Obervations by David Robertson, 1/21/22

It was another wild week as volatility kept investors on their toes. With Treasury yields continuing to press higher and stocks falling lower, the new national pastime is handicapping the Fed’s reaction. Let me know if you have questions or comments along the way at drobertson@areteam.com.

Market observations

One of the most prominent trends over the last several weeks has been the outperformance of value relative to growth. The increase in interest rates is an important part of this as are hopes of improving economic growth. Another part of this, however, is a simple rotation to sectors that have vastly underperformed for years.

A very similar dynamic is also happening with emerging market stocks and especially so in China. The big question is, does this represent a meaningful transition for long-term investors or is it merely a short-term trading opportunity?

Companies

While I have certainly mentioned valuations plenty of times in regard to stocks over the last several years, I have also tried to be judicious in such mentions. I have wanted investors to be aware of the risks with stocks but I also know that a message delivered too frequently gets ignored and that doesn’t do anyone any good either.

Now is an appropriate time to refresh those warnings, however. Part of the reason is valuations are still shockingly high. Grant’s Interest Rate Observer (December 21, 2021 edition) points out, “At presstime, 83 constituents of the S&P 500 trade at a ratio of enterprise value to revenue of more than ten times.”

As a result, the returns to stocks in general are likely to be terrible. The valuation measure conceived of by John Hussman that most closely correlates with future returns suggests returns of about -6% per year for the next ten years. This is the risk.

At the same time, companies are increasingly contending with obstacles such as raw material inflation, labor cost inflation, increasing regulation, and geopolitical risks. Further, monetary policy is changing from providing loads of liquidity to actually withdrawing liquidity. The punchline is this is an excellent time to be paying attention to risk.

Commercial real estate

In August of 2020 the outlines of the future of commercial real estate were taking shape. I wrote in Observations:

“When the pandemic first started taking hold, it was reasonable to believe that it could be managed in a way that involved severe but short-lived constraints on activity. For a number of different reasons, this did not work and therefore transformed what could have been an acute challenge into a chronic one. This means different policies will now be required and expectations for a return to normalcy will also need to adjust.”

Now, with the benefit of additional experience, it is quite clear the global real estate challenge has indeed morphed into a chronic one. As the graph below indicates, occupancy rates worldwide are at structurally lower levels.

John Dizard’s comments back in the summer of 2020 remain on point, if a bit early: “Commercial real estate will have to be entirely restructured in the US. More equity and less . . . hope. Starting next year.”

Technology

Trove of doctors’ data sets could help AI predict medical conditions earlier ($)

https://www.ft.com/content/af763300-9fc6-4863-b5bf-c3e670301c09

“Ziad Obermeyer, a physician and machine learning scientist at the University of California, Berkeley, launched Nightingale Open Science last month — a trove of unique medical data sets, each curated around an unsolved medical mystery that artificial intelligence could help to solve.”

“What sets this apart from anything available online is the data sets are labelled with the ‘ground truth’, which means with what really happened to a patient and not just a doctor’s opinion.” This means that data sets on cardiac arrest ECGs, for example, have not been labelled depending on whether a cardiologist detected something suspicious, but with whether that patient eventually had a heart attack.

The trend of artificial intelligence seems to be taking a turn. For years companies have bandied about terms like “AI”, “big data”, and “machine learning” often with little understanding of what the phrases meant and even less understanding of how to deploy them to improve business. Several big AI failures have now socialized the reality that AI is hard.

Failures can be mostly counted in two different camps. One is trying to do too much. AI can do a lot of things but is still mostly relegated to “cool tricks”. It can be extremely helpful to assist human decision making but is not ready to fully replace it. The other general failure is that of data. Many systems are trained on data that often has a lot of biases and often has little information content.

That is changing. Increasingly the emphasis is changing from enormous piles of data to more selective batches of useful data. This change has a number of important implications for businesses and investors alike. One is the initial “hype” phase is over which means expectations for economically justifiable deployments will increase. Another is the importance of good data is paramount. Relatedly, AI and machine learning projects are not simple plug and play but require strategic integration to be successful.

