Areté's Observations 5/28/21

Areté (Pronounced ar-uh-tay) 1. Goodness or excellence of any kind. Fulfillment of purpose or function, the act of living up to one’s potential. 2. Effectiveness, knowledge.

Market observations

Clean energy stocks are as crowded as tech before dotcom crash, says MSCI ($)

https://www.ft.com/content/74baff9a-bce6-49a5-b7f5-7cbf84ac32c6

“This left clean energy stocks only a fraction less crowded than small and mid-cap technology companies were immediately prior to the 2000 dotcom crash, during which the tech-heavy Nasdaq Composite index plunged 78 per cent over the subsequent two-and-a-half years.”

“I think we’re 100 per cent in a green bubble,” Gordon Johnson, chief executive of GLJ Research, said the same month. “Pretty much every solar company I cover, their numbers got worse and the stock, like, tripled . . . This is not normal.”

There is plenty of froth to go around but clean energy is both an excellent representation of speculative fervor and a good analogue to tech stocks in the late 1990s. Just as with internet stocks, the issue is not whether the technology will be important; it will. Rather, the issues are the steady-state level of profitability and the valuations relative to potential.

Housing

House prices are acting like stock prices

https://www.ft.com/content/e16ab937-bb55-473b-b73f-6df9d6f4a17f

“One important piece of broad context, which should make us worry less about speculation, has been offered to me by Dimitris Valatsas, chief economist at Greenmantle. He says the simple scarcity of US houses is more important than the much-discussed labour and materials bottlenecks. In the long recovery of the past decade, the US has under-built. For every job added, just 0.5 houses were constructed. The long-term average is 0.7. That ratio suggests that, as of 2020, the US was 3.5m houses short.”

“Cerberus . . . operates more than 24,000 rentals through a portfolio company called FirstKey Homes. The firm recently borrowed $2.5bn against a portion of the property portfolio at a fixed rate of 1.99 per cent, according to Kroll Bond Rating Agency.”

There are two key points here. One is the main factor behind rising house prices is dearth of supply. Yes, demand is there and yes, lumber prices have increased but those causes are overwhelmed by the supply situation. In addition, supply takes time to adjust. As a result, there is a good chance higher home prices will be around for a while.

Another point is rates matter a lot in regard to housing. Since most people need a mortgage to buy a home, rates are a huge factor in affordability. Rates also matter in a relative sense. Even though the Fed is regularly buying mortgage-backed securities, which helps keep mortgage rates down, its other efforts to keep rates low make it possible for corporate entities to borrow at even cheaper rates. As a result, on the margin, real home buyers get outbid by companies that rent the properties out. This is just one of many ways interventionist policy can become counterproductive.

Politics

The GOP Becomes What it Once Despised ($)

https://frenchpress.thedispatch.com/p/the-gop-becomes-what-it-once-despised

“One of the incredibly bizarre developments of this dysfunctional modern time is the extent to which a faction of the Republican Party is now rejecting the crown achievements of the conservative legal movement. Increasingly, the GOP is looking at remarkable legal advances in the fight against speech codes, against government regulation of corporate speech, and against government-mandated viewpoint discrimination—and declaring that it prefers power over liberty.”

“Even when ‘anti-woke’ laws are applied only to teachers at K-12 public schools and public charter schools (where current case law holds that teachers enjoy minimal rights to free speech and academic freedom), it is still necessary that laws be clear enough to be understood by persons of ordinary intelligence. Instead, these laws are broad and vague enough to create an extraordinary chilling effect on classroom speech.”

From the vestiges of the Capitol insurgency in January a number of GOP legislative efforts are emerging to facilitate propagation of partisan narratives and to limit free speech when it threatens those narratives. In short, the efforts are designed to enshrine stupidity and fuel the fury of a “stolen election”.

Because these efforts are so idiosyncratic and often contradict the conservative legal movement, legitimacy is tenuous at best. While it is easy to understand that large chunks of the population are not happy with current conditions, it is less understandable why they are pursuing such a chaotic and tribal path. While many Republican (and other) leaders seem to be quietly hoping this movement will gradually fade, the scary scenario is it keeps growing. If it does, it is hard to imagine how politics and society as a whole would not be adversely affected.

