Observations by David Robertson, 12/16/22

It was a big week for economic and financial data with the CPI on Tuesday, FOMC on Wednesday, retail sales and unemployment on Thursday and a massive options expiry on Friday. Let’s dig in to see what’s going on. By the way, if you ever want to follow up on anything just let me know at drobertson@areteam.com.

Market observations

Stocks started the week strong with the S&P 500 up 1.4% on Monday. In the absence of meaningful market news, this runup appeared to be a bet on a benign CPI reading coming out on Tuesday. Behavior in volatility corroborated this thesis: VIX was up almost 10% in one of the very few instances in which volatility rose substantially while stocks also rose substantially.

Stocks burst out of the gates on Tuesday jumping over 2% at the open on the tails of a softer than expected CPI report, kissed 4100 at 10:00 (S&P 500), and tailed off the rest of the day. Treasury prices followed a similar pattern spiking from the CPI news early and then giving up gains the rest of the day.

This would have been eventful enough, but Sam Bankman Fried, founder of crypto exchange, FTX, was also arrested early in the week. With the likes of @EpsilonTheory and @AlderLaneEggs providing all kinds of incriminating analysis on Twitter, it is hard to say whether the authorities finally moved out of a sense of duty or rather a sense of embarrassment and CYA. Either way, one of the bad guys is locked up.

The FOMC met on Wednesday and gave analysts a lot to talk about and the markets a lot to gyrate over, but at the end of the day, provided little incremental insight. Overly hawkish or overly dovish commentary revealed more about the commenters than the Fed.

Stocks got beat up on Thursday which took away the week’s gains - and a little more. Overall, the week was much ado about nothing.

Technology

The big news in artificial intelligence has been the unveiling of OpenAI’s chatbot, ChatGPT. The program uses natural language processing to take in inquiries and spew out responses that in most instances make a remarkable amount of sense.

While many articles are ebullient about this “one great leap for mankind”, others compile the still-noticeable shortcomings. What is certain is that it is an improvement over past tools and is starting to look a lot like something people can productively benefit from. It is free to check out at https://openai.com/blog/chatgpt/ - all you need to do is create a user account.

Inflation

I like this quick and easy analytical take on inflation - stay out of the weeds and focus on incomes. This approach avoids many of the pitfalls of sniffing out all the analytical details. For example, there is more data on goods inflation than services, but services are a bigger part of the economy. There are also lots of timing issues and the importance of some factors can get overrated largely because they are more visible (e.g., gasoline).

Incomes keeps things easy - and mainly right. On this front, there are two main issues to track. First, the table shows incomes continuing to grow at a fairly hefty 5-6% per year pace. Even if this flattens out, it implies inflation only falling to the 5-6% range. Income growth will need to fall to get anywhere close to the 2% inflation target.

The second issue is income growth is still falling behind inflation so real wages are falling. It is easier to imagine workers demanding wages catch up to inflation and even surpass it than it is to imagine workers resigning themselves to continuous erosion of quality of life by way of declining real wages. At some point, I would expect income growth to exceed inflation - and then we will have a real wage-price spiral.

Politics

I’m not going to go quite as far as @FedGuy12 in claiming pension fund bailouts are now de facto public policy, but there are a couple of important points embedded in this news. The smaller point is yes, there are a lot of underfunded retirement plans and now with the ice broken, it is not hard to see a path to much greater public assistance in backstopping the promises made to retirees.

The bigger point is this is a quieter but still effective way to generate inflation than fiscal or monetary policy per se. While the aid is coming from the March 2021 American Rescue Plan (ARP), obviously funding the Teamsters pension fund is a very discretionary allocation. This is the point: Whether funded or not, discretionary allocation of public funds are likely to be the embers that keep the inflationary fire burning.

Geopolitics

Terrific insight (again) by Michael Pettis regarding the global system of trade. As he concludes, the multiple squabbles about tariffs and other constraints are “almost prima facie evidence that the postwar trading system no longer works to promote an optimal trading environment”. In other words, the problem is not the constraints, but the system itself.

