Areté's Observations 7/30/21

Areté (Pronounced ar-uh-tay) 1. Goodness or excellence of any kind. Fulfillment of purpose or function, the act of living up to one’s potential. 2. Effectiveness, knowledge.

Welcome back!

The beat goes on. News was dominated by housing and China over the last week or so and punctuated by the Fed meeting and disappointing GDP growth this week. All of that and little has changed – time for some vacation.

If you have any comments or questions, reach me at drobertson@areteam.com.

Market observations

The picture below from the thedailyshot.com paints a thousand words about market action. Since early 2020, retail investors have been consistently pouring money into stocks at a much higher level than in the last several years. In addition, the effect has been amplified by the prolific use of options. The net result is dips get bought quickly which means retail investors are effectively creating a “put” on the market right now.

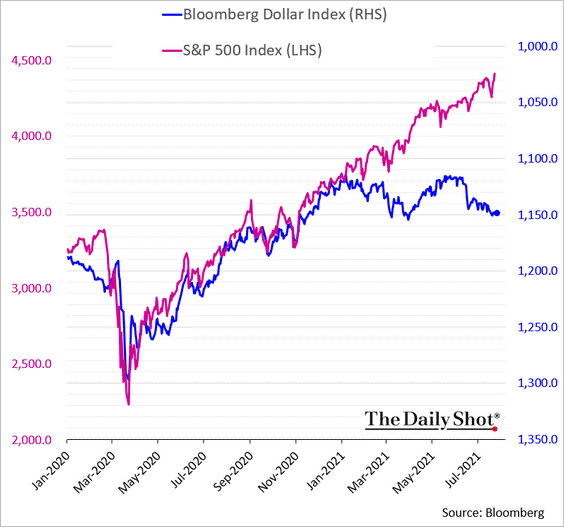

The idea of a retail “put” is especially interesting in the context of the S&P 500 relative to the US Dollar index. The wide gap forming between the S&P 500 and the USD shown in the graph below invites an easy hypothesis: Savvy USD traders started becoming much more cautious at the beginning of the year while rambunctious stock traders are having too much fun to notice the warning signs.

If that hypothesis seems like too much of a leap, take a look at the graph of the S&P 500 vs. the VIX from themarketear.com posted on Jul 27, 2021, at 13:37. Typically, the S&P 500 turns down when volatility increases. For the last month or so, however, volatility has clearly trended up, but the S&P 500 has kept charging along undisturbed.

Housing

As moratoriums lift, will America face a wave of foreclosures and evictions? ($)

“Surveys conducted by the Census Bureau do indeed show worrying signs. One in four renters and one in ten mortgage-holders have little to no confidence in their ability to pay for housing in the next month (see chart 1). Some 2.8m households, containing 7.4m Americans, are behind with the rent. The same surveys show that 1.9m households, in which 6m Americans live, are behind on their mortgages.”

Will the economic recovery survive the end of emergency stimulus? ($)

“Debtors themselves may not know where they stand. Non-payment of rent by American firms in 2020 ‘occurred privately and in a somewhat disorganised way’, according to a paper by Goldman Sachs, a bank, leaving ‘lingering disagreements about whether rents have been truly abated or merely deferred’. Estimates of the ‘back rent’ owed by American households to their landlords vary by a factor of six.”

With the expiry of various moratoriums beginning to take effect, the fate of millions of people who are behind in their rent or mortgage will be determined. Having some extra time helped a lot of people but not everyone. Over the next several months we will discover how much disruption the catch-up in evictions and foreclosures will cause. On one hand, the addition of a bolus of property on the market certainly has the potential to increase supply and reduce prices. On the other hand …

US housing inflation: the sleeping giant that might tip the Fed’s hand ($)

https://www.ft.com/content/efdf1845-6138-4af7-8d2b-c20df9fed218

“Housing expenses are the sleeping giant that could tip the scales of the increasingly heated debate on US inflation. They are quickly emerging as a pivotal indicator for officials at the Federal Reserve, within the Biden administration, and among private economists.”

“’We calculate the market won’t be fully in balance until 2023 or 2024. So I’m not sure that the uptick in rents is particularly shortlived,’ said Ali Wolf, chief economist at Zonda, a property market advisory group.”

GIMME SHELTER, Almost Daily Grant’s, 7/23/21

https://www.grantspub.com/resources/commentary.cfm

“As rental contracts typically last one year and inflation indices capture prices on currently occupied domiciles as opposed to asking prices on vacant units, it takes about five quarters for trend changes in measured home or rental prices to appear in the CPI data, a June 9 analysis from Fannie Mae economist Eric Brescia finds. That suggests that last year’s deep freeze is still working its way through the system and will soon abate.”

