Observations by David Robertson, 11/8/24

It was an eventful week with both the election and the FOMC meeting. Let’s dig in to consider what it all means.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

Stocks popped on Wednesday morning on the announcement of Trump as the winner of the presidential election. Part of that was simply volatility crashing due to the election being over.

Notably, however, a number of other markets experienced wild moves on the basis of Trump’s victory. John Authers ($) provided an interesting dashboard:

The 10-year Treasury yield spiked higher as did the US dollar. Both gave back a fair bit on Thursday, although stocks remained buoyant.

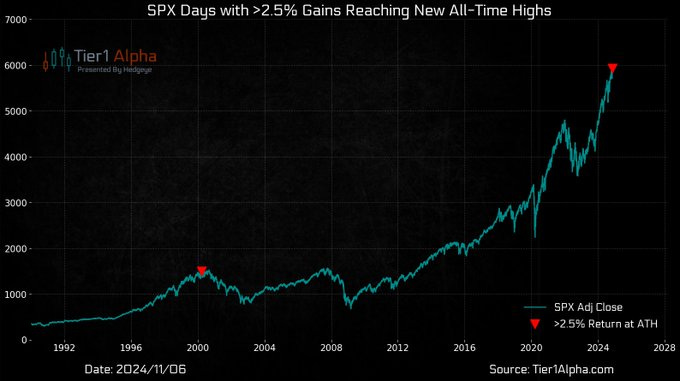

Tier1Alpha made an interesting observation about the market response to the election: “Fun fact: This was only the 5th time since 1960 that $SPX returned more than 2.5% while simultaneously breaking into an all-time high. The last time this happened was March 21st, 2000.” Exuberance certainly. Time will tell how rational it was.

China

The news coming out of China continues to be bad. For a society that for years had few investment options other than real estate, the real estate crisis/debt deflation is incapacitating. While public policy measures are beginning to come out, a couple of anecdotes highlight the magnitude of the challenge.

One way to raise money to plug fiscal holes is to go where the money is. As the FT ($) reports, Chinese officials are ramping up efforts to collect taxes from the wealthy:

Tax officials in recent months have asked wealthy individuals and companies to carry out “self-inspections” of their tax payments and cough up any deficiencies, as local governments hunt for revenue to refill coffers depleted by a property slump.

While the enforcement of tax collection can send a message of competence and fairness, it can also send a message that you have a target on your back if you have a certain amount of wealth.

In addition, Michael Pettis observes an increased effort to squeeze money out of small businesses:

Many friends of mine who own businesses have complained that the only problem worse than weak domestic demand has been predatory action by local governments determined to find new revenue sources. Because local governments can't go after SOEs, it is SMEs that bear the brunt.

These examples provide some good context for just how serious the problems in China are. As such, they also indicate, as Bob Elliott highlights, that news coming out of China this week may prove every bit as consequential as news coming out of the US.

While focus is on the US election & Fed, China's Standing Committee meets this week to discuss stimulus plans which could have even greater impact on the global economy.

Monetary policy

Coming into the Federal Open Market Committee (FOMC) meeting this week, there were two distinct and opposite views as to the appropriate policy response. One camp views moderate inflation and weakening employment numbers as more than sufficient reason to justify another rate cut. Another camp views still-low unemployment, near record high stock prices, and record low credit spreads as sufficient reason to pause on easing.

What has been less discussed, and probably more important in terms of liquidity, is what happens with balance sheet policy. Joseph Wang highlighted what could be a seriously complicating factor to the Fed’s overall position on monetary policy:

Very hawkish balance sheet thoughts by Logan - suggesting not just future MBS sales but for Fed to shift Treasury composition towards more bills (implies more coupons for private sector to hold).

In the event of dovish policy on rates and hawkish policy on the balance sheet, what would the net effect be? If the balance sheet effect is higher long rates and higher mortgage rates, my guess is negative.

Of course, the “hawkish balance sheet thoughts” may have been delivered with ulterior motives. They could have simply been jawboning in an effort to undermine the perception policy has been “over easy”. They also could have been politically motivated. They could have just been talking out loud.

Regardless, on game day the Fed press release focused solely on interest rate policy and Chair Powell delivered typically anodyne comments at the press conference.

That said, there were a few interesting reveals, all along the lines of the Fed really being a pro capital (vs. pro labor) machine at heart. The most interesting tidbit was the last question which touched on the appropriateness of undershooting inflation for some time in order to normalize price levels. Powell didn’t hesitate a second in responding that would not be appropriate. So there you have it, by the Fed’s reckoning price “stability” means prices only go up!

Public policy

Trump’s trade remedies reflect America’s troubled reality ($)

https://www.ft.com/content/c72fac7b-4b0c-4981-8bc8-8999bde17900

The trading system is not the only culprit in this tragedy [of slowing growth and growing inequality], but it is a major one. Economists’ free trade prescriptions fail because they do not reflect modern reality. Classical economists told us that a country exports in order to import. That is how it gets the “trade benefit” — Portuguese wine for English woollens per Adam Smith. We got the theory of comparative advantage from David Ricardo — a country produces what market forces say it makes best, not everything.

