Arete's Observations 4/23/21

Market observations

JPMorgan: Clients Are "Increasingly Nervous", Fear "A Market Pullback In May Or June"

“as of this moment a near record 96% of S&P stocks are trading above their 200DMA, which is the highest in more than 20 years, and the last time it happened - in Sept of 2009...”

Expanding market breadth signals further rally

“Shares from a broader range of sectors and individual firms are outperforming expectations, indicating a robust, sustainable market rally. The portion of S&P 500-listed stocks trading above their 200-day moving average has surpassed 95% to reach the highest level since October 2009.”

One data point, two very different conclusions. These two stories capture current markets, and current market commentary, in a nutshell. The CFA brief, and the original WSJ article itself, are representative of what passes for financial media. Take a fact, like the portion of S&P 500 stocks trading above their 200 day moving averages and then tell readers how to think about that fact.

Of course, facts can be interpreted in different ways – and that is part of what makes markets so fascinating. However, when important facts are glossed over (or even completely omitted), I have a beef with that. Such cases comprise advocacy much more than information.

The WSJ article in this case does eventually get around to the interesting question that arises, “Is [this market breadth] a sign of an impressive comeback and recovery, or is it a sign of excess speculative behavior, where everyone is buying anything?” However, it only does so towards the end of the piece and only after rigorously priming the reader to view the data positively.

Looking back on the weak performance early in the week, it looks like Zerohedge’s interpretation that S&P 500 futures appear “to be reaching an exhaustion point with just 10 points to go until resistance is hit” was the more useful one.

What the irrational price of dogecoin says about crypto investors

https://www.axios.com/dogecoin-cryptocurrency-irrational-9facef23-1db9-46af-ab55-441db47604cd.html

“Unlike Bitcoin, dogecoin (pronounced ‘d'oh-zh coin’) — a literal joke of a cryptocurrency — is not supply-constrained. If you want more of it, you can mine it — and then, presumably, sell it, given the profit margin of about 57%.”

As Axios’ Mike Allen summarizes, “This is like GameStop but dumber.” Seems to be a lot of competition these days.

Companies

Inflation looks to be not so transitory as price hikes continue

“Procter & Gamble became the latest company to announce it will raise its prices in September to respond to higher commodity costs, joining consumer giants like Kimberly-Clark, Smuckers, Coca-Cola and a host of others.”

As earnings reports are rolling in, so too are updates on input costs for companies. The indications thus far are input costs are starting to make their way into price increases. The process of such transference, however, is usually much more fraught. If you increase prices and the incomes of customers have not risen, they push back by buying less or by looking for cheaper alternatives.

As a result, the early stages of the price changing process are always a bit of tug-of-war. I’m sure a number of companies would like to raise prices, but with corporate margins still historically high, doing so will be easier said than done. It will be interesting to watch which price increases hold and which ones don’t.

Economy

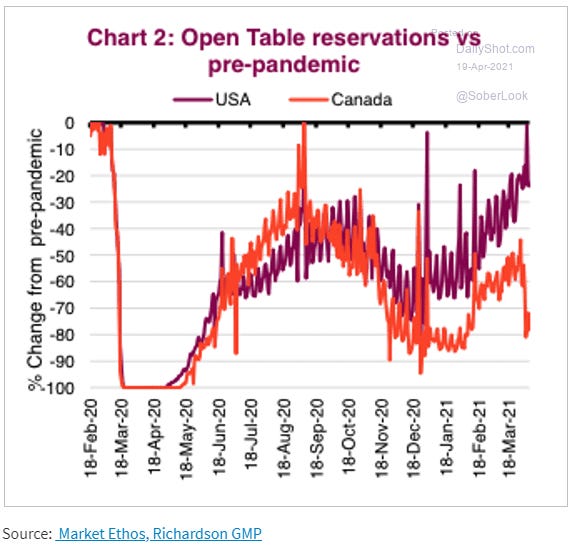

The graph below shows a striking deviation in restaurant reservation patterns between the US and Canada emerging in the last month or so. I suspect the worsening infection rates in Canada are being reflected in lower restaurant activity. Regardless, the data demonstrate the potential for dramatically different economic trajectories.