Commodities

The global chip shortage is here for some time ($)

“’The most important thing [to recognise]’, says Malcolm Penn, who runs Future Horizons, a chip-industry consultancy, ‘is that shortages are a natural part of the industry.’ Chipmaking, he says, is a good example of what economists call a “pork-cycle” business, named for the regular swings between under- and over-supply first analysed in American pork markets in the 1920s. As with pigs, the supply of chips cannot quickly react to changes in demand. Capacity was tight even before the pandemic, says Mr Penn, pointing out that investment by chipmakers in factory equipment has been below its long-term average for many years.”

“And, says Mr Penn, when the drought eventually ends, chipmakers may find they face a familiar problem, but on a bigger scale: a capacity splurge in response to serious shortages today could well mean a sizeable glut tomorrow.”

While the subject of this Economist article is semiconductors, it applies equally well to all commodities. The main point is price changes are caused by supply and demand imbalances, but response time of adjustments to supply and demand can be of different durations. This is the stuff of which cycles are made. When it is difficult for supply to adjust quickly, there tend to be longer cycles.

This dynamic is especially important in the context of an environment of significant public policy interventions. It is hard enough for business to navigate normal economic vicissitudes. However, when public policy ranges from cavalier dismissal of a pandemic to sudden lockdowns to multi-trillion-dollar infusions of support, the challenge of balancing supply to demand is virtually impossible. In short, that already challenging task is vastly complicated by active public policy.

