Observations by David Robertson, 1/12/24

Whew - it’s good to be back in the saddle! The year is starting off with a lot of things to figure out so let’s get started …

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

If you want a good characterization of what the driving themes of last year’s market were, Simon Ree sketched a good outline:

The term "rally in crap" often used to describe 2023 is justified

The best performing stocks in 2023 were

1) Those that performed badly in 2022

2) Those with no earnings

3) Stocks with high short interest

4) Stocks with no dividends

If you are trying to get a handle on why stocks jumped so much at the end of last year, look no further than the chart from Longview Economics. As is plainly evident, “Nasdaq CFTC net speculative positioning [is] at all-time highs”.

Speculation, after all, is what happens when financial conditions ease, and boy did they ease late last year. According to Zerohedge, “This has been the biggest two-month easing in financial conditions in history, surpassing the announcements of QE1, 2, 3, and so on.”

Matt Klein corroborated that take with his own assessment: “One of the funny things that happened in 2023 was that policymakers kept saying that they were being restrictive despite all of the data pointing in the other direction.” In other words, despite all the Fed’s huffing and puffing last year, overall policy just wasn’t that tight. Then it got looser yet late in the year.

While the trigger for speculation has been clear enough, it is not at all clear whether it is a useful signal for long-term investors. Another piece of information from @SoberLook highlights an unusual level of insider sales relative to purchases. So, while speculators are loading up on stock, insiders are selling it to them. Choose the signal that suits you best.

Geopolitics

With so much attention placed on whether the US will have a hard or a soft economic landing, its relative performance has often fallen out of the spotlight. This is a shame because it overlooks an extremely important point. As the graph from @SoberLook illustrates, expected growth in the US has been trending up while growth in both China and the Eurozone has been trending down. If these forecasts are in the ballpark, it should bode well for the US dollar at very least.

In other geopolitical news, Taiwan is having its election this weekend. While I am certainly no expert on Asian politics, the basic proposition is fairly clear. Currently the leading candidate, Lai Ching-te is a pro-sovereignty thorn in Xi Jinping’s side. However, close runner-up, Hou Yu-ih, represents the KMT and is far more friendly to mainland China. So, it is quite likely the political direction of Taiwan will swing either closer to China or closer to the US.

As a result, the potential for the election to mark an inflection in Sino-American relations is also fairly clear regardless of outcome. While I would be surprised if any significant, organized hostilities erupted immediately after the election, I wouldn’t be surprised at all to see an increase in the friction between the US and China - possibly in the form of tariffs or sanctions. Lest anyone forget, TSMC, the largest dedicated semiconductor foundry in the world, sits right in the middle of it all.

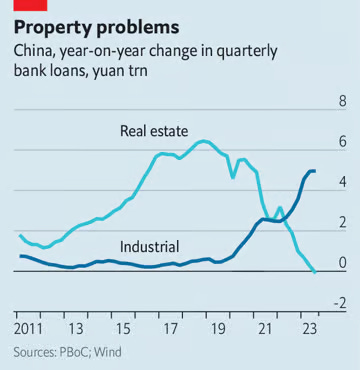

Speaking of friction, the Economist just published a story highlighting the risk of China setting off a trade war. As the graph indicates, China’s public policy is focused on bumping up industrial capacity (and exports) in order to offset the slump in real estate. This is completely consistent with my assessment in the Outlook edition that “China’s determination to spark economic growth through even greater trade imbalances is also grinding on nerves.” So, it looks like grinding on nerves there will be.

Monetary policy

Just as markets got jazzed over the prospect of the Fed cutting rates, and perhaps significantly so, news came out that it is also considering pulling back on its Quantitative Tightening (QT) program. As the FT reported ($):

First, the minutes from the December FOMC meeting released last week revealed that while policymakers felt it was “appropriate” to continue QT, some of them think it should be slowed after shedding $1.3tn of bonds since mid-2022.

Then on Saturday, the Dallas Fed’s Lorie Logan made it clear she’s among them. In a speech she noted that the emergence of small but noticeable month-end money market pressures “suggests we’re no longer in a regime where liquidity is superabundant and always in excess supply for everyone”.