The problem with the system is that a number of countries rely on “large, persistent surplus to resolve their domestic demand problems”. Not only does that perpetuate imbalances, but also provides motive for those countries to avoid change.

The negative view is it looks like there will continue to be conflict over trade. The positive view is it looks like the goal is to develop a better and more efficient regime for trade and capital - and that would be worth fighting for.

Monetary policy

After monetary officials have spent the last decade or so plugging every hole in U.S. money markets, it’s likely they will have to perform the same circus, this time in the U.S. Treasury market complex.

As market participants continue trying to guess what part of the market might break this time around, the good news is many of the holes have been plugged. This piece by Concoda on Substack does a nice job of chronicling adjustments that have already been made and new ones that are on the horizon.

Since the Treasury market is a likely problem area, it has been the focus of policy remedies - which anchor on the construct of central clearing. While it is encouraging plans are in place to correct deficiencies, it is unfortunate the chances for proactive intervention are low. “Bureaucracies are slow to react to monetary threats and usually end up imposing emergency measures — some of which turn into conventional monetary policy.”

Hopefully the next emergency measures will be planned well enough to establish a more robust Treasury market.

Interest rates

The inverted yield curve has been the talk of the town with the 2-year/10-year and the 3-month/10-year Treasury spreads being the most popular. The 2/10 spread, for example, is getting so much attention because it has plumbed deeper into negative territory than either the Tech bust in 2000 or in the buildup to the GFC in 2006.

The attention these spreads get is related to the quality of information content they convey: Historically, they have been extremely accurate indicators of recession. As a result, a lot of investors are taking the cue from deeply negative spreads that an upcoming recession is a no-brainer and the only question is, “How deep?” Headlines like “The most anticipated recession ever?” are testament to this belief system.

While the outcome of a recession is certainly a possibility, it is less certain than the historical record of yield curve inversions suggests. The reason is current conditions are different than most of that history. With record intervention by the Federal Reserve leading to a record balance sheet, longer-term rates have been providing less information content than they have in the past. To wit: A year ago 10-year Treasuries yielded just 1.5% and revealed nothing about the inflation that was about to flare up so violently.

By the same token, I would argue, it is dangerous to take current longer-term rates completely at face value. While inverted yield curves may generally speak to impending economic weakness, there is also a good chance it speaks to the mispricing of inflation expectations. Relatively low long-term rates suggest inflation will rapidly come down and stay down. As Research Affiliates points out though, there is no sound basis to believe inflation will evaporate so quickly:

The main point is inverted yield curves should be considered in a different light today. While their historical record is strong, conditions have changed. Analysts should remain flexible and avoid dogmatism.

Investment advisory

For the Market's Winners, the Hard Work Starts Now ($)

No one could have predicted the events that unraveled into 2022, he [David Kelly from JP Morgan] said, from the war in Ukraine that pushed inflation to its highest in four decades to a rate-hiking spree by a Federal Reserve hell-bent on taming surging prices of goods and services (which almost nobody foresaw as the year started), prompting a sharp sell-off in stocks and bonds. But when it comes to the greatest risk for the coming year, he’s clear: “From an investor perspective, the biggest risk is waiting too long to get invested by waiting until we feel everything is okay,” the firm’s chief global strategist said in a video call. “We are so accustomed to worrying about the next great disaster that we freeze.”

I don’t know if David Kelly actually believes this or not, but I can’t read it and not see a shameless attempt to retain business rather than to advise in the best interests of clients. He comes right out of the gates with mischaracterizations and misinterpretations. Actually, yes, many people did predict inflation because the underlying causes were in place. While Russia’s invasion of Ukraine exacerbated some price pressures, it was by no means the sole cause. Also, by the way, it is the job of an investment professional to dig into these things and get ahead of the curve rather than drum up excuses as to why it wasn’t your fault.

Despite completely missing the inflation story, he reveals absolutely no contrition and instead doubles down on the suggestion that any conservatism at this stage is actually “risky”. But this is Wall Street: Cheesy used car salesperson demeanor cloaked with a well-known brand to convey some degree of respectability.

