Observations by David Robertson, 2/25/22

Russia attacks Ukraine, the markets get slammed, the Fed still hasn’t raised rates yet, the markets massively rebound. Seems like an appropriate time for the Lenin quote: “There are decades where nothing happens; and there are weeks where decades happen.” It was one of those weeks. If you have questions or comments, let me know at drobertson@areteam.com.

Market observations

The single most notable observation during the week was the historic market turnaround on Thursday. Major indexes were down 2-3% early in the session and finished up 2-3%. Most of this was attributed to derivates-related activity as short positions got covered. While many took cheer that markets didn’t crash, such substantial intraday volatility is not a sign of healthy markets either.

Another notable trends since the beginning of the year has been the incredibly poor performance of several companies focused on disruption. Affirm, a leader in buy now pay later services is down 64%. Roblox, the online game design platform, is down over 50%. Spotify, the disrupter of music services, is down 36%. The fund that made its name on innovative disruption, ARKK, is down over 30% (all comparisons as of Wednesday).

In one sense, recent performance is merely the flip side of the same coin. Each of these securities had huge runups and recent performance is simply some give back. There is also something more going on, however. As Alf rightly points out in his tweet below, the performance of “innovation” has been highly correlated with real rates.

In other words, when rates are very low, stories about innovative growth sell in the stock market. However, when real rates start rising, those dreams of growth get re-evaluated quickly and harshly.

That said, buy-the-dippers are a hearty lot and have not lost their taste for buying stocks that are down, regardless of the situation. In the immediate aftermath of selling on Thursday morning, retail BTDers left their fingerprints all over the place. It is going to take time for this powerful tendency to dissipate.

Economy

Rent-A-Center Gives Dire Update On State Of US Consumer

https://www.zerohedge.com/markets/rent-center-gives-dire-update-state-us-consumer

“In the fourth quarter, the combined effect of significantly reduced government pandemic relief, decades-high rates of inflation, and supply chain disruptions impacted our target customers’ ability to access and afford durable goods, which negatively impacted our results. We anticipate these external headwinds will continue for the foreseeable future, resulting in year-over-year declines in revenue and earnings for 2022 …

By catering to lower income consumers, often ones whose credit is too low to finance durable goods like furniture and appliances, Rent-A-Center (RCII) provides a unique view into an important segment of consumers. Unfortunately, the news on lower income consumers is terrible. They are getting hit on all sides and are having to significantly reduce spending as a result. The stock price for RCII, which was already down to $35 from a high of almost $68 in April 2021, opened down over 30% on Thursday after the report.

The result provides a strong warning. Economically, a large portion of the population is not able to make ends meet. With inflation continuing to remain high and hopes for additional stimulus virtually nonexistent, the most likely scenario is things will continue to get worse.

In addition, this kind of economic distress normally gets translated into political sentiment against the incumbent party. Things are looking to get very ugly for the Democrats in this year’s midterm elections.

Energy

Put all these assumptions together and you arrive at an annual average oversupply of roughly 500 kbpd from the EIA and a more-or-less balanced market for the year from OPEC. These forecasts aren’t terribly bearish, but they don’t scream $150 or $200 per barrel crude and getting to those unprecedented levels would require at least one of these common assumptions to be wrong.

This fairly new substack publication by Rory Johnston is a balanced, insightful, and accessible analysis of commodity markets. Not surprisingly, oil has been getting a lot of attention lately.

One of the great challenges of investing in oil is the market is significantly controlled by OPEC. As a result, short-term forecasts depend on the degree to which OPEC voluntarily curtails production. In addition, an important ingredient in this equation is the degree of cohesiveness among members and relatedly, the degree to which various members cheat on their quotas. Because of the political nature of supply, short-term price frameworks are inherently fragile.

There is no doubt concerns about inflation are driving interest in oil and there is no doubt the problems in Ukraine are magnifying those concerns. Johnston concludes, “These forecasts [from OPEC and EIA] aren’t terribly bearish, but they don’t scream $150 or $200 per barrel crude”. In other words, current sentiment seems to be taking oil prices above what is justified by fundamentals.

Geopolitics

A couple of tweets from a couple of heavyweights in geopolitical analysis. One main point is this is a very serious development and another is this will not be a single, one-off event. Rather, it is the beginning of a “full scale Cold War” that will last “for the next several years”. Not happy talk but not sensationalist either. Let’s be honest about what it really is and manage to that reality.