Credit

Hidden Valley, Almost Daily Grant’s, Friday, April 16, 2021

https://www.grantspub.com/resources/commentary.cfm

“Might the placid current environment be helping mask stress within those ranks? In a Tuesday commentary for LCD, Lehmann Livian Fridson Advisors chief investment officer Marty Fridson observed that the current 3.1% ratio of distressed issues (defined as those trading with at least a 1,000 basis point option-adjusted spread over Treasurys) marks a notable contrast with persistent industrial slack.”

“Thus, the 74.4% reading for March capacity utilization sits 520 basis points below the 1972 to 2020 average, per the Federal Reserve. As Fridson notes, over the 17 monthly occasions since 2001 in which capacity utilization fell below 75, the high-yield distress ratio averaged 25.5% with a prior low reading of 10.7%, more than triple the current figure.”

The guy Grant’s calls the “dean of high yield” concludes somewhat anticlimactically, “I believe the [most] likely explanation of [that divergence] is that the Fed’s current, unprecedentedly aggressive intervention is distorting market signals.” Well, yeah.

Nonetheless, the detailed characterization of where credit would be without such aggressive intervention gives some indication of the dangers that lurk. While deliberate, continuous effort has been made to defy financial gravity, eventually gravity prevails. It is just a matter of how long it takes.

Coronavirus

‘The challenge to come’: Vaccinations are open, but demand is down, turning Pa. and Philly’s focus to fighting hesitancy

https://www.inquirer.com/health/coronavirus/pennsylvania-covid-vaccine-herd-immunity-20210421.html

“After months of high demand for hard-to-get vaccine appointments, the landscape has changed nearly overnight across the commonwealth. Appointments are not being filled in Bradford County. And thousands of appointments are going unfilled at Philly’s two mass vaccination centers, too.”

Supply vs Demand: When Will the Scales Tip on COVID-19 Vaccination in the U.S?

“Thus, on average across the country, it appears we are quite close to the tipping point where demand for rather than supply of vaccines is our primary challenge.”

The account of vaccination progress in Philly and PA appears very similar to what is happening across the country; the ranks of people anxious to get vaccinated are rapidly declining. While it was easy to get wrapped up in the successful rollout of vaccines early on, this development highlights the more somber underlying reality: It is quite unlikely that the vast majority of adults will get vaccinated.

As a result, the coronavirus is likely to be with us in some form for the foreseeable future. A best guess is it lingers at a lower, but still elevated, rate of new infections for some time with periodic regional flareups. This view suggests some form of pandemic restrictions will persist for some time. That’s the good news. The bad news is other parts of the world are faring much worse …

Reopening

Get ready for the new politics of resentment in the office ($)

https://www.ft.com/content/016a9d70-99a4-48e2-a9da-e1fb4dad2e8b

“We saw quite a bit of friction in organisations,” says David D’Souza, membership director at the Chartered Institute of Personnel and Development. “You had a group of people who had hugely different perceptions about the other’s experience, and they were coming into contact with each other.”

“Bosses should be aware the schemes have created ‘a new, distinctive in-group and out-group’ of workers, says Pearn Kandola, a business psychology company. For full-time staff slogging through the crisis, the idea of being paid to stay home can sound like a holiday.”

This story provides a useful reminder for an issue that many, if not most, managers aren’t even thinking about right now. It’s nice to think about returning to some degree of normalcy again but there are always office politics. Further, there is nothing like a year of working from home to enable a whole host of misperceptions, perceived slights, and biases between different groups of works to become accentuated. Given that a low level of “organisational resentment” often simmers at companies in the best of times, it is fair to expect some friction when people get back together.

ESG

Oil companies are now a more complex foe for environmentalists ($)

https://www.ft.com/content/03bc2e75-80a2-440b-b766-9110f636233f

“Last week, Shell said that even though it has ‘some misalignment’ with groups such as the American Petroleum Institute, the US oil industry’s biggest and most powerful lobby group, there were merits of standing by them, even as it has left others. Why? ‘Because there is evidence that their positions are changing, and we believe we can have a greater positive impact within the associations than outside them,’ said the Anglo-Dutch oil major.”

“BP chief executive Bernard Looney has spent the past few months trying to hammer home the message that investors should not reward only green companies, but also those that are ‘greening’.”

