Observations by David Robertson, 10/8/21

The roller coaster ride continued into this week. Even with a temporary respite from the debt ceiling pyrotechnics, there is plenty to keep investors on their toes.

Let me know if you have comments. You can reach me at drobertson@areteam.com.

Market observations

Monday was a big down day with the S&P 500 down 1.3%. Tuesday was a big up day with the S&P 500 up over 1.5% at one point but fading to up just over 1% by the close. Wednesday, futures were down about 1% at the open and the market was weak until later in the session when rumors emerged that McConnell might allow a temporary extension to the debt-limit. On that news, stocks rocketed to a positive close. Thursday started strong and finished weak, but still up 83 bps on the day.

The main observation in all of this is stocks have become a great deal more volatile in the short-term and VIX has been staying stubbornly high. Some of this may have to do with stocks hitting key technical thresholds. In the absence of useful signals from fundamentals, technicals have taken on unusual weight in this market.

Labor

Money isn’t everything in the Great Re-evaluation ($)

https://www.ft.com/content/411faba8-3d75-4c71-86d2-5b1b308dfc9a

“We need to revolutionise the way we make roles in manufacturing appeal to younger generations,” said one executive from a global company with thousands of employees. “If we don’t, we’re not going to have a workforce to make our products.”

“Tellingly, pay was not the main reason cited for jumping ship. Rather, the top three factors people mentioned were feeling undervalued by their organisations, or by managers, or not feeling as if they belonged. So what is the answer? Several executives cited more autonomy, more recognition, more flexible hours, better holidays and anything that generally made working life more enjoyable.”

Several important points come up in this deceptively insightful report by Pilita Clark. One is we seem to be at a major inflection point in work attitudes. Part of this is generational and part is changing norms, but it is coming hard and fast.

One implication is jobs will need to be reimagined so as to be more attractive, but I believe an even more important implication is the work of people management will also need to be reimagined. Most managers are older and more experienced, but also more stuck in their ways. Further, many older managers rose through the ranks by way of sharp elbows, personal competition, and the effective hazing of subordinates. This will not do.

Good managers are rare enough as it is. Success depends on a deep knowledge of how the business runs, an ability to manage superiors, peers, and subordinates, an ability to solve problems and get things done, and loyalty to the best interests of the company. Now, an entirely new dimension is being added which involves nurturing, developing, and inspiring junior employees. This additional constraint is reducing the already small set of excellent managers to a very tiny subset.

Combine this reality with the reality that most employees, and especially knowledge workers, have a very good idea of what they contribute to a company and what they get in return. In the absence of a clear purpose, many employees will simply go through the motions of work (probably while looking for a job elsewhere) rather than stretching to make outstanding contributions. The effect will be similar to that of disrupted supply chains: It will take longer to get things done, it will be more costly, and it will be more uncertain. Also, as with supply chains, this will take quite some time to resolve.

Energy

Why oil producers won’t stop the rally ($)

https://www.ft.com/content/10410f23-796a-423c-85ca-addf1f76f920

“Last year’s price war still terrifies the American oil sector. In the US, producers fear that if they start deploying more rigs, Saudi Arabia, Russia and other Opec+ producers have enough firepower — in the form of 4m-5m barrels a day of spare capacity — to punish them.”

“For shale companies, value investors and dividend hoarders have replaced growth investors. As Sheffield said last week: ‘There’s no growth investors investing in US majors or US shale. Now it’s dividend funds. So we can’t just whipsaw the people that buy our stocks.’ Any company that tried to start growing production instead of rewarding these new investors with the variable dividends they had been promised would be ‘punished’, he said.”

Now that energy is getting a lot of attention, these comments from one of the industry’s veterans, Scott Sheffield, helps keep things in context. On the first point, Opec+ has quite a bit of spare capacity that can be used to crush oil prices if US frackers start ramping up capacity too quickly. While that imposes discipline on supply growth, the large chunk of spare capacity creates an overhang that makes chasing prices more speculative.

