Areté's Observations 7/9/21

Areté (Pronounced ar-uh-tay) 1. Goodness or excellence of any kind. Fulfillment of purpose or function, the act of living up to one’s potential. 2. Effectiveness, knowledge.

Welcome back!

It has been another hot and humid week interspersed with thunderstorms. I hope you are staying cool and have a great weekend!

If you have any comments or questions, you can reach me at drobertson@areteam.com.

Market observations

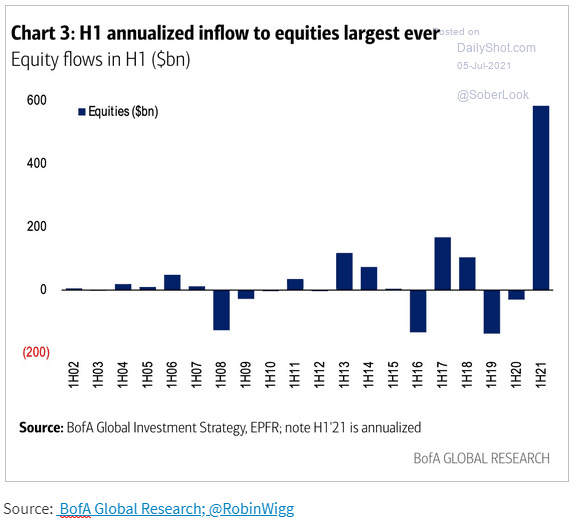

After putting in a strong first two quarters of performance, the S&P 500 started off the first days of the third quarter strong too. While there is no single obvious reason for this, it is clear an absolutely enormous amount of money flowing into equities in the first half helped matters.

Futures, Yields Plunge Amid Global Slowdown Panic, China Tech Rout

https://www.zerohedge.com/markets/futures-yields-plunge-amid-global-slowdown-panic-china-tech-rout

“After S&P futures printed at new all time highs on 8 of the past 9 days, one can almost feel sorry for the euphoric bulls … And sure enough, just one day after it appears that nothing could stop markets from exploding to recorder highs day by day by day, on Thursday morning both the reflation and growth trades were a dumpster fire, with Dow e-minis plunging 475 points, or 1.37%. S&P 500 e-minis were down 58 points, or 1.34% and Nasdaq 100 e-minis were down 190 points, or 1.3%, the VIX jumped above 20 after trading at 14 just a few days earlier and 10Y yields dropped as low as 1.25%.”

As rosy as the stock market looked through Wednesday, the collapse in Treasuries the last several days has forewarned of other problems – and now stocks seem to be catching up. This synopsis does a nice job of putting the activity in context.

One potential catalyst is a slowdown in China. Of course, a more generalized concern about moderating growth worldwide could be contributing as well. Regardless, the main point is with GDPNOW currently registering 7.8%, the market’s discontent has less to do with current growth levels and more to do with a decelerating trend. If stock investors are counting on accelerating growth, there could be a lot more disappointment ahead.

Labor

Take one look at the graph of labor force participation and what you see is not a gradual return to a clearly defined trajectory but rather a step function change. This illustrates as clearly as anything that labor markets are in a an entirely different world than before Covid-19 and therefore it is not fair to expect a return to normal. There is also economic rationale for this, however …

The answer to inflation fears lies in ending Covid disruption ($)

https://www.ft.com/content/e79c894e-8e89-44c6-a864-c6a2cc70bbb0

“As new business models are adopted, old jobs are destroyed. There will not be a return to normal. Labour markets will be divided between those workers who are reskilled and retooled for the jobs that have been created by the pandemic, and those who are not. The result is likely to be some labour markets that are too hot in terms of demand from companies for employees with the right skills and some areas where the supply of workers is too much.”

While changes in business models will disrupt the labor market in important ways, other factors will inhibit significant change. As Robert Armstrong reports below, workers in rural areas are often especially beholden to the very limited number of employers in their region.

Don’t freak out about the job numbers ($)

https://www.ft.com/content/0a793306-f55f-4bd6-9eb5-2c1b5b4101d3

“Labour markets in many parts of the US are dominated by a few employers, and monopsonistic employers are slow to raise wages. ‘This is a big reason employers are hesitant to raise wages. [In employer monopsonies] employees are paid less than what they produce . . . what makes it hard for employers [to offer a new employee higher wages] is that then they have to raise everyone’s wages’ … Rural Americans don’t have a lot of job choice”

Media

When Narrative Trumps the Facts ($)

https://gfile.thedispatch.com/p/when-narrative-trumps-the-facts

“No, I’m talking about stuff that is reported like it’s news, stuff that is accurate in a factual sense, but isn’t actually newsworthy. The best you can say about it is that it’s information. That’s fine as far as things go. But it’s often information that’s reported as if it were somehow important.”

