Arete's Observations 4/16/21

Market observations

Peak Euphoria: Stock Inflows In Past 5 Months Exceed Inflows From Prior 12 Years

“Of all the metrics we have seen in the past year trying to capture the sheer mania and frenzy of the retail rotation into stocks - a process also known as ‘distribution’ because it allows legacy investors to offload to new bagholders - none is better than the following statistic from BofA's Michael Hartnett, who in his latest Flow Show notes ‘the big flow to know’, namely that inflows to stocks past 5 months ($576bn) exceed inflows in prior 12 years ($452bn) - and we have retail investors armed with freshly printed stimmy checks to thank for this historic spike.”

The week started off quiet, even eerily quiet, perhaps in wait of upcoming earnings reports. That gave a chance to step back and put things in perspective. The graph above illustrates the stunning increase in flows to stock funds over the last five months.

Any time things change so materially it warrants scrutiny. Taking into account all the negative signals – retail investors have a terrible record of adding money at the top of markets, interest rates are going up, stocks are at record high valuations, there are still a lot of debts from the pandemic to be dealt with - this looks like a flashing sell signal. At very least the rapidly increased pace of retail buying may help explain the steepness of the recovery in stocks over the last year.

Economy

Hoisington Investment Management, Quarterly Review and Outlook First Quarter 2021

https://hoisington.com/pdf/HIM2021Q1NP.pdf

“Revolutionary technology, like the internal combustion engine, transmission of electricity, modern sanitation, modern communication, and new discoveries in pharmaceuticals and chemistry, all enhanced the demand for labor and natural resources. Evolutionary technology, which is the type currently being experienced, diminishes the demand for labor and natural resources.”

Lacy Hunt is referring to the book, The Rise and Fall of American Economic Growth, by Robert Gordon, which I have also read and think highly of. The main thesis of the book is that the period between 1870 and 1970 produced revolutionary innovations that dramatically improved welfare and economic growth.

Innovations since, while still impressive, have been of a fundamentally different and less impactful nature. Per Hunt’s description, these “evolutionary” technologies tend more to the characterization of efficiency improvements. While efficiency is a good thing, especially in a world with finite resources and a growing population, lower demand for labor and natural resources fundamentally changes the equation.

Specifically, the need for managed growth, rather than moar growth, becomes paramount. The good news is managed growth allows for high living standards to be sustained. The bad news is the proposition can be a tough sell to populations and precious few leaders are good at doing it.

Labor

The mismatched economy

https://www.axios.com/jobs-growth-higher-wages-demand-d88095d0-0536-4b16-9111-b0389511784d.html

"While [lower wage] workers are plentiful, firms are going to find it difficult to recruit workers unless they are willing to pay higher wages," he [Joseph Brusuelas, chief economist at tax policy firm RSM] tells Axios, something large companies especially have shown they are unwilling to do.

“’Total nightmare’ is the way FAT Brands CEO Andy Wiederhorn described the staffing situation to Russ for franchisees of his company’s restaurants like Johnny Rockets and Fatburger.”

The pandemic seems to have further widened the gap between what employers are willing to pay and what lower wage workers are willing to do for that money. The fact that the clearest path forward is for companies to invest more in capital to replace low wage workers speaks volumes about the state of the labor market and the lack of potential for higher wages. The bottom line is "the pre-pandemic status quo ante is not returning."

Housing

Feds Warn Mortgage Firms: "Tidal Wave Of Distress" Coming As Forbearance Programs Set To Lapse

CFPB said mortgage firms should "dedicate sufficient resources and staff now to ensure they are prepared for a surge in borrowers needing help." To avoid what the agency called "avoidable foreclosures" when the forbearance relief lapses, mortgage servicers should begin contacting affected homeowners now to guide them on ways they can modify their loans.

"There is a tidal wave of distressed homeowners who will need help from their mortgage servicers in the coming months," said CFPB Acting Director Dave Uejio.”

Wait, what? Amidst all the optimistic news about the economy and reopening comes this zinger from the Consumer Finance Protection Bureau. Actually, the pent-up problem with home mortgages (and commercial mortgages to boot) shouldn’t be any surprise at all. Nonetheless, it’s good to remember there is one more big honking problem on the to-do list for recovery.