Emerging markets

Emerging markets: all risk and few rewards? ($)

https://www.ft.com/content/9cc2826b-dcd2-49c5-a408-7de043d24a79

Larger emerging economies appear to be in less immediate danger. But Ed Parker, head of global sovereign research at Fitch Ratings, a credit-rating agency, talks of “a long tail of weak, fragile frontier markets” that look to be at risk.

The key risk event for emerging markets in 2022 is rising US interest rates. “History tells us that when the US has its own inflation problem to deal with, that’s bad for emerging markets,” Lubin says.

In the vernacular of conventional investment strategy, emerging markets often serve as a convenient substitute for developed markets. The rationale is strengthened by the fact that many emerging markets have much better growth prospects than developed ones.

This well-worn practice should be considered in the context of a couple of overarching problems, however. One is the global influence of the US dollar and therefore, the de facto imposition of US monetary policy on the rest of the world. Some emerging markets do have attractive growth potential, but it will still be impeded by the tightening of liquidity conditions in the US.

Another problem, which has unique recency value this week, is emerging markets are particularly vulnerable to geopolitical risk. This was true even at the height of US geopolitical power but is becoming more so by the day. As a result, emerging markets come with a fair amount more risk.

There will be a time when well-managed emerging markets provide extremely attractive opportunities, especially relative to demographically constrained developed markets. That time is not yet, however, and there will be costs to being early.

Inflation

The predominant view of inflation is still that it will peak in the next few months and then decline to much lower and more manageable levels. The difference between short-term and long-term inflation expectations is portrayed in the graph and is also confirmed by surveys and portfolio positioning.

A big problem with this view is that it is not the only possibility in terms of outcomes and may not even be the most likely one. With producer prices well above CPI, there is still inflationary pressure to be realized in consumer prices. Real wages need to continue rising or consumer spending will tank. House prices remain high and housing tends to enter inflation indexes with a lag. In short, a lot of factors that are important to the inflation picture are likely to be very sticky.

If inflation fails to fall very far but instead remains stubbornly high, two things are likely to happen. A big one is a lot of traditional 60/40 portfolios will be poorly positioned for an environment of persistently higher inflation. By the time this becomes obvious, inflation hedges will be much more expensive.

The good news is there is likely to be a period of declining inflation before that happens. This will be an excellent time to reposition portfolios before it becomes exceedingly expensive to do so.

Monetary policy

Jim Bianco: Has the Fed Signaled a Policy Error? MacroVoices with Erik Townsend, February 17th, 2022

https://macrovoices.podbean.com/e/macrovoice-311-jim-bianco-has-the-fed-signaled-a-policy-error/

And so the Fed is under enormous political pressure to do something about inflation. And oh, by the way, it wasn't their plan. But effectively, the Senate is sitting on a veto of the Fed. You know, so that J. [Jay Powell] fix inflation, J. If you don't fix inflation by say mid year, we could just march down to the floor of the Senate and we don't have 50 votes for your renomination. And we'll throw you out and we'll find somebody else.

As I mentioned last week, liquidity is the name of the game especially since the Fed decided to manage through the years since the financial crisis in 2008 with massively interventionist monetary policy. So, a big question for investors is always, “What is the Fed going to do?”

A widely held assumption is the Fed will talk up a big game of fighting inflation by raising rates, but will eventually be compelled to back off for fear of slowing the economy down too much. The underlying assumption is that the Fed cares more about economic growth than price stability.

Jim Bianco has been a vocal proponent of the theory that things are different this time around because inflation is an intensely political issue and currently a top complaint of voters. As a result, the Fed no longer has the same capacity to promote growth at the expense of easing up on its efforts to police inflation.

As true as this is, a case could still be made that when push comes to shove, the Fed will capitulate on raising rates. This is where Bianco’s analysis really hits home: “Effectively, the Senate is sitting on a veto of the Fed”. In other words, Powell’s position as chairman of the Fed is now being held over him as a threat to actually deal with inflation.

If there is one thing Washington understands it is power. The Democratic Senate will wait to confirm Powell until inflation notably declines or will nominate someone else. Given this power, I can’t imagine the Senate won’t use it to its fullest. The main question now is not, “Will Powell even try to fight inflation”, but rather, “Can Powell bring inflation down fast enough to save his chairmanship?”

Investment landscape

Jim Bianco: Has the Fed Signaled a Policy Error? MacroVoices with Erik Townsend, February 17th, 2022

https://macrovoices.podbean.com/e/macrovoice-311-jim-bianco-has-the-fed-signaled-a-policy-error/

But there's another dynamic that's going on in the credit markets, which I think a lot of people don't realize is occurring. No one sells anymore in the credit markets. It's either you buy or you hedge or you buy your hedge.