“Meanwhile, a dearth of affordable housing supply complements the ultra-tight rental conditions identified by the NHMC. Citing data from Freddie Mac, The Wall Street Journal relayed Wednesday that the annual construction pace of homes sized 1,400 square feet or less (a category typically denoting starter homes for first-time buyers) has remained stuck between 55,000 and 65,000 units per annum in recent years, compared to more than 400,000 new units in the late 1970s.”

The Economist points out landlords might increase rents “to make up for lost income” and to adjust for “higher property values”. Grant’s reports owner equivalent rent is expected to “accelerate to between 4.8% and 6.3% year-over-year by December” which would add “as many as 1.5 percentage points CPI”. There are certainly good reasons to expect housing to be an important contributor to inflation over the next several years, but I suspect it will be a bumpy ride.

China

Chinese Massacre Spreads To Bonds, FX Amid Rumors Of Foreign Liquidations

https://www.zerohedge.com/markets/chinese-massacre-spreads-bonds-fx-amid-rumors-foreign-liquidations

“The rout in Chinese shares, which has demolished the country's tech giants following Beijing’s regulatory crackdown on various sectors, extended into the bond and currency markets Tuesday amid unverified rumors swirled that U.S. funds are offloading China and Hong Kong assets.”

Markets haven’t even begun to reflect China-US decoupling risks ($)

https://www.ft.com/content/471feda8-bae1-426a-b57f-a845baefe79b

“This is just the latest example of a process of financial decoupling, as it is known in Washington, or self-reliance, as it is called in Beijing.”

“As investors and businesses face more conflicts of interest and decisions about whose rules to obey and whose to flout, politics is likely to win out. Valuations don’t even begin to reflect this yet.”

First the headlines, then the analysis. The market in China made news by crashing last week and then continuing into this week. For some perspective, Chinese stocks had done well – and for a lot of good reasons. Strong economic growth, higher bond yields, favorable currency movements and increasing inclusion in world market indexes all contributed to a positive disposition.

However, and once again it is a big “however”, China’s markets can be capricious. After DIDI shareholders got hit shortly after its IPO, education stocks got slammed with an unexpected prohibition of their main business activity. And then, of course, there is the massive problem of China Evergrande and its creaking debt burden.

As George Magnus, an astute and seasoned China watcher, put it, “investors are in the crosshairs where assets and valuations are the target of random political initiatives.” As I put it in the July 16, 2021 edition of Observations, “A risk factor that should always be considered in regard to China is the government can and will do whatever it takes to achieve its objectives.” Either way, it does not appear the potential for weakness from China is being meaningfully discounted yet.

Monetary policy

The Fed should stop treating all money the same ($)

https://www.ft.com/content/8ed6a9a5-914c-4c15-89f3-fe7f2395dea3

“The paragraph [of the Federal Reserve Act on monetary policy] begins with instructions on how the Fed should reach those goals: the bank ‘shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production’.”

“But the Fed is already allocating credit, whether it wants to or not. It has pushed so many reserve dollars out in the world that banks don’t know what to do with them. Is that increasing productive capacity, as the Fed mandate directs? Meanwhile, interest rates on credit card balances continue to climb. Short-term dollar liquidity is cheaper for banks, but more expensive for humans.”

Brendan Greeley makes a couple of excellent points here. The main one is the Fed lost the story line of what monetary policy is all about – maintaining money supply commensurate with economic growth – in the process of dealing with the financial crisis. Often distracted by secondary objectives such as employment and stable prices, the Fed has lost touch with its reason for being.

