Observations by David Robertson, 1/28/22

The roller coaster ride continues. After getting off to a rough start this week, the market went spinning again after the Fed meeting on Wednesday. If you are starting to get motion sickness, or just have a question or comment, let me know at drobertson@areteam.com.

Market observations

One of the unusual phenomena experienced this week was the elevated level of volatility (VIX). After ending last week near 30, VIX shot up to 38 on Monday before crashing down below 30 at the end of the day. This compares to last summer where VIX with 16 and 17 handles were the norm. The graph below captures some of that change.

While the market has experienced other bouts of volatility over the last year and a half, they have tended to be short pulses that quickly dissipate. This bout is persisting. This creates an eerie sense that something different (and worse) is going on.

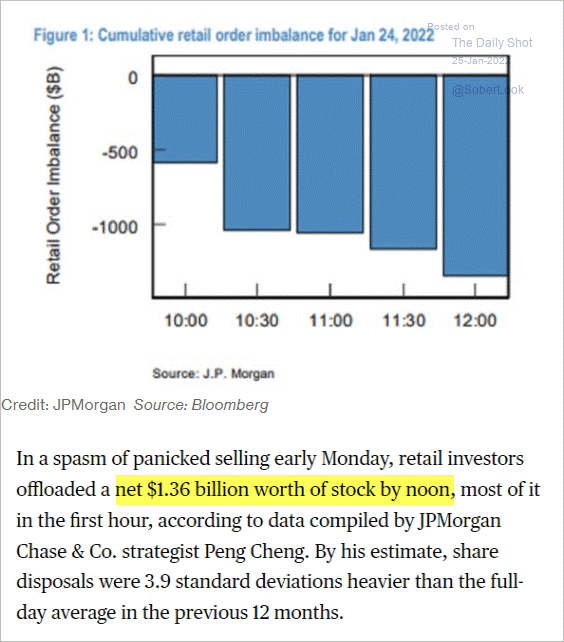

One hypothesis is retail is selling out of positions. The graph below shows there is at least an element of truth in this. With many of the meme stocks and other tools of rampant speculation suffering the most, it is not hard to imagine some newbies are losing their nerve - as well as their capital.

It is also true, however, there is still a lot of dip buying and retail has been involved in that too. It looks like this has been more in the form of funds rather than individual stocks, however. One observation is this is no kind of washout or “panic” from which stocks can be bought cheaply. It is simply a step down with the most egregiously overvalued stocks being affected most.

Another interesting phenomenon this week was the jump in the US dollar. It jumped noticeably during the Fed’s press conference and was up over 1.25% at market open on Thursday. This sends a pretty clear signal that market participants were surprised by the Powell’s hawkishness on Wednesday afternoon.

The dollar adds one more complicating factor to an already complicated landscape for volatility. A higher baseline level of volatility makes for a more challenging market and one that is more expensive to hedge. A higher dollar squeezes liquidity for foreign markets which compresses their growth prospects and by definition, global growth prospects. None of this is conducive to stocks except for the fact it makes US stocks more attractive relative to others.

Economy

US Services PMI Crashes To 18-Month Lows As Omicron Strikes

https://www.zerohedge.com/economics/us-services-pmi-crashes-18-month-lows-omicron-strikes

Soaring virus cases have brought the US economy to a near standstill at the start of the year, with businesses disrupted by worsening supply chain delays and staff shortages, with new restrictions to control the spread of Omicron adding to firms’ headwinds.

However, output has been affected by Omicron much more than demand, with robust growth of new business inflows hinting that growth will pick up again once restrictions are relaxed.

Omicron outbreaks were bad for business in January

https://news.yahoo.com/omicron-outbreaks-were-bad-business-110011060.html

About 8.8 million people didn’t work during the period of Dec. 29 to Jan. 10 because they had to care for someone or were sick themselves with COVID symptoms, according to Census Bureau survey estimates. That’s nearly triple the number of people who said so during the first two weeks of December.

