Arete's Observations 8/28/20

Weekly observations of the most interesting happenings in the investment environment

Market observations

Points of Return email by John Authers, August 24, 2020

“AAPL, MSFT, and AMZN account for 10%, 10%, and 8% of the benchmark, respectively. Many managers face restrictions around diversification and position weights, making it challenging for them to hold the FAAMG stocks at their respective index weights.”

One of the key tenets of managing portfolios for other people is taking care to avoid undue risk. Risk management guidelines are laid out for retirement portfolios in the ERISA rules and managers typically apply specific constraints as a means to adhere to those guidelines. Those constraints often include rules that limit sector deviation from the benchmark and limit individual security weights, commonly to a threshold of less than 5%.

For as long as the big tech stocks continue handily outperforming the rest of the market, this creates a real headwind for actively managed funds subject to such risk management constraints.

Longer term, however, it raises some very interesting questions about the proposition of passive investing. By one account, an index fund for the S&P 500 provides market exposure at a low expense ratio. As a result, many investors and advisors view index funds as a low risk proposition.

By another account, that index fund is so extremely concentrated that it appears more like a vehicle for speculation than a well-diversified fund for long-term investment. This creates all kinds of potential for some investors to eventually be very surprised by what they own.

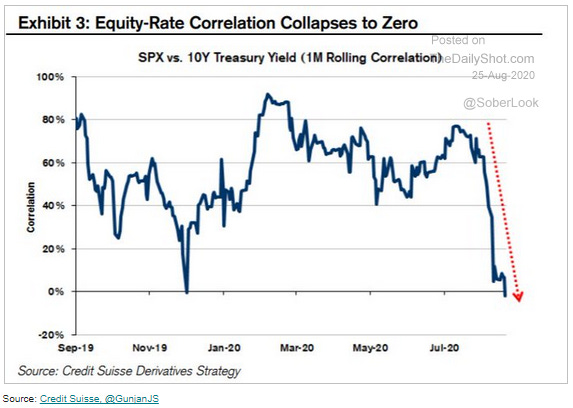

Just as excess concentration of stocks is one kind of diversification risk, another risk is the correlation between stocks and bonds. I have written about this before and it is a critical relationship to the value proposition of balanced portfolios.

Although the graph here illustrates short-term (one month) correlations, this a phenomenon to keep an eye on. If and when stock prices move with bond prices on a more sustainable basis, the hedge will be lost and many portfolio strategies will need to de-risk by selling stocks.

Economy

Pandemic triggers wave of billion-dollar US bankruptcies

https://www.ft.com/content/277dc354-a870-4160-9117-b5b0dece5360

“It pains me to say this, but bankruptcy is a growth industry in America.”

This graph from the FT illustrates clearly the ominous trend in bankruptcies. As bad as this looks, it represents the less affected part of the economy – companies big enough to have at least $1 bn in liabilities. Thus far, the curve does not appear to be flattening.

Labor

Thus far, it has been hard to get a solid read on the pandemic effect on labor. Although unemployment surged and remains high, unemployment benefits and other measures have offset the economic impact.

Now that many of those benefits have expired, the effects are becoming more visible. Spending from debit cards, through which UI benefits are often distributed, is down about 50% in the last two months. If this is even remotely representative of spending patterns of the population of unemployed people, it bodes very poorly for economic growth for the remainder of the year.

*These* Are The Real Huge Jobs Numbers, And They Will Make Your Blood Run Cold

https://alhambrapartners.com/2020/08/21/these-are-the-real-huge-jobs-numbers/

“this divergence between hours and headline payrolls had already suggested that companies may have been holding on to more workers than the decline in output would’ve demanded.”

“But then, for next year, in 2021 as 2020’s W-2’s come rolling in, the agency anticipates receiving 37 million fewer of them than what it had been thinking this time last year.”

This piece of research does a nice job of revealing some incremental insights about the job market. One is that there are indications that unemployment has been understated, not overstated. The numbers imply some companies “may have been holding on to more workers” than activity levels suggested.

Another insight suggests that unemployment may also be persistent. Although the estimate of 37 million fewer W-2’s probably overstates the number of workers affected (since some have more than one job), it nonetheless reveals the expectation of significantly lower employment levels for the remainder of the year.

This tweet by @lisaabramowicz highlights yet another risk on the employment front. While some jobs are coming back, it increasingly looks like a significant portion of what had been considered temporary furloughs will turn out to be permanent job losses. Based on the news from American Airlines this week, this trend is just getting started.

