Observations by David Robertson, 12/17/21

With a big Fed meeting on Wednesday and lots of volatility before and after, it has been an eventful week. It is also the kind of environment in which “Observations” is especially useful. Check in to get perspective on things and by all means share it with others who might be interested!

I’ll be off next week for the holidays and will probably post an abbreviated note at the end of the year. If you have questions or comments during the interim, let me know at drobertson@areteam.com. Otherwise, happy holidays!

Market observations

The market’s mood does seem to have shifted over the last several weeks and the changes are most evident in some of the craziest stories of the year. Meme stocks are down, and so are nonprofitable tech stocks, the most expensive stocks, and bitcoin. Perhaps the most succinct way to summarize this activity is in the graph below showing the index of most popular names on investing forums.

None of this is to say retail interest is dying – at all. The volume of absolutely idiotic and uninformed content out there is mind boggling. Jim Chanos, who ranks in the analytical elite, referenced one particular video in the tweet below, but there are so many pieces to choose from. If you have not done so, I would recommend checking at least a couple of them out in order to appreciate the mindsets that have been driving stock prices.

Finally, a sharp rally after the Fed meeting on Wednesday may be something – or not. With the S&P 500 poking at new all-time highs, it certainly creates the impression there may be a new leg of upside on the way. However, Vix (volatility) was unusually high going into the meeting and got crushed after. Zerohedge reported, “Either a bullish Fed and/or OPEX could trigger a violent rally that is purely a function of puts positions unwinding.” So, maybe the rally was just based on some hedges unwinding. We will see.

Coronavirus

At this point, I would like to interrupt regularly scheduled programming to point out that coronavirus is still not dead. Sure, the Omicron strain seems to be less dangerous than Delta, but it is also much more infectious. As Ben Hunt highlights in the tweet below, the number of active cases is at an all-time high – a fact not widely reported. For what it’s worth, this also jibes with my anecdotal evidence of a lot more people getting infected.

I don’t see this as any reason to run around like your head is on fire, but there are implications. For one, as infections rise, governments are going to be compelled to “do something”. This is much more evident in Europe right now, but it is coming our way. Second, higher infection rates and more countermeasures will mean fewer people showing up to work and therefore more friction in the economy. Be safe out there.

Emerging markets

EMs hit by abrupt slowdown in overseas investment ($)

https://www.ft.com/content/0b2c2c42-420c-4610-a7d7-747146905e59

“Foreign investment in emerging market stocks and bonds outside China has come to an abrupt halt over fears that many economies will not recover from the pandemic next year, their prospects worsened by the Omicron coronavirus variant and expectations of higher US interest rates.”

“’We’ve seen the willingness of investors to engage with emerging markets dry up,’ said Robin Brooks, chief economist at the IIF.”

Emerging markets are continuing to experience the worst of all worlds. Wracked by inflation, these countries are having to raise interest rates. In doing so, they are also putting the brakes on growth. Further, there is no respite in offshore markets either with the Fed getting tighter with its policy. Higher rates and lower growth are never a compelling investment proposition and even less so when there are more attractive options. There will be a time for emerging markets, but not yet.

Inflation

The CPI numbers came out last Friday at an annual rate of 6.8%. One point is this probably comports reasonably well with most people’s experiences – a lot of prices are noticeably higher. Given this is territory we haven’t been in for a long time, and territory that is extremely sensitive politically, there is likely to be a lot of jawboning trying to characterize the trend. An important antidote for attempts to disarm your concern about inflation is to understand historical patterns.

For starters, over short periods of time inflation, bounces around. The graph above shows monthly CPI readings over the last year. From Nov20 to Apr21 it looked like inflation was increasing exponentially. Over the summer, it looked like inflation was cooling off. The point is, it is very hard to establish any meaningful pattern, or infer any meaningful insight, from a single monthly reading.

If we zoom out to a five-year view, we start getting a little more perspective. Inflation was pretty flat and pretty low right up until the Covid lockdowns. After the initial recovery, however, it is also clear that prices have been on a more volatile, but clearly upward trajectory.

Zoom out again to a 100+ year perspective and a few more patterns become evident. Inflation has been consistently lower and less volatile over the last forty years than before. A few big peaks punctuate the landscape, but none since the early 1980s. Perhaps we are due for another one?

