Observations by David Robertson, 2/23/24

Last week the CPI report was the big news item. This week it was Nvidia’s results, which have become a macro factor. Anyway, let’s take a look at what’s been going on.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

A good heads up from Brent Donnelly to get some perspective on Bitcoin trading:

For anyone who doesn't already know this:

Bitcoin is essentially the same thing as triple-levered NASDAQ.

TQQQ is the 3X NASDAQ ETF.

Here, I compare how the two have behaved since 2019. They are twins, but not identical.

Bottom line: Bitcoin is a liquidity-driven trade and a very levered one at that. Also, that cuts both ways.

JustDario posts, “Jeff Bezos sells an additional $2.37 billion of $AMZN to a total $8.4 billion in 10 days!” That’s an awful lot of stock in a clearly concentrated sell program. You always have to wonder what the insider knows that you don’t when there is a grouping of transactions that big.

Nvidia reported after hours on Wednesday and posted huge gains in revenues, earnings, and cash flow. While the company definitely deserves credit for being at the forefront of the capital spending wave for artificial intelligence, it hardly presents an unblemished case for growth. Operating in an intensely cyclical industry, having lots of impending competition, and employing multiple tricks to pad sales are normally reasons to discount near-term results. Not now. It’s just another night at the casino.

Finally, a weak auction of 20-year Treasuries on Wednesday caused longer-term Treasury yields to go up. If longer-term rates keep going up, they will eventually cause problems by way of constraining the economy, such as through higher mortgage rates. However, if stocks keep going up as well, that will offset the effects of higher rates which could continue to rise. It all begs the question, “At what point would policymakers be compelled to intervene?”

Politics

Every once in a while I come across a post that vividly captures the essence of a situation. The following post from Don Johnson is one of those:

With each book & research piece I read on the subject I’ve to come realize that most in the Boomer generation didn’t acquire their wealth through intelligence, innovation, and ingenuity but rather through looting it from the next 10 generations and dramatically lowering the quality of life for the much smaller generations to come.

While it is certainly possible to take such generalizations about generational identity too far, it is also possible to not take them far enough and pretend they don’t exist. If it wasn’t already clear with the “OK Boomer” sentiment, younger generations are becoming increasingly discontent with the legacy left them by Boomers as they are becoming increasingly informed about it.

For what it’s worth, I think the position is somewhat overstated because I personally know a lot of Boomers who have succeeded due to intelligence, innovation, ingenuity … and also hard work and persistence as well. That said, I also personally know a lot of Boomers who have succeeded with few or any of those qualities. I very much agree with the notion that the Boomer generation, as a whole, has benefited disproportionately, and significantly at the expense of younger generations.

I have been surprised how long it has taken for people to recognize the problem, but it seems like it is happening. The advanced age of the two major presidential candidates, combined with the well above average age of members of the Senate and House of Representatives, seems to be providing a toehold for political resistance.

Because that resistance is to more than just age, but also to values and ways of doing things, not least of which regards fairness and equality, there is growing potential for some real political fireworks. It may not happen this year, but it is brewing. When it hits, there could be dramatic change across the spectrum of policy arenas.

Commercial real estate

Bad property debt exceeds reserves at largest US banks ($)

https://www.ft.com/content/4114454c-a924-4929-85f4-5360b2b871c6

Across the wider US banking sector the value of delinquent loans tied to offices, shopping malls, apartments and other commercial properties more than doubled last year to $24.3bn, up from $11.2bn the year before.

Bill Moreland of BankRegData, which collects and analyses lender data, said there was little doubt across the industry that “allowances for these loan losses have to come way up”, adding, “There are banks that may have looked fine six months ago that are going to look not so good next quarter.”

Should We Resurrect the Reconstruction Finance Corporation?

Policy makers in Washington need to start thinking about dusting off the Reconstruction Finance Corp of the 1930s to help finance the restructuring of an awful lot of now moribund commercial real estate. We are talking here not just about the CRE loans in default now or next year, but a whole class of urban commercial properties that are impaired because the original use case is no longer relevant.

The first set of quotes from the FT set the stage: The problems of commercial real estate are beginning to manifest in bad debt and losses. While the problem has been around for quite a while now, it is only just recently that numbers are getting assigned to losses in a big way and hitting bank results. There is a lot more to come and this will hit the owners of such assets hard.

