Areté's Observations 8/20/21

Areté (Pronounced ar-uh-tay) 1. Goodness or excellence of any kind. Fulfillment of purpose or function, the act of living up to one’s potential. 2. Effectiveness, knowledge.

Welcome back!

This past Sunday, August 15, was the 50th anniversary of one of the most important economic events in the last fifty years very few people think much about. President Nixon closed the gold window which halted the dollar’s convertibility into gold and made it a pure fiat currency. Several pieces in today’s edition will touch on that subject.

If you have any comments or questions, reach me at drobertson@areteam.com.

Market observations

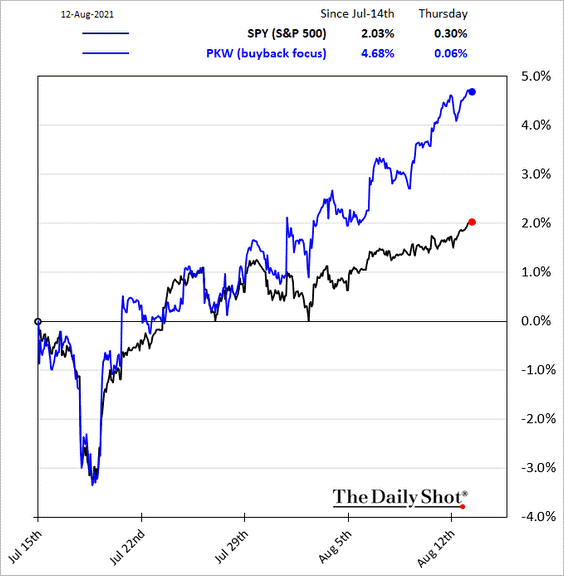

The market was extremely calm through the first half of August. Some of the most notable happenings have been throwback themes. One of the more notable has been the outperformance by companies that repurchase their own shares.

All that peace and serenity started changing this week, however. The most notable single observation was the explosion in volatility. The VIX volatility index finished last week just over 15 but popped over 24 later in the week. The S&P 500 continued to fight off the rise in volatility but did give up some ground. While increasing risks posed by the spread of the Delta variant top the list of potential causes, there are a lot of supporting characters. The bottom line is the market seems a lot more tenuous than it was just a few days ago.

Economy

Consumers are worried, markets are not ($)

https://www.ft.com/content/2153efa3-f2d3-403a-8b7f-6c84409ee750

“The Consumer Sentiment Index fell by 13.5% from July [to August], to a level that was just below the April 2020 low of 71.8. Over the past half century, the Sentiment Index has only recorded larger losses in six other surveys, all connected to sudden negative changes in the economy: the only larger declines in the Sentiment Index occurred during the economy’s shutdown in April 2020 (-19.4%) and at the depths of the Great Recession in October 2008 (-18.1%). The losses in early August were widespread across income, age, and education subgroups and observed across all regions.”

Wow! It looks like consumers are looking at completely different information than investors. While it is hard to place too much emphasis on one month’s data, let alone results of a sentiment survey, the dissonance between weakening sentiment and all-time highs in the market conjures images of Wile E Coyote overshooting the edge of the cliff.

Stock picking

Private Equity and Software are Competing to Eat the World ($)

https://diff.substack.com/p/private-equity-and-software-are-competing

“One of the greatest beneficiaries of the baby boomer retirement wave is a small company called RCI Hospitality. “RCI” is an abbreviation for “Rick’s Cabaret,” and “Cabaret” is a euphemism for strip club. Strip clubs are a profitable business, but most people don’t want to own one, which means the odds of someone a) owning one, and b) having a kid who wants to inherit it, are quite low. As a consequence, RCI can pay bottom-dollar to buy strip clubs, cut some costs, and turn a healthy profit.”

