Arete's Observations 12/4/20

Market observations

There was no doubt, the month of November was a momentous one for stocks. This happened in spite of election uncertainty, the worsening of the pandemic, and already high valuations. My first thought to capture the extraordinary excesses was to list the multitude of signs of investor euphoria, but that didn’t seem like a strong enough statement. The following comments from the FT do a pretty good job of characterizing market conditions …

The ‘everything rally’: vaccines prompt wave of market exuberance

https://www.ft.com/content/d785632d-d9a0-45ae-ae57-7b98bb2fb8d6

“’Money is now so easy, why not borrow what you can and put it into stocks? That’s what our customers are doing, and they’re making helluva lot of money,’ he [Thomas Peterffy] says.”

“All told, the global economy is likely to shrink 4.4 per cent this year, according to the IMF — a decline not seen since the Great Depression.”

“’There is as much craziness now as there was in late 1999 or 1929,’ he [Jeremy Grantham] argues. ‘It is bewildering, impressive and for financial historians like me, exciting. This is the real thing . . . It looked like we were in a bubble mode this summer, but the real craziness has come out in the last few months’.”

The following comments by Jim Chanos, the well-respected short seller, also capture the extremes and adds some perspective …

TAMSanity and the Golden Age of Fraud (Realvision interview with Jim Chanos)

“Yes. What a quaint notion, talking about fundamentals and doing deep dives on companies. It is a quaint notion, and one day, it might come back into vogue but that does not seem to be the case these days.”

“What is even, however, crazier [than passive investors doing no research] is the fact that we have layered on to that now something that we had not seen for the first 10 years of this bull market, which we have now layered on starting in the fall of last year, with the advent of zero commissions, and the explosion in activity online in Robinhood and others, we have added to that interesting mix of the retail investor, who not only is doing no work, but is doing bad work and are just following trend, following things, speculating massively in options and really is in the market in a way in which they have not been since 1999, or 2000.”

One takeaway is rocketing stock prices say nothing about underlying fundamentals. Worse, they provide cover for a lot of fraudulent behavior. The combination promises quite a reckoning when the time comes.

Economy

Why it is misleading to blame financial imbalances on a saving glut

“An excess of saving, then, determines neither the geographical source nor the scale of cross-border financing. Nor is excess saving necessarily the right causal starting point.”

“But in this case, the increase in foreign saving and surpluses is a side-effect of a financial boom within America, not a cause of its overspending. The authors believe a credit, rather than a saving, glut is a more convincing explanation for the pre-2008 imbalances identified by Mr Bernanke …”

This article is more revealing than it appears. For one, it highlights an important but understated aspect of economic theory. Conventional theory incorporates savings and investment, but largely considers credit an externality. As the financial system has evolved over the years to one in which credit has become the primary driver of liquidity, conventional economic theory has become less useful to the point of often being counterproductive for prescribing public policy measures.

This begs the question of why economic theory, and its luminaries, still carry so much weight in policy formulation when they fail to accurately describe reality so regularly. Perhaps David Goodhart provides part of the answer in his book, Head, Hand, Heart.

Goodhart argues Western societies have reached peak “head” in the sense of the status that accrues to intellectual and educational achievement, especially relative to occupations and activities that involve manual labor (hand) or sympathy and compassion (heart). By this theory, high levels of academic achievement are accorded the highest levels of status.

I find it interesting that not so very long ago the phrase often accorded to a person of high academic achievement was “nutty professor”. This wasn’t meant so much as a disparagement as a recognition that people who spend most of their lives in academia often become at least somewhat detached from the reality that the rest of us live in. As such, they often have important deficiencies in navigating that world. Unfortunately, I think we’ll be re-discovering this reality sooner rather than later.

Public policy

Wall Street wonders how bad it has to get

"’What I can't figure out is what is going to need to happen to kind of light a fire under Congress to actually compromise and get something done,’ says Liz Ann Sonders, chief investment strategist at Charles Schwab’.”

This is the new biggest parlor game for investors. Since the overwhelming combination of fiscal and monetary policy measures were unleashed beginning in March, the market’s expectation is for more. The only questions are when, and how much? The only problem is, no such policies are imminent: “There’s nearly no hope of additional support before year-end, and the current safety nets are set to expire.”