Another point is US E&P companies seem to have found religion in managing supply and distributing cash flow to shareholders. It is absolutely right that company heads should listen to their shareholders and the owners of energy companies right now want to see dividends rather than growth. This also creates the interesting prospect that energy stocks (through their dividends) could be among the safest providers of fixed income for the foreseeable future.

Politics

Our constitutional crisis is already here

https://www.washingtonpost.com/opinions/2021/09/23/robert-kagan-constitutional-crisis/

“The United States is heading into its greatest political and constitutional crisis since the Civil War, with a reasonable chance over the next three to four years of incidents of mass violence, a breakdown of federal authority, and the division of the country into warring red and blue enclaves. The warning signs may be obscured by the distractions of politics, the pandemic, the economy and global crises, and by wishful thinking and denial.”

“The banal normalcy of the great majority of Trump’s supporters, including those who went to the Capitol on Jan. 6, has befuddled many observers. Although private militia groups and white supremacists played a part in the attack, 90 percent of those arrested or charged had no ties to such groups. The majority were middle-class and middle-aged; 40 percent were business owners or white-collar workers. They came mostly from purple, not red, counties.”

While a great deal of the day-to-day partisan political rhetoric has quieted down after the election, Robert Kagan reminds us to not be complacent; the machinery for serious future problems is already in place. Walk through the steps and the roadmap for a constitutional crisis becomes all too clear.

Typically, I discount extreme possibilities because they are oversold for dramatic effect. I find Kagan’s primary insight incredibly unsettling, however, because I think he is exactly right: “While it might be shocking to learn that normal, decent Americans can support a violent assault on the Capitol, it shows that Americans as a people are not as exceptional as their founding principles and institutions.” In other words, the constitution and other founding principles have been for us but are not of us.

I’m not the only one willing to give this more serious consideration …

We should pay more heed to alarmists ($)

https://www.ft.com/content/76be11a0-0130-49ae-bffd-cfcd456db501

“Which leads to the paradox of alarmism. My colleague Martin Wolf this week added his voice to that of Bob Kagan in warning that US liberal democracy may be entering its final days. You do not need to agree with Martin’s forebodings to accept that it is entirely plausible. The more we dismiss such warnings the likelier they are to come true. The best reaction to reason-based alarm is to take it seriously and do something about it. Unfortunately most of us are programmed through our national(ist) education curricula — and the drumbeat of patriotic rituals — to believe that our countries possess unchanging personalities, almost always benign.”

“America has also been changing, in some respects radically. There are two developments that stand out to me. The first is that the US is no longer an envy-free culture as the stereotype used to go … The second is the strength of cynicism towards public institutions. American patriotism used to include admiration for its institutions. Now it just as often means antagonism towards them. That is a breathtaking change, which cannot easily be reversed.”

Ed Luce at the FT always has a keen eye for political trends and two points he makes are worth highlighting. One is the country is changing, “in some respects radically”. While one could find seeds of today’s America in the history of forty years ago, the current situation was not preordained – and it is very different. To that point, the attitude of Americans to their institutions has undergone “breathtaking change”. Indeed, there seems to be progressively less common ground upon which one considers oneself to be American …

A Whiff of Civil War in the Air ($)

https://frenchpress.thedispatch.com/p/a-whiff-of-civil-war-in-the-air

“I’ve [David French] written about all of this before. I even wrote a book about it! Divided We Fall came out a year ago last week, and it presented a simple argument—that America’s strongest social, political, and cultural forces were driving America apart, and that if we did not arrest the trend and address the culture of grievance that animates our politics, the future unity of the nation could not be guaranteed.”

“I think I released the book a year too soon. Now the trends are so abundantly clear that warnings about potential coups, rising hatred, and civil strife appear in virtually every major American publication. Secession talk has moved from the fringe to the mainstream with alarming speed.”

Absent a generally positive attitude to the country’s institutions, Americans increasingly have precious little in common with one another. At the same time, there is “a rise in a purely destructive spirit” in which “’The fight’ becomes everything”. This is not the makings of a story that ends with “quietly ever after”.