Strip clubs/RCI: surge raises ethical issues ($)

https://www.ft.com/content/fc3a8fbf-c6bc-4c3d-988e-6ed6be301b87

“An offshoot of the sex industry is responsible for one of the biggest turnrounds of the past year. Shares in blandly titled RCI Hospitality have jumped by more than 700 per cent since late March 2020. RCI is best known as the owner of strip club chain Rick’s Cabaret. Its sales are surging.”

“Investors goggling at potential returns should consider the widely held view that the industry is exploitative. The objectification of women is one concern. Pay has been another. In 2015, the company settled a $15m lawsuit with 2,000 Rick’s Cabaret dancers who claimed that they had been cheated out of earned wages.”

I couldn’t resist this example because it demonstrates so clearly some of the tradeoffs of investing. When I hear of a business that is consolidating, has fairly steady demand, few natural buyers, and opportunities to reduce overhead with scale, I get pretty interested. When I hear that business is strip clubs, I have to decide how bad it might be.

On the “pro” side, you have an interesting opportunity to grow and consolidate. In doing so, there is also an opportunity to increase the professionalism of the business and therefore mitigate the potential for legal risks. After all, whether it is alcohol, tobacco, gambling, or strip clubs, people are going to consume them; you might as well be the one to make money from it.

On the “con” side, there is no doubt strip clubs objectify women and many of them don’t exactly have prestigious human resource departments. Further, the mere presence of such businesses can lead to all kinds of other problems that society is left to deal with and pay for. Finally, the ready availability of capital actually encourages all of these things.

I’m not here to try to persuade one way or the other. Rather, I just want to highlight the types of tradeoffs that often arise in investment analysis. Those tradeoffs often become even more challenging when they feature a comparison of primarily quantitative information with primarily qualitative input.

Geopolitics

Rabobank: When The Penny Drops It Will Be You And Your Portfolio On That Kabul Tarmac | ZeroHedge

“Yet Bloomberg is right in that this geopolitical nightmare is almost certainly only just beginning. As noted here on Friday, if you don’t see this US policy debacle increases the risks of ‘red-line’ incidents in the Asia/Indo-Pacific, perhaps you should look for a desk job at the CIA.”

While there are plenty of political discussions that can be had about the botched withdrawal from Afghanistan, there are also important investment implications. One is obviously increased geopolitical risk. As tensions with China increase, food inflation is causing problems worldwide, and debt is impinging upon many countries, negative risk factors continue to accumulate.

Another lesson is the unsustainability of the dual mandate for the presence in Afghanistan. While the impetus for a presence there was national security, an important part of the ongoing narrative was nation building. Alas, most Afghans never wanted the kind of nation the US could help build, ergo the tumultuous presence there.

This leads to a final point. While it is hard to argue the withdrawal could not have been managed better, it was always going to be fraught. The point that some things can last a lot longer than you can imagine and then suddenly transpire a lot faster than you can imagine is also an excellent lesson for big market changes.

US dollar

Nixon broke with gold 50 years ago. What comes next? ($)

“Under the Bretton Woods Agreement, sealed at a hotel in Bretton Woods, New Hampshire, in 1944, the U.S. promised to convert into gold any dollars brought by other countries’ central banks at a rate of $35 per ounce. Other currencies traded at fixed exchange rates to the dollar. In effect, the entire Western financial system was pegged to gold, via the dollar.”

“No more, Nixon announced. Henceforward, the dollar would be worth whatever people thought it was worth. He meant this as a temporary measure. Gold was flowing out of the U.S. as the war’s defeated countries re-emerged as economic competitors. Other countries had to let the dollar drop a little. Closing the gold window for a while would show that Nixon was serious.”

The end of Bretton Woods after fifty years - by Chris Marsh - Money: Inside and Out\

https://moneyinsideout.exantedata.com/p/the-end-of-bretton-woods-after-fifty

“A look-back on reserve asset data from the time confirms that shortly after non-gold reserve assets in Europe and Japan—liquid claims on the US—exceeded the available US gold stock, the system was abandoned.”

