Areté's Observations 8/13/21

Areté (Pronounced ar-uh-tay) 1. Goodness or excellence of any kind. Fulfillment of purpose or function, the act of living up to one’s potential. 2. Effectiveness, knowledge.

Welcome back!

Markets have continued to be sleepy through the summer and even more so now that most earnings reports have been digested. As a result, a disproportionate number of items below will be more higher-level thought pieces.

If you have any comments or questions, reach me at drobertson@areteam.com.

Market observations

$4.2B worth of buying per day, Aug 09 2021 at 10:40 ($)

https://themarketear.com/premium

“There has been 187 US equity trading days from November 1st to today. This was the start of positive vaccine developments. Since November 2020, there have been +$837 Billion worth of global equity inflows in 40 weeks. This is +$21B worth of inflows every week or +$4.2B worth of buying per day.”

This flows data puts into perspective just how important vaccines have been to market sentiment and how sustained that effect has been. It also raises a number of questions. How much longer can this go on? At what point will incrementally negative news on vaccines and the coronavirus cause flows to reverse? It’s always hard to say but it is increasingly looking like this narrative has run its course.

Economy

Big Economic Challenges Await Biden and the Fed This Fall ($)

https://www.nytimes.com/2021/08/03/business/economy/Biden-Federal-Reserve-economic-challenges.html

“The U.S. economy is heading toward an increasingly uncertain autumn as a surge in the Delta variant of the coronavirus coincides with the expiration of expanded unemployment benefits for millions of people, complicating what was supposed to be a return to normal …”

The key words here are “uncertain” and “complicating”. As it turns out, the wide variety of crosscurrents in the economy are causing trouble for a market hungry for simple and straightforward explanations. While it has been easy to latch on to the notion of a “return to normal”, this is no longer a good baseline expectation.

Recovered COVID Patients Suffering 'Significant Cognitive Deficits' According To Large-Scale UK Study

“the vast majority [of Covid patients] have recovered - while up to one-third reportedly suffer from lingering symptoms of varying severity, known as 'long covid’.”

“Most surprisingly a significant degree of cognitive decline was found in mild cases of COVID-19. These individuals performed 0.23 standard deviations below normal – a decline that is roughly equivalent to 3.5 IQ points in a classic test of intelligence.”

In what is proving to be a very good metaphor for the economy, research is showing Covid is not just something you suffer through for a while and then are done with for many people. Rather, the effects are often persistent and indisputably negative. Individuals with long covid face persistent symptoms ranging from brain fog to lower IQ.

“Long covid” is not a bad way to frame the economy either. It is not hospitalized, and it is much better. However, there absolutely are lingering problems that will prevent a return to prior performance levels. While those problems may eventually dissipate, the better expectation is something less than a return to normal.

Housing

For better and worse, we have already learned (or should have learned) the lessons of excessive household debt. As Atif Mian and Amir Sufi elaborated in their book, House of Debt, and I mentioned in a blog post several years ago, poor homeowners are at much greater risk when things turn south. Having fewer resources means it is harder and less likely to recover from adverse events. Higher levels of debt mean lower levels of equity which means that equity can get wiped out quickly.

The point here is not to make a value judgment about public policy, but rather to recognize the consequences of the pandemic which have been forestalled up until this point. Once foreclosures start, the effects cascade through entire communities. Unusually low prices for foreclosed properties become comparables for other properties and that brings all prices in the area down. This means several mortgages will need to be written down (i.e., money is destroyed) and inequality will increase as houses in more affluent neighborhoods continue to rise.

Social dynamics

Policy Errors Have Consequences

https://www.mauldineconomics.com/frontlinethoughts/policy-errors-have-consequences

“In a round-robin email conversation with friends about the Fed, David Bahnsen quipped that ‘the people wanted a king,’ referring to the Old Testament Israelites in Samuel’s time who wanted a king. Samuel warned of all the problems a king would bring, but they wanted one anyway.”