Chris Whalen highlighted the policy implications in his report. The point he makes is the commercial real estate problem is far larger than the asset class, but rather affects “a whole class of urban commercial properties that are impaired because the original use case is no longer relevant”.

He’s right and he’s probably very early. If past experience is any guide, urban centers will need to suffer significant pain before any kind of relief comes. That said, there are good precedents for managing these problems.

This also highlights what I think is going to be an often overwhelming disparity in economic outcomes the next few years. Urban centers will struggle, weighed down by persistently eroding commercial real estate values, yet there will be several pockets of strength which will keep unemployment relatively low and allow wages to rise.

Inflation

Most of the talk about inflation has been about either the hotter than expected CPI and PPI reports or why those reports were misleading and inflation is really still going down.

Regardless, Althea Spinozzi highlights a good reality check: “The Breakeven rates are accelerating”.

True enough. While rising expectations for inflation have started to creep into Treasury yields, stocks have remained blissfully oblivious. It’s hard to say how long this could go on, but it feels like water building up behind the dam.

Investment landscape I

Hard Cope ($)

https://www.yesigiveafig.com/p/hard-cope

This is my base case view. “Bitcoin!©” (h/t Ben Hunt) and commodities before crypto (and Dotcom before commodities… and… you get the idea) are a way for the world to redirect excess resources when real investment opportunities are stymied.

It’s not a big surprise that bubbles happen in financial assets but it is interesting to consider their causes. Mostly, bubbles have been written off to behavioral causes such as “irrational exuberance” or the antics of rambunctious “degens”.

Green identifies another possible cause, however, and it has more to do with the environment. He points to research that suggests the combination of too much money and too few real investment opportunities cause resources to get “redirected”. When there aren’t good investments and people have money in their pockets, they are going to bet on something.

Considered in this light, bubbles can be seen primarily as policy failures. The presence of too much money has been a bias in monetary policy for decades. Weakness in demand and excessive costs for starting and running businesses are both government policy failures that have stymied investment opportunities.

One message to take away is that bubbles are not indications of health; they are warning signs the economy is not functioning well. Another message is that the way out is not more of the same. In order to escape, government policy needs to establish a more constructive environment for business and the central bank needs to carefully calibrate money supply. Easier said than done, but that’s the formula.

Investment landscape II

Jim Bianco posted an interesting analysis of bitcoin ETFs that is also applicable to broader markets:

