Observations by David Robertson, 11/19/21

As we are pulling into the home stretch for the holidays the government plans on celebrating with another debt ceiling showdown. Needless to say, things will be interesting until that gets resolved. In the meantime, I’ll be off next week - I hope you have a very happy Thanksgiving!

Reach me with comments at drobertson@areteam.com.

Market observations

The two manias trying to tell us something?, Nov 16, 2021, at 04:45 ($)

https://themarketear.com/premium

“Did Tesla start something bigger than just the Tesla puke?

The aggregate psychology of this market is extreme. Irrespective if you believe in the ‘year-end melt-up’ or not, make sure to watch the most speculative assets closely.”

There is no doubt that one of the more important phenomena in the markets is the degree of speculative interest. Regardless of the many forms it can take, it has the effect of driving prices higher, sucking in bystanders who fear missing out, and therefore taking on a life of its own.

Because of this reinforcing nature, and because of the downside support monetary policy and market structure have provided, it is excessively difficult to time the top. The best we can do is identify signals that things may be turning around.

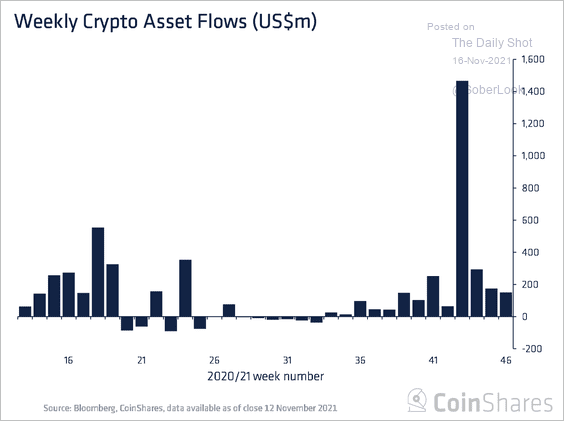

On this front, the simple price momentum of the biggest magnets for speculative interest is one metric. TSLA and BTC are two of those and TSLA does seem to be leading the way downward at the moment. Another metric is flows and the second graph shows a noticeable slow down in flows to cryptocurrencies in recent weeks.

Coronavirus

Not too much to say here other than coronavirus is not dead yet. While conditions in the US have improved the last couple of months, many European countries are experiencing their all-time highest infections rates. This is worrying at least partly because many of these countries have relatively high vaccination rates. For the time being, it is fair to expect European economic growth will remain relatively weak.

Labor

One thing that is clear from the graph is the total number of jobs hasn’t returned to anything close to pre-pandemic levels or to their pre-pandemic trajectory. This is especially notable in light of the fact that GDP has completely recovered to its pre-pandemic trajectory. The implication is a lot fewer people are producing more than ever and therefore the production per payroll has jumped considerably.

I can say from my own experiences this isn’t fun or sustainable. When I worked food service in college the number of fellow workers that didn’t show up during finals always jumped higher. A lot more work for no more pay on top of finals made for a crappy few weeks every semester. Something similar seems to be going on throughout the economy now …

The Great Resignation is Becoming Self-Aware

https://www.mauldineconomics.com/connecting-the-dots/the-great-resignation-is-becoming-self-aware

“The same holds for workers [the whole becomes more powerful than the sum of its parts]: They’re stronger when they act together. But now something new is happening. Even without formal organizations like labor unions, working people are realizing they can achieve more when they’re united.”

“a growing number of workers think the system is aligned against them, and some are realizing cooperative action can force change.”

The number that made headlines in the prior week’s headlines was that a record 4.4 million people quite their jobs in September. The historically high number has prompted the question, “Why?” A couple of good reasons are overwork/burnout and increasing realization of the power of collective action.

The evidence is accumulating that something fundamental is happening in regard to the social compact that comprises work, compensation, and working conditions. One change is management teams are being forced to try tools such as soft power which is a tough nut when all one knows is leading by diktat. Nothing about these ructions in the labor force feels like they will resolve quickly or easily.