Reopening

Flexibility is the new great workplace divide ($)

https://www.economist.com/business/2021/03/25/flexibility-is-the-new-great-workplace-divide

“This shift may be self-perpetuating. If employees are coming in less often, firms will adopt hot-desking as the best use of office space. The McKinsey report suggests employers are planning to downsize their offices by 30%. Some will welcome the chance to trumpet the resulting reduction in their carbon footprint. But hot-desking also reduces the scope for workplace friendships. If so, employees will have even less incentive to go to the office five days a week—leading to even smaller offices with more hot-desking, and so on.”

Back when I worked part-time from the Betamore co-working site in Baltimore I listened to a presentation by a local entrepreneur. This person had grown his business rapidly but in order to do so allowed a number of employees to work remotely, often from other states. Initially it worked fine but after a while these employees began complaining they didn’t get a birthday cake or other perks enjoyed by employees at the main office. Before long, the arrangement became so contentious and cumbersome, he vowed to never allow employees to work remotely again.

I find the whole discussion about remote work fascinating because I have been doing it for well over ten years and it is interesting to observe others who are encountering the pros and cons for the first time. One of the things I discovered is how much more productive I can be in reading research reports, writing commentary, and building models in a relatively quiet environment and very few meetings. I have sometimes wondered how others got any work done with all the distractions at the office. That said, I do miss the social aspects of the office and acknowledge it is much more difficult to collaborate when participants are not under the same roof.

The bigger point is it is unlikely we will get back to something very close to the workplace “normal” we knew before the pandemic. Adaptations lead to multiple derivative effects, many of which are unpredictable.

For example, prior to the pandemic, business leaders and office managers were scrambling to improve work productivity and increase collaboration by rolling out open office environments. Who would have thought those goals could be accomplished by just letting people work from home more often? Sometimes it is just hard to tell how things will work out. In regard to workplace environments, the can of worms is officially opened.

Politics

Religious fervour is migrating into politics ($)

https://www.economist.com/united-states/2021/03/27/religious-fervour-is-migrating-into-politics

“This pseudo-religious makeover on the right was instigated by lapsed white evangelicals, who backed Mr Trump in the 2016 Republican primary when observant ones held back. Their continued self-identification as Christians, though they do not attend church, is often a proxy for ethno-nationalism.”

“Christian leaders, confusing the decline of their congregations with the cultural threat of liberalism, made common cause with Mr Trump and the pseudo-evangelicals. For partisan reasons, the rest of the Republican coalition followed them. The party has never been more avowedly Christian or more clearly out of line with gospel doctrines.”

John Wayne, Jesus, and the Struggle to Define the Christian Man ($)

https://frenchpress.thedispatch.com/p/john-wayne-jesus-and-the-struggle

“First, culture (including political culture) is at least as important in defining Evangelicals as theology.”

“Second, Evangelical culture has had an unhealthy attachment to a particularly aggressive vision of masculinity, one that is modeled less on Christ than on secular warrior-figures who are deemed singularly effective at confronting and defeating enemies of the nation and the church. This is the John Wayne archetype—the man of strength and action.”

I have come across several pieces touching on the role of religion in politics in the last several months and have a hard time disentangling the degree to which this is a weird curiosity for me, a bizarre phenomenon in the presidential election, or a crucial ongoing force in politics that also speaks to broader social problems. I suspect there is an element of all three.

Clearly, there has been a great deal of research done and words written in trying to understand not just the election, but the QAnon movement, the storming of the Capitol in January, and ongoing demonstrations of “religious fervor” migrating into politics. One question I have been riddled by is why so many Christians seem to endorse, or at least tolerate, distinctly un-Christian behaviors. Both of these pieces shed light on the matter. Unfortunately, the conclusion by the Economist is ominous: “Not since the 1850s … have politics and religion been so destructively confused. It is not a reassuring parallel.”