This has all the makings of a showdown that will allow things to get pretty bad in order to finally garner broad enough legislative support for more relief. While this is not the only possible scenario, it is probably the most likely one at this point and also one that is absolutely not being discounted by current market prices. One thing is very clear if not too surprising: People like receiving assistance from the government and are getting used to receiving it.

Coronavirus

The kids aren’t alright: How Generation Covid is losing out

https://www.ft.com/content/0dec0291-2f72-4ce9-bd9f-ae2356bd869e

“’We are not in this together, millennials have to take the brunt of the sacrifice in the situation,’ said Polina R, 30, from Montreal, Canada. ‘If you won’t watch out that we don’t end up jobless and poorer, why should we protect you’?”

“Many respondents said they were losing faith in their leaders and felt that the pandemic had been poorly handled — with the exception of some Europeans and respondents from parts of Asia.”

While these comments are anecdotal, they also capture the same sentiments and themes I have seen corroborated frequently elsewhere: Younger people are disenchanted with leadership at many levels and are calling “BS”. Moreover, they feel, with good cause, that their interests are not given fair consideration. Thus far, such alienation has been kept fairly quiet. It is not hard to imagine how it might manifest in more noticeable ways, however.

Social trends/politics

The Rotting of the Republican Mind

https://www.nytimes.com/2020/11/26/opinion/republican-disinformation.html

“In a recent Monmouth University survey, 77 percent of Trump backers said Joe Biden had won the presidential election because of fraud. Many of these same people think climate change is not real. Many of these same people believe they don’t need to listen to scientific experts on how to prevent the spread of the coronavirus. We live in a country in epistemological crisis, in which much of the Republican Party has become detached from reality.”

“In the fervor of this enmity, millions of people have come to detest those who populate the epistemic regime, who are so distant, who appear to have it so easy, who have such different values, who can be so condescending. Millions not only distrust everything the “fake news” people say, but also the so-called rules they use to say them. People in this precarious state are going to demand stories that will both explain their distrust back to them and also enclose them within a safe community of believers.”

Ever since Trump was elected in 2016, I have been fascinated (if also depressed) by the political reality that people on opposite sides of the political spectrum occupy different worlds. While I have certainly been able to grasp how different life situations can lead to very different perspectives of the world, I have struggled to understand the mass rejection of reasoning and science and authoritative facts.

David Brooks has gone a long way in reconciling those differences for me. His explanation, which is the best one I have encountered thus far, is that “Distrust and precarity, caused by economic, cultural and spiritual threat, are the source [of paranoia]”. That paranoia is the impetus behind the wholesale rejection of the “epistemic regime” in which college grads swim so freely, and also the impetus for what replaces it …

The Prophecies of Q

https://www.theatlantic.com/magazine/archive/2020/06/qanon-nothing-can-stop-what-is-coming/610567/

“QAnon is emblematic of modern America’s susceptibility to conspiracy theories, and its enthusiasm for them. But it is also already much more than a loose collection of conspiracy-minded chat-room inhabitants. It is a movement united in mass rejection of reason, objectivity, and other Enlightenment values. And we are likely closer to the beginning of its story than the end. The group harnesses paranoia to fervent hope and a deep sense of belonging. The way it breathes life into an ancient preoccupation with end-times is also radically new. To look at QAnon is to see not just a conspiracy theory but the birth of a new religion.”

“the historian Norman Cohn examined the emergence of apocalyptic thinking over many centuries. He found one common condition: This way of thinking consistently emerged in regions where rapid social and economic change was taking place—and at periods of time when displays of spectacular wealth were highly visible but unavailable to most people.”

This article by Adrienne LaFrance on QAnon provides further insights. As she describes, the essence of QAnon is a new religion. It provides hope and a sense of belonging for many people who do not find them elsewhere. In doing so, however, it also reduces complex phenomena into black and white, good vs. evil characterizations. It also involves “rejecting mainstream institutions, ignoring government officials, battling apostates, and despising the press”.

My first reaction was to feel edified by these insights that go a long way in explaining behavior that I have found largely incomprehensible. My next reaction was to slowly start to appreciate the scale of the public policy challenge of serving an important part of the population that actively rejects the epistemic regime that has been responsible for the advance of human beings through history. Finally, QAnon used to be an item of vague interest; now it is firmly on the radar.

