Observations by David Robertson, 2/18/22

On again/off again reports of the imminent invasion of Ukraine by Russia dominated news flow during the week. This provided something of a break from Fed news and market pyrotechnics but kept things interesting nonetheless. If you have questions or comments, let me know at drobertson@areteam.com.

Market observations

With the market in something of a holding pattern waiting for something definite to happen (or not) in Ukraine, it is a good time to take a look back and form some perspective on what has happened in markets since Covid first hit about two years ago.

As the chart above shows, the cycle of lockdown opportunism is completing. Beneficiaries had their run of outperformance and now have given it all back up.

It might be tempting to label this a return to normal, but things are hardly normal. For one, there is the issue of how many of the lockdown beneficiaries can survive, let alone thrive, after such massive disruption. For another, valuations are still extremely high.

Economy

Ukraine Threatens a ‘Pulp Fiction’ Loss of Focus ($)

While the headline of this piece features Ukraine, it also focuses on the direction of the US economy. The chart above from Jim Bianco shows “companies are suddenly guiding more bearishly than they’ve done in a decade.” This is telling.

One of the top reasons is rising costs. Many companies have been behind the curve in raising prices fast enough to offset inflation in costs. It was less of a problem last year, however, when demand was strong and year-over-year comparisons were easy. In 2022, things get a lot harder.

For companies, short-term rates are jumping higher and the yield curve is flattening, which signals lower growth ahead. This is corroborated by various sentiment indicators which show consumer confidence levels well below the lows during pandemic lockdowns and the worst since the aftermath of the financial crisis. The future demand picture is not good.

On the subject of tougher times, a thought that keeps occurring to me comes from book, The hard thing about hard things, by Ben Horowitz. He made the point that most leaders are either successful in good times or in bad times, but not both. I suspect a lot of current CEOs got to where they are by surfing the waves of easy money and benign conditions and will be severely challenged in dealing successfully with adversity.

It may well be CEOs are having the same thoughts. According to Axios: “72% of CEOs worry their jobs aren't going to survive the challenges ahead, according to a survey AlixPartners released at the end of 2021. That number is up from 52% the year before.”

Housing

The Housing Party Is Starting to Wind Down

https://www.advisorperspectives.com/articles/2022/02/09/the-housing-party-is-starting-to-wind-down

But the Federal Reserve is tightening monetary policy, and rates on 30-year fixed-rate mortgages have already risen from 2.82% in February 2021 to a recent 3.84%. Also, the spread between those mortgage rates and yields on 10-year U.S. Treasuries to which they are linked has risen from 1.4 percentage points in May to 1.9 percentage points, suggesting that mortgage rates will continue to rise faster than Treasury yields. Furthermore, the central bank was a massive buyer of mortgage-backed securities, purchasing some $2.7 trillion during the last cycle, or 23% of the amount outstanding. As it concludes those purchases in March and then, very likely, begins to sell what it holds, the negative effects on the mortgage market will be much greater than past Fed tightenings.

Things are starting to turn in the housing market and that is usually a good sign to watch out. As a reminder, homebuilding stocks started turning down in 2005, fully three years before the financial crisis.

This shouldn’t be too much of a surprise. Mortgage rates have shot up. Home prices are at all-time highs. There is very little inventory. A recent survey by Fannie Mae showed “the share of Americans who think it’s a good time to buy a house fell to an all-time low of 25% in January.”

One takeaway is the outlook for housing is not good. As Gary Shilling describes, “With demand waning and supplies increasing, the housing market is in for a lot of pain.” For better and worse, however, it takes time for that pain to manifest. The process is like a very slow motion train wreck. Don’t expect this to be over soon.

Another takeaway is that housing deeply affects the rest of the economy. For many people their house is their most valuable asset. As a result, a change in home prices has a big affect on perceived wealth. In addition, a lot of jobs are related to housing either directly or indirectly. Assuming the housing market continues to slow, it will be an important drag on economic growth.