Yet, what we have seen in recent decades is countries adopting industrial policies that are designed not to raise their standard of living but to increase exports — in order both to accumulate assets abroad and to establish their advantage in leading edge industries. These are not the market forces of Smith and Ricardo. These are the beggar-thy-neighbour policies that were condemned early in the last century.

A major point is this article reflects one of the rare instances in which the core cause of a troubling problem is properly diagnosed: Slow growth and rising inequality are the undesired consequences of large trade imbalances imposed by countries (like China) that design policies to “increase exports”.

Mike Green ($) makes clear that with such policies in place by trade partners, doing nothing is tantamount to conceding the design of industrial policy to others:

If the US refuses to take strategic actions to maximize US citizens' individual and aggregate wealth, others will make those choices for us. This has been the pattern of the US over the last 30 years as we allowed the vision of the “free market” to override commonsense and the objective of a “competitive market.”

As a result of these pieces, it is much clearer to see what the problem is. China has designed a trade policy that emphasizes exports, at least partly because it has been relatively easy to subsidize the supply of manufactured goods to boost economic growth. That has only worked because the US has been complicit in accepting the consequences of large trade deficits in the form of a combination of higher debt and higher unemployment.

This won’t end until the US changes its trade policies. Fortunately, there is both growing recognition of the problem and a fairly straightforward playbook for a policy response.

Investment landscape I

There have been a lot of takes already regarding which trades are likely to work under a Trump presidency. While some of those ideas can be useful for traders, for longer-term investors it is more useful to understand what the election does and does not signal about the investment landscape.

For starters, the demographic breakdowns showed Republicans gaining with virtually every group except white college educated women and seniors (65 and over) (Source: FT.com ($)):

Clearly, the Democratic message did not reach very far. Van Jones captured the dynamic well (h/t The Rabbit Hole): “If progressives have a politics that says all white people are racist, all men are toxic, and all billionaires are evil it’s kinda hard to keep them on your side. If you're chasing people out of the party, you can't be mad when they leave.”

Russell Clark ($) also posted some interesting thoughts about the election:

The thing about the President Trump getting reelected and likely sweep by the Republicans is that America First is here to stay. In some ways, this moves US political practice is closer to US business practice. What I mean by that, is that rules are not so important - leverage and power is.

In the longer term, I would bet on politics in the rest of the world turning more violent. Rule of law and free trade politicians are useless against a Trump administration.

Clark’s descriptive phrase, “rules are not so important - leverage and power is” sends chills but mainly because it is such a coldly realistic, clinical assessment. While I think it will be easy to overstate the degree to which this will be the case, I also think it is a useful eye-opener for anyone doing business or investing.

All that said, as the graph from The Daily Shot shows, this election was unique in demonstrating an extended pattern of anti-incumbency: “This is the first time since the late 1800s that an incumbent party in the White House has lost three consecutive presidential elections.”

This trend is not constrained to just the US either. As John Burn-Murdoch writes in the FT ($), the sentiment against incumbents is a worldwide phenomenon:

the economic and geopolitical conditions of the past year or two have created arguably the most hostile environment in history for incumbent parties and politicians across the developed world.

The incumbents in every single one of the 10 major countries that have been tracked by the ParlGov global research project and held national elections in 2024 were given a kicking by voters. This is the first time this has ever happened in almost 120 years of records.

In light of this context, it is best to not read too much into the Trump victory. Voters are dissatisfied everywhere. Problems have been kicked down the road by politicians for too long. As Burn-Murdoch concludes, “But it’s possible there is just no set of policies or personas that can overcome the current global anti-incumbent wave.”

Another perspective which deserves consideration is that we should be looking less at the political parties and political figures than the money and power behind them. Izabella Kaminska posts:

Separately I think what is also happening, which is underemphasised, is that Trump 2.0 is more of a cut out operation. Trump is more like Yeltsin in the 90s - just without the booze. The shots are really being called by the techbro/industrialists who have backed him. Just like in USSR I think this kind of represents a schism in the security apparatus, where the “underworld” the security state used to depend on to interface with the market, has outmanoeuvred the security state.

And now, just as with Russian shock therapy reforms, everything depends on the ethics of those industrialists. Will they use the power Augustus-style to maintain and extend Pax Americana by reinvesting in the US and championing an AI-boosted Ara Pacis. Or will they use the power to enrich themselves and their goons even further.

This suggests there is a bigger game at play. While the outcome of that game is still very much uncertain, it suggests too much focus on political parties and personas runs the risk of missing the more important forces shaping the investment landscape.

Investment landscape II

Long-term Treasury rates have always been extremely important for financial assets because they comprise the “risk-free rate” foundation of valuation models. For many years, that rate was effectively subsidized as foreign central banks that had trade surpluses with the US bought Treasuries with the excess dollars. They also did so without regard to price.