“It seems the people want a king in the guise of the Federal Reserve. Well, not the people, but banks and the markets and the elites. They assume our wise philosopher-kings can sit around the table and decide the price of the world’s most important financial instrument—US dollar interest rates—better than the collective wisdom of the hoi polloi.”

This blurb struck me as especially descriptive because it helps explain many unusual economic, social, and political phenomena. Why do people allow the Fed to continue aggressively implementing policy that will obviously cause huge problems? Because they want a king. Why doesn’t the electorate push back when both parties create multi-trillion-dollar fiscal spending packages? Because they want a king. Why are so many people enamored of autocrats who clearly are pursuing their own personal goals at the expense of general welfare? Because they want a king.

Of course, there will be consequences and of course, when those consequences become obvious, people will complain. For now, however, the path of least resistance seems to be to look (i.e., hope) for a quick and easy solution to difficult problems.

China

China’s young ‘lie flat’ instead of accepting stress ($)

https://www.ft.com/content/ea13fed5-5994-4b82-9001-980d1f1ecc48

“’Lying flat’, a trend among young Chinese to opt out of stressful jobs, represents the antithesis of a development model that has delivered extraordinary growth over four decades by enlisting the maximum effort from its people.”

“The stress that such lifestyles display to unmarried young people has an impact beyond inducing some of them to “lie flat”. Statistics show that couples are getting married later and the birth rate is falling precipitously. In 2020, only 12m babies were born, down from 14.65m a year earlier.”

This article is interesting for a couple of reasons. One is the exposure of some indications that “China’s social contract is fraying”. It seems the proposition for younger Chinese of working extremely hard for some indeterminate better situation is just not as compelling as it used to be. The implications are huge since social accord is a primary objective of China’s government. If the social contract continues to fray, China will lose the political legitimacy needed to reduce debt and instill more sustainable economic practices.

The article is also interesting for the way in which it mirrors social changes in the US and much of the western world. Older people look at younger people and think they overspend and refuse to work very hard. Younger people look at older people and think they have destroyed much of the earth and the climate and kept all the spoils for themselves. Both positions rely on different sets of assumptions about the current situation and future opportunities. For places that are so different in many ways, it is interesting on the point of intergenerational differences, they are quite alike.

Finance industry

Below are a few twitter excerpts from a guy who worked as a quant trader at Goldman Sachs for four years and has taken the time to reveal a number of the “non-glamorous things” one should know about working as a sell-side Quant. It turns out that many of these points are also useful for consumers and investors to know. The entire thread is at:

One point that becomes clear is the mercenary nature of much sell-side work. It is not about doing quality work, advancing science, increasing the efficiency of capital markets or anything that ostensibly serves a social purpose. It is about making money and that’s it. Quibbles about where that money ultimately comes from, what social problems it may cause, or what economic inefficiencies it may cause are left for others to explore.

While the mercenary element has always been around, I do believe it has gotten worse and I also believe public sentiment is turning strongly against it. This is making the career choices of extremely talented young workers even more difficult. You can make a lot of money for a company you don’t respect that you don’t see as doing anything particularly useful, you can make average money in a company that doesn’t have much purpose or vision, or you can take a flyer on a startup, hope things work out, and if they don’t – start over.

Technology

Twilio’s Second Act ($)

“Much of a developer’s life consists of being told to do the impossible by people who have no idea what they are talking about. Whether it is the Product Manager who can’t code or the CEO who thinks reading a16z’s content marketing makes him a technical leader; their idea may sound good but is usually unobtainable.”

While this piece is well worth the read for its insights about Twilio, the quoted excerpt reveals a great deal about the often-awkward relationship between technology and business. As a person who has done plenty of modeling work and evaluation of technology, I can absolutely attest to the vast chasm that spans between most people on the IT team and a company’s executive team. The poor understanding and communication between the two parties leads to a lot of waste and missed opportunity.