This relatively short article from the FT highlights all the key issues that should be discussed in regard to ESG. Can a company be more effective inside industry organizations or outside them? Is it more important to have a seat at the table or break away from corrupted organizations? How can more influence be exerted?

It is easy to cast dispersions at “dirty” oil companies, and some of them probably deserve it. But until the world stops using oil (and other high impact resources), the most important goal is to figure out the best way to improve.

Politics

Big Business Can’t Fire the GOP, They Quit ($)

https://sweep.thedispatch.com/p/the-sweep-when-to-jump

“The problem confronting McConnell is not about having created a monster in the form of politically active companies who have now turned on him and his party. McConnell’s problem is that going into the 2022 midterms big chunks of his party are going full nationalist/populist and intentionally trying to alienate the very voters on whom the GOP will rely to defend Senate seats in five or six swing states.”

One of the more interesting political developments is the push by both parties to attract blue collar votes, often through some form of class warfare. This is interesting partly because neither party seems particularly constrained by little things like political philosophy in doing so. What’s important to convey is there is some “evil other” out there that needs to be brought to account for the good of society.

If political battles are not fought on ideology, what is the future of the major political parties? Imagine if a Democrat in one state wins a campaign in exactly the same way and with exactly the same voters as a Republican in another state. What would that say about the major parties? Further, if populist programs prove more effective than more conventional political strategies, what does that imply about the ability of anyone to truly govern? This could get interesting.

Public policy

Markets Haven't Priced in Biden's Tax Hikes Yet

“Despite great interest and speculation, then, it is fair to say that so far any Biden tax changes haven’t been priced in at all. As any tax rises would take effect before much of the money they raised could be spent, it is also fair to expect them to have a negative effect on the stock market (and a positive one, at the margin, on bonds).”

John Authers from Bloomberg took a timely dive into corporate taxes this week. His overriding point is despite a sound rationale for increasing corporate taxes and a clear interest in increasing tax revenue, the risk is not showing up in markets yet.

This is interesting for a couple of reasons. Historically, tax rates have been one of the more reliable ways to systemically alter the course of corporate cash flows. While large international firms often find ways to tap dance around tax increases and exploit loopholes, not everyone can. As a result, tax increases normally have the effect of reducing corporate cash flows in aggregate and therefore present a real risk.

Even though the Trump tax cuts in 2017 provided a material benefit to companies, little weight is being placed on the chance these benefits get reversed in any meaningful way. Either the market doesn’t believe significant hikes will get passed or it doesn’t care because the Fed will be there to support asset prices regardless. This seems risky.

The complacency regarding corporate taxes also seems inappropriate in the context of broader history. Authers points out:

“Over a longer time scale, revenues from corporate taxation begin to look shockingly low. They have fallen to barely 1%, from more than 7% after the war. With populism in the air, it shouldn’t be difficult to sell some kind of hike”

This raises another important point. Economic comparisons are often made to the late 1940s and 1950s because that was the last time debt/GDP was as high as it is now. However, not only was growth much higher, but taxes were much higher too. Excess eventually has to be paid for - and the market is not reflecting this reality yet.

Inflation

MacroVoices #267 Jeff Snider: Why Deflation Is The Story, Not Inflation

https://www.macrovoices.com/965-macrovoices-267-jeff-snider-why-deflation-is-the-story-not-inflation

“normally short term inflation expectations are those further out on the curve, the longer term expectations. We would expect to find that the five year inflation breakeven would be below the 10 year. Since January, however, it's been the other way around for the first time since 2006. The five year TIPS breakeven is now considerably more than the 10 year, which has been a record amount of inversion since 2021.”

“And that's the TIPS markets … own way of saying that, yes, there may be some additions to the CPI in the short run, whether that's commodity prices working their way through or even the near term impacts of all that monumental government stuff. But the market does not believe it will last … there very [sic] isn't likely any lingering impact.”

Some great insight and commentary here by Jeff Snider at Alhambra Investments. He is simply interpreting the market signals from Treasury Inflation Protected Securities (TIPS) and observing the market does not believe current inflationary signals will persist. This suggests significantly more fiscal and/or monetary intervention will be required to cause lasting inflation or the signals from the TIPS market are bad.