Business

Business on the Frontline

https://www.mauldineconomics.com/frontlinethoughts/business-on-the-frontline

“I think our business will survive largely because we had better information. The closure didn’t shock us, as it did many others. We were as ready as anyone could be. Most small businesses weren’t ready, are now badly damaged, and may never recover. Their workers will stay jobless while their lenders and landlords face certain losses.”

Patrick Watson’s comments in this piece really resonated with me. Since he also spends a good chunk of his time parsing through economic and financial and investment information (like I do), he also comes across information and draws inferences that can be extremely useful. An important part of the job is getting “better information”.

Interestingly, although such information has become less useful in regard to publicly traded stocks, it is still very relevant to small businesses which have stronger ties to economics and cash flows. Because Watson also runs a small business, he knows his knowledge of the investment environment has also helped that business.

One key point is that investment research is also valuable outside the realm of public securities. Another is that many small businesses often do not have access to that kind of research. A final point is that it is getting harder and harder to manage a small business solely on the optimism that things will work out. At least if you know what you are up against you have a fighting chance.

Politics

Martin Wolf: ‘Democracy will fail if we don’t think as citizens’ | Free to read

https://www.ft.com/content/36abf9a6-b838-4ca2-ba35-2836bd0b62e2

“In today’s world, citizenship needs to have three aspects: loyalty to democratic political and legal institutions and the values of open debate and mutual tolerance that underpin them; concern for the ability of all fellow citizens to lead a fulfilled life; and the wish to create an economy that allows the citizens and their institutions to flourish.”

Living in the world of acrimonious political rhetoric that we do, Martin Wolf’s comments struck me as very reasonable. Although the three aspects of citizenship he mentions can mean different things to different people, they are a good foundation for starting the discussion. His comments also highlight the role we all have as citizens to fulfill democratic principles. It is not just, or even primarily, the job of politicians.

The Recessionals: why coronavirus is another cruel setback for millennials | Free to read

https://www.ft.com/content/241f0fe4-08f8-4d42-a268-4f0a399a0063

“’It’s just kind of like . . . the millennial story,’ he says. ‘We keep working for this future that’s not really coming’.”

“Edward Glaeser, an economics professor at Harvard, says millennials in the US look at the free healthcare for seniors under Medicare and tax breaks on mortgages and see a form of ‘boomer socialism’ that excludes them.”

I find stories like this interesting partly because they highlight the very different economic realities for millennials relative to baby boomers. Based upon my readings and personal conversations, a lot of baby boomers have almost no appreciation for how different conditions are today from when they were the same age as today’s millennials (of course, some know all too well).

This fact is illustrated vividly in a graph from the FT article. Milliennials today comprise just 3% of total household wealth. Conversely, baby boomers at about the same age comprised 21% of household wealth. There is no getting around the fact that baby boomers enjoyed wealth and economic opportunity many times greater than that of millennials.

This leads to another reason why I find articles like this interesting. Superficially, policies like forgiving student loans seem ridiculous to me. However, when policies such as Medicare and tax breaks on mortgages are described as “boomer socialism”, I do get closer to understanding where those ideas come from. It certainly exposes programs such as Medicare and tax breaks on mortgages as also being ridiculous. Both disproportionately benefit a segment of the population at the expense of everyone else.

Credit

In the May 8th edition of Observations I shared my thoughts about how I envisioned the harm from lockdowns to migrate through the economy: “My guess is that things will be much harder for smaller private companies that do not have good of access to capital. I suspect there will be a wave of bankruptcies of small and mid sized businesses.”

Three months later in August now and there is good evidence to support my original hypothesis. John Authers reports in his Points of Return email from August 25, 2020:

“Companies dependent on banks for financing have a problem, because lending standards are tightening, as shown by the Federal Reserve's most recent survey of senior lending officers. Meanwhile, larger companies that can access capital markets are in a much easier position, because high-yield bond issuance is booming.”

Although I think this is hugely unfortunate and destructive to the country’s economy and to all of the small business owners struggling to get by, I also don’t see the trend changing any time soon. Creating a level playing field for small businesses would require a fundamentally different approach to public policy.

Technology

When The Magic Happens

https://www.collaborativefund.com/blog/when-the-magic-happens/

“Innovation is driven by incentives. And incentives come in many forms.”