China

“We are on our last legs, which means there are no other options.” He urged employees to "hunker down as one would during a war to survive”

Almost Daily Grant’s, 2/14: Hide and Seek

https://www.grantspub.com/resources/commentary.cfm

Vanke, China’s third-largest property developer by revenue, saw contracted sales collapse by 50% in January compared to a year ago. Yu isn’t alone in his predicament. China’s top 100 developers posted a 41% year-over-year sales decline last month according to data provider CRIC, following a 38% annual tumble in December.

It is still normal to see commentary advocating the investment opportunity in China on the basis of some potentially positive development such as improving credit impulse. While any volatile environment presents trading opportunities, the bigger point for long-term investors is that China is still in the early days of a major restructuring of its economy.

This harsher reality is especially evident from the all-important real estate development business. The industry as a whole has suffered a year-over-year decline of 41%. The chairman of the country’s third largest developer said publicly, “we are on our last legs.”

This is not the evidence one finds in a run-of-the mill cyclical downturn. Rather, this is the stuff of a major challenge that presents an existential threat to many participants and also threatens to reverberate way beyond the confines of a single industry or country. The restructuring of China’s real estate market will be a long, slow grind that will have a deflationary impact around the world.

Technology

EE380 Talk, by David Rosenthal

https://blog.dshr.org/2022/02/ee380-talk.html

Cryptocurrencies' roots lie deep in the libertarian culture of Silicon Valley and the cypherpunks. Libertarianism's attraction is based on ignoring externalities, and cryptocurrencies are no exception.

The only reason to be on the buy side of these orders is the belief that "number go up". Thus the exchanges need to attract speculators in order to perform their function. Thus a permissionless blockchain requires a cryptocurrency to function, and this cryptocurrency requires speculation to function.

It would be wonderful if we could figure out how to build a Web that would resist centralization. But all the technical and financial cleverness that's been poured into cryptocurrencies hasn't succeeded in doing that. Why? It is because It Isn't About The Technology … Right now, there is way too much money. If a system is to be decentralized, it has to have a low barrier to entry. If it has a low barrier to entry, competition will ensure it has low margins. Low margin businesses don't attract venture capital.

It is rare that you come across a person with elite technical chops, vast real world experience, and a balanced philosophical perspective, but David Rosenthal is all that in this lecture he gave at Stanford.

For those who are interested in learning more about cryptocurrencies, this is a great overview. There are also lots of references if you want to go down some rabbit holes. Rosenthal’s insights range far beyond just cryptocurrencies, though, to cover the broad universe of technology.

One of the main points he makes is one that is very generalizable: The funding environment affects the kinds of technology that gets developed and the business strategies that get used.

The bottom line is, contrary to the beliefs of many technophiles, technology can’t solve all the world’s problems by itself. If you’re a techie and want to save the world, it is best to run your project on a low budget. If you get sucked into the high margin business models that VCs will fund, it will inevitably lead to centralization. And with centralization goes many of the ideals that motivated the project to begin with.

Inflation

US Producer Price Inflation Unexpectedly Remains Near Record Highs In Jan

January saw US producer prices rise 1.0% MoM (twice the expected 0.5% jump) and is the 21st straight month of MoM rises. This sent prices up 9.7% YoY (record highs and well above the expected +9.1% YoY)...