That’s the “realism” part. The “magical” part is the stock market doesn’t care, at least not yet. Throw in the potential for a real-life constitutional crisis in a few years and the market … hovers within a few points of its all-time highs.

Technology

Facebook Is Weaker Than We Knew

https://www.nytimes.com/2021/10/04/technology/facebook-files.html

“Facebook is in trouble. Not financial trouble, or legal trouble, or even senators-yelling-at-Mark-Zuckerberg trouble. What I’m talking about is a kind of slow, steady decline that anyone who has ever seen a dying company up close can recognize. It’s a cloud of existential dread that hangs over an organization whose best days are behind it, influencing every managerial priority and product decision and leading to increasingly desperate attempts to find a way out. This kind of decline is not necessarily visible from the outside, but insiders see a hundred small, disquieting signs of it every day — user-hostile growth hacks, frenetic pivots, executive paranoia, the gradual attrition of talented colleagues.”

“’Facebook is for old people’ was the brutal verdict delivered by one 11-year-old boy to the company’s researchers, according to the internal documents.”

When people envision the demise of a tech company, it often takes the form of a spectacular crash. The more common outcome, however, is the slow and painful relegation to irrelevance. I am absolutely not saying Facebook is irrelevant at this point, but Kevin Roose does an excellent job depicting how its “best days are behind it”.

All of the things that help tech stocks on the way up – new ideas, a disruptive business model, a “coolness” factor for being cutting edge, the lottery ticket of stock options for employees - all create a virtuous cycle. Growth rates way above those of the market can’t continue forever, though, and cracks begin to show.

The beginning of the decline can be nearly imperceptible. The main difference is all the factors that worked on the way up, start causing problems on the way down. Projects become boring or are of a more dubious nature. Financial goals become more urgent and come at the expense of true innovation which gets de-emphasized. Top people leave to have more autonomy or to work on more interesting projects. To top it all off, the money train of ever-increasing stock values slows down or even reverses. The bottom line is it is exceptionally hard to keep a tech company at the top for very long.

Regulation

It is frustrating to observe frequent trading scandals and other similar ethical breaches. It is even more frustrating to observe how little attention they get by media and how little enforcement occurs from regulators. It is also unfortunate that the long-term effects are so debilitating: Miscreants learn they can get by with quite a lot and honest businesspeople face an unfair disadvantage.

In the absence of effective regulation or sufficient investigative media, one of the loudest voices to tackle these types of issues is Ben Hunt from Epsilon Theory. In my opinion, he has been doing an incredible public service by exposing many of the worst instances of self-dealing and abuse of power. In the case of Robinhood, the trading on material nonpublic information (MNPI) is shockingly illegal, let alone unethical. It’s even more shocking it is done with such a casual, indifferent tone. Hunt is right, this is not a gray area.

The Uncontained Spark

https://www.epsilontheory.com/the-uncontained-spark/

“But are these leaked internal communications enough to give the lie to much of the public posturing and narrative creation efforts made by Robinhood’s CEO Vlad Tenev and Citadel’s CEO Ken Griffin? Yes, I think they are.”

Interestingly, Zerohedge published a story about a “huge” hack of Amazon’s streaming service, Twitch, in what appears to be a case of vigilante justice. I’m not a fan of rampant regulation or vigilante justice, but by the same token, history and human nature teach us that people have a tendency to exploit others for personal advantage. Technology allows that to be done at ever-greater scale.

As a result, some constraints are helpful to ensure a reasonably level playing field. If regulators cannot or will not to this, society will find unofficial ways that may or may not be better than official ones.

Emerging markets

Emerging markets’ tough test ($)

https://www.ft.com/content/e626dcd7-b512-4752-939d-9bcb298a62e5

“But if the threat of stagflation is annoying in the developed world, it could be calamitous in the developing world … Emerging-market consumer price index baskets are more heavily weighted to volatile (and correlated) food and energy prices. Because of this, and because of past inflation scares, EM central banks have to be much more reactive to maintain their credibility and keep inflation in check. And when developed market central banks are tightening, that weakens EM currencies, making inflation worse and reducing or reversing capital inflows.”