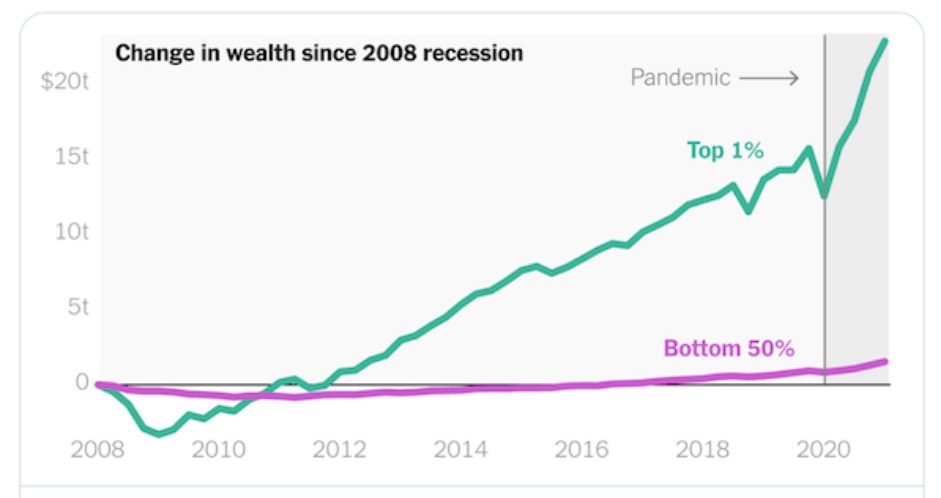

One very serious consequence of that mission drift is the unequal allocation of credit. Greeley rightly notes that credit conditions have gotten better for banks but worse for people. This is not the business the Fed should be in, but here we are.

“Open Letter to the FED”

https://www.convexitymaven.com/wp-content/uploads/2021/07/Convexity-Maven-Open-Letter-to-the-FED.pdf

“As such, with similar modesty, let me propose a few ways for the Federal Reserve Bank (FED) to ‘trim the sails’ of their monetary support programs before another ‘Chuck Prince moment’ arrives with a deafening silence.”

“Similarly, while I cannot show a formula that links concentrated wealth creation to significant political unrest, once again I will let your lying eyes consider the -broccoli line- and the -cabbage line- on the prior chart.”

Harley Bassman takes the same basic message a step further. He cordially, but firmly, suggests the Fed had better cut back on monetary support or another market seizure will happen like in the financial crisis. Further, he doesn’t pull any punches in highlighting the increasing inequality being caused by the Fed’s current course.

These points are also excellent. Similar issues have been highlighted over the last several years by people who have been paying attention and willing to say so, and I’ve done my fair share. What is different is now a major voice in finance (the FT) and one of the smartest and most influential minds in fixed income (Harley Bassman) are broadcasting the message. The narrative is gaining force, and this will put additional pressure on the Fed.

Cryptocurrencies

Structural fault lines

Grant’s Interest Rate Observer, July 23, 2021

“Binance Holdings Ltd., the world’s largest cryptocurrency exchange, is in the crosshairs of regulators around the globe. Meanwhile, the issuance of the problematic ‘stablecoin’ tether has flatlined. A market structure that threatens the stability of the crypto universe is the subject at hand.”

“Light on his feet, Zhao moved the headquarters of Binance to Japan from China after the People’s Republic shut down crypto exchanges in 2017. He pulled up stakes and moved again to Malta in 2018 after Japanese regulators, in turn, cracked down. Wearing out his welcome in Malta, he next set up shop in the Cayman Islands.”

‘I was panicking’: the high-risk bets sparking a backlash at Binance

https://www.ft.com/content/f7f7f110-32d5-4931-a7b7-d3cd0f63410a

“Binance is to cut drastically the risk clients can assume in one of its flagship cryptocurrency products after a backlash from regulators and consumers over high-risk derivatives that can quickly leave users with painful losses. The crypto exchange, which facilitates hundreds of billions of dollars worth of trades a month, said it would reduce the maximum leverage — the amount investors can borrow to magnify their bets — on its futures contracts to 20 times from a previous peak of 125 times.”

At the risk of being too negative on cryptocurrencies, I do believe there are some important points raised in these two articles. One of those points is more evidence of shady dealings. Can you imagine if your bank or broker changed headquarters once every year or so with a clear preference for offshore tax havens? Not exactly the markers of sound finance or the basis for trust.

Another point is the fragility of market structure. The crypto world relies on a lot of interdependencies and there are a number of weak links. As George Noble of Noble Capital Advisors L.P. told Grant’s: “The crypto guys always want to talk about Bitcoin … They want to talk technology. And they talk about all the price action. But they never talk about market structure.”

Investment advisory

2nd Quarter 2021 Commentary, Horizon Kinetics

https://horizonkinetics.com/app/uploads/Q2-CVALUE-Review_FINAL.pdf

“At each of those times, these topics [out of consensus ideas] were never mentioned in the financial press. Eventually they came to be sporadically mentioned. Then some more time would pass, and they came to be mentioned more regularly, but only as a curiosity, because of early mention by sufficiently prominent guests. That at least qualified them for the regular news cycle, even if they were of dubious merit. It’s not wise to discuss an idea that other people aren’t discussing, but you are permissioned to discuss it if a financial sector influencer has already brought it up.”