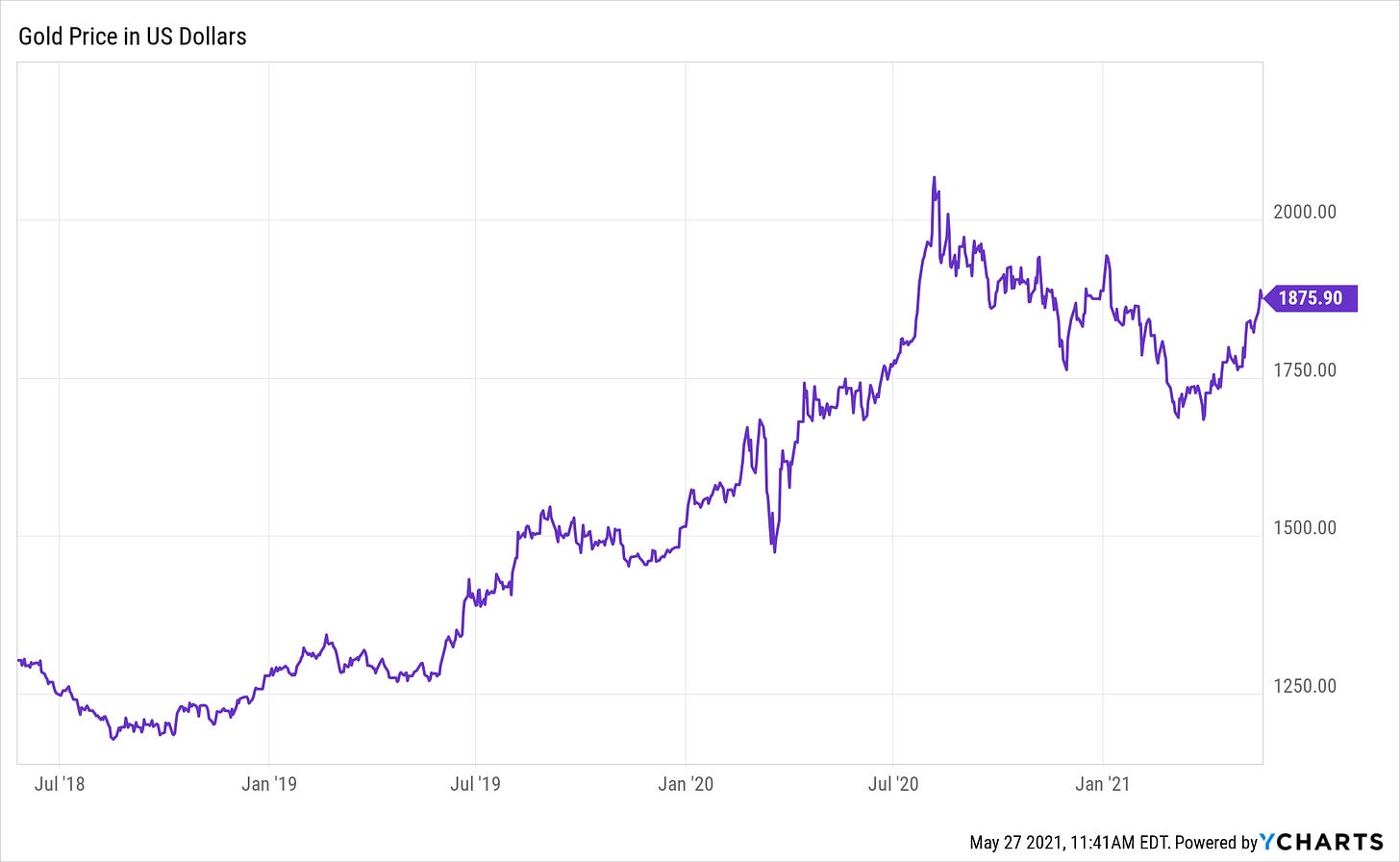

Gold

Basel III & The New Role For Gold

https://www.zerohedge.com/commodities/basel-iii-new-role-gold

“These rules are coming at the end of June for the European Banking System which will adopt the new Basel III rules. In short, the incentive to have exposure to gold as a pile of credit will go away if the banks can’t use any of that as part of their reserve calculations for their ASF – Available Stable Funding.”

“In effect, Basel III, if implemented in its current form, would change the gold market from a speculative one based on perceptions of the efficacy of monetary policy to control real interest rates to one that should force price discovery in an almost purely physical market.”

While big changes in regulatory systems often tend to get renegotiated and forestalled, things are looking increasingly likely it will be considerably less attractive for banks to back gold derivatives. In a market notorious for being rigged for many years, this will be a big change. For starters, price discovery will be based more purely on physical supply and demand. As such, extremely limited supply is more likely to reveal itself in the form of higher prices.

In gold we trust.report, May 27, 2021

https://www.incrementum.li/en/ingoldwetrust-report/

“If you think that you’re living in the best of all worlds, then you don’t need gold.”

This quote from Daniel Briesemann sums up the tone and content of this authoritative (and free!) report on gold which just came out yesterday. I will have more on this next week but these 346 pages of insights into the gold market ought to keep interested investors busy over Memorial Day weekend! One administrative note: As of this writing the new (2021) report has not been posted online yet.

Investment advisory

As I have been working on a project to transition Areté’s investment strategy from a focus on stock selection to one more about asset allocation, I have been conducting a lot of research on the best ways to populate various allocation slots. This effort has refreshed my memory of exactly how bad the value proposition is for the vast majority of mutual funds out there.

For example, there is a list almost as long as the alphabet of various investor classes. Most of these are differentiated mainly by the type of sales fees that are involved, not by the exclusion of sales fees. The most offensive in my mind are 12b-1 fees which are annual tolls on client assets for the sole purpose of supporting marketing efforts. Nothing could be less useful for investors.

With this kind of competition, it is no wonder many younger investors are migrating to exchange traded funds (ETFs) as a lower cost alternative. While this makes sense on the basis of fees alone, it doesn’t make any sense at all in terms of strategy. In a rapidly changing investment landscape, the last thing you would want is a strategy that simply buys when new money comes in, completely irrespective of investment merits.

This glaring structural weakness of passive strategies has been glossed over by central bank policies that have cushioned market selloffs and inflated valuations. Since central banks cannot perpetuate such fictions forever, valuations will eventually fall and reconnect with economic reality. When that happens, it will become incredibly apparent that a third way is needed, namely, investment funds with a low-cost structure and a sound investment strategy.

Monetary policy

"RRP Explosion": Fed Reverse Repo Soars To Third Highest With "Incredible Amount Of Cash"

“Why does this [reverse repos pushing toward a new record over $500B] matter? Three reasons …

The Fed is taking Treasurys out of the market through QE purchases and putting them right back in via the RRP

The heavy use of the o/n RRP facility tells us that foreign banks too are now chock-full of reserves.

Banks don't have the balance sheet to warehouse any more reserves at current spread levels.”