“You cannot compare the incentives of Mountain View coders trying to get you to click on ads to Manhattan Project physicists trying to end a war that threatened the country’s existence.”

This article by Morgan Housel provides a useful perspective on innovation. The main point is that necessity often is the mother of invention. As he puts it, “the biggest innovations rarely occur when everyone’s happy and safe, or when the future looks bright”.

The bad news is things may need to get quite a bit worse before the proper incentives emerge. The good news is there is enormous potential to leverage technology for the good of society.

Commodities

Last week I mentioned part of the reason why commodities prices tend to run in long-term cycles is due to the cycle of investment. Those cycles are also mirrored by investments in education and training. When prices are high, there are lots of opportunities to invest in finding and producing new sources of supply. The graph at the right captures the pattern beautifully.

Inflation

On Inflation (& How It's Not What Happens Next)

https://www.zerohedge.com/markets/inflation-how-its-not-what-happens-next

“Dollars 'die' when debts are paid back.”

This is a short but very readable piece that highlights an important but under-appreciated phenomenon. While the vast majority of discussion has revolved around significant increases in money supply, very little mention has been made of the potential for “dollars to die”. Some of this is due to a lag effect; forbearance programs forestalled debt repayments. Regardless, the birth and death of dollars needs to be netted out to get an accurate trajectory of money supply.

Monitoring the Inflationary Effects of COVID-19

“Current data show that the recent drop in core PCE inflation is mainly attributable to large declines in consumer demand for goods and services stemming from COVID-19, which have more than offset any upward inflation pressures due to supply constraints in some sectors.”

This is just one report, but it offers some early and useful insight into inflation dynamics.

Investment advisory

The ergodicity problem in economics

https://www.nature.com/articles/s41567-019-0732-0

“The present situation is both dispiriting and uplifting. It is dispiriting because economics is firmly stuck in the wrong conceptual space. Because the core mistake is 350 years old, the corresponding mindset is now firmly institutionalized.”

“Perhaps the most significant change lies in the nature of the model human that arises from our conceptual reframing. Homo economicus has been criticized, perhaps most succinctly for being short-termist. Given that time is so poorly represented in mainstream economics, this should come as no surprise.”

Although ergodicity is not exactly a household word, it is an important concept and one that ends up being extremely important to many investment considerations. This especially comes into play in regard to growth. Growth happens over time periods that differ in regard to underlying circumstances. As a result, expectations for growth are fundamentally different than expectations for purely statistical phenomena like flipping a coin.

Peters analyzes this problem and traces it through the many ways in which time has been misrepresented in economic and investment theory.

Implications for investment strategy

I am always reluctant to be dramatic but I do believe that Peters’ work has the potential to drastically change the investment industry. Although his findings will affect large swaths of the industry, they are not completely revolutionary. There are plenty of smart, independent investors who have been operating in accordance with his insights.

The biggest changes will need to occur with consultants and advisors that have institutionalized the mistakes of economic theory into slick presentations and alluring sales pitches. Among other things, those mistakes have resulted in models that underemphasize downside risk. Because of this, financial markets can appear as machines that reliably produce attractive retirement income, if you just stick to the plan. This is a fairly easy way to sell advisory services. It’s also wrong.

The problem starts with a widely propagated misinterpretation of financial history. Returns and risk are presented as averages that can be realized so long as the investment horizon is long enough and one sticks to the plan.

In reality, the returns of risk assets vary considerably over time with the effect that returns over one’s investment horizon depend critically on the particular period of time invested. As Peters says, “Perhaps people aren't so different, but their circumstances are.”

I suspect this issue will be highlighted in the not-too-distant future. Returns since 1982 have been exceptional and stand out as historical anomalies. This unusually good performance has helped facilitate a fair amount of “willful blindness” in regard to the shortcomings of economic theory. If performance becomes less favorable, however, investors are bound to challenge the efficacy of their advisors’ models.

In short then, some of the best ways to incorporate Peters’ findings are to be very skeptical of models and to be leery of exposure to risk. There is a time for these things, but clearly the circumstances for investing are very different now than they were in 1982.

Feedback

This publication is an experiment intended to share some of the ideas I come across regularly that I think might be useful. As a result, I would really appreciate any comments about what works for you, what doesn’t work, and what you might like to see in the future. Please email comments to me at drobertson@areteam.com. Thanks! - Dave

Principles for Areté’s Observations

All of the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, Areté’s Takes are designed to show both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.