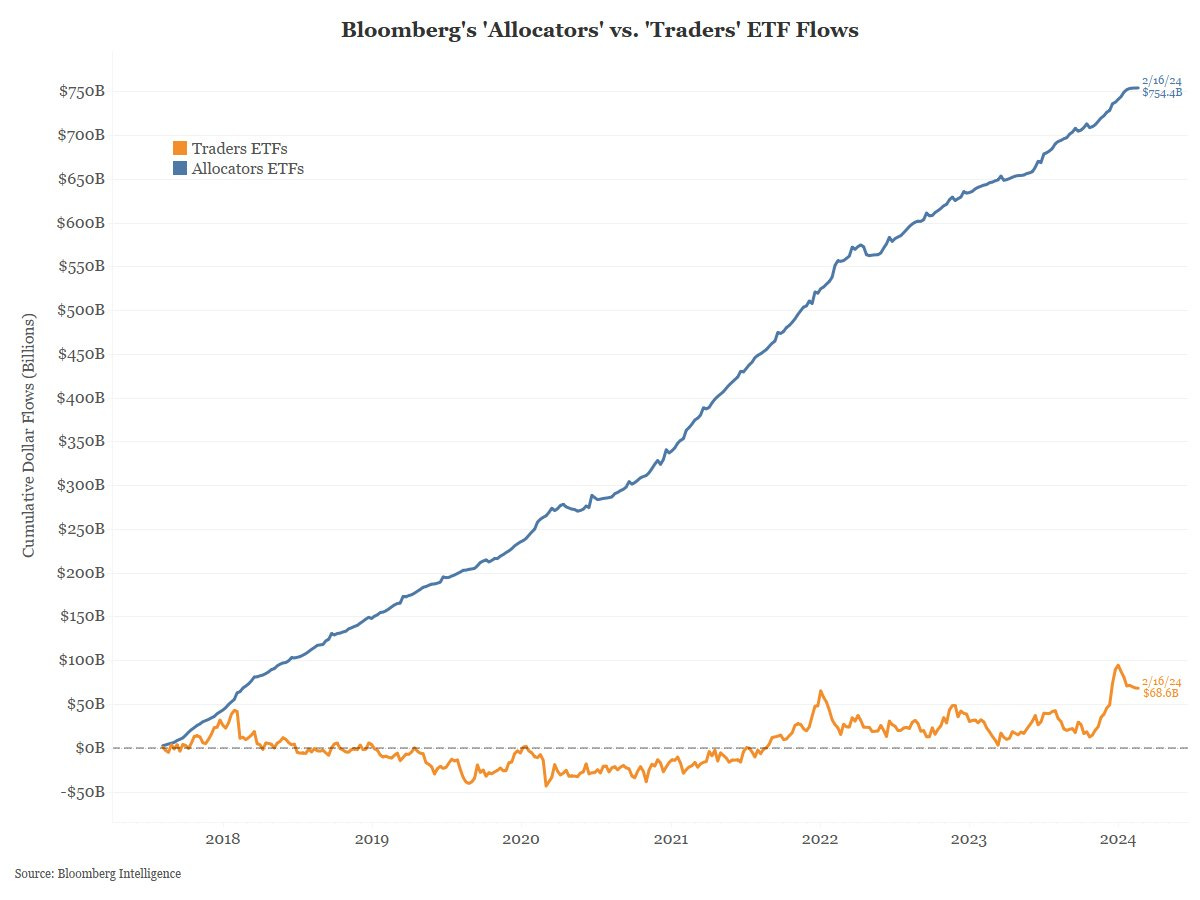

I've been commenting on the spot BTC ETFs today. In the repost below, I asked if Degens or Hodlers are buying the spot BTC ETF. This is a well-known concept in the ETF community. They go by "trader ETFs" and "allocator ETFs." The words are what they imply. Trader ETFs are dominated by "degens" that punt in and out of the markets, often chasing its trend. Allocators are "hodlers" that buy for the long haul and do not get shaken in/out because of price movements. The cumulative flows of these categories are shown in the chart below. The full list of traders and allocators are shown in the table. Trader flows are in orange. In the last six years, they have seen only $68 billion in total flows. This list includes some of the biggest high-profile names in ETF-land, SPY, QQQ IWM, EEM, HYG, and DIA. They have $1.069 trillion in assets.

Wall Street has an old saying, "Take the escalator up and the elevator down."

If the cumulative flows in all spot BTC ETFs are traders/degens taking the "escalator up" to the tune of $500 million/day, then they can easily, someday, take the "elevator down" to the tune of a billion-plus in one day (or a few hours).

The first point Bianco makes is a hypothesis. Because the flows into allocator funds is massive, and much, much greater than those into traders funds, an assumption is being made that BTC ETFs are going mainstream by tapping into those enormous allocator flows.

But what if that assumption is wrong? Vanguard, the largest allocator, is not participating so that gives some credence to the idea. Taking the hypothesis a step further, if BTC ETFs are being driven by flows from traders that are only playing for a short-term profit, that action can go both ways and money can leave just as quickly.

If and when that happens, Bianco describes, “They [the BTC ETFs] are forced to enter the market with massive sell orders that must be filled IMMEDIATELY AT ANY PRICE, regardless of market conditions in an unregulated market.” This can cause severe and nearly instantaneous declines is price.

So, point number one is don’t be surprised by massive volatility in the cryptocurrency space, not that that should be any surprise. Point number two, the same type of risks exist in the broader markets. To the extent that big price runs are occurring primarily due to short-term flows from traders, there is a risk those flows reverse quickly and send prices reeling.

Investment landscape III

Hard Cope ($)

https://www.yesigiveafig.com/p/hard-cope

The rapidly changing status of the debate is telling. We have moved away from “Ah, it’s just an underperforming active manager who doesn’t know what he’s talking about” to “Well sure passive is impacting markets, but is it really bad relative to active managers overcharging for services?” This is important in my view and I think the world is increasingly open to hearing the “true” story.