“If you are out there as an EM central bank talking about transitory inflation and anchored expectations, you are deluding yourself. If you are overlooking inflation, and the Fed is adding more inflation by weakening your currency? Bond owners will sell. Buy the adults in the room. This is a real test of the credibility of these central banks.”

This is a good update on emerging markets which highlights the particular challenges they are facing. While emerging markets are cheaper, they also have much less control over their own destiny. I like the idea of “buying the adults in the room”. All of this is very consistent with comments I made in Observations from 9/3/21:

“If the Fed is in a bit of quandary over when to taper, the conundrum is felt many times over in emerging economies. Many of these countries have large amounts of debt so any rate increases could be extremely harmful to growth. At the same time, many of these countries are also experiencing significant food inflation. The bottom line is there are few good options. There is a reason emerging markets look cheap.”

Investment landscape

The optimists still at the bull market party ($)

https://www.ft.com/content/3b25bba9-831a-4e04-8762-4cf8b217e177

“But at the heart of Ely’s apparently indomitable optimism running through the $6bn he oversees in three funds lies his strategy of hunting for disruption, the ‘digitalisation of everything’. That outweighs any debate about inflation and the next steps from the Fed, in his view. ‘Macro doesn’t matter,’ he said.”

“The more highfalutin version of this view is that betting against stocks makes little sense in an environment where benchmark interest rates and, by extension, bond yields, are so painfully low. ‘Equities remain the best escape from severe financial repression,’ said Keith Ney, a portfolio manager and member of the strategic investment committee at European asset manager Carmignac, in a presentation this week.”

These two different takes on the markets expose investors to a couple of extremely important ideas. The first, that “macro doesn’t matter”, is pure hubris. This is the type of zealotry that proliferates at market tops. It’s so alluring because there is truth in it: Many things will be digitized. However, just like railroads and fiber optic cables, even useful things can get overdone to the point of causing great harm to investors who don’t believe in limits.

The second point is a very fair one, but one that is slightly misleading for individual investors. Stocks are more attractive relative to bonds, but that only matters to organizations like big pension funds that rely heavily on financial assets like stocks and bonds because they are so big. Smaller investors have the advantage of considering a larger universe of possibilities – of which gold and other real assets are prominent candidates.

Implications for investment strategy

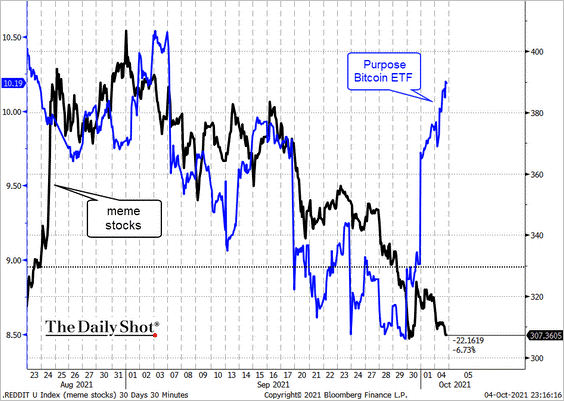

With stocks showing some weakness (but also more volatility), bond yields reaching higher, and commodities hitting multi-year highs, there are plenty of things for investors to take into consideration. At the same time, the debt ceiling drama has been pushed back to December, the Fed is still on track to begin tapering, GDP estimates are tanking, unemployment benefits are plunging pandemic lows, and the big honking market that is Chinese real estate is wobbling severely. Meantime, there is still plenty of speculative money playing around which seems to have found a short-term home in crypto.

All this points to an increasingly wide range of possible outcomes, and yet stocks are only down a few percent from all-time highs. It seems very likely some fundamental assumptions are going to start getting tested. Perhaps most important is the belief the Fed will save the day and keep stocks moving upward. As inflation becomes more deeply embedded on one hand, the prospect of deflation is also relevant as fiscal stimulus declines sequentially in the US and the potential for debt deflation increases in China.

The best approach at this point is to not over-commit to any single scenario.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.