“But there’s a downside to all this. Actually, there are several downsides … First, it’s not just that we’re drowning in fluff, it’s that everything is being flattened. The human brain has only so much capacity for attention. And every day we’re barraged with fluff like flak over shock-and-awe in Baghdad. The ratio of noise to signal is becoming overwhelming, to the point that it’s hard to figure out what’s truly important because we’ve become accustomed to thinking that whatever grabs our attention must be.”

The issues Jonah Goldberg discusses here resonate with me because I have observed and spoken out about them in regard to investment news for years. In particular, I wrote a blog post five years ago highlighting Neil Postman’s book, Amusing Ourselves to Death. The main point is the “form of media fundamentally shapes the nature of consumers' interaction with it and, therefore, the types of messages that can be effectively delivered by it.” As smartphones have become ubiquitous purveyors of news, the type of information delivered has become choppier, “fluffier”, and more entertainment-oriented.

As a result, I completely agree with Goldberg’s assessment that there are several downsides to “all this”. For certain, a big part of the reason why I started writing this letter is to help filter out the stuff that gets a lot of attention but isn’t very important and conversely, to be sure to focus on things that really are important to long-term investors.

Regulation

The Morning Dispatch: SCOTUS Goes Out With a Bang ($)

https://morning.thedispatch.com/p/the-morning-dispatch-scotus-goes

“As Roberts pointed out, certain factors made the burden of California’s law particularly onerous. While the state claimed it would keep donor information private, its security protocols for protecting the information were often weak, and the attorney general’s office accidentally published thousands of confidential donor disclosure reports on its website. In addition, the state rarely relied on the reporting mechanism to detect instances of fraud.”

A couple of interesting points came out of the Supreme Court’s summer rulings. One was that political partisanship played a much smaller role, and often a counterintuitive role, in many of the Court’s decisions. While justices do have political beliefs, and those beliefs certainly can influence their rulings, the effect of political leanings on Court rulings tends to be far less than many people fear.

The second point is a general one and merely recognizes in many situations in which harm is caused, culpability can be assigned to multiple parties. In general, I can see why a state attorney general’s office may want to keep tabs on nonprofit donors. However, if they are allowed to do that, they take on an important responsibility to protect that private information.

In this case, the attorney general’s office not only failed to ensure adequate security protocols were in place, but “accidentally published thousands of confidential donor disclosure reports on its website.” In my mind, this constitutes a huge abrogation of trust that should have consequences.

Part of the reason why this situation resonates with me is because it has so many parallels in the tech world. A tech company asks for personal information in order to sign up for its service. They fail to protect your information and it gets hacked. Then you have to scramble to change passwords, check your credit report, and whatever else. Again, in my mind, once a company violates its end of the deal, it loses its authority to make demands like providing personal information. Fair is fair.

China

Didi caught as China and US battle over data ($)

https://www.ft.com/content/00403ae5-7565-413e-907d-ad46549375ba

“Bankers on the deal also said they would not have proceeded had they known about the looming problem (data laws), and explained that that they had rushed Didi’s IPO roadshow partly to avoid a clash with the celebrations of the 100th anniversary of the Chinese Communist party on July 1. The company and its banks had assurances from Chinese lawyers that ‘it was fully compliant’, said an executive at one of the Wall Street banks running the process.”

“’This is now a risk factor that is unmeasurable, unpredictable and impossible to navigate,’ said an executive at one Wall Street bank.”

This story provides some good commentary on, and insight into, how Wall Street works. For example, it is completely disingenuous for the bankers to say, “they would not have proceeded had they known …” Anyone paying attention to China knows the government reserves the right to do whatever it wants to in the country. This obvious reality could not have escaped major banks such as Goldman Sachs, Morgan Stanley, and J.P. Morgan.

As a result, the better conclusion is the banks knowingly completed an extremely risky transaction because it was extremely profitable. Duh. I’m not sure how many times investors will need to get figuratively hit upside the head with a two by four to learn the lesson, but until the lesson is learned incidents like this will keep occurring.

Emerging markets

Emerging markets diverge from playbook ($)

https://www.ft.com/content/d9f44a44-23f6-4420-a153-0982de4abd26

“You can tell a really positive macro story, with the opening of the global economy, a return of tourism, the potential for a new commodity boom,” said Mary-Therese Barton, head of emerging debt at Pictet Asset Management. “But on the other hand, we would probably struggle to find a strong structural growth story.”

Emerging markets are typically considered to be higher beta plays on developed markets. They are also considered to be much more representative of commodities prices since commodities comprise a much larger part of their economies.