The FT’s Ethan Wu ($) followed up by establishing some perspective around the issue:

In the Fed’s terminology, QT is meant to move the financial system from a regime of “abundant” reserves to one of “ample” reserves — from an uncontrolled flood of cash to a more modest, but still plentiful, level of liquidity. Crucially, QT must not create “reserve scarcity”, the rigid pre-financial crisis monetary regime.

So, this provides some important clues as to what is going on. Yes, the Fed’s primary concern is avoiding “reserve scarcity”. It cannot allow any kind of deflationary spiral like what happened in 2008-9. All else equal, this is a form of Fed put and is good for stocks.

However, all else is not equal. The Fed is also continuing to move from “abundant” reserves to “ample” reserves. While there is all kinds of subjectivity regarding what those characterizations mean in practice, what is clear is that liquidity is still coming down.

I’m not the only one who is suspicious of interpreting the Fed’s recent moves as overtly dovish. John Comiskey, who has investigated the Quantitative Tightening (QT) program in incredible detail, expressed his reservations:

But then of course, right on cue, folks like BoA think it reasonable to conclude as a base case that QT will taper starting in March and end shortly thereafter in June. I disagree of course. I think that’s a completely unreasonable base case … In my opinion, a taper starting in September with an end to QT late in 2025 is a reasonable base case.

How will these two opposing forces be reconciled? That’s a good question and one that is likely to be prominent most of the year. I like this perspective from Stimpyz on X:

Let's stop screwing around

There is only ONE question we should be asking leading lights on Fin-twit:

Will the Fed willing to restart QE/ZIRP to help Congress run 7% full employment deficits?

Answer how you want. But we need to let them know we are watching.

The rest is noise

Inflation

Just in case people don’t know what to think about inflation on their own, Nick Timiraos at the Wall Street Journal does it for them:

"In a good place"

US consumers' inflation expectations are back to where they were before the pandemic, per the NY Fed

Inflation is expected to rise 3% this year and 2.6% annually over 3 years (down from 5% and 3%, respectively, one year ago)

This is the environment in which things like falling oil prices and 4% 10-year Treasury yields get evaluated. As the reasoning goes, it all points to lower inflation. This is also the picture the Biden administration is promoting.

As with almost anything market-related, however, the consensus can become the problem. As PauloMacro posts, big money is not made when almost everyone believes the same thing:

The issue of course is that a mild recession is priced in, and/or hard landing is well on its way to being priced. This is the consensus. Big money is not made in the consensus. Pedestrian, subpar returns accrue to the consensus.

Further, there are indications economic growth, and therefore inflation, could pick up. GDPNow is currently estimating 2.2% for the fourth quarter (as of Wednesday) which is solid growth, not recessionary growth. Further, the Atlanta Fed’s Wage Growth Tracker posted 5.2% in December, halting a decline that had been in place for over a year. Add on accumulating evidence of supply chain challenges and unwieldy fiscal deficits and it is no surprise why the 5-year, 5-year forward inflation expectation rate also ticked up since the end of the year.

Indeed, the direction of motion was corroborated by the CPI report on Thursday. The month-over-month number was 0.3% which was up from 0.1% last month. Rising shelter costs were the dominant cause for the increase. The annual increase in CPI bumped up to 3.4% from 3.1% last month.

None of this is to say we are on an express train to hyperinflation. It is to say, however, inflation is looking higher and stickier than the fairy tale narratives suggest and for which the market is currently positioned. I don’t expect big moves based on this one CPI report, but it does serve as a shot across the bow: If subsequent evidence continues to points to an uptick in inflation, a lot of investors are poorly positioned.

Investment landscape I

I have read a lot of investment commentaries over the last month or so and one of the most comprehensive and thoughtful came in a post by Dr_Gingerballs on X. The following is basically his outlook for this year:

Okay so 2024. I think that M2 will not keep pace with treasury issuance in 1H24, and rates will spike again. This accelerates after March if Fed closes BTFP as I suspect they will. After march, velocity will not be able to offset lower M2 growth, dragging on NGDP. Both of these things are bad for stocks. Currently bonds are being margined for leverage in the equity options market, causing them to be positively correlated. Bonds up, stocks up. Bonds down, stocks down. These higher rates will continue to push down on earnings, as workers keep fighting for wage gains. So less leverage in equities and lower valuations.

