younger generations. Obviously, this is extremely detrimental to younger generations and historically youth would rise up to rebel against such injustices. Today, not nearly as much so as one might think. Safetyism helps explain much of the tepid response thus far. Insofar as this remains the case, expect economic inequality and intergenerational wealth transfers to continue apace for the foreseeable future.

Joe Biden’s popular stimulus reveals a changed America ($)

https://www.ft.com/content/ffb8988f-ac8c-49e6-8e2a-c8f75294d07b

“But the tolerance of fiscal intervention now is not just greater than it was in 2008-09. It appears to be more or less open-ended.”

It’s hard to say if these things are connected or not, but the individual aversion to risk and amenability to third party adjudication of coddled teens and young adults goes hand in hand with the acceptance of enormous fiscal outlays.

Inflation

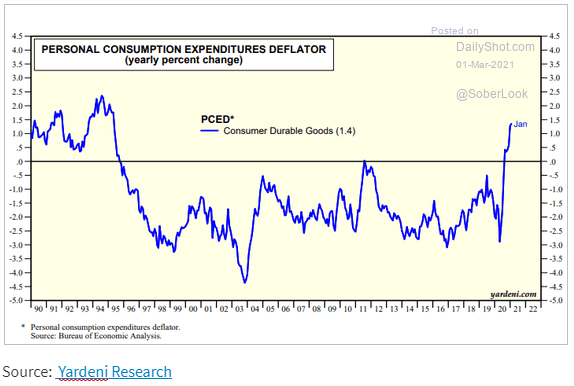

Commodities have been on a tear lately and have stoked many of the concerns about inflation. While this is absolutely something worth watching, there are indications prices may be getting ahead of themselves. For one, the performance in February stands out as the hottest in ten years. For another, it takes time for such increases to become permanently embedded in end product pricing.

For example, one of the notable, but limited, end product categories demonstrating price pressures is consumer durable goods. Given the fairly rapid exodus of many younger families from cities over the last year, this seems both understandable and transient.

Gold

With many commodities on fire amid increasing concerns about inflation, the incredibly obvious one being left out is gold. This makes sense to some extent as gold tends to move up as real interest rates move down – and vice versa.

Given my belief that short-term economic growth prospects are fueled mainly by loose monetary policy and fiscal spending and therefore are not sustainable, the weakness in gold presents a very nice buying opportunity. While premiums are still a bit high on coins I will be watching for opportunities and gold miners are much cheaper than just a few months ago. Cheap gold definitely looks like a better option than chasing prices of other commodities right now.

Monetary policy

Ample Liquidity and Productive Assets

https://www.radigancarter.com/dispatches/money-and-durability

“Our politicians and Fed will not stop easing and keeping interest rates low. After reading Lords of Finance I understand why. They are so terrified of a deflationary depression and the political consequences, they have a near zero pain tolerance for any deflation. In addition they are like a struggling Atlas trying desperately to meet the world’s liquidity requirements for dollars during any event which spooks global markets and causes a sudden rush for the safety of the dollar.”

“It is not an enviable position to be in, but since they refuse to tell the truth, continued to reward bad behavior, and have stolen years of my life from me, I have no sympathy for them.”

There are two excellent points here. One is the Fed will not stop easing. Carter is right that there is “near zero pain tolerance for any deflation”. The consequence is monetary and fiscal policy will become so expansive they will eventually blow up the financial system. So, right up until the moment of detonation, risk assets will be supported at levels that bear no resemblance to economic reality.

The second point is also telling. Massive monetary intervention has a lot of unintended consequences not least of which it destroys the mechanism by which discipline, and prudence get rewarded over time with attractive investment returns. Carter feels like years of his life have been stolen from him and I can absolutely relate. This means monetary policy has now very much become politicized as well. I would not be surprised to see calls for increasing scrutiny of the Fed as a result.

The era of central bank convergence is over ($)

https://www.ft.com/content/7c56165b-5d6b-4eea-b663-07dac93dd28a

“This does not mean a wave of central banks will drop their inflation targets. What we do expect, however, is for central banks to follow New Zealand’s lead by increasingly reflecting the national political mood.”

New Zealand’s central bank is now being tasked with considering “policies related to achieving more sustainable house prices”. Even the Fed is looking at a broader set of unemployment metrics. This provides even more evidence of the increasingly politicized remits of central banks.