Mike Green has been the biggest champion of the notion that passive is fundamentally changing the investment landscape. Sadly, this is a point that is still hugely under-appreciated by the investment community.

Perhaps that is changing, however. As Green notes, the narrative around passive investing is evolving from one of pure disregard of criticism to one of relative advantage over active management. This is an important step. Once its imperfections are acknowledged, it is only a matter of time before those imperfections get weighed - with great scrutiny and regularity.

Ultimately, such scrutiny will reveal some massive shortcomings of passive investing, shortcomings that Green and others have been highlighting for years. Once that insight becomes more widely appreciated, a couple of things are likely to happen. One, it will become clear that passive investing does a terrible job of price discovery and that facilitates the massive mispricing of financial assets. Two, the realization of massive mispricing (and the flows that accompany it) will pave the way for active management opportunities.

This will take time and we are still in the early innings of this transition. Major things to watch for to mark progress will be relatively poor performance from major indexes, flows away from big passive funds, and a resurgence in the performance of star active managers.

Investment research

Leadership in a politically charged age ($)

https://hbr.org/2022/07/leadership-in-a-politically-charged-age

Political allegiance tends to distort how we perceive and interpret facts. Although we may believe that we consider facts dispassionately when making up our minds, a growing body of research suggests that we often deploy them selectively in defense of our worldview or group interest—a process known as motivated reasoning.

When employees with differing ideological outlooks are presented with the same evidence about contentious issues, they’re likely to attend to and interpret it differently and will then experience their perceptions as singular truths. This tendency, called naive realism, helps to explain the bewilderment, frustration, and anger that people often feel when others perceive things differently.

In an environment of extreme political polarization, there is all kinds of potential for disagreement at work. Essentially this is just a subset of the challenge facing almost any research team, however. Diverse backgrounds and beliefs lead to disagreements.

This is a challenge for individual analysts as well. Even if you are just yelling at the screen, “How can the market be so stupid?” (which I have done plenty of times, btw), there is a disagreement that can be productive … or not.

The article suggests some ways to jump start the process of reconciling those differences. You can ask yourself, “Which parts of that statement did I automatically disagree with?” In addition, you can ask, “How could I construct the best argument against my perspective if I had to?” You can also employ a strategy called self-distancing which involves thinking about conflict “from the perspective of a neutral third party who wants the best for all involved”. Analytically, it’s more about being curious than about being right.

One take away is that it is important to recognize extreme viewpoints and to recognize them as potentially strong forces. It is also important to avoid becoming seduced by them. Another take away is the best analysts and traders embrace differences. If there weren’t plenty of people on the other side of the trade, they would never make money. Finally, most organizations don’t do a good job of encouraging and rewarding curiosity; indeed, many times it is penalized. No wonder so many have trouble coming up with good ideas.

Implications

One of the ongoing challenges of being a long-term, valuation-based investor in a liquidity-driven environment is deciding whether it makes more sense to try to get ahead of where the liquidity waves might land or to keep waiting for prices to get really cheap.

Jim Bianco’s insights provide some useful perspective here. If short-term traders (as opposed to long-term allocators) are setting prices on the margin, then big price increases can be reversed quickly as those money flows reverse. Worse, since trading is currently turbo charged with momentum, leverage, and zealotry, any reversal could be harsh. In short, there is clearly risk involved in engaging in such a frenetic environment.

There is clearly risk involved in waiting to engage too, though. The tradeoff depends on how long it’s going to take for stocks to get cheap again. Since this stock market orgy has primarily been driven by liquidity, and since liquidity is largely determined by policy, the timing is going to depend on those policy choices.

On that front, there are plenty of obstacles to be concerned about. Coupon issuance is set to increase significantly in the second quarter and that will likely draw funds from other assets like stocks. Further, there has been a broader effort in the US to mop up excess liquidity created in the response to Covid-19. This effort is ongoing - so the liquidity window is closing. Finally, the Bank of Japan is widely expected to incrementally tighten monetary policy in the not-too-distant future - which will also impinge upon the liquidity environment in the US.

In sum then, while the action in stocks has been attention-getting, especially in artificial intelligence, much of that activity can be traced to favorable liquidity conditions. My best guess is the forces crimping liquidity will start biting well within the investment horizon of long-term investors.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.