Observations by David Robertson, 1/14/22

After a gloomy first week of the year, investors looked for some relief this week. They got it to some extent as stocks and bonds rebounded, but there was also plenty of volatility to keep things interesting. If you have questions or comments along the way, let me know at drobertson@areteam.com.

Market observations

The week started off with a bang as futures were weak before the open on Monday and stocks fell further during the session. Things turned, however, and the S&P 500 experienced a 2% intraday reversal while the Nasdaq experienced a 3% reversal. The action was captured well by Zerohedge. Stocks weathered high inflation numbers well but gave up ground later in the week.

An interesting phenomenon in the new year has been the stellar performance of energy stocks. The performance of energy relative to the broader market has bounced up and down relative to the strength of the reflation narrative. There are good and bad reasons for this, but for the time being investors are willing to chase energy stocks higher.

Economy

Small businesses comprise an important part of the economy but rarely make headlines. As a result, they often provide useful indicators that don’t reach a wide audience.

The point David Rosenberg makes above is that small businesses are indicating an extremely weak economy. In many respects this makes sense. Small businesses have borne a disproportionate burden in managing through ever-changing pandemic restrictions, rising costs, and scarce labor. All of this has happened while large company competitors, which have had access to lower cost of capital, have continued to increase market share. It ain’t easy.

One small caveat I would add is small business sentiment seems to have become increasingly politicized. The big increase in economic expectations after Trump was elected and the fall after Biden was elected say at least as much about political preferences as actual economic conditions. As a result, it makes sense to take small business sentiment with a grain of salt as an economic indicator.

Politics

Why Americans are switched off from January 6 ($)

https://www.ft.com/content/6c738e7f-3907-4a41-8e5c-0acf7cb11ba3

“I profoundly wish this [Why Americans are switched off from January 6] were an inaccurate headline. As I have said before, the future of US democracy is on the line. Moreover, what happened on January 6 last year is likely to be tried again — probably more effectively — unless the organisers of last year’s failed putsch are legally held to account.”

“Unfortunately most Americans do not agree that their republic hangs in the balance, or else they do but aren’t particularly bothered. It’s hard to say which is more troubling. Either way, we should remind ourselves that history, for better or worse, is usually made by small numbers of motivated people. Most others are too busy with their lives to take part.”

One of the issues raised here is the breadth and depth of indifference. This resonates with me because I have observed the same thing. Whether it be in regard to overreaching authorities, blatantly unethical behavior, clearly illegal behavior, or other transgressions - in just about any walk of life - the collective response is, meh.

I have also hypothesized as to the causes of such apathy. I think a lot of it is due to the fact that many people are working so hard and are stretched so thin just to maintain their lifestyles they have precious little mindshare for anything else. I also think, however, there is a pervasive sense among many people that they don’t have a meaningful responsibility to ensure the fabric of society remains healthy. Whether in regard to ensuring civil discourse, ethical behavior, or even lawful actions, those things are considered somebody else’s job.

Not surprisingly, these same characteristics are increasingly observable in political behavior as Ed Luce at the FT notes. There hardly seems to be any ideal important enough that it can’t be brushed off by most people on the basis of some trivial excuse. The thing that is extremely frustrating is about the only way that lesson is learned is to actually lose what has been taken for granted. I’m afraid Luce is right that we are going down a path where the future of the republic hangs in balance.

Labor

Survey Reveals a Majority of Americans Identify as Creators or Freelancers (h/t afterschool@substack.com)

“According to a survey by Oxygen, the financial technology company, more than one-third of Americans have started a new side hustle during the pandemic — and close to half of Americans say it has been profitable.”

“In fact, in its survey, 88 percent of all respondents also said they consider themselves to be a creator or freelancer. This accounts for 93 percent of Gen Z, 87 percent of Millennials, 91 percent of Gen X, and 78 percent of Baby Boomers.”