Dealing with inflation is a big honking economic challenge and even more so with the current extenuating circumstances. The proliferation of Omicron took a huge chunk of the work force out of action over the holidays and into the new year. This seemed to have negatively affected the services PMI and no doubt affected other measures as well.

Amex gives bullish outlook as customers ‘adapt’ to pandemic ($)

https://www.ft.com/content/25d1cf5c-9f20-4861-99d5-a240093fc635

American Express has grown confident enough to issue its first long-term revenue forecast since the arrival of Covid-19, saying robust spending across its card network suggests its customers are adapting to the “reality of the pandemic”.

“When I look at our customer base, they have clearly gotten better as time has gone on at learning how to adapt their personal and business lives to [the] reality of the pandemic,” Jeff Campbell, chief financial officer, said in an interview. “We are really on the cusp from a behavioural perspective of turning from a pandemic to an endemic.”

Getting a good read on economic growth will be extremely important for properly calibrating monetary policy. Most likely people will return to work fairly quickly and economic numbers will show fairly strong growth. Evidence from American Express shows consumers are spending and fourth quarter GDP came in ahead of expectations. While solid growth seems to be the main direction, there is also plenty of room for bumps along the way.

Banks

Bank investors face new ‘black box’ quandary ($)

https://www.ft.com/content/dbfb2dca-4bb4-4697-9b4e-b84a5fa8b48e

During a call with Wall Street investment analysts, Dimon was pressed for details on what kind of bang the bank could expect from the big bucks [$12B] it is throwing at tech.

“Investing in banks is always a degree of investing in a black box — it’s a different shade of grey leading up to black,” said Mayo. “In the case of JPMorgan, this got to be too dark a grey for our comfort zone.”

Some comments that came out of the conference call for JP Morgan were interesting because the bank is a microcosm of corporate America - and Jamie Dimon is a microcosm of corporate leadership.

For starters, the $12B number for tech spending that was thrown out came with little additional color. What does it mean? In part it is not so impressive because about half of it is to run ongoing operations. One project mentioned was a transition from a mainframe facility to the cloud. From a mainframe for pete’s sake. Like many older companies, JP Morgan has some seriously old tech and there are no easy answers for modernizing it. This also applies to government.

This might create the image of a lumbering dinosaur ripe for plunder by younger competitors, but there is still 6$B that can be thrown at competing viciously with whoever dares to. Further, JP Morgan is extremely profitable so there is more where that came from. The tech companies have their “kill zone”; maybe Jamie is trying to stake out his own?

This same basic story manifests in several different ways across the economic landscape. On one side is the big, old, established, profitable company that has a lot of resources but which is often resistant to change. On the other side is a fertile environment of smart, ambitious entrepreneurs looking to create better ways of doing things often through the creative application of technology.

Who will win out? It’s hard to say but certainly the battle lines are drawn. Right now it’s mainly capital and incumbency versus people and ideas. It will be very interesting to see if things shift one way or the other or find some kind of middle path.

Energy

U.S. Energy Information Administration Short-Term Energy Outlook, January 2022

https://www.eia.gov/outlooks/steo/

This regular forecast piece by the Energy Information Administration is an excellent place to start for anyone who wants to dig into some details to get a better handle on the industry. Breakdowns of supply and demand (by country) also provide tremendous context for understanding the energy picture holistically. There is also a compendium of great charts in the back. None of this is to say the outlook should be taken as baseline guidance for an investment thesis though; it is merely a useful starting point.

Right now global oil supply and demand is mostly in balance and inventories are forecast to rise modestly in both 2022 and 2023. Thereafter, demand is expected to exceed supply. With such small margins, however, small changes and/or slight differences in assumptions can lead to very different forecasts.

This is what makes oil prices so hard to predict. Small imbalances can lead to major price differentials and supply and demand are comprised of lots of moving parts. Many of those parts are also political and/or geopolitical in nature and therefore are unpredictable.