Snider thinks we remain in the same old deflationary regime excepting a short-term blip, and I tend to agree. That doesn’t mean inflation won’t come, but it will require another big push to get there and stay there.

Currencies

Bitcoin Tumbles As Turkey Bans Cryptocurrency Payments

https://www.zerohedge.com/crypto/bitcoin-tumbles-turkey-bans-cryptocurrency-payments

“the rally [in cryptocurrencies] came to a screeching halt early Friday as dictatorial banana republic Turkey - of all places - decided to crack down on the use of virtual currencies in desperate hopes of preserving confidence in the Turkish lira, the world's worst performing banana republic currency.”

The new restrictions on cryptocurrencies imposed by Turkey present a very interesting milestone. Since a huge part of the argument for cryptocurrencies is that they sustain value better than fiat currencies, what better place to look for proof of concept than in a country with one of the weakest fiat currencies in the world?

So, when push came to shove, with Turkey’s currency reserves low and declining, and with very little credibility in the central bank, the government decided to put significant restrictions on cryptocurrencies. While Zerohedge reported, “Turkey's ban looks more like a worried government sidelining a serious competitor to its own currency,” that’s exactly the point. That is what worried governments do; they sideline competitors.

As a result, I have a hard time seeing this as anything other than a serious failure of proof of concept for cryptocurrencies. They will work just fine until governments get worried, and then they will be banned or significantly curtailed. As such, Turkey serves as a useful precedent.

It will also be interesting to see if this affects other assets. If cryptocurrencies have been a popular “net” by which to catch excess dollars floating around, then any perceived deficiencies in that net would prompt marginal investors to look for the next best net. Will the restrictions in Turkey increase the relative appeal of stocks and gold?

Capital markets

Capital Markets Series: Market Microstructure, by the CFA Society of Chicago, 4/21/21 ($)

“The larger the option volume is relative to the underlying, the more distortion there can be.”

This was an interesting and timely panel discussion hosted by the CFA Society of Chicago with all the right people. One takeaway is that we are probably still in the early stages of ETF proliferation as younger investors vastly prefer passive versus active strategies. Another takeaway is the proliferation of both ETFs and derivatives is causing some interesting dynamics in market microstructure (e.g., GME, HTZ). This can be viewed as merely a curious phenomenon or as an ominous sign of increasing fragility. I tend toward the fragility angle.

Implications for investment strategy

FUTURAMA, Almost Daily Grant’s Tuesday, April 13, 2021

https://www.grantspub.com/resources/commentary.cfm

“The red sea flows stateside. More than a quarter of U.S. stocks failed to generate positive net income last year, Bernstein analysts led by Toni Sacconaghi reported yesterday, the highest proportion in at least the past 50 years. Technology companies were amply represented within that group, with 37% of sector constituents generating a loss in 2020.”

As a fundamental, cash flow driven, valuation-based analyst it has been absolutely amazing to watch the eminently observable decline in business results the last ten years show in stark contrast to ever increasing stock prices. One way in which this phenomenon is reaching the public consciousness is by way of the increasing proportion of profitless companies.

Of course, there are valid reasons why otherwise valuable companies might not show a profit in the short-term, but the consistently increasing prevalence suggests something is awry. Let’s try a thought experiment to find out why. Let’s say markets price in a cost of capital for companies that is close to zero and let’s say markets assume the Fed will step in to prevent any significant selloff from happening.

In such a scenario, companies don’t face any discipline from markets so management teams are free to pursue the riskiest of strategies. In a sense they have to because they lose ground to competitors if they do not. Conversely, management teams that work hard to produce high economic returns are “rewarded” with a higher cost of capital.

What else could constrain the amount of risk to be taken? Not much. Regulators ostensibly could, but they too could be at risk of backlash if aggressive enforcement might initiate a systemic risk event. As such, the logical progression of such an extreme environment is more and more companies with fancy visions but no earnings. In other words, pretty much what we have.

I don’t think things can go too far down this path because weaker profits will eventually mean weaker incomes. Nonetheless, the exercise is useful because it illustrates the Fed’s overarching attempts to “save” capital will continue to hollow out the economy until it is forced to stop. Given the large and increasing number of profitless companies, it looks like we are already well down this path.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.