Importantly, and once again with feeling, this doesn’t help investors get better results. What it does is enable most investors to do what they want to do - which is nothing - even though the landscape is changing and their investment strategy is not. It also enables providers to retain business and therefore profitability.

Investors who want to “feel” like they are doing the right thing without exerting the effort to do so will find plenty of providers willing to help separate them from their money.

Investors who truly want better results need to challenge their advisors and providers in order to get the best information and ultimately to drive the best decisions. The healthiest relationships are built on constructive conflict and fiduciary duty.

Investment landscape I

Your Second-To-Last Chance To Get It Wrong In 2022

https://www.zerohedge.com/markets/your-second-last-chance-get-it-wrong-2022

The IMF Global Debt Database released yesterday showed the largest one-year decline in global public and private debt-to-GDP ratios since the 1950s: it fell 10 percentage points (ppts) in 2021, following the largest one-year increase in 2020, when it soared 29ppts of GDP. I would imagine 2022 has seen an even steeper debt decline in those terms.

After all, I am no gold-bug … but this debt decline is not a bug, it is a feature - it’s always been one of the reasons why we have high inflation. As such, anyone seriously thinking we must get back to low inflation and low nominal GDP growth again when debts are so high is not being serious about our real underlying problems.

As frequent readers know, I’m a big fan of focusing on big honking issues as opposed to day-to-day “noise”. One big honking issue Michael Every from Rabobank addresses is the enormous debt burden many countries and companies have. To that point, inflation is actually making the situation … better - by allowing nominal GDP to outpace growth in debt.

So, one point is this is exactly why I expect inflation to continue at a higher level than in the past - because it is the least worst way to manage excessive debt burdens. Governments simply cannot stay in power as economic growth stagnates, populations age, and debt continues to grow without debasing money in some way. To expect something else is to expect some magical silver bullet cure. Possible, but extremely unlikely.

With this understanding then, the only real question is whether inflation will be a relatively slow, manageable flicker, or whether it is a massively destructive five-alarm fire. The magnitude will depend on where and how the excess money gets distributed. As Every highlights, “The only issue is if the money goes into productive areas, like supply, as a way to bring inflation down slowly, or unproductive ones, like demand and financial bubbles.”

In an important sense then, the magnitude of inflation will be a function of quality of public policy making.

Investment landscape II

Market Sit-Rep December 12th, 2022 | "Understanding The Transmission"