I also think this is one of the main reasons why many tech companies have performed so well over the last ten to fifteen years. Most of their leaders understand the tech. They grew up in it. Many of them developed it. As a result, they also intimately appreciate the tradeoffs involved as well as the strategic opportunities.In addition, because the power of many technologies increases so rapidly, tech leaders are generally much more familiar operating in an environment with major paradigm shifts as opposed to small incremental changes.

I don’t necessarily think tech leaders will take over the world of business, but I do think it is becoming increasingly important to have a deep, native understanding of tech in order to run a business competitively. That evolution can happen from both sides, but it has to happen.

Monetary policy

"Stunning Divergence": Latest Bank Data Reveals Something Is Terminally Broken In The US Financial System ($)

“So what does all of this mean? In a nutshell, with the Fed now tapering QE and deposit formation slowing, banks will have no choice but to issue loans to offset the lack of outside money injection by the Fed. In other words, while bank ‘deposits’ have already experienced the benefit of ‘future inflation’, and have manifested it in the stock market, it is now the turn of the matching asset to catch up. Which also means that while ‘deposit’ growth (i.e., parked reserves) in the future will slow to a trickle, banks will have no choice but to flood the country with $2.5 trillion in loans, or a third of the currently outstanding loans, just to catch up to the head start provided by the Fed!”

“It is this loan creation that will jump start inside money and the flow through to the economy, resulting in the long-overdue growth. It is also this loan creation that means banks will no longer speculate as prop traders with the excess liquidity but go back to their roots as lenders. Most importantly, once banks launch this wholesale lending effort, it is then and only then that the true pernicious inflation from what the Fed has done in the past 5 years will finally rear its ugly head.”

Although it does so in a way that is a bit rambling and hyperbolic, Zerohedge is absolutely right to highlight the incredible divergence between bank deposits and loans. One of the key signals I have flagged as an indicator of inflation is bank lending. So far, lending has continued to flatline. If quantitative easing (QE) is tapered, however, and banks increase lending in response, a much larger increment of money would make it into the economy and would create greater inflationary pressures. This is something to watch closely.

As Zerohedge also points out, however, the purchase of mortgage-backed securities also affects inflation by boosting home prices. Since housing is the single largest component of the consumer price index (CPI), this is a very relevant concern. Further, since this pressure can be induced by either the Fed or the banks, there is a good chance it will continue regardless of the fate of QE.

Gold

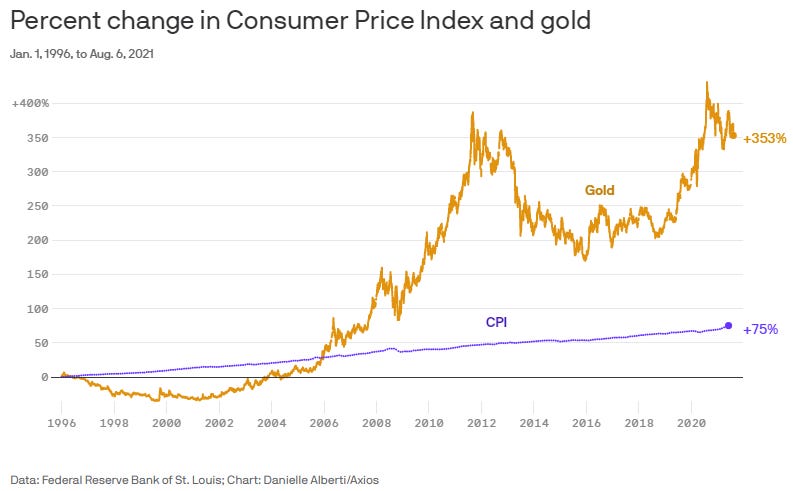

Gold fails as an inflation hedge

https://www.axios.com/gold-price-inflation-hedge-8cb1f4d7-fdfd-443e-94de-e6ecbf9b3307.html

“Gold is often sold as a hedge against inflation. It isn't.”

“The gold price isn't predictable, however. The foremost use case for the metal is simply sitting on it and doing nothing — or shilling it to viewers of right-wing television.”