But that's the way that we seem to trade it right now. And that's one of the things that might be masking the selloff that you see or the lack of urgency in the credit markets is it trades as one instrument, and when that one instrument decides that now's the time to sell, which it hasn't for many many years because it either buys hedge, you could have real problems moving forward with the market.

This interview with Jim Bianco was so good I am featuring it in two segments in order to capture the most important insights. The phenomenon Bianco is referring to in the quotes is the market structure for credit. This is the same issue I have discussed frequently in regard to stocks and the impact passive investing is having on the investment landscape.

One observation is the credit market largely trades as a whole rather than as an agglomeration of individual components. This has the effect of muting important credit signals because what trading does occur happens primarily on the basis of top-down concerns rather than bottom-up research.

I presented an example of this in a market overview a few years ago. Grant’s Interest Rate Observer from September 22, 2017 relayed the tale of how Toys 'R' Us senior unsecured bonds cruised through the summer priced around 95 cents on the dollar. Suddenly, however, rumors of a debt restructuring emerged in early September and the company filed for bankruptcy on the 18th. The bottom line is there was exceptionally little warning from the market that anything was wrong.

For a number of reasons, including market structure and reduced trading, the strength of signals is getting muted. The lesson to takeaway from all this is to recalibrate your monitoring of market signals. Weak signals may be more important than they appear.

Investment strategy

Interestingly, market structure is also becoming an increasingly important issue in the market for US Treasuries, one of the most liquid markets in the world. Of course a big reason for this is the Fed. Throughout QE, the Fed has been the 800 pound gorilla buying Treasuries. With the end of QE in sight, we need to understand what the market for Treasuries and mortgage backed securities (MBS) will look like without the Fed’s thumb on the scale.

For reference, I have addressed this issue many times from the perspective of top down economic and political analysis. On one side of the debate is Lacy Hunt with the thesis that growth will be very low and therefore Treasury yields will remain quite low. On the other side is Russell Napier who believes governments have discovered the “magic money tree” and will therefore be consistently able to generate inflation - which means higher rates.

While both of these arguments have merit, neither of them gets into the details of exactly which parties are going to be buying or selling Treasuries that weren’t doing so before. One person who does delve into those weeds is Lee Adler who provides a great deal of insight with his Liquidity Trader newsletter. One of Adler’s main points is someone new will need to step up to fund continued Federal deficits as the Fed backs off. Who will it be? And at what price?

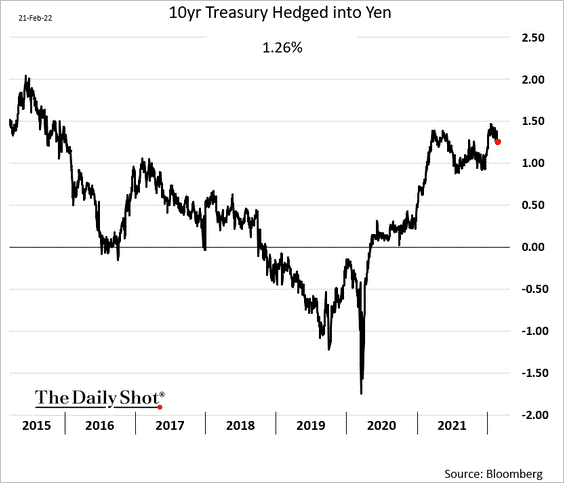

To be sure, there is a market for safe, long duration assets. Certainly if markets remain unsettled due to Russian attacks on Ukraine, bonds will provide a safe haven from falling stocks. In addition, rising Treasury yields look increasingly attractive to many foreign institutional buyers. Japan is just one major example where fully hedged yields are competitive.

The question is at what price does the absence of Fed demand get filled? This could be an even bigger question if the Fed starts reducing its balance sheet. Without the protective cover of Fed purchases, it would not be surprising to see Treasury buyers only accept lower prices (higher yields). While neither the Fed nor the Treasury want yields to get too high, in the absence of any means of actively offsetting that pressure there is a good chance those limits will be tested.

In other words, don’t be too surprised if at some point 10-year yields spike up to levels that would be devastating for the economy if they persisted. In fact, such a scare may be just the impetus necessary to establish a formal process of yield curve control.

Implications for investment strategy

Generally I am not a fan of using past market patterns as a guideline for current possibilities but the graph below from themarketear.com ($) has been eerily prescient. It compares the path of the S&P 500 in 2018-2019