Energy

Commodities' King Sees "Structural Supply-Side Commodity Inflation" Sending Oil To $200

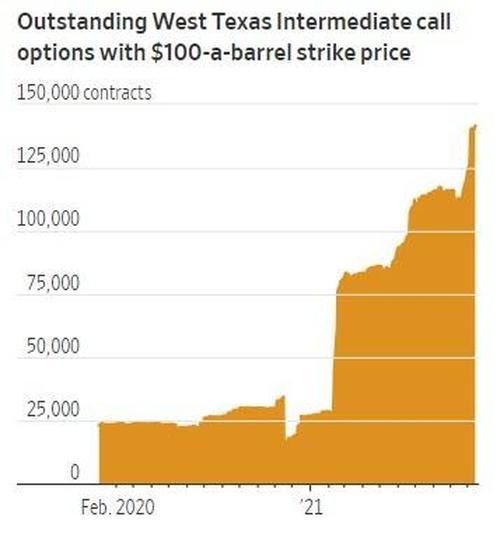

“I haven’t seen crazy strikes like this in a long time,” said Mark Benigno, co-director of energy trading at StoneX Group Inc., referring to the price in the underlying asset at which the options become exercisable.

The case for oil is proving to be a classic example of “yes, but”. The long-term structural case is there which I have mentioned several times in the past. New supplies of oil take time and money to find and develop and there just hasn’t been enough of it to keep up with growing demand.

Yes, but … there is also a case that it is still too early to fully commit to oil. Fiscal support for growth is declining at the same time the Fed is withdrawing monetary support. The combination is a serious threat to commodities like oil. Further, higher fuel and energy prices are likely to take a big cut out of household budgets as they always do.

Nonetheless, speculators eye an opportunity to profit from a short-term move. One of the tells is the huge increase in out-of-the-money call options. This suggests a lot of people are taking a gamble on oil prices.

This isn’t inherently good or bad, but it does provide useful context for understanding oil prices. Namely, the recent run is significantly a function of frenetic option activity rather than an indication of long-term fundamental improvement. While it is certainly possible speculators are right about oil, it would be a lot easier to believe if easy financial conditions didn’t make it so cheap to place bets. This foray seems a little desperate.

China

China's Property Sector Is Crashing Again And This Time It Has Reached The Country's Biggest Developer

“According to Bloomberg, while Country Garden is not facing imminent repayment pressure - it has US$1.1 billion of dollar bonds due this year and had 186 billion yuan (S$39.5 billion) of available cash as of June last year - risks may emerge if it is seen to have limited access to funding. Any sign of doubt in the firm's capacity to weather liquidity stress risks may prompt a widespread repricing of other higher-quality developers. With more than 3,000 housing projects located in almost every province in China, Country Garden's financial health has immense economic and social consequences, far greater than Evergrande.”

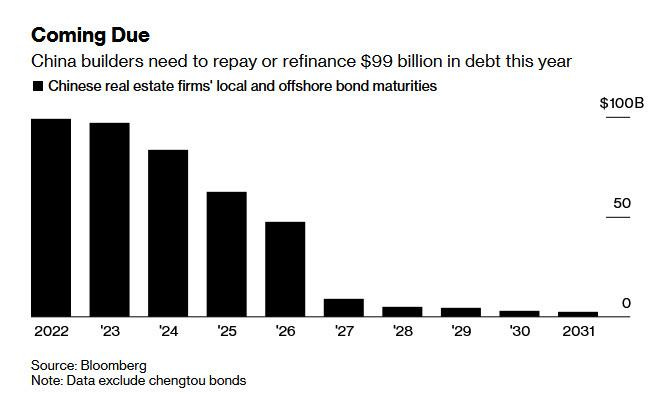

While there still seems to be a great deal of bullish bias towards China, its real estate restructuring is longer-term process. This is becoming clearer as problems revealed by Evergrande last fall continue rippling through the industry. One ripple is reduced access to funding, a problem which got reflected in the selloff of Country Garden’s bonds. Another ripple is heightened concern over hidden debts.