Normally, I share quotes that not only shed some light on market conditions, but also provide a link to a source of information I find useful and think you might as well. This is the exception. While Axios generally does a nice job reporting on many different issues, this a particularly reprehensible piece of reporting.

First, the headline is entirely misleading. For the full period shown in the graph, gold has outperformed CPI by about five times over. Talk about an outstanding hedge for inflation! Rather than highlighting this incredible performance, which is most relevant to investors with longer time horizons, the author instead focuses on underperformance over the last year, which is almost completely irrelevant for long-term investors. This is a very clear case of missing the forest for the trees.

In addition, the comment that the gold price is not predictable is just inane. No market-determined price is predictable. Further, the author decided to wrap up the piece with some name-calling, just to ensure (I suppose) that the piece would not be mistaken for one with useful information content.

I’m not sure why gold causes so many people to do such stupid things, but it happens. You will see plenty more pieces like this. Ultimately, this is a good thing. Those pieces will sow doubt in some investors and cause others to turn away. All of that will allow some of us to acquire meaningful positions at attractive prices.

Analysis and decision making

Psychology of Intelligence Analysis by Richards J. Heuer, Jr.

https://www.cia.gov/static/9a5f1162fd0932c29bfed1c030edf4ae/Pyschology-of-Intelligence-Analysis.pdf

“What is required of analysts, in his [Heuer’s] view, is a commitment to challenge, refine, and challenge again their own working mental models, precisely because these steps are central to sound interpretation of complex and ambiguous issues.”

“Throughout the book, Heuer is critical of the orthodox prescription of ‘more and better information’ to remedy unsatisfactory analytic performance. He urges that greater attention be paid instead to more intensive exploitation of information already on hand, and that in so doing, analysts continuously challenge and revise their mental models.”

I came across this little gem from a reference in the book, Alpha Trader, I talked about in Observations earlier in the summer. Many analytical teams, whether in government intelligence operations or investment management firms, are assembled and managed with the same basic precepts: Get some smart people together, give them access to lots of information, and let them on their merry way. Heuer identifies the pitfalls with such an approach and also identifies useful ways to improve analytical performance.

Interestingly, most of the improvement potential comes with the mindset of the analysts, and not the information. In this sense, one can argue that individual investors are at least as well positioned as professionally analysts. Pro analysts have ego needs to look smart, political needs to impress bosses, and organizational needs to talk in succinct bullet points. Any of these can undermine the process of holding beliefs lightly and simultaneously considering multiple competing hypotheses. For as important as this stuff is, it is amazing how few investment organizations place any real emphasis on it.

Implications for investment strategy

I am closing in on the launch of Areté’s All-Terrain allocation strategy and sense that a lot of pieces are falling into place. I like the timing because I think it is going to start getting a lot harder to just ride the wave of stock performance. Just as investors are getting increasingly comfortable putting money into stocks, uncertainty is increasing to undermine the fundamental rationale for them.

At the same time, the capacity for bonds to offset poor stock performance is diminishing at such low yields. Further, as if that were not enough, the seeds of inflation have been planted. Once those seeds germinate and start growing, the investment environment will start looking very different.

When that happens, different investment approaches will be needed, as will different mindsets and different assumptions. One of those different assumptions regards how to best structure a portfolio - and this is a key premise behind the All-Terrain strategy. While the last forty years have been a wonderful time for 60/40 stock and bond portfolios, it has also left valuations at unsustainably high levels. As monetary and fiscal policy ramp up to deal with high levels of debt and flagging growth, the prospects for both deflation and inflation increase. Robust, truly diversified portfolios will need to encompass a much broader array of assets – and this will feel very uncomfortable for many investors.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates, I express my opinion as to which side I believe has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

One goal of this letter is to provide fairly dense information content – so you don’t waste your time filtering through a lot of fluffy verbiage. A consequence of that decision, however, is sometimes things may not be as understandable as they could be. If you have follow-up questions or comments, please use the comment utility, or send me an email at drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.