“As for the immediate market implications they are even more ominous: either the Fed will have to hike the IOER or rates will soon go negative. Worse, with the Fed still planning to do at least $1 trillion in QE even assuming a December taper, and potentially as much as $2 trillion based on the latest just released Fed ‘forecast’, there is simply no place to park all of these reserves.”

So, here we are again. Extremely activist monetary policy distorts markets. In the process of adjusting, those markets cause problems with yet other markets. And on and on.

While I am less inclined to call the situation “ominous”, I do believe this is one more indication that a) with each incremental intervention, the Fed vastly increases the complexity of potential consequences, and b) it is quickly running out of room to operate as it has and still retain credibility. Oh, and if the Fed makes a mistake, there is a ton of downside.

Fed Prepares To Go Direct With Liquidity

https://www.zerohedge.com/economics/fed-prepares-go-direct-liquidity

“Then as now, we view the actions of the FOMC as slowly destroying the private money markets in the US and preparing to very visibly push the big banks out of the transmission chain of monetary policy.”

“the Fed’s primary concern is not employment or inflation, but rather keeping the market for Treasury securities functioning.”

Christopher Whalen takes the analysis a step further and by viewing these phenomena as steps in a grander strategy by the Fed to displace money center banks in their roles in facilitating money markets and transmitting monetary policy. If this is right, it would be a big deal. It would mark “the end of the old Anglo model of finance” and it would “present a huge challenge to the major US banks”.

Capital markets

LIQUIDITY CASCADES: THE COORDINATED RISK OF UNCOORDINATED MARKET PARTICIPANTS

https://www.thinknewfound.com/liquidity-cascades

“One would hope that as markets mature, volatility occurring from endogenous events would diminish. Yet from 2010’s Flash Crash to February 2018’s Volmaggedon and the more recent March 2020 Coronacrisis, these events appear to be occurring with greater frequency, not less.”

“Market participants have developed several theories as to why these events have occurred, including: (1) accommodative monetary policy, (2) the rise and influence of passive investing, and (3) insufficient liquidity in the face of increased leverage.”

This excellent (albeit fairly technical) report pulls together many of the important trends I have highlighted over the last year. In short, monetary policy and the proliferation of passive investing have combined to enable a regime that is persistent but increasingly unstable. This prognosis is remarkably similar to the one given in the book, The Rise of Carry, that I have quoted several times in this letter. The bottom line is the potential for liquidity cascades presents special problems for long-term investors, but there are some thoughtful ways to manage the risk.

Implications for investment strategy

The demise of the dollar? Reserve currencies in the era of ‘going big’ ($)

https://www.ft.com/content/408d4065-f66d-4368-9095-c6a8743b0d01

“That said, there is general agreement that the biggest single peacetime threat to reserve currency status is economic and financial mismanagement. And with the Federal Reserve having abandoned its longstanding commitment to tightening policy in anticipation of inflation and President Joe Biden ‘going big’ with fiscal policy, the fear that inflation could undermine the currency is mounting — at least in some circles.”

A couple of weeks ago, Stanley Druckenmiller barked out a warning on the US dollar’s reserve currency status that rapidly circulated through financial media. While such concerns have smoldered for decades, they heated up after the financial crisis. Now, with Druckenmiller’s endorsement, it is fair to say there is a mainstream narrative on the subject.

It is an important subject too because just as cash flows are crucial for determining the value of an investment, so too is the currency in which they are denominated. It is also important because when governments accumulate excessive levels of debt, the currency is often the pressure release valve.

Many investors are dismissive of the potential for the US dollar to lose its reserve status based on the argument there are no good alternatives. True as that may be today in terms of existing international currencies, it sidesteps the issue that the dollar can lose value relative to commodities and real assets.

Obviously, these issues are linked to inflation, commodities, and gold to name a few. One key point is these subjects are new for many investors who have focused more on economic growth and company-specific opportunities. Another key point is these are the kinds of issues that come at key turning points in investment markets. As a result, it is best to pay attention, learn about the subject, and prepare to act before it is too late.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

One goal of this letter is to provide fairly dense information content – so you don’t waste your time filtering through a lot of fluffy verbiage. A consequence of that decision, however, is sometimes things may not be as understandable as they could be.

If you have a general question that may also be useful for others to know the answer to, please make a comment in the newsletter and I will do my best to answer the question or make a clarification. If you have a more specific question, please send it to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.