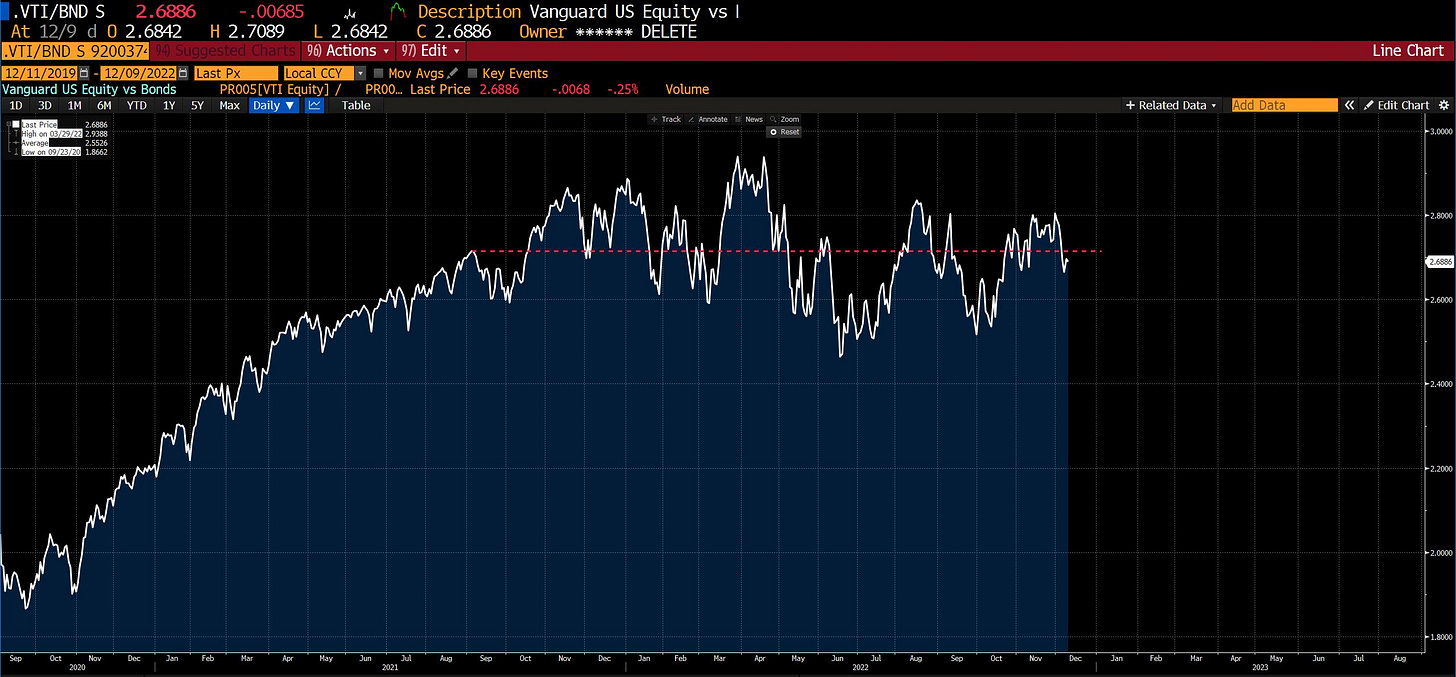

The two papers build off the work of Jonathan Parker of MIT, whose paper "Retail Innovation and Stock Market Dynamics" in 2020 postulated the idea of a rebalancing channel where the Fed, by raising or lowering interest rates, affects the price of bonds and by extension the price of equities -- not through discounted cash flow valuation, but through systematic portfolio rebalancing. If you have a systematic rebalancing strategy, e.g. a target date fund, when you lower the price of bonds you must sell equities and buy bonds.

The concept that passive investing has fundamentally changed the investment landscape by way of flows driving asset prices is one Michael Green has championed for several years now and one I have highlighted here several times. Flows also help explain some unusual market activity this year as Tier1alpha lays out.

For starters, when interest rates are pushed up, which the Fed started doing this year, bond prices go down. When there is a large proportion of balanced (e.g., target date) funds, that means those portfolios need to be regularly rebalanced. That means if bond prices go down more than stocks, bonds need to be purchased and stocks need to be sold, and vice versa.

In short, the Fed, “by raising or lowering interest rates, affects the price of bonds and by extension the price of equities -- not through discounted cash flow valuation, but through systematic portfolio rebalancing”. The effect is to tighten the relationship between stocks and bonds regardless of what fundamentals might suggest for either. This has happened.

A related effect is the combination of regular rebalancing and a relatively static guidelines for the holdings of stocks relative to bonds provide something of a governor on volatility. This helps explain the “relative lack of high volatility events”. It also helps explain why it has been so difficult to short this year despite some very tempting setups.

Implications for investment strategy

Judging from the items above, there are two big things investors should watch out for in the new year. One is for long-term inflation expectations to adjust higher. While inflation is likely to continue to fall in the short-term, I believe some time next year it will become obvious that inflation is not going quickly or sustainably fall down to 2%. This will cause lots of problems and investors should be prepared for that scenario.

Another thing to watch out for, and it may amount to the same thing, is a change in the volatility regime. The Fed has been able to continue raising rates with a program of “controlled demolition” at least partly because the rebalancing of passive funds has helped reduce volatility. This has masked the risk of stocks and other risk assets adjusting quickly down to values based on fundamentals. It can happen and there’s a good chance it will happen.

As Tier1alpha advises, “In the meantime, keep your arms and legs inside the vehicle. The ride is about to get bumpy.”

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's partar financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.