There will be more. The graph below shows the industry’s debt problems are both large and imminent.

What we know about Evergrande’s ‘black-box’ restructuring ($)

https://www.ft.com/content/df906d88-26e9-4dcf-9cf2-820edace202a

“It feels like a slow-motion car crash that, because it’s so high profile for the government, may never actually fully crash,” said one investor who has been following the situation closely. “The ongoing issue with this entity is the black-box nature of it.”

“It’s not clear that there is a holistic centralised legal framework for what’s happening in Evergrande, it’s all ad hoc fiat,” said an industry veteran.

Traders continue to find silver linings in any mildly positive development as characterized by the frenzy over China’s rate reduction earlier in the week. Nonetheless, the bigger picture is one of managed decline. One investor described the situation as an “orchestrated, slow-burn collapse” while another one estimated the process “could take five years”. Anyone placing bets on short-term recovery is doing so amidst little official communication, a great deal of uncertainty, and headwinds for years to come.

Monetary policy

Return-Free Risk

https://www.hussmanfunds.com/comment/mc220114/

“The chart below shows how deranged Federal Reserve policy has become. I use that word advisedly: de-ranged as in wildly outside of historical bounds, and also deranged as in intellectually unsound. The most important issue facing the Fed here isn’t how quickly to taper its asset purchases, or when the next rate hike should occur. The real problem for the Fed is that it has completely abandoned any semblance to a systematic policy framework, in apparent preference for a purely discretionary one.”

“The current level of the monetary base relative to GDP is utterly at odds with Section 2A of the Federal Reserve Act, which instructs the Fed to ‘maintain long-run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production.’ The ratio of base money to GDP never exceeded 16% before 2008. The nearest alternative to holding zero-interest base money is to hold a Treasury bill, and 16% of GDP in zero interest base money is already sufficient to drive T-bill rates to zero. Until the Federal Reserve contracts its balance sheet by half, the only way the Fed can raise short term interest rates above zero is by explicitly paying interest to banks on their excess reserves (IOER).”

I like Hussman’s intentional use of the word “deranged” in describing the Fed’s activist monetary policy because it is so appropriately descriptive. Not only has policy been “wildly outside of historical bounds” but it has also been “intellectually unsound”. As stocks were going up, it was easy to either ignore such characterizations or to dismiss them as epithets. That doesn’t change the reality, however. With inflation unacceptably high and asset bubbles all over the place, investors are going to get some up close and personal experience with the consequences of deranged monetary policy.

One place to start is with the Fed’s inflationary toolkit. Once upon a time, the Fed used the Fed funds rate to tweak policy one way or another. That only works when actual reserves are very close to required reserves, however. With trillions in excess now, raising the Federal funds rate will have a negligible effect on financing activity. In short, it is going to be extremely difficult for the Fed to extricate itself from its own excesses.

Collision Course: Monetary Tightening Meets an Easy Money Bubble

https://www.hussmanfunds.com/research/rs211211/

“The biggest risk to the financial markets and also to the recovery in labor markets is probably what Chairman Powell once described as exceptions to the Brainard Principle. In this case, he wasn’t referring to soon-to-be vice chair Lael Brainard. He was instead commenting on the work of Yale economist Bill Brainard, who once suggested that the more uncertain a policy maker is about the impact of a change in policy, then the more incrementally they should move.”

“Two particularly important cases in which doing too little comes with higher costs than doing too much. The first case is when attempting to avoid severely adverse events such as a financial crisis or an extended period with interest rates at the effective lower bound. In such situations, the famous words ‘We will do whatever it takes’ will likely be more effective than ‘We will take cautious steps toward doing whatever it takes.’ The second case is when inflation expectations threaten to become unanchored. If expectations were to begin to drift, the reality or expectation of a weak initial response could exacerbate the problem. I am confident that the FOMC would resolutely ‘do whatever it takes’ should inflation expectations drift materially up or down or should crisis again threaten.”