If you want to get some perspective on the impact this event had, go to the website wtfhappenedin1971.com and scroll through various economic phenomena that fundamentally changed direction in 1971. Is it fair to blame all of these outcomes exclusively on the decision to end the dollar’s convertibility to gold? No. Is it easy to come up with a competing hypothesis to explain how so many fundamental trends clearly pivoted in 1971? Also no.

For example, take a look at productivity growth relative to compensation growth. From the end of World War II there was a very clear one-to-one relationship. When workers improved productivity, their pay increased by exactly the same amount. After 1971, productivity continued to improve at about the same rate, but virtually none of that improvement accrued to workers in the form of compensation.

There are a lot of different ways to characterize what happened in the aftermath of that decision, but I think the best is as the initiation of an era of financialization. Prior to the early 1970s, the country grew as the middle class grew – through work and population growth and productivity growth. After the early 1970s, growth became much more correlated with the appreciation of financial assets.

Inflation

Are We Ready for a World Without Merkel? ($)

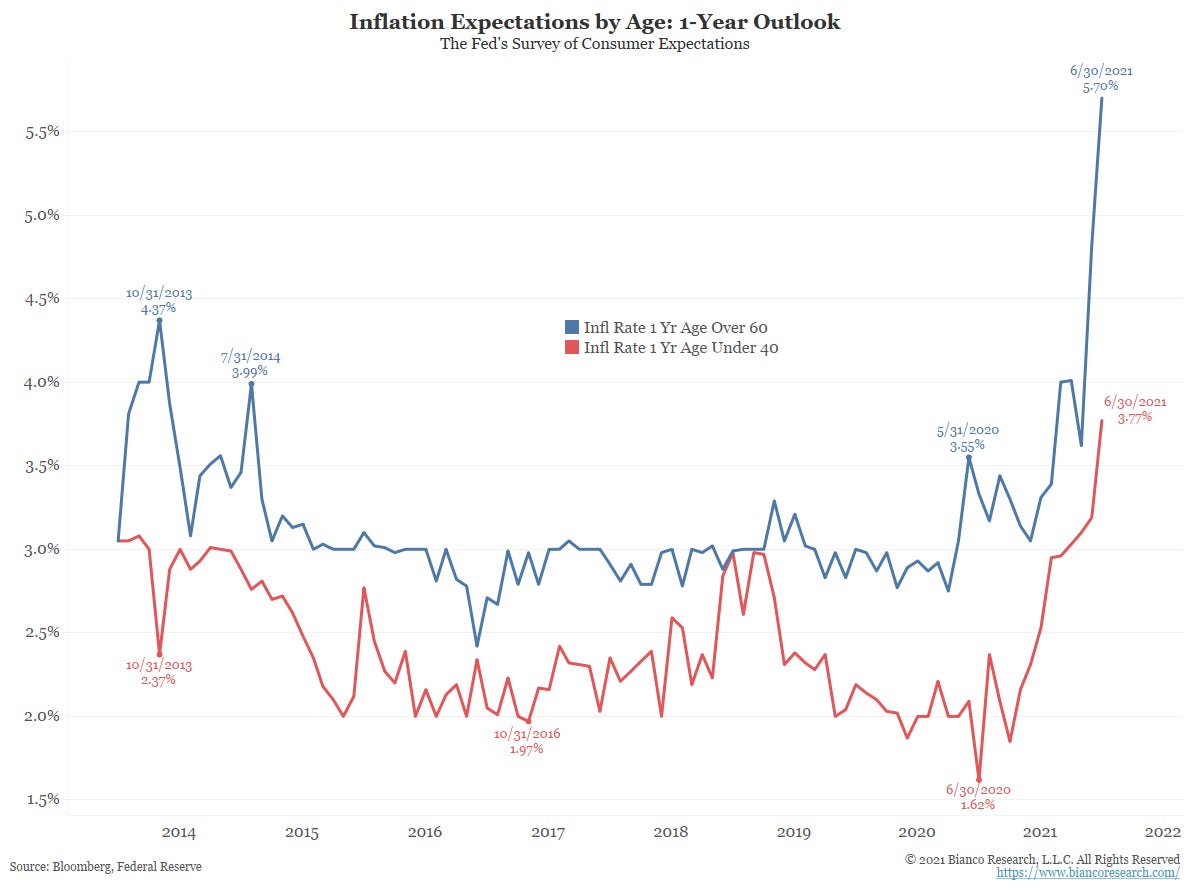

“And if there really is an increase in inflationary psychology afoot, it looks like something else that millennials can blame on boomers. Jim Bianco, of Bianco Research LLC and a Bloomberg Opinion colleague, offers charts from the New York Fed’s survey of consumer expectations of inflation. The Fed slices and dices the findings several ways, including by age of respondents. It turns out that over-60s have much higher inflation expectations than under-40s. The blue line shows that boomers are braced for inflation of 5.7% over the next year, two full percentage points more than the millennials:”

The significant difference in inflation expectations by age group raises a couple of important points. For example, it seems reasonable the real-life experience over-60s have had with inflation in the 1970s makes the potential for future inflation much more imaginable. As a result, under-40s may need to see inflation flare for some time in order to believe it.

Another point is expectations are a complex function of many different people with different backgrounds and different mental models of how the world works. Change starts at the margin and works out to more extreme cases. As a result, it takes time for the expectations of a large diverse group to change.

Gold

Exchange Stabilization Fund

https://www.newyorkfed.org/aboutthefed/fedpoint/fed14.html