“This awareness is spreading. One database shows more than 1,300 strikes and walkouts since March 2020. Often these are spontaneous, not union-organized. Some business leaders aren’t prepared for this. They will need to learn.”

One last item which has bearing on both labor and economics in general is metrics. As the Fed has placed enormous weight on unemployment as a trigger for a change in policy, the graph below illustrates the shortcoming of doing so. Unemployment provides only part of the picture; a more complete (and relevant) picture is provided by unemployment relative to job openings.

The bigger point is that there are problems with many of the metrics singled out as drivers of public policy. To the extent public authorities continue to use bad metrics, there is little reason to have confidence in the success of their policies. Sometimes old metrics just need to be fine-tuned and sometimes entirely new ones need to be developed to be fit for purpose. If the sport of baseball can pull this off (Sabermetrics), surely the profession of economics can replicate the success?

Economy

Last quarter I thought it was underappreciated how much GDP growth was slowing down. This quarter the opposite is happening – it is underappreciated how blazing hot GDP growth is. The huge differential from quarter to quarter also highlights the instability of an economy rocked by lockdowns, huge fiscal and monetary infusions, and uneven recovery. Expect more crosscurrents ahead and expect those to make things challenging for both economic participants and policymakers.

Capital is an extremely important factor of production so the continued rise in capital expenditures over the last year and a half is worth watching. Certainly, some of this is just making up for money that wasn’t spent during the worst of the lockdowns. I’m sure part of it is to offset labor shortages as well – to either increase productivity of existing labor or to replace some labor altogether.

If capital spending sustains at higher levels, it will be an important input to the inflation equation. For example, as Millennials reach peak ages for household formation, more housing and associated durable goods will be needed. Further, if consumer demand remains at higher levels, many companies will need to increase capacity.

To the extent companies keep capital spending levels higher, and use debt to help finance it, that spending would also have implications for inflation. The greater proportion of productive debt would (finally) increase the velocity of money – which would help drive prices up. As a result, the trajectory of capital spending is revealing for both economic growth and inflationary pressures.

China

When Evergrande did not blow up the global financial system in the same way Lehman did thirteen years ago, many pundits wrote it off as unimportant. Now, the lasting impact is becoming clearer: the slowdown in both construction and industrial metals is a function of the slowdown in the real estate market that Evergrande precipitated. This is not going to reverse suddenly.

Turkey

Turkey On Verge Of Currency Collapse As Lira Implodes, Crashes 4% In Minutes

https://www.zerohedge.com/markets/turkey-verge-currency-collapse-lira-implodes-crashes-4-minutes

“Citing two local traders, Bloomberg said that the recent move of the lira ‘is the result of a surge in local demand for the dollar’ which, of course, is obvious... even more so since it is extremely difficult if not impossible to buy bitcoin or other cryptos as a hyperinflation/currency collapse hedge.”

I have mentioned Turkey several times in the past as being a top candidate to spark global instability. I reported in July 2020, “This is how big things can happen” and “Turkey has a lot of US dollar denominated debt and is struggling to prevent capital from leaving the country”. Here we are, over a year after my first remarks, and Turkey is making another big bid. It is a textbook case of the problems that emerge when your currency unravels.

The trigger to look out for is capital controls. We have already seen a mild form of that with a crack down on cryptocurrencies in Turkey. Concerns about further devaluation and even stricter capital controls are exacerbating weakness in the lira and boosting stronger stores of value like the US dollar and gold.

Inflation

Everyone is worried about inflation, except the bond market ($)

https://www.ft.com/content/f60c8e1e-b82d-4f60-aec8-933912b9f742

“My naive understanding is that if inflation starts to get out of control, real yields have to go up, because investors want compensation for volatile future inflation. But this ain’t happening.”