Inflation and the Common Knowledge Game

https://www.epsilontheory.com/inflation-and-the-common-knowledge-game/

“For months now, Missionaries large and small have been saying that inflation is here and inflation is well-embedded. But when the most powerful Missionary in the world, Jay Powell, says that inflation is no longer ‘transitory’ … well, now everyone knows that everyone knows that inflation is here to stay.”

“And when everyone knows that everyone knows that inflation is here to stay, ALL businesses can raise prices to maintain margins without fear of competitive pressure or customer pushback.”

Ben Hunt has produced some of the most prescient analysis on inflation and this piece is an excellent refresher. His main point is with Jay Powell acceding that inflation is not transitory, it sends a strong message to the entire world that inflation is now a real thing to deal with. This will unleash a lot of forces: Companies can raise prices and workers can push harder for wage increases.

Monetary policy

As analysts anxiously awaited the Fed meeting with bated breath, the outcome was mostly as anticipated. The tapering of quantitative easing (QE) was accelerated which puts the program on course to be concluded in March. The completion of QE will then be the starting gun for rate increases which are expected to follow in short order.

With rates in the limelight, the market for Treasuries is beginning to rumble a bit in the background. As the Fed rapidly withdraws its support of the Treasury market, the Treasury will be revving up its debt issuance machine. The combination of issuing debt for new spending and rebuilding the Treasury General Account will rapidly soak up funds, many of which are currently parked in the Fed’s reverse repo facility. In a few months, when natural demand for Treasuries gets overwhelmed by new supply, we are going to start getting hints at what more natural, market-based long-term interest rate might look like.

This highlights what a tenuous position the Fed is in. Back off QE and rates are likely to get wonky. Maintain QE and inflation is a massive political liability. Some clues to how the Fed thinks about this tradeoff were provided in the press conference after the release.

Based on those comments, John Authers described, “There is still no belief at the Fed that inflationary conditions are ‘normalizing’,” and that the dominant belief at the Fed is “inflation can be brought under control with relative ease.” In other words, the Fed’s heart does not really seem to be into inflation hunting.

The tweet below by Jim Bianco also provides useful color on the reaction to the Fed. His explanation is that Powell’s elaboration signaled something like, “Wink, wink, nudge, nudge, we aren’t going to do anything to upset the markets.”

While Powell has been skillful thus far in walking a fine line between sounding responsible on price stability yet also being accommodative for markets, the room for such maneuver is running out. Quite arguably he hasn’t done anything difficult at all; he has just stalled for time. When that time finally runs out, there will be consequences. It looks like we are getting close.

Investment landscape

Triumph of the optimists: 101 years of global investment returns, Elroy Dimson, Paul Marsh, and Mike Staunton ($)

First off, Triumph of the optimists is one of the great works of financial history that any student should read and thoroughly understand. The vast majority of investors and advisors do not.

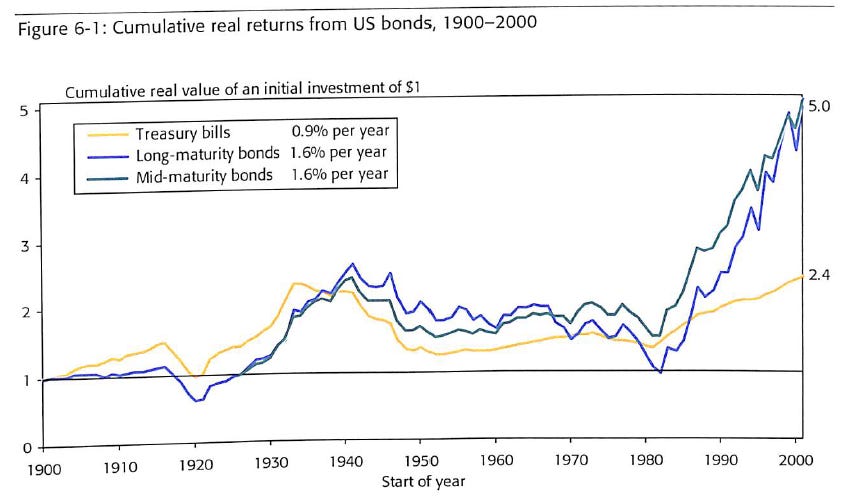

Second, its lessons are especially relevant today. Focus on the blue line that represents real returns from long bonds and it becomes immediately evident that history is dominated by a small number of distinct regimes. Early in the 1900s bonds did very little. From 1920 through the start of World War II, bonds were terrific investments. For the next forty years they were terrible investments. Then, for the following forty (twenty pictured, twenty not pictured) they were terrific again.