“The Exchange Stabilization Fund (ESF) of the United States Treasury was created and originally financed by the Gold Reserve Act of 1934 to contribute to exchange rate stability and counter disorderly conditions in the foreign exchange market. The Act authorized the Secretary of the Treasury, to deal in gold, foreign exchange, securities, and instruments of credit, under the exclusive control of the Secretary of the Treasury subject to the approval of the President.”

Owning gold has often been a frustrating experience. It does nothing for years and years and years and then takes off. It goes down when you think it should go up. It is incredibly hard to time purchases with any effectiveness. It takes a certain type of person to be able to overlook these shortcomings and appreciate gold’s value in a broader portfolio.

While there are a lot of reasons for gold’s often mysterious short-term price behavior, some of those reasons are because the price is manipulated. Traders at big banks have often played a role in this manipulation, although that phenomenon is likely to dissipate as rule changes will vastly reduce the volume of gold derivatives.

The players that are left are governments, not least of which is the US Treasury. The quote above regarding the ESF indicates clearly the Treasury has the authority to “deal in gold”. Further, incidents such as the recent overnight bashing of gold described by Zerohedge strongly suggest a government organization is involved is such trading.

This inference completely reframes the meaning of the $100 drop in the price of gold. If the decline were due to market forces, it would be appropriate to worry that gold may be becoming less attractive in the near term. However, if the US Treasury is acting to depress the value of gold, that suggests it is trying to boost the perceived value of the dollar. If that is the case, it means the Treasury is worried about the value of the dollar declining. And … that is ultimately good for gold.

Monetary policy

G-30 Liquidity Panic: Standing REPOs and Centralized Clearing

“The new report published by the Group of Thirty last week contains a great deal of information about changes that are being put into place to address the growing liquidity problems in the market for US Treasury debt, changes we described earlier this year … The report then goes on to describe why this is happening, namely a dearth of capital supporting market-making activity in Treasury debt.”

“All this translated into English, the Fed is now going around the largest banks to provide liquidity to the markets directly. Since the banks have been neutered by Dodd-Frank and the Volcker Rule, the central bank is now going to push JPMorgan (NYSE:JPM) et al out of the way and disintermediate the large dealer banks entirely. As we’ve said before, the Anglo-American model of finance is being discarded by the Fed in favor of a government-centric, European model a la Frankfurt.”