There are a few of important dynamics I think the post covers especially well. One is there are a lot of moving parts. As a result, the situation is likely to remain fluid through the year. This makes directional bets extremely risky. Another regards liquidity. Net/net it looks most likely liquidity will turn down and that won’t be good for stocks.

Another dynamic is leverage. This adds an important dimension because liquidity has been such an important driver of asset prices. When longer-term rates declined last fall, bond prices went up - driving bond values higher. Further, those “bonds are being margined for leverage in the equity options market”. So, what appears to be improving liquidity has to some degree been improving bond values instead, and those improving bond values have facilitated more leverage.

In short, it appears the run in stocks has been more a factor of leverage and positioning than of increasing liquidity. This matters because there are limits to leverage and positioning currently looks extreme. It also matters because leverage can unwind quickly. If we see long-term rates go up again, for whatever reason, all those equity bets go into reverse.

Investment landscape II

One of the investment patterns that manifested during the QE era was the increasing exposure of households to stocks. This made sense because that’s part of what QE was supposed to do - force people further out on the risk spectrum.

The graph below from @SoberLook adds some perspective to the matter by going back a couple decades before the GFC. With this additional history, its much easier to see the approximately 40-year span breaks into two very different regimes. While households clearly increased exposure to stocks during the QE era, they clearly had a neutral to negative bias earlier.

One possible way of interpreting the change in demeanor is Baby Boomers, who were rapidly approaching retirement age in the mid-to-late 2000s had already started de-risking their portfolios. When QE started they reversed course. It’s not hard to understand why this may have happened given the meager returns to fixed income and the ongoing potential for inflation.

While more recent data indicates households are still net buyers of stocks (albeit at a considerably slower pace), it’s not hard to imagine it would take much to resume the pattern already established twenty years ago. It wouldn’t be at all surprising if much better interest rates and being twenty years further into retirement would be sufficient reason to compel a lot of Baby Boomers to move funds into safer alternatives.

Investment landscape III

Geopolitics Matter — Even to the Magnificent Seven ($)