China

Chinese companies waiting twice as long for payments as in 2015

https://www.ft.com/content/0b831a12-6101-4420-8629-8d73f1dded91

“Official data show it took an average of 54 days for Chinese private manufacturers to get paid in the first three quarters of this year. That is up from 45 days in 2019 and 27 days five years ago.”

“’The receivable problem is across the board,’ said Wang Dan, a Shanghai-based economist at Hang Seng Bank China. ‘It suggests the economy is not in a normal shape.’ She added that the receivable problem ‘suggests the economic recovery remains weak’.”

One of the classic warning signs of impending financial difficulty is increasing accounts receivable. Whether vendors explicitly need to finance their customers in order to close sales or customers simply do not pay on time, those payments are a critical (and visible) part of the business. This is exactly what is happening across China right now and runs in direct contrast to the narrative of an economy that has returned to normal.

String of defaults tests safety net for Chinese bonds

https://www.ft.com/content/e842dceb-d97c-42f7-bc3a-347c864d6e46

“’People don’t de-risk because they think they can wait for governments to step in before they have to sell assets,’ said Logan Wright, an analyst at research firm Rhodium Group. ‘But now there’s going to be greater government tolerance for pain’.”

“Chinese officials ‘recognise there’s no lending discipline in the market’, said Michael Pettis, a finance professor at Peking University. ‘Right now is probably not the time to test what would happen if there were real, serious defaults and losses taken. But eventually they have to do it’.”

The recent default of a state-owned company in China marked the end of the long-standing practice of supporting such companies. With it, a new era of credit evaluation has commenced. No longer can investors treat state ownership as a guarantee.

This also paves the way for a period of greater recognition of bad debts and enhanced regulatory scrutiny. Being this is China, however, it is unlikely this will devolve into a chaotic crash in credit. Rather, the new approach can be expected to serve the state first – which means the changes will most likely come intentionally and at a measured pace. Nonetheless, changes there will be and with them incremental constraints on credit.

Emerging Markets

Solid Rock, Almost Daily Grant’s, November 24, 2020

https://www.grantspub.com/resources/commentary.cfm

“Peru launched a $4 billion, three-part sovereign debt offering yesterday, including $1 billion worth of 101-year bonds at 3.23%, José Olivares, director-general of the Public Treasury of Peru´s Economy ministry, told Reuters. That marks the lowest yield on an emerging market century bond yet.”

I am saving this article for my virtual scrapbook as a memento of the unusual times we live in. For starters, the words “century bond” and “emerging market” should never be used in the same sentence. For another, the beneficiary of this deal, Peru, is the same country whose government was overthrown five times between 1930 and 1992 and more recently cycled through three presidents in a period of two weeks. As for investors, caveat emptor and buena suerte!

ESG

Europe leads the way in the ‘greening’ of steel output

https://www.ft.com/content/b07c8a83-4b0c-4f96-8ff0-789c51b6e46b

“Every tonne of steel produced results in an average of 1.85 tonnes of CO2, making the sector responsible for between 7 to 9 per cent of all direct fossil fuel emissions.”

I have conflicting thoughts on ESG. On one hand, I think it is a great idea and ultimately an aspect of doing investment the right way. On the other, I think many manifestations of ESG have a lot more to do with telling narratives to raise money than they do with any kind of virtuous pursuit.

As a result, I find stories like this interesting because they highlight some of the more challenging aspects of ESG. Making steel is an inherently dirty process. It is also a necessary process if we are to maintain anything close to our current standard of living. As a result, there is a great deal of potential for improvement in the effort to reduce emissions in steelmaking. Simply favoring businesses that are inherently cleaner is an exercise in avoidance: it does not improve anything.

Commodities

INVESTING IN THE UN-INVESTABLE, THIRD QUARTER 2020, Goehring & Rozencwajg

http://gorozen.com/research/commentaries/3Q2020_Introduction

“In 2Q 2020, amid rapidly slowing drilling activity, a significant historical development occurred in the US shale patch. In previous drilling cycles, sharp slowdowns in activity produced large offsetting increases in drilling productivity. Drilling productivity normally rises as activity falls because of a phenomenon known as “high-grading.” In a period of low commodity prices, operators stop drilling their least productive prospects first. The remaining activity is focused almost exclusively on the areas with the highest average well productivity.”