I consider the folks at Horizon Kinetics to be among the most thoughtful people in the investment management business. They always have an interesting perspective (even if I don’t always agree with them) and their quarterly reports should be on the list of any curious investor to regularly peruse for insights.

This particular blurb resonated with me because I have had very similar experiences with Areté. The fact of the matter is one of the keys to being a truly insightful analyst is to be so independent as to follow evidence at the expense of (at least occasionally) being out of consensus. While this is normally an excellent formula for making money with investments, it is a less excellent formula for growing an investment business.

The reason is out of consensus ideas can appear extreme and most investors are not comfortable with extreme views. This creates a special problem though. Often ideas appear most extreme when they are early, i.e., before they are socialized. Unfortunately, those early stages often tend to be when they are most effective, i.e., before they get thoroughly discounted by the market.

One of the reasons I publish Observations is to provide insights and observations investors are unlikely to get from more mainstream sources. Another reason is to begin acclimating readers to nonconsensus ideas early enough so they have some time to digest and embrace them. Having some time is key. Interesting ideas that don’t get implemented because one isn’t yet comfortable with them don’t help performance.

This process is extremely important as we transition from a regime of steady growth and low volatility to one of higher volatility and lower growth. I know it sounds extreme now, but that just means it is still early enough to do something about it.

Investment landscape

The horror scenario lurking in the plumbing of finance ($)

https://www.ft.com/content/a0482f69-be5c-4d92-ae59-17a8e2b2cdde

“This year, though, the horror movie in US Treasuries, the mother of all contemporary markets, is being played over the summer and early autumn.”

“Just as the expendable teenagers [i.e., horror movie cliches] will always split up and then open the wrong doors, we can count on the US Federal Reserve and Congress to do the stupid thing. In this case, that would be congressional inaction on the artificial debt ceiling limit and the real (as distinct from rhetorical) budget. This nonsense is limiting how many Treasury bills and short-term government securities can be issued.”

John Dizard does a nice job in this piece for the FT not only making some sense of financial plumbing but also highlighting the implications. Importantly, after the financial crisis, “banking regulation changes known as Basel III and new securities market rules have dramatically increased the demand for government securities to be used as collateral.” At the same time, the Fed’s asset purchases have dramatically decreased the supply of government securities.

Dizard frames the scenario as a horror movie: “Unfortunately, we now have the conflict of two giant and terrifying programmes: ‘Basel reforms’ playing Godzilla, and ‘Fed asset purchases’ taking the place of Rodan, the Flying Monster.” In short, there are massive contradicting forces that can cause all kinds of problems.

But wait, there’s more. Now, there is a catalyst too. With the debt ceiling reaching its expiration, the supply of Treasuries will be further constrained. As Dizard concludes, “Unless you believe in fairies and cross-party goodwill, there will be no resolution of the debt ceiling and budget legislation before October or November, which means November.” Time to buckle up.

Implications for investment strategy

Volatility Beckons After Warp-Speed Recovery ($)

“Simply put, the fundamentals have shifted. After six months of congruent first and second derivatives, divergence has arrived. An inflection point is upon us. Growth is high, but decelerating.”

“When the first and second derivatives fall out sync, investors become less certain. Bulls and bears tussle. Market gyrations become more pronounced. Leadership shifts, and then shifts again.”

John Authers provided the above quotes from Larry Hatheway of Jackson Hole Economics. The conclusion is, “volatility and dispersion increase … We should probably get used to it.”

The logic of first and second derivatives falling out of sync is absolutely right. This is the market’s form of “What have you done for me lately?”

It is especially relevant now. Is there a bull case? Yes – the economy is still growing at a healthy clip and retail investors continue throwing money in the market.

Is there a bear case? Yes – the relatively strong US dollar and increasing VIX reflect a certain amount of trepidation. Some kind of adjustment appears to be happening in China, the world’s second largest economy, and it does not seem to be discounted. Pressure for the Fed to relax its monetary interventions is increasing and the upcoming debt ceiling expiry threatens to cause glitches in liquidity.

To use Dizard’s metaphor, retail stock investors appear to be the hapless teens in the horror movies that always do the wrong things. As a result, I am more interested in what could and should be done in the event of a significant selloff than I am in chasing stocks further at this point.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates, I express my opinion as to which side I believe has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

One goal of this letter is to provide fairly dense information content – so you don’t waste your time filtering through a lot of fluffy verbiage. A consequence of that decision, however, is sometimes things may not be as understandable as they could be. If you have follow-up questions or comments, please use the comment utility, or send me an email at drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.