This piece by Bill Hester is an excellent general overview of inflationary conditions and the implications for monetary policy. One of the points he makes that deserves special attention are the caveats to incrementalism. For a long time now, investors have become habituated to 25 basis point moves by the Fed. The only things to estimate are probability and timing.

There are cases, however, when the cost of incrementalism is too high and the situation demands more aggressive action. One of those is when “inflation expectations threaten to become unanchored”. In this case, quelling inflation concerns is like overcoming static friction; it takes a burst to get things moving.

This is useful to keep in mind in an environment in which everyone seems to have a psychological profile on each Fed governor and in which the pattern of baby steps seems to be carved in stone. Is it possible the Fed wants to talk tough in hopes it won’t actually have to act tough? Absolutely. But it is also possible that at some point the Fed will act tough because it believes it has no other option. This possibility seems underappreciated.

Investment landscape

https://fedguy.com/the-qt-timebomb/

“The mechanics behind the 2019 repo spike suggest that another spike in rates will eventually occur. Last time banks deployed their enormous QE cash balances into repo, but this time around they are pouring it into Treasury and Agency MBS securities to the tune of $1.5t. An aggressive QT will both rapidly increase the supply of duration to the market while at the same time rapidly reduce the cash balances of banks, a key marginal buyer. The combination of a positive supply shock and negative demand shock can eventually again lead to violent dislocations.”

Fed Will Administer Volckera to Cure Inflation Pandemic, and We’ll All Die ($), Liquidity Trader by Lee Adler

“If there were only one thing you need to know, this is it. Treasury supply is surging. Fed purchases are declining. That translates to less demand against at least a stable flow of heavy supply. If you are a follower of the Law—the Law of Supply (and Demand), then this is unequivocally bearish.”

“Therefore, right now is as good as it gets for the bond market, and secondarily for stocks … February will be worse. A lot worse.”

For all the commentary about the Fed and its monetary policy, two absolutely crucial factors are often omitted or understated. The first is the political importance of inflation in Fed decision making which I have talked about before. The Fed no longer has the luxury of making easy decisions; it will have to start making difficult tradeoffs between inflation and markets (with markets often being a proxy for economic growth).

The second factor is the supply and demand for Treasuries. As Lee Adler rightly points out, supply is surging and demand, in the form of Fed purchases, is declining. It doesn’t take a PhD in economics to appreciate the potential for bond prices to decline and yields to go up. This is already happening.

Implications for investment strategy

The single biggest implication of rising long-term rates is that it creates a headwind for both stocks and bonds. As a result, it fundamentally shakes up the rationale for “balanced” portfolios since the two assets no longer “balance” one another.

Another implication is this most recent program of QE is likely to have different after-effects than the last one. As Joseph Wang describes above, in the prior round of QE, banks put their enormous cash balances primarily into repos. When that got reversed, the repo market blew up. This time banks have put their enormous cash balances into Treasuries and mortgage-backed securities (MBS). As a result, when QE starts getting reversed later this year, the problems will most likely emerge with Treasuries and MBS.

This will have a much greater and more noticeable impact on investors. While repos are esoteric financial instruments embedded in the financial system “plumbing”, Treasuries and mortgages are front and center for investors. Negative returns on “safe” bond portfolios will surely get attention. Similarly, higher rates and a less liquid MBS market are likely to be a one-two punch to the housing market that was on fire last year.

There are also less direct implications for investors. Hussman’s chart shows the Fed’s balance sheet would need to be cut by half for rates to be able to rise materially above zero. Combined with comments by Wang, it is clear to see rate hikes alone aren’t going to do squat to temper financial conditions.

That said, as Wang also points out in his tweet, there is precious little room for the Fed to quickly or substantially reduce its balance sheet; it would simply be too disruptive. Further, the notion that the Fed “doesn’t know what they are doing” introduces another troubling scenario.

What if long rates have remained relatively low in the context of rising inflation because investors trust the Fed will do what it takes to keep inflation in check? What if investors are proven wrong? What if the Fed either cannot or will not be able to keep inflation in check in an abundantly visible way? If investors lose confidence in the Fed, scenarios for inflation will be much higher and financial assets will be much lower.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.