The numbers seem high but if they are anything close to representative they speak to an important trend. Clearly the pandemic created an opportunity to appreciate greater flexibility with work hours and places, but it seemed to do a lot more than that. It also seemed to break people out of the mindless routine of just going through the motions everyday and instead really thinking about sources of intrinsic enjoyment.

I have mixed feelings about this. On one hand, I find it extremely encouraging. If a large, educated work force suddenly found things to do that got them really jazzed, just imagine what that would do for economic growth, let alone personal fulfillment! On the other hand, though, creating a business is hard work and there are lots of ways to fail. David Rosenberg’s report on small business sentiment is an indication of real world conditions. I hope the intrepid adventurers are well prepared for the challenges ahead so they have a fair chance to realize their dreams and don’t become disillusioned.

Energy

MacroVoices #304 Louis-Vincent Gave: China, Russia, US Dollar & more

https://macrovoices.podbean.com/e/macrovoices-304-louis-vincent-gave-china-russia-us-dollar-more/

“Well, let me tell you how I look at energy very briefly. You know, for me, there's really, if I look at the past 20 years, there's really two different periods, there's a 2000 to 2015. And then there's a 2015 to COVID. Basically, you know, 2000 to 2015, the world goes from using 400 exajoules jewels a year to 500 exajoules a year. And out of that 500, 61 comes from China and out of that 61 from China, 51 come from coal. Meanwhile, there's basically no increase in the consumption of energy from 2000 to 2015, across the OECD. So basically, what happened between 2000 in 2015, to cut a very long story short, is that the world decided, you know what, I still want to consume a lot of these goods. But I'm going to outsource the production to China. And China's going to produce them, not with expensive natural gas and not with expensive oil or expensive nuclear, but China is going to produce them by using very cheap coal. Because coal is much cheaper than everything, anything else. You know, if it wasn't so darn polluting, we'd be using nothing but coal. It's easy to move. It's cheap, cheap to move, it's easy to exploit. And there's so much of it around the world. So what happened between 2000 and 2015 is basically half of the world's increase in energy supply was done by Chinese coil. And at the cost of just enormous environmental devastation in China, you know, you were spending time there at the time so was I.”

I found this analysis by Louis Gave absolutely fascinating. One idea it introduces is that energy consumption and emission production are not black and white issues that stop discretely at national borders. Rather, the total cost of energy consumption, including externalities like pollution, can be arbitraged and outsourced. This allows developed countries to be sanctimonious and self-righteous about clean energy while quietly subcontracting energy deficits out to other countries.

Now that China is clamping down on pollution, alternative sources will need to be arranged. As Gave details, “between now and the end of 2023, the world will need to produce an additional 50 or 60 exajoules, knowing that it won't come from Chinese coal, and knowing that it won't come from the US oil patch.”

There are hints as to possible solutions. For example, if nuclear is deemed to be “clean”, that could help, at least longer-term. The main point, though, is the rubber is hitting the road in terms of the tradeoffs between “clean” energy and affordable energy.

China

Two quick points on China. One is the economic restructuring precipitated by the real estate crisis is clearly continuing. With steel as a good proxy for construction activity and construction activity being a good proxy for overall economic growth, clearly China’s contribution to global GDP is going to be much lower.

Another point is the trend in steel output is inherently choppy and is not going down forever. Indeed, intrepid investors have already pounced on beaten up tech shares and will likely look for other targets. Expect a lot of volatility until a steady state trajectory becomes clearer.

Inflation

The CPI report came out pretty much as expected on Wednesday. CPI increased 0.5% from the prior month and 7% year over year. The biggest contributors were shelter and used cars and trucks. To be sure, there are good reasons to believe the car and truck numbers will ease over time.