Greenspan's Conundrum Has Returned to Haunt Markets ($)

“Now we have a new version of the conundrum. It isn’t as though the Fed is trying very hard to push up long yields at present, although at least it is tapering its bond purchases. This time, the upward pressure on yields is coming from the sharpest inflation spike in three decades. Over time the 10-year yield has clearly correlated with inflation, and bond arithmetic dictates that it should. The higher inflation is, the higher the yield you should demand to protect you. But the declining trend in 10-year yields continues unabated.”

Historically, long-term interest rates have correlated fairly closely with inflation – which makes the current disconnect between higher inflation and still-low long-term rates a “conundrum”. There are several hypotheses as to why this may be the case, but the main point is to keep an eye on those long-term rates because that is what other investors are watching as a clue to inflation expectations. If and when the 10-year Treasury yield sustains a rise up towards 2%, which could happen early next year if Fed tapering continues apace, it will be hard for financial assets to continue getting a “free pass” in regard to inflation.

Investment advisory

Should FAs Stay in Their Lane and Ease Up on Asset Mgmt?

https://financialadvisoriq.com/c/3397434/431974/should_stay_their_lane_ease_asset_mgmt?

“Asset management is not a practice where advisors can typically deliver a lot of value, ‘especially if they’re trying to do active allocation or select actively managed funds or individual stocks,’ according to Amy Arnott, a portfolio strategist at Morningstar.”

“For the majority of financial advisors, it makes sense to outsource investment management. That frees up more of their time and energy to spend with clients and to really spend more time doing financial planning, which is where they can add significant value,” she told FA-IQ.

One of the toughest things new investors often have to contend with is just figuring out what types of positions do what kinds of work. This challenge is magnified many times over by industry participants who intentionally misrepresent their work, by regulation that fails to clearly differentiate between positions and credentials, and by organizations that dabble across multiple boundaries.

For example, most investors are familiar with financial advisors (FAs). FAs are like relationship managers and usually focus on financial planning, insurance, and other elements of a financial plan. These are useful and valuable services for many people.

Part of what makes things confusing is many FAs also manage money in one form or another. As such, they are also acting as investment advisors. Sometimes this is done in-house and sometimes it is outsourced, often by way of a standard allocation of passive funds.

The important thing is financial advice is a very different activity from investment advice and requires very different training. This issue has not caused big problems as the market has continued marching upwards the last several years, but it has the potential to cause huge problems in the event of significant and/or sustained market turmoil. The key thing for investors is to identify your greatest needs (financial planning, investments, or both) and find the advisors most suited to help with each.

Monetary policy

The great inflation debate — part 2 ($)

https://www.ft.com/content/0ffddb1c-a898-4f5a-a970-bae289a8a21c

“Purves is betting that this ‘inflation complexity’ will make central bankers err on the side of dovishness, rather than being pushed to interest rate increases that might require a quick backtrack. That could, of course, ultimately contribute to serious inflationary pressure (remember the Weimar Republic!).”

“As Purves puts it, in a way, it’s as if the Federal Reserve has suddenly become an [emerging markets] central bank — facing screwed up supply chains, re-localisation, some commodity scariness and labour angst’.”

One element of the monetary policy debate is what constitutes a “policy error”. Some think rates should stay lower for longer in order to support financial asset prices. Others think rates need to start coming up soon or there will be a real inflation problem that could be destabilizing.

Another perspective highlights the catch-22 nature of the situation for the Fed. Lower rates for longer makes the Fed look more and more like a third world central bank. Conversely, push rates up just a tad too high and the fragile market could come tumbling down. Worse, it could do so when the political stakes are exceptionally high. Either way, once the Fed loses its credibility, the gig is up.

Signs of stress in the Treasury market

“Primary dealers — mainly banks who facilitate liquidity by making markets in the paper — have scaled back their activity due to capital constraints imposed by post-financial crisis regulations.”

“Treasury has already proposed reforms like expanded central clearing of trades, gathering better data on positions and transactions, and investigating the role that levered hedge funds play in the market.”