“Consensus opinion believes that much of these productivity increases occurred because of changes in completion techniques —longer laterals, more frac stages, and more proppants. However, our research tells us the boost in drilling productivity has been the result of old-fashioned high grading.”

This commentary, highlighted in the November 27 issue of Grant’s Interest Rate Observer, is a 33-page tour de force of research on natural resources. Of the many gems in the report is an alternative explanation for productivity in the US shale patch. In short, it has less to do with the popular narrative of technology and more to do with the common practice of high grading. This is an excellent example of how deep research can produce non-consensus views that can be extremely valuable.

Gold

Gold has noticeably been underperforming stocks and its alter egos of cryptocurrencies. Part of the reason is a normalization of the gold/oil relationship which had reached highs. Part of the reason is probably a subset of investors favor the dynamics of cryptocurrencies over those of gold. A somewhat scary interpretation is that for the short-term at least, the underperformance reflects expectations of higher real rates due to lower inflation and lower economic growth.

For long-term investors, the thesis has not changed. Gold represents an excellent hedge against inflation and financial system volatility. As such, lower prices make more attractive entry points.

Implications for investment strategy

Being a patient long-term investor presents plenty of challenges in the best of times but can be especially challenging during times of rampant speculation. Even when one is resolute about the strategic decision to avoid participating in speculation, temptation can peck away.

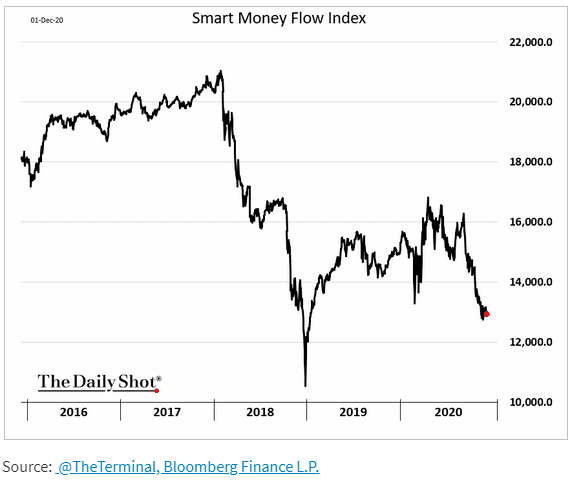

In order to keep things in perspective, it helps to remember periods of speculation, just like periods of excess risk aversion, run in cycles. Although valuations and other metrics help establish guidelines, those tools can lose their sway in the heat of the moment. The key is to understand who is on the other side of a transaction and why. For what it’s worth, it looks like “smart money” is sitting out this rally.

Principles for Areté’s Observations

All the research I reference is curated in the sense that it comes from what I consider to be reliable sources and to provide meaningful contributions to understanding what is going on. The goal here is to figure things out, not to advocate.

One objective is to simply share some of the interesting tidbits of information that I come across every day from reading and doing research. Many of these do not make big headlines individually, but often shed light on something important.

One of the big problems with investing is that most investment theses are one-sided. This creates a number of problems for investors trying to make good decisions. Whenever there are multiple sides to an issue, I try to present each side with its pros and cons.

Because most investment theses tend to be one-sided, it can be very difficult to determine which is the better argument. Each may be plausible, and even entirely correct, but still have a fatal flaw or miss a higher point. For important debates that have more than one side, I try to represent both sides of an argument and to express my opinion as to which side has the stronger case, and why.

With the high volume of investment-related information available, the bigger issue today is not acquiring information, but being able to make sense of all of it and keep it in perspective. As a result, I describe news stories in the context of bodies of financial knowledge, my studies of financial history, and over thirty years of investment experience.

Note on references

The links provided above refer to several sources that are free but also refer to sources that are behind paywalls. All of these are designed to help you corroborate and investigate on your own. For the paywall sites, it is fair to assume that I subscribe because I derive a great deal of value from the subscription.

Comments

Please direct comments or feedback to drobertson@areteam.com.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.