The shelter numbers, however, are likely to remain elevated and Robert Armstrong from the FT suggests the appropriate view is to “panic moderately”. He captures the thinking of Bob Michele, head of fixed income at JPMorgan Asset Management:

“It has amazed us how much of the conversation has been about the supply bottlenecks and how they are a cause of a lot of inflation. We are looking at something else: shelter. We look at November, the third consecutive month primary and owners equivalent rent rose more than .4 per cent, so above five per cent annually. If that goes on, it changes the conversation . . . it will validate the newfound hawkishness coming out of the Fed”

This outlines what I think will be one of the greater challenges for investors over the next year or two. On one hand, headline inflation numbers are likely to come down in the short-term. On the other hand, a number of important contributors are likely to remain uncomfortably high. How much inflation will investors discount? Regardless, it will be really easy to get the answer wrong.

Monetary policy

A week ago, the Fed sent a harsh message to investors that it was going to be serious about dealing with inflation. It had the ominous tone of a parent scolding unruly children, “This time I really mean it!”

This week, Powell modulated the tone and markets appreciated the effort. This is the problem with relying so heavily on “communication policy”, however. People react, and sometime overreact, to your communication. Further, after a pattern of communication, adverse reaction, and clarification is established, credibility becomes sorely tested.

In addition, as any unruly child knows, the only way to really find out how far things can be pushed is by experimenting with pushing them too far. To date, the Fed has not been forced to act on its warnings, but that time is running out. When it is finally forced to act on inflation, investors will get a much clearer picture of the Fed’s policy disposition.

Robert Armstrong at the FT captured Martin Wolf’s comments on the subject. In short, he has a similar view that credibility will be key:

“The actions themselves don’t really matter. What matters instead is the confidence that the Fed is serious about its goals. Then, if what it has done is not enough, the Fed will do more — much more. So, the signal is the policy and the signal on its own might be enough . . . but that only works to the extent that the intentions revealed are believable. The smaller the credibility of its intentions, the more the Fed will need to do to show it’s serious ...

For 40 years the Fed has lived on [Paul] Volcker’s credibility. Maybe it will have to show it means it once again. That would be a nightmare. And that is also why letting inflation rip is dangerous. The more that needs to be done, the less credible the needed actions become. That is why a Volcker became necessary in the 1970s.”

Finally, all this is happening amidst a great deal of turnover at the Fed and while it is under a cloud of unethical behavior. As Joseph Wang points out, “rumored nominees seem to be more political activists than market operators” which doesn’t help fill the void in market savvy left by Clarida. Wang advises, “Expect even more policy errors.”

Investment landscape

The Psychology of 7% Is Hiding Other Inflation Data ($)

“For an example, look at this chart sent to me [John Authers] by Michael Howell, who runs Crossborder Capital Ltd. in London. Howell is a champion of valuing and predicting markets using liquidity measures, an exercise that ignores corporate fundamentals altogether and therefore often feels uncomfortable … In the chart, which covers developed world equities, P/E is price/earnings (of course), and P/L is price compared to his measure of liquidity — the amount of money available to investment. The P/E moved around a lot. The P/L was remarkably stable … It just so happened that vast new sums of money were released by central banks, and so this meant that the price of equities went up a lot:”

The notion that “World stock market gyrations over the period have been entirely explained by movements in ‘liquidity’” is an important one and one I have highlighted several times in the past. The graph above just depicts how true the statement is.

It also goes a long way in describing the nature of the investment landscape. If the world is going to be swimming in money created by central banks, that money has to go somewhere. Not only does this help explain the inexorable rise in stocks the last several years, but also exposes a great vulnerability. Just as soon as liquidity declines, financial assets will be at risk.

When that time comes, which the Fed has clearly outlined its intent to do, the proposition of financial assets will completely change. No longer will they be useful ways to “catch” the new liquidity entering the market, but they will become overvalued securities at serious risk of losing value. As such, they will be clearly inferior to plain old cash.

Implications for investment strategy

While the liquidity train is still rolling ahead, it is slowing down. Increasingly there is risk it could even turn around. One implication of the still extremely accommodative Fed policy is there are still strong incentives to buy the dips. Another implication is there are strong incentives to find the next “hot” area where money might shift to. The result is a fair amount of reshuffling without much change in the major indexes.