Another point is that industry experts are often better at understanding the nuances of supply better than those of demand. Detailed modeling and deep industry knowledge absolutely can provide valuable insight. In order to fully understand the demand side, however, different skills and analysis are needed - which normally includes macro forecasting.

Further, firms that focus on commodities are biased. Of course they want their stocks to do well and as a result they tend to be overly optimistic in regard to demand. While good commodity analysis is often an extremely valuable tool, it should still be scrutinized and judiciously incorporated into portfolio decisions.

Is Exxon’s new net zero ambition a big deal? ($)

https://www.ft.com/content/e6ff5e7e-c83d-4958-aac2-7766f1302d51

The company says it is building out “road maps” for how to bring emissions at 33 of its major assets — large refineries, plants and oilfields and gasfields — around the world down to net zero. It says it can get the Permian to net zero by 2030. Ending flaring, staunching methane leaks and electrifying operations will be key.

ExxonMobil made news last week when it rolled out a new energy transition strategy. This was newsworthy partly because it reflected a material change in direction; the company had been stalwart in refusing to budge from its fossil fuel origins. It was also newsworthy for other reasons, however.

For one, the new strategy was the result of a process that started with a proxy battle by a small hedge fund (Engine No 1). The fact that a small player got three seats on the board of an industrial giant makes for a great “David vs. Goliath” story. Further, the winning logic was that the company “essentially did not have a strategy for the energy transition”. Seems like an important omission. On both counts it was a big win for corporate governance.

In addition, the plan the company has spelled out focuses very clearly on existing assets and on activities such as “Ending flaring, staunching methane leaks and electrifying operations”. These activities are the quintessential “low-hanging fruit” in that they are super-easy to do and likely to have a significant impact.

Finally, this move by a large, iconic industrial company sends a shot across the bow of many other companies. The message is you don’t have to be a radical “tree-hugger” to be a more environmentally friendly company. In fact, doing so in a thoughtful and measured way can arguably make your company stronger.

Monetary policy

Following several days of down markets and significant volatility, this week’s Fed meeting was highly anticipated. Things started off well enough with stock futures up before the open on Wednesday and continuing strong through the session. Stocks even got a little extra pop just after the press release hit at 2:00 pm.

Once Chair Jay Powell began the press conference and Q&A session, however, stocks started moving down and the dollar started moving up. It wasn’t that anything new was communicated in the release or that Powell surprised anyone. Mostly he did a good job of being noncommittal.

One comment he made was the Fed considered rate increases to be the primary active tool of monetary policy (as opposed to balance sheet shrinkage). He also described the labor market as “very, very strong” at least three times.

More importantly, he said he didn’t think the risks in the financial system are very high since household balance sheets are in good shape, companies are healthy, and banks are well-capitalized. Powell added the Fed wanted balance sheet shrinkage to be “orderly” but also that there was “substantial” balance sheet shrinkage to be done. Finally, he summarized the Fed’s upcoming effort as “a year of moving steadily away from pandemic policy”.

The most notable outcome was Powell’s comments came across as more hawkish than the press release and more hawkish than many had anticipated. He certainly gave the impression the Fed was not overly concerned about declining stock prices. That said, the Fed hasn’t actually raised any rates or begun shrinking the balance sheet yet.

Investors will just have to wait and see how much fortitude the Fed has for tightening. My guess is it has a lot more fortitude than many investors are currently assuming. I think the Fed is a lot more concerned about appearing to not be the “bad guy” by allowing inflation to run too high than it is about being the market’s best friend.