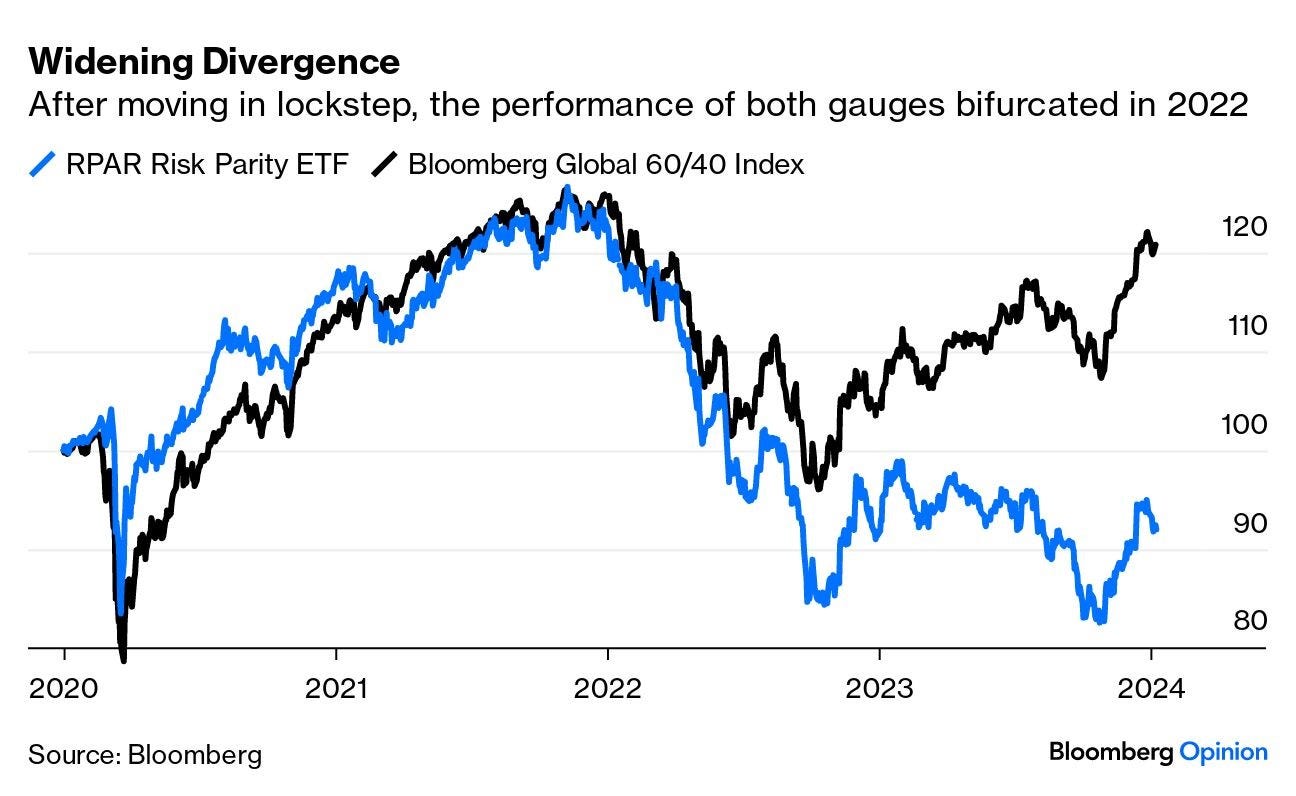

Risk parity, the supposedly steady strategy popularized by Bridgewater Associates founder Ray Dalio that is meant to serve as an antidote to market surprises, is suffering volatility not seen since the Global Financial Crisis. That has now called the whole approach into question.

It is striking the risk parity strategy (captured by the RPAR ETF) underperformed the 60/40 strategy so significantly. It is also telling.

As the story suggests, two factors contributed to the undoing. One was bond volatility. A foundational premise of the strategy is inherently lower volatility in bonds allows those bonds to be leveraged up. Unfortunately, bond volatility has been unusually high and has stayed high.

A second factor was asset correlations. As long as stocks and bonds generally move in opposite directions, they provide a nice offset to one another. Over the last couple of years, however, stocks and bonds moved much more in sync with one another. As a result, the strategy exacerbated problems rather than softening them.

This performance reveals a couple of interesting elements about the investment landscape. One is these changes first started appearing just as inflation was starting to take off in the latter part of 2021. Probably not a coincidence.

Another is while inflation expectations have fallen and stock volatility is exceptionally low, bond volatility has remained quite high. One of these things is not like the others. Either bond volatility is too high - and is about to come down - or inflation expectations are too low - about to come up. I think the latter explanation is the better one.

If this is right, it will have big implications for stocks and bonds. For one, the risk parity strategy, at least in its current form, will lose its reason for being. More importantly, it reveals the 60/40 strategy as similarly flawed, just to a lesser degree. Both will be resigned to the fate of periodically falling, not quite recovering, and then falling again in an ongoing downward ratcheting pattern.

As unappealing as this might be, there is a silver lining. The MOVE index could be the most important market indicator out there right now.

Implications

A great deal of market action the last few months, and what it implies, boils down to one’s interpretation of what the Fed is trying to accomplish. If you believe the Fed mentioned rate cuts and tapering its QT program because it is ready to release the reins of tight monetary policy, then one should increase exposure to risk. It appears this is about where consensus is.

There is another interpretation, however, and one that has very different implications. I would argue the Fed shifted the goal of monetary policy post-GFC from pro-growth (in the absence of fiscal stimulus) to crisis-prevention after the pandemic.

Insofar as this is the case, then signals to cut short-term rates and plans to taper QT reflect an acute concern about potential for financial instability. Even though the Fed is mandated to support price stability and maintain full employment, the thing that scares the bejeezus out of governors is deep financial crisis and a deflationary spiral.

In practical terms, this means keeping banks solvent and keeping the Treasury market functioning smoothly.

In investment terms, this means an intense focus on the Treasury market. It also means other things, like the stock market, don’t really hit the radar. As the Fed’s objectives become progressively clearer through the year, I expect stocks will suffer. I also expect investors to start increasing allocations to fixed income.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.