Geopolitics

Is America Living in a 9/10 Moment? ($)

https://frenchpress.thedispatch.com/p/is-america-living-in-a-910-moment

“The title of this essay asks if we’re living in a 9/10 moment—that period of calm before the unexpected, shattering 9/11 storm. We can hope not, but for the first time in a long time, we simply can’t be sure.”

“Two things are happening at once that should wake us up to the possibility that the world might change again, as dramatically as it did in 1989 and 1991—but with far more catastrophic consequences. First, American military hegemony is in doubt. Yes, we still have the world’s strongest military, but our qualitative advantage is decreasing, and we face the possibility of actually losing a war.”

“Second, our enemies are increasingly aware that they’re closing the gap and are now, today, engaged in dangerous and provocative actions overseas. We might find ourselves quickly facing the most serious foreign policy crises in a generation, in Ukraine, Taiwan, or both.”

French is clear to make the point that he doesn’t want to be alarmist but rather to consider the possibility of significant geopolitical risk. It is a fair point.

Just as a dog blissfully chases a frisbee, completely oblivious to the dangers that lurk in the street up ahead, investors seem completely oblivious to the dangers than lurk in recent geopolitical developments. French is “increasingly concerned that the old world is coming back” and that “the Long Peace might come to an end”. Me too; this is serious stuff.

Inflation

Just how anchored are America’s inflation expectations? ($)

“When they do have a view, both firms and households chronically overestimate price rises. Consumers seem unduly swayed by the price of petrol.”

Rabo: When It Comes To Inflation, What One Does And Doesn’t See Is All Political

“Everything around you that you need to buy today is going up in price rapidly – but don’t worry: something big you might not need to buy until 2028 is going down in a hedonic-adjusted price. Sit back and feel the savings.”

Several good points come out of these two pieces. Both touch on the perception vs. the “reality” of inflation. The thing that jumps out at me is how amenable these observations are to well-known behavioral biases.

For example, recency bias means that we tend to overweight things that have happened more recently and therefore are more memorable. By this logic, it shouldn’t be any surprise at all that things we purchase regularly like gas and food tend to send strong signals when prices go up.

Along the same lines, loss aversion means that people tend to suffer more from losses than they enjoy gains of the same magnitude. When prices go up without a corresponding increase in income, purchasing power is lost. As a result, that loss has a greater impact than a gain would (price decline) of similar magnitude.

This tells us something interesting about the inflationary impulse. When prices start rising, especially in areas like food and gas, they are felt quickly and disproportionately. For better and worse, these biased perceptions get incorporated into narratives about inflation. Sometimes these are head fakes and sometimes they serve as leading indicators.

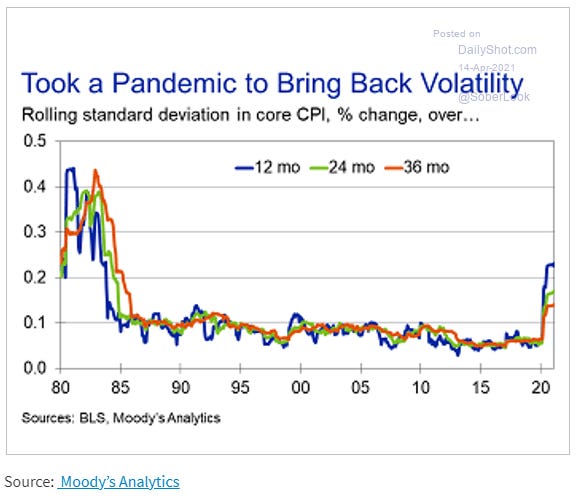

Almost as if on cue, CPI volatility has jumped recently which goes to corroborate the increasing uncertainty regarding inflation. For more about inflation see the Market review Q121: Incorporating inflation.

Capital markets

Technical Analysis of the Financial Markets, by John J. Murphy

As I am wont to do when I have a challenge, I often look for a book that can shed some light on the matter. In this case the problem is understanding stock prices that no longer seem even remotely connected to underlying fundamentals. As a result, I thought it might be a good time to refresh my knowledge of technical analysis. I’m glad I picked this book and I highly recommend it.

I have never been a big fan of technical analysis, but Murphy makes some excellent points. For example, he notes, “The fundamentalist studies the causes of market movement, while the technician studies the effect.”