As a result, it has been noticeable that emerging markets have disconnected from both developed markets and commodities since February this year as both developed markets and commodities have continued to rise. Are emerging markets providing a “canary in the coalmine” for other assets? Perhaps. It is also possible most emerging markets just don’t have a “strong structural growth story”. Either way, these are serious questions to answer for emerging market advocates.

Analyst tips

The Long Slow Short ($)

https://www.netinterest.co/p/the-long-slow-short

“Faced with disruption from the telephone, the fax, the personal computer, the internet, and now digital payments, Western Union has been on a steady decline for over 140 years. When it comes to operating in markets that are collapsing around it, Western Union has form. And yet it's still going.”

As a way of managing information, I save notes and articles in Evernote so I can easily retrieve them. I also apply labels to categorize them just as I did with paper files before. Two of the labels that have evolved as useful repositories are “Wisdom-investment” and “Analyst tips”.

This history of Western Union by Marc Rubenstein is a good example. Business school textbooks would have laid Western Union out for dead many decades ago. And yet … it lives on. As Rubenstein puts it, “One of the reasons there’s a lot more money in venture than in short-selling is precisely because it can take so long for a business to destruct.” While this is obviously an extreme case, the basic insight is the same: Established habits and patterns and connections are often hard to completely displace, regardless of the presence of new and better alternatives.

Monetary policy

Jay Powell Defends the Lower Bound

https://www.theinstitutionalriskanalyst.com/post/jay-powell-defends-the-lower-bound

“As in December 2018, September 2019 and April 2020, the Federal Reserve Board is playing the Wizard of Oz, trying to navigate the ebb and flow of dollar market liquidity as Congress spends trillions more that we don’t raise via taxes. The likelihood that the Fed gets it wrong and plunges the markets into another liquidity crisis a la December 2018 is fair to middling. Buckle your shoulder harness and have a great week.”

Chris Whalen’s post captures a few of the more important perspectives on current monetary policy. One is the Fed is using centralized planning to manage the massively complex business of dollar market liquidity. Another is there have already been three major disruptions in this “market” in less than three years, so the Fed’s track record thus far is poor.

Finally, given the complexity of the task and the poor record, there are good reasons to expect another liquidity crisis in the not-too-distant future. The big question then will be, “Does the crisis lead to a deflationary implosion, or does the Fed react so strongly as to trigger significant inflation, or does the Fed do just enough to calm markets and re-establish the carry trade?”

Implications for investment strategy

Reports of Value’s Death May Be Greatly Exaggerated ($)

https://www.tandfonline.com/doi/full/10.1080/0015198X.2020.1842704

“This classic measure of value was designed at a time when the economy was much less reliant on intellectual property and other intangibles. In today’s economy, intangible investments play a crucial role, especially in growth stocks and even in value stocks, yet book value ignores most internally sourced (intangible) investments. We capitalize intangibles and show that this measure of value outperforms the traditional measure, notably beating B/P-based HML by nearly a twofold margin after 1990.”

“Indeed, revaluation accounts for about two-thirds of the variability in factor returns over the past 13½ years and well over 100% of the cumulative shortfall.”

I have to admit I read this article with low expectations because so much has been written about the “growth vs. value” debate. As a result, I was pleasantly surprised to come across a couple of insights I think are useful for long-term investors.

One involves the increasing impact of intangibles on valuations. I haven’t paid a whole lot of attention to this because in my valuation process I have always capitalized research and development expenditures for the very same reason – they are still assets and should be accounted for. Nonetheless it was interesting to read the value universe with capitalized intangibles outperformed the traditional universe by 220 basis points per year since 2008. Sounds about right.

The bigger issue is trying to understand why value has underperformed growth so significantly over the last thirteen years. While intangibles help account for some of the shortfall (growth stocks tend to have a higher proportion of intangible assets), the biggest reason for the underperformance was revaluation. In other words, growth stocks have become progressively more expensive relative to value stocks.

To the extent the value factor works because of mispricing, which I believe, then it is only a matter of time before value stocks revert to the mean and get revalued higher, at least relative to growth stocks.

This also highlights an interesting market phenomenon over the last thirteen years. Before the financial crisis most risk was idiosyncratic. In other words, stocks tended to outperform or underperform due to stock-specific developments. Over the last thirteen years, risk has become more systematic; stocks outperform or underperform due much more to their broad economic or market exposures.

The implication is passive index funds can be just as mispriced as individual stocks. This will create great opportunities for active investors and will be an enormous and disappointing surprise for many investors in passive funds.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

One goal of this letter is to provide fairly dense information content – so you don’t waste your time filtering through a lot of fluffy verbiage. A consequence of that decision, however, is sometimes things may not be as understandable as they could be.

If you have a general question that may also be useful for others to know the answer to, please make a comment in the newsletter and I will do my best to answer the question or make a clarification. If you have a more specific question, please send it to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.