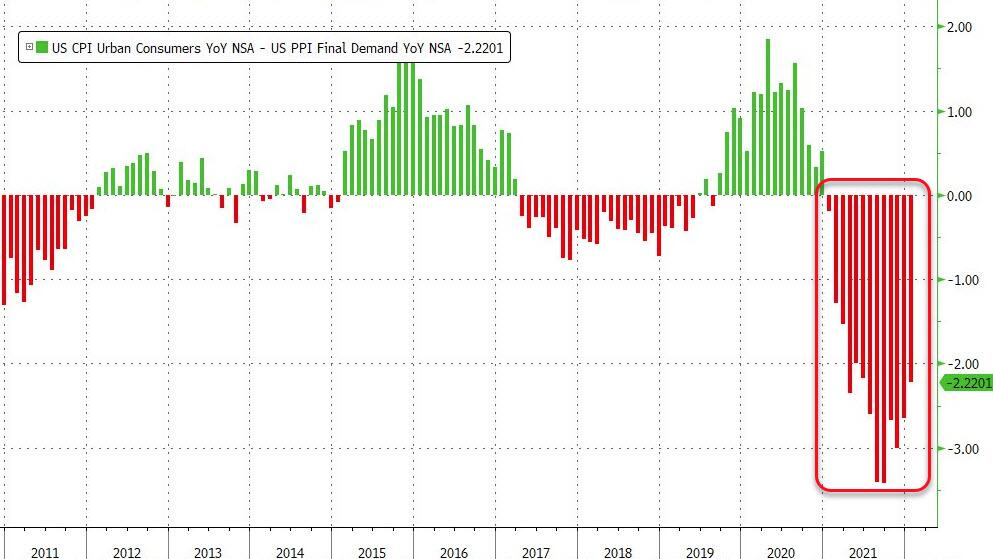

The current inflationary environment is still quite threatening as revealed by the PPI report this week. Producer prices were high and came in much higher than expectations. In addition, PPI is a leading indicator for CPI since it shows price increases that just haven’t gotten all the way to reaching the consumer yet. The amount of “latent” CPI is indicated below and suggests inflation will not be declining in the very near future.

Lacy H. Hunt, Ph.D & Russell Napier, The Path to Deflation ($)

https://www.eri-c.com/news/892

“Structural problems facing the US economy are the worst in nine decades.”

The longer-term view on inflation has been part of an ongoing debate that effectively boils down to the relative importance of economics vs. politics. No two people capture the opposite ends of this debate than Lacy Hunt and Russell Napier. As usual, Lacy Hunt didn’t mince words; the US economy is facing enormous challenges.

I agree with the vast majority of Hunt’s position and highlighted part of his argument in the 4/16/21 edition of Observations. A key point is that excessive debt impedes economic growth. As a result, when central banks fund government spending, it provides only a short-term stimulus but comes at the expense of even slower growth over the long-term.

On this particular webcast, I was able to get a question in that I have been pondering for a while now: If we agree excessive debt impedes economic growth, then what is the more likely political/public policy solution - austerity or financial repression? Hunt argues that all signs point to austerity; there is nothing to be gained from additional debt.

While I appreciate Hunt’s position and logic, I don’t believe any Western government could get re-elected in an environment of virtually no growth with a platform of massively lower government spending and higher taxes. As a result, I agree with Napier that the most likely outcome is that government plays a role through its “visible” hand.

It may take a while to get there, but eventually governments will establish a regime of financial repression whereby inflation remains higher than nominal interest rates. This will allow the value of debt to gradually diminish over time. It will also be terrible for investors.

A key point in the discussion is that this is more than just an economic problem; it is also a political problem. As a result, forecasting an outcome depends on forecasting public policy responses. While some austerity will also be necessary to slow the growth in debt, austerity alone is not a viable policy politically.

Monetary policy

What the Fed might think about QT ($)

https://www.ft.com/content/4f85bba0-3daf-4fed-995a-bd523cd8db2a

Signalling is the notion that a fixed quantitative easing programme commits the Fed to a certain timing of rate hikes — it makes the bank’s rate policy announcements more credible. In other words, investors can be confident rate increases won’t start until QE is over, because buying bonds while raising rates would be insane. QE is how the Fed “ties itself to the mast.”

The duration-risk channel depends on the idea that by taking long-duration assets out of the hands of the public, the Fed reduces term premiums, bringing yield of long-lived assets down. The portfolio balance channel suggests that investors will replace the Treasuries bought by the Fed with imperfect substitutes — long-term corporate bonds, say — depressing yields on those assets, too.