This puts fundamental analysis in a unique perspective that exposes a weakness. It is true that a fundamental analyst is essentially trying to beat the wisdom of the crowds by out-forecasting the market. This takes a degree of ego that can easily bleed into hubris.

Murphy’s book, which was refreshed in 1999, does show its age at times though in ways that detract from the proposition of technical analysis. For example, Murphy points out, “a market can fall just from inertia. Lack of demand or buying interest on the part of traders is often enough to push a market lower; but a market does not go up on inertia.”

Well, this proposition has actually gotten completely turned around. In an environment with passives dominating flows and with monetary policy serving as a backstop, the inertia now resides with purchases, not sales. I don’t know exactly what this implies for interpreting charts, but it is coming from a different environment than Murphy wrote about.

Regardless, this exercise provides a few helpful guidelines. One is that most stock prices are far in excess of intrinsic values so there is a great deal of risk in stocks. Another is that even technical analysis is handcuffed in some ways by current market conditions. It is hard to reach high conviction about many decisions in such an environment.

Implications for investment strategy

THE UNHOLY TRINITY: VOLATILITY, ILLIQUIDITY, AND INSOLVENCY, Featuring Christopher Cole and Michael Green ($)

“In that sense, most people are thinking that Bitcoin is an antagonist to the Fed. I would actually argue at this juncture, it may actually be helping our monetary policy and the smoothing of liquidity, transmuting asset price volatility from extreme asset classes into something that is right now, a purely speculative vehicle. We're able to transmute a trillion dollars' worth of excess speculation that otherwise would be pumping up real estate prices, causing civil unrest in the United States, pumping up stock prices even more, you're able to transmute that to this asset that really only exists right now for speculation, that only exists for speculation.”

I found Chris Cole’s comments here interesting for a couple of reasons. One is that his description of speculative assets transmuting the effects of excess liquidity comports well with my vision of figurative nets swiping up the excess money. His fresh insight is to recognize the utility of speculative assets like bitcoin in the context of so much money. Just imagine where house and stock prices might be without these “pressure release valves”.

This helps clarify an ongoing problem besetting investors: Is there a way to cast a “net” so as to capture some portion of speculative money but without taking the risk of a purely speculative investment? The answer is, “not really”. Worse, the greatest money flows seem to be moving to the most speculative instruments, i.e., those that quite legitimately can go to zero.

This puts investors in a tough spot but at least you can go in eyes wide open. Investing in any asset at prices well above intrinsic value can, and most likely will, result in significant losses. To believe one can succeed in speculation is to believe one can identify a top before everyone else and exit cleanly, to beat everyone else out of the investments after a panic sets in, or that the Fed will eventually step in to buy stocks and other assets as a necessary measure to maintain prices. You pick.

Strategic Allocation (White Paper)

https://www.hussmanfunds.com/research/strategic-allocation-white-paper/

“Whether an investor is an individual looking to provide for spending during retirement, a pension fund looking to provide future benefits to participants, or an institution looking to provide a long-term stream of operating funds, a central goal of long-term investment planning is to construct a portfolio containing a mix of assets that is well-suited to meet those needs, with an appropriate level of risk. Two popular approaches for long-term investment planning are ‘target date’ strategies that set allocations to equities and fixed income based on the number of years until retirement, and ‘fixed allocation’ approaches that invest a constant percentage of assets in stocks, bonds, and money-market securities, with little or no variation.”

“The striking feature shared by these approaches is that the amount invested in stocks, bonds, and other securities has absolutely nothing to do with investment valuations or prevailing market conditions; even if the securities being held are profoundly overvalued or undervalued relative to historical norms.”

John Hussman describes in a very clinical sense how profoundly unprepared many investors are for a changing investment landscape. Drafted into investment vehicles that were overfit to a different environment and stuck on autopilot as conditions rapidly change, these investors are about to encounter some turbulence and are headed toward some violent storms.

The good news is that it is not especially difficult to develop or employ an adaptive allocation strategy. The bad news is you do have to be prepared to make a change and that change will look quite a bit different than what you are familiar with.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.