The Financial Times also published a story on this topic which provides a good overview. In short, the outline of a package of policies to reform the market for US Treasuries is beginning to take shape. Among the proposals are a standing repo facility, which has already been implemented, and the establishment of “central clearing for all Treasury trading”.

The objectives of these policies are also taking shape. Regulators are concerned about market transparency, excessive leverage, and counterparty risk. As a result, they are moving to squeeze the bank-affiliated dealers out of their current roles in Treasury trading.

This is a giant experiment that bears close attention. The big banks bring a lot of political capital to the table which threatens to create snags for complete implementation. If most of the plan goes through, however, there is a prospect for a dramatically different trading and policy environment. Just imagine what would happen the next time there is a big selloff and there is no need for the Fed to pump in loads of liquidity to “preserve market functioning”. Bye-bye Powell put.

Landscape for investing

A new theory suggests that day-to-day trading has lasting effects on stockmarkets ($)

“Using statistical wizardry the authors isolate flows into stocks that appear unexplained (by, for example, gdp growth) over the period from 1993 to 2019. They find that markets respond in a manner contrary to that set out in the textbooks: they magnify, rather than dampen, the impact of flows. A dollar of inflows into equities increases the aggregate value of the market by $3-8. Markets are not ‘elastic’, as textbooks say they should be. Messrs Gabaix and Koijen therefore call their idea the ‘inelastic markets hypothesis’.”

Looking for Easy Games:How Passive Investing Shapes Active Management

“Active money managers need to seek easy games. These include competing against individuals, investors who buy and sell without regard for fundamental value, and investors who use simple decision rules. Wealth transfers are another potential source of excess returns.”

These two pieces provide a nice pairing that captures one of the most important trends in the market over the last several years. Flows of money into the market disproportionately affect values. Since passive investing has significantly increased share, passive flows have had a dominant effect on prices. An “easy game” for active investors is taking the other side of trades from investors who buy and sell without regard for fundamental value and who use simple decision rules, i.e., passive investors.

Therefore, this situation should mean easy pickings for active investors. That hasn’t happened, at least not yet. As such, you have to believe one of two things. Either the research on flows is wrong, or a big opportunity for active management is coming. I vote for the latter.

Implications for investment strategy

The decision by Nixon to break the dollar’s convertibility into gold was a historic event that altered the course of the economy for decades to come. This raises an important point: big events like this don’t come along often, but when they do, they can fundamentally alter the landscape. As a result, such events can also severely disrupt the process of wealth accumulation and reorder winners and losers.

Were there ways to see it coming? The answer is both “Yes” and “No”. “Yes” in the sense there were plenty of warning signs. Spending on the Vietnam War and on new social programs promised to create fiscal headwinds for years into the future. “No” in the sense there was no way to predict the timing. Serious concerns about fiscal imbalances dated back to the early 1960s. You would have been right to start worrying then but would have had to wait ten years for confirmation.

A couple of lessons can be learned and applied to the future. First, because the impact is so great, it pays to regularly monitor the potential for such events. Second, the reality on the ground is a much more continuous process than the event which causes widespread recognition. This creates a significant opportunity to follow the fundamentals as opposed to popular opinion.

I believe there are a number of useful analogies between the buildup to Nixon’s announcement 50 years ago and today. Just because nothing has happened yet doesn’t mean that it can’t or won’t. There needs to be a reconfiguration of the global currency system and when that happens, a lot of people and their portfolios will suddenly be focused on exactly the wrong things.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates, I express my opinion as to which side I believe has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

One goal of this letter is to provide fairly dense information content – so you don’t waste your time filtering through a lot of fluffy verbiage. A consequence of that decision, however, is sometimes things may not be as understandable as they could be. If you have follow-up questions or comments, please use the comment utility, or send me an email at drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.