Funny story – so, the “startlingly weak auction for 30-year Treasuries last week on the back of worse-than-expected inflation data” was caused in large part by regulations on primary dealers that were intended to improve financial stability. Even funnier, those regulations also incentivized hedge funds to participate bigly in Treasury markets with massive amounts of leverage and flighty capital. This sounds like the Geico commercial about kids in horror movies doing such stupid things.

The good news is a “who’s who of financial regulatory agencies” met on Wednesday to discuss plans for ensuring the proper functioning of the Treasury market. I have mentioned this before and ideas include central clearing among others. Other good news is the effort seems to be getting some traction despite the odds. This could have huge implications for investors – if the Treasury market functioned properly on its own, it would be much harder for the Fed to justify heavy-handed interventions.

Investment landscape

One of the more pronounced and important trends of the last six months has been the incredible strength of the US dollar. After suffering much of the early part of the year due to concerns about excessive spending, it started climbing as its haven status became the more important factor.

This raises two points. One is the value of currencies is always relative to other currencies. You may hate the dollar, but would you rather own the Turkish lira? Or even the Euro? The fact of the matter is that as inflation heats up, coronavirus remains a challenge, and there are large pockets of dollar denominated debts, other countries will fare much worse than the US, at least for the time being.

As liquidity and safety take more central roles in global portfolios, it is fair to expect continued strength in the dollar. As such, it will be interesting to observe how the dollar performs relative to other stores of value such as gold and commodities. Commodities look especially interesting as they weaken in dollar terms due to slowing global economic growth but have utility in preserving wealth against the longer-term threat of dollar debasement.

Implications for investment strategy

One of the most common market themes the last several years has been speculation and one of the most common investment challenges has been determining to what extent to participate in that speculation. The allure is very different if you are a young investor with few assets or an older investor who can’t replace savings if they are lost. One thing is certain, though, many investors are chasing returns who should not be …

Private Party, Almost Daily Grant’s, November 16, 2021

https://www.grantspub.com/resources/commentary.cfm

“Facing a high bar to generate necessary returns within the confines of public markets, the largest pension fund in the United States tweaks its own strategy in the opposite direction. The California Public Employees Retirement System (Calpers) voted in a board meeting yesterday to upsize its allocation to private equity holdings to 13% from 8% and bump private credit holdings to 5% from less than 1%, while adding $25 billion in leverage (equivalent to just over 5% of assets) to help juice returns. Without those changes, Calpers estimates that its portfolio would generate a 20-year return of 6.2% annually, lagging the 6.8% annual bogey established this summer, which was itself lowered from 7%.”

To sum up, the largest pension fund in the country is not only increasing allocations to the riskiest assets at the most expensive valuations in history, but it is also taking on debt to boost returns even more. One effect of this move is it may provide encouragement for others who are inclined to speculate – after all Calpers is doing it.

Another possible effect, however, is to create even bigger investment problems. As Grant’s also reports, “The white-hot conditions are making some nervous” and even private equity people are referring to deal prices as “a state of collective delusion.” When asset prices finally do correct, it will be painful for investors, but it will also be devastating for some pension funds. As a result, either pensioners will be shortchanged, or the pensions will be bailed out by the government. If the latter happens, then the correction will also be painful for taxpayers.

So, if crazy speculators AND big pension funds are doubling down on risk, where does that leave more ordinary investors who just want to be able to retire? I think a useful distinction can be drawn between sort of run-of-the mill speculation and more aggressive speculation.

The first is based more on the premise that the Fed has your back. While I think the Fed will ultimately fail market enthusiasts, it has been true that the Fed does seem very sensitive to protecting asset prices and does not tend to change its position quickly or unexpectedly. The second is a more defiant effort to turn a quick profit on stocks with some of the worst fundamentals in the universe. That is reckless and cannot be considered investing. So, if long-term investors must venture out on the risk curve, it makes more sense to do through the S&P 500 than through Tesla or Bitcoin.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.