As Jim Bianco rightly highlights, the trend in these price-insensitive purchases of US Treasuries has been clearly downward: “Over the past few years, foreign official entities’ holdings of U.S. Treasury notes and bonds has dwindled. From a peak of $4 trillion in July 2021, these holdings now total $3.57 trillion (orange).”

Bianco goes on to describe … “Over the same period, private foreigners more than picked up the slack. Their holdings of notes and bonds went from $2.66 trillion to $3.79 trillion (red).” In short, while there are still ample buyers for Treasuries, the mix of buyers is becoming increasingly price-sensitive. When people talk about the potential for bond vigilantes to come back, this is what they mean. Bianco concludes, “While this is good in that it allows for more honest price discovery in the bond market, it may also come with a more volatile market as buyers are more discerning.”

This is especially relevant at a time when Treasury bond yields are low relative to their historical relationship with economic growth and inflation and when the Treasury has been issuing a disproportionately large amount of bills relative to coupons. The big point is, when coupon issuance becomes normalized, there will be more bonds to sell and price-sensitive parties will increasingly be the price setters. These conditions strongly suggest an upward bias to longer-term yields.

When this happens, it will be extremely difficult to deal with. The persistence of higher yields would impose much tighter financial conditions, but efforts to further suppress yields would unleash inflation. No good choices.

Investment landscape III

While markets have clearly expressed optimism with the election of Trump, there are no small number of risks that continue to threaten financial markets. This is a good opportunity for a quick survey.

First and foremost on that list is Trump himself. Robert Armstrong at the FT ($) writes:

Investors think they know who they are dealing with in Trump. They probably do. But that “probably” is a bit dangerous here. The man is hard to predict. He is not bound by history or his past statements. The distribution of outcomes for his presidency will have fat tails.

I’m always amazed at how people can believe Trump is good for business but also acknowledge that he is hard to predict. News flash: Unpredictability is bad for business! During his first term, the economy was plugging along, rates were low, and as a result, the consequences of missteps were also low. That is far less likely to be the case this time around.

While I believe there is plenty of room for policies that are incrementally beneficial to business, I also believe there is under-appreciated potential for instability that is harmful for business. The main question is how long the honeymoon will last.

That brings us to a long list of factors that have the potential to cause investors trouble. First on that list is valuation. As much as one might believe earnings will grow much faster, stocks are already discounting the most optimistic conditions in history.

Also close to the top of the list is liquidity. The Fed’s Reverse Repo Program (RRP) has gradually but persistently provided liquidity for markets but is now nearly depleted. Going forward, the rising supply of debt will need to be funded by sales of other assets.

Also high on the list is longer-term interest rates. These are a good indicator for overall financial conditions and are rising rapidly, even as short-term rates decline.

Another item which rarely gets mentioned is accounting. After strong stock moves, companies find it increasingly difficult to meet expectations, so they have incentive to tweak the numbers. This was absolutely the case in the tech bust in 2000 and there is increasing evidence it is happening again.

Concern about geopolitics often gets relegated to weekend firefights, but as global trade imbalances become a higher priority, foreign relations are going to become a more regular and persistent risk factor for stocks.

The most obvious instance is China. Not only could much higher tariffs increase the cost of many goods, but China could launch a deflationary wind across the globe if it devalues the yuan. Japan could also cause problems for US markets if it starts repatriating capital it has invested in US markets.

In addition, the Eurozone is caught with weakening growth and inadequate supplies of energy while also at risk of losing military support from the US. The middle east was always a bubbling stew of potential conflict, but is likely to lose US oversight as a peace keeper.

While these are some of the more important risks to monitor, they aren’t the only ones. I didn’t even mention two of the most fundamental problems of debt and demographics.

However, the main point is the Biden administration went all-in to win the election and in doing so, suppressed a number of risks. One of Trump’s main priorities seems to be to shake things up. It’s fair to say some things do need to be shaken up, but too much shaking could be a lot more than investors are bargaining for.

Implications

Now that the election is over, it’s like the dog caught the car - now what?

One of the most interesting aspects of the Wednesday morning market moves was the number of instances of what appeared to be glaring inconsistency. The US dollar was up huge, almost 2%, when Bitcoin was up almost 7%. Isn’t Bitcoin supposed to be the the replacement for the dollar?

In addition the 10-year Treasury yield shot up even further, almost 18 bps while stocks also pushed much higher. Aren’t higher discount rates supposed to be negative for stocks?

It seems like much of the action on Wednesday was primarily the result of degenerate gamblers placing their bets. Not too surprising given the magnitude of the occasion.

Going forward, the way these types of inconsistencies get resolved will be telling. If long-term yields keep going up, stocks are going to get hit sooner or later. If the US dollar remains so strong, it will not only obviate the use of alternative monies like Bitcoin, but it will also severely constrain financial conditions in the rest of the world. The euphoria of everything going up at the same time is not likely to persist for very long.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.