Democratic senators call for tougher capital requirements for US banks ($)

https://www.ft.com/content/44792b80-c331-44e3-b02c-41a151f4cb6c

“The looming deadline [for the softened supplementary leverage ratio] has amplified a political split on the issue, with Republicans, banks and industry executives pushing for an extension of the measures while Democrats are calling for them to expire.”

What might otherwise be a technical discussion of an arcane monetary subject is now, to an important extent, a partisan battle over the Fed’s remit. Expect a lot more of this. The increasingly political implications of Fed activity also mean it has fewer degrees of freedom in communicating its actions and intent. This may be partly behind the market’s disappointment in Powell’s presentation on Thursday.

Capital markets

I would not have guessed the income level with the highest percentage of people using government stimulus checks to play the market would be the $100,000+ level. It makes sense in a way though. At those income levels the funds are mostly not critical for household survival so why not take a flyer on stocks? Indeed.

Implications for investment strategy

One of the great challenges of managing through a period of extreme monetary intervention is investors are forced to make difficult choices. When stocks are significantly overvalued but also significantly supported by monetary and fiscal policy, it is only a matter of “when” and not “if” the losses get realized.

An interesting example arose from the recent letter to shareholders by Warren Buffett. In the letter, Buffett explained how Berkshire suffered an $11 billion write-down that “is almost entirely the quantification of a mistake I made in 2016. That year, Berkshire purchased Precision Castparts (“PCC”), and I [Buffett] paid too much for the company.”

Coincidentally, I also owned Precision Castparts in Arete’s midcap strategy portfolios when the acquisition was announced. While I was fairly happy with the offered price, that was also a time during which I was finding very little value in the markets broadly and began accumulating cash with proceeds instead of reinvesting in overvalued stocks.

So, the question is, who made the bigger mistake, me, or Buffett? Buffett ended up writing down about 30% of the purchase price but I ended up foregoing five years of attractive returns on capital by holding cash and suffered real losses to the extent inflation eroded purchasing power over that period.

Over this very limited time frame I probably came out ahead on this one security, but the bigger challenge is what this same comparison will look like across longer investment horizons. If and when inflation picks up, cash will provide negative returns which will compete with overpayment premia for destruction of capital. Indeed, this is a critical question for investors right now: Is there a greater risk to overpaying for stocks at current prices or is there a greater risk to holding cash that will lose value due to inflation?

The answer depends on several factors including length of time, degree of overvaluation, and magnitude of monetary and fiscal support, among other things. It also depends on when the writedown is taken. In the case of Precision Castparts, the problems with the Boeing 737 MAX and pandemic-affected travel volume imposed some urgency to recognize value impairment.

What if there is no such urgency, however? What if Precision Castparts had remained a public company, took the writedown, but the stock did not selloff in response? What if the valuation multiple of the company keeps rising along with the rest of the market? In both of those cases, the market value can continue ascending well past intrinsic value for a long time.

This describes the current market fairly well and creates a serious conundrum for long-term investors. You can either overpay for stocks, with no margin of safety, and hope to be able sell at an attractive price later, or hold cash waiting (and waiting and waiting) for the opportunity to buy stocks at prices that are truly cheap.

There is a third way, and this is one I have been contemplating a lot recently. This third way recognizes the inherent valuation risk at current price levels but also recognizes a public policy environment in which authorities will not willingly allow risk assets to fall too far. It is an active approach in that it recognizes the likelihood of policy support at lower levels, the likelihood of excesses and new highs given a high degree of moral hazard, and relatively frequent moves between the two extremes given the structurally fragile nature of the system.

One way to invest in these conditions is to identify stocks that actually do create value. For example, businesses such as Precision Castparts that generate attractive returns on capital regularly create economic value. Commodities producers appear likely to benefit from longer term supply and demand conditions as well. Other real assets like real estate and even intellectual capital are likely to be long-term beneficiaries. In all cases the purchase price is a key consideration, so it is best to look during and shortly after a significant selloff.

Another consideration for such an approach is to beware the types of situations that can lead to especially significant losses. Fraud always picks up in strong markets but can be managed by analyzing financial statements. Companies that do not produce cash and have only tenuous strategies by which to do so are also especially risky prospects.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.