This pattern makes it looks almost obvious that bonds are in store for an extended period of negative real returns. Of course, there is the question of when that period starts. Also, there is a question of whether the negative real returns that bonds are likely to experience are any worse than the real returns from other financial assets. They may be the best of a bad lot.

Regardless, exceptionally few investors or advisors are plugging in negative real returns to their retirement models and when they don’t, their expectations will be too high.

Portfolio management

The main mantra of portfolio management is diversification but because that point has so well been made, many investors and advisors often overlook important details. For example, diversification often focuses on fine tuning weights of different asset classes. That misses the more important objective, however, of protecting against big drawdowns in the tails of the return distribution. In other words, you mainly want to protect against everything going down at once.

This may seem obvious, but in this carry regime, the correlations of financial assets have converged to a great extent. It’s like a black hole and has the same kind of reinforcing mechanism. The more volatility gets suppressed by investors trying to eke out whatever income they can in an environment of extremely low rates, the more financial assets get pulled into the force field.

This has several implications. For one, many different asset classes behave in a very similar way. Most are extremely sensitive to liquidity and interest rates. While it sounds reasonable to consider things like real estate and private equity as diversifiers, effectively they do very little to make a portfolio more resilient. That raises another point. A black hole is an all or nothing gig, and so is a carry regime. As a result, it will be far more important to have assets that will diversify in future conditions.

Finally, one way of thinking about diversification is by level of abstraction. Stocks are abstract in that they are just claims on assets. The closer you can get to owning real assets the better. While this is often hard to do with retirement portfolios, moving in the right direction still helps. Quality companies that consistently produce good cash flows are a good place to start.

Implications for investment strategy

I have mentioned several times that the investment landscape is likely to be far less certain going forward than it has in the past and that is absolutely looking to be the case with inflation. This uncertainty will create challenges for some and opportunities for others.

For example, I absolutely expect we will start seeing short-term indications that inflation is easing in the next few months. As economic growth cools down, fiscal spending slows, and inventories accumulate, it will be easy to pass a narrative that inflation is transitory. Indeed, it is already happening:

The "powerful forces" that will help lower long-term inflation

https://www.axios.com/inflation-economic-data-supply-chain-7cb2a84c-cfb4-4aa8-83b4-b000e869c0a3.html

“After supply chain snarls begin to ease and monetary policy starts tightening, the long-standing economic trends that underpinned the last two decades of low inflation will still be around.”

Such views miss the bigger picture, however. For one, short-term perspectives can be very different from long-term ones as I illustrated in the “Inflation” section. For another, these differences can be exploited by investors who are patient and maintain a longer-term perspective.

The problem with buying insurance against something like inflation is that most people do it when it is obvious. As a result, premiums go up and people get insurance at a hefty price. That also means patient investors can wait until the need becomes less obvious. I think we will have that chance early next year.

Another important element of the investment landscape, in addition to increasing uncertainty, is the nature of the carry regime that I have described many times. A huge part of the problem is that the mechanics of carry are very different than the mental model of free markets that many of us grew up with.

More concretely, free markets are based on the assumption of competition. Companies compete for business, and policy and regulations serve the purpose of keeping the playing field as level as possible.

Carry regimes are completely different. They are based on power and cumulative advantage. More power leads to more advantage which leads to yet more power.

It is not hard to see how the different models lead to different conclusions. Because in free markets there is always a chance to outcompete others and win business, the pattern of reversion to the mean is common. It is extremely hard to maintain significant advantages over competitors for any length of time. In a carry regime, however, winners accrue power which leads to even more power … and more inequality.

The main point here is not to pontificate as to which situation is better or worse than the other, but rather to highlight the different models lead to very different outcomes. This is especially relevant to emerging markets, but it is widely true. The lesson is: Beware the tendency to bet on stocks or sectors or groups that look cheap based on the assumption of mean reversion. By the same token, however, beware the tendency to always bet on winners when inflation is taking root and threatening to destroy the carry regime.

Finally, the tweet below highlights one of the main lessons of investing: Most people realize returns that are lower, and often much lower, than fund averages. The reason, of course, is they tend to buy high and sell low. It is a good reminder that having a long-term plan mitigates much of this risk. It curbs the desire to chase returns and it tends to space out position changes which smoothes out exposure to extreme price moves.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.