This analysis of the Fed’s study, “Issues in the Use of the Balance Sheet Tool,” by Robert Armstrong may be wonkier than you are up for, but it certainly addresses important and timely issues.

Armstrong’s point is an extremely valid one: “What is striking about the ‘Issues’ paper is that it does not focus much on what QE creates and puts into the system, and what quantitative tightening will take out of it and destroy: money. That is, it is not much concerned with the liquidity channel.” One might go so far as to think the creation and destruction of money would have an important impact on markets - and one would be right.

It’s no wonder the Fed is leery of placing too much focus on the issue of reducing its balance sheet - because it just doesn’t really know what would happen if/when it begins to unwind QE. This is not a huge endorsement of the Fed’s policy skills nor is it a strong signal for stability in the Treasury market.

Investment strategy

All That Pandemic Liquidity Finally Led to Erosion ($)

As he [Mike Howell of Crossborder Capital Ltd.] shows, provision of liquidity and the creation of wealth through higher asset prices are intimately connected over time. Falling liquidity, while obviously necessary now that the emergency has passed and inflation is rising, could well signal problems ahead:

By his [Howell’s] measure, the liquidity created by central banks has stopped growing and is now in a significant decline. It is the second derivative of the change in the speed with which liquidity is flowing that has the greatest impact on markets:

If there is one thing investors need to understand right now it is exactly what Michael Howell spells out in the graphs above. The first point is liquidity is currently the dominant driver of asset prices. The second point is liquidity is declining - and will continue to do so.

In an important sense, this makes things super-easy for long-term investors. Liquidity is going down so asset prices are going down. Either hang on for the ride, or wait and prepare to jump on board later when the liquidity environment is more favorable.

Of course, there are other narratives out there and most of them even contain some element of the truth. But this is part of the point. The task here is to filter out the noise and listen to the signal. In this case, the signal is pretty strong.

Implications for investment strategy

Wealthy Investors Run to Cash Despite Inflation Woes: UBS

https://financialadvisoriq.com/c/3493464/437814/wealthy_investors_cash_despite_inflation_woes

More wealthy Americans, worried about a market correction, are fleeing to the purported safety of cash — even as their concerns about inflation are rising, according to a recent survey.

The Curse of Humphrey Hawkins

https://www.theinstitutionalriskanalyst.com/post/the-curse-of-humphrey-hawkins

One wealthy business owner told The IRA last week: “If the Fed does the right thing now, I will loose 25% of my net worth due to the obvious and necessary reset in stocks, but that’s OK. I’m still up a lot. But if Powell doesn’t take strong action now to control inflation, then we are all in big trouble.”

A couple of interesting points come out of these two related insights. One is there are times to simply opt out of the “game” if you are not in a good position to benefit from playing it. Over very long periods of time it tends to make sense to invest in stocks because they tend to generate attractive returns. That doesn’t mean they always produce attractive returns, however. When high valuations, weakening fundamentals, and decreasing liquidity conspire to create a very unattractive proposition, it is alright to “just say no”. Indeed, many investors are doing just that.

Another fair point, however, is to fully appreciate there are ups and downs with stocks. Indeed, a 25% drawdown is not only possible, but very likely over a long enough period of time. For most long-term investors it does not make sense to try to maneuver in and out of stocks because effectively timing the market is extremely difficult to do.

Finally, an important aspect of investing is making tradeoffs. High single digit inflation does pose an immediate threat to purchasing power. Hugely overvalued stocks, however, also pose a threat to purchasing power. As a result, the logic of owning overvalued stocks as an inflation hedge is a mistake because it fails to account for the potential loss in value of the stocks.

The bottom line is it can be painful to be sitting in cash while inflation is high. However, having one’s stock portfolio down significantly and suffering high inflation on top of it can be truly devastating. Sometimes you don’t get great options. Sometimes the least worst option is best.

Note

Sources marked with ($) are restricted in some way. For example, they may be behind paywalls, only allow access to registered advisors, or other such constraints.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.