Investment landscape

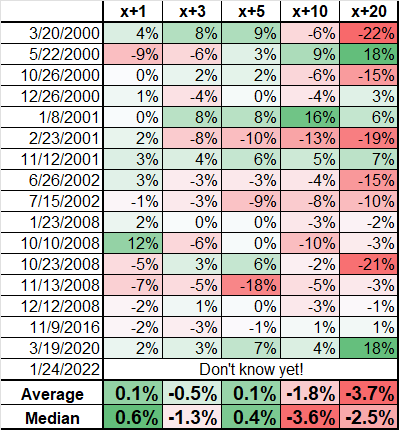

With another rough week for stocks on top of an already rough start to the year, investors are wondering how “real” the selloff is. Is this just another dip (albeit bigger than others) to be bought or is it something more sinister? Both Jim Bianco and Brent Donnelly shot out tweets with their characterizations:

Both reach similar conclusions. As Bianco puts it, “Wild volatility like this tends to happen in a bear market, not a bull market.” This is corroborated by the other instances of wild volatility which have only emerged during broader market selloffs.

The graphs below (from https://themarketear.com/premium) provide a peak into an important source of volatility. Namely, the presence of several systemic strategies is creating a systemic sources of supply. When these funds hit certain triggers, they have to sell; it’s a mechanical process.

This doesn’t have to be a big deal but in an environment of low liquidity, which the last couple of weeks has been, there is a disproportionate impact. When funds must sell there are precious few buyers. Forced selling into tight liquidity creates an ugly feedback loop which can cause prices to drop further.

When a broad swath of discretionary funds exists, those funds can opportunistically provide demand by buying into forced selloffs. As passive investing has proliferated, however, the universe of discretionary funds has shrunk considerably. As a result, when the selling starts there are fewer forces to stanch the decline.

In sum, the market conditions are now dramatically different than what investors have experienced over most of the last thirteen years. “Wild” volatility is likely to be around for some time and while that will undoubtedly create trading opportunities, these will most likely happen in the context of a bear market.

Implications for investment strategy

What do you get when low liquidity is mixed with overly optimistic expectations? You get a lot of investors who need to reduce exposure with only fleeting opportunities to do so. This is a big component of the higher volatility regime and is likely to continue keep market conditions “fragile”.

So what should investors do? The answer depends on your starting point. If you are a long-term investor and fully understand your risk, the answer is, nothing different. If you are a good short-term trader with excellent risk management discipline, the answer is also, nothing different.

Unfortunately, that leaves a lot of people and for them the answer isn’t necessarily to panic, but certainly to start recalibrating. Whether intentionally or inadvertently, these people have taken on a lot more risk than they intended. It’s time to dig in, figure out how much risk one is exposed to, and make adjustments if necessary. If, in that process, things don’t make sense, then it is time to retest assumptions.

In the meantime, this process of catching up to a new reality for risk is already manifesting in some interesting ways. Already quite noticeable are rantings from various apologists. People who just don’t want to believe the risk environment is fundamentally changing are manufacturing all kinds of arguments to explain away recent declines. Many of these are logically inconsistent and some sound desperate. For example, I have seen many analyses suggesting stocks are currently “oversold”, but I have yet to see one that applied the same criteria to argue stocks were “overbought” in November.

Another manifestation is the loss of anchoring. Value investors (myself included) have argued for years that stock prices became untethered from economic fundamentals. In the absence of such anchoring, analysts began applying all kinds of spurious relationships as guidelines. Average performance over the last x number of years or the average outcome of a specific scenario have been common formats.

The fact is, these constructs were never good guides. If stocks are seeming less “anchored” recently because patterns fall outside the norms of recent history, that shouldn’t be too much of a surprise. The constructs were never robust tools and we are at a turning point where a lot of things are changing. That can be scary if you don’t understand what is going on, but it can be exciting if you do.

Finally, a large proportion of the investment commentary I come across is oriented to short-term trading. I believe much of this is well-intended and much is insightful. That said, I would caution most investors, especially long-term investors, from incorporating it uncritically. The activity of trading is extremely difficult and high frequency which means it is easy to lose a lot of money quickly. Further, most people do not have the skills, resources, expertise, demeanor, and other characteristics to trade successfully. I sure don’t.

If you want to play around with money you can afford to lose, sure, you can learn a lot by trading. Make sure to keep money for longer-term investment plans segregated though.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.