The lack of major change thus far, however, belies the potential for just that. The Vanguard balanced fund (VBIAX) dropped 2% in the last five days of 2021 and dropped another 2% in the week from 1/4 to 1/10. Long bonds got crushed. While some of these losses have been recovered, I believe they serve as a warning shot of what can happen if/when bond yields break higher. As such the lesson should be to reduce duration risk.

In addition, the Macro Compass is an excellent and relatively new source for macro and market insights. Two points are touched on in this piece that are especially useful.

One is the notion of a monetary reset. This is something I have talked about many times before and Alf provides an excellent summary. This isn’t going to happen today or tomorrow, but anyone with an investment horizon of more than a couple years should be aware of these dynamics because they will dominate the investment landscape.

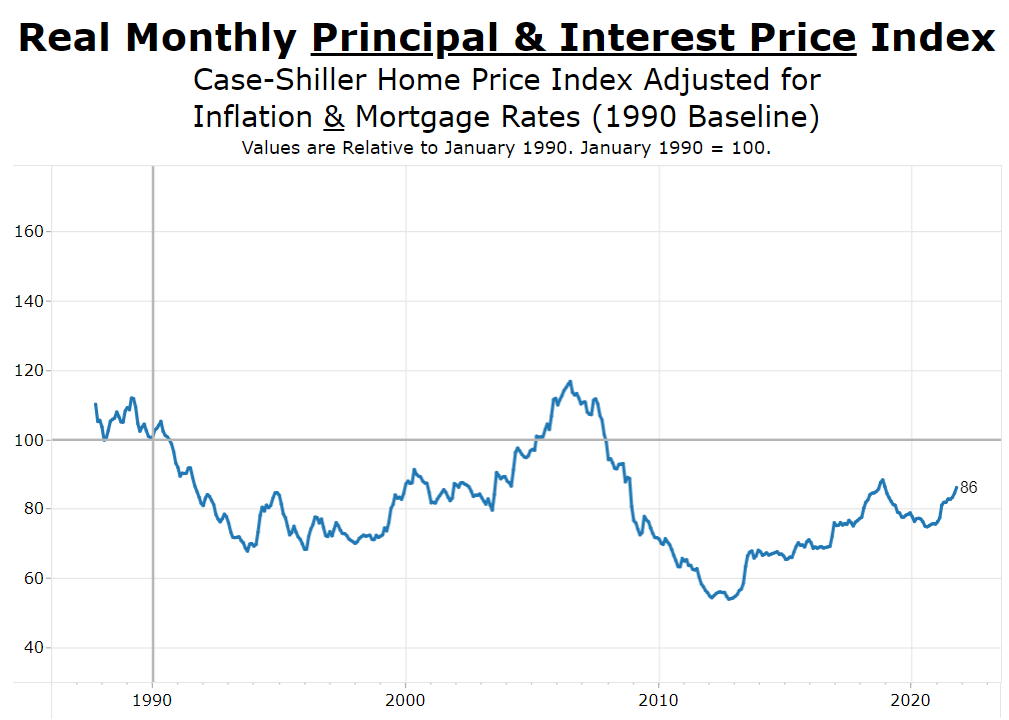

Another point is the discussion of house prices. Alf describes: “To further back the wealth illusion point, consider that the US Case-Shiller Home Price index has gone up by 258% (!) since 1990 but once you adjust it for inflation and the drop in mortgage rates, here is what you get.”

In other words, once calibrated for the effects of inflation and lower mortgage rates, houses are cheaper today than in 1990. What that demonstrates as much as anything is how powerful the effective of inflation is over time and how important the decline in rates has been in boosting house prices.

One point is while house prices may look unbelievably high today, those prices are inflated by unusually low mortgage rates. If rates go up anything close to historical norms, prices will come down - and possibly by a lot.

The other point, however, is if rates stay about where they are, we’re just going to have to adapt to what seem like outrageously high prices. Of course that logic works both ways. What may seem like extremely healthy retirement savings aren’t going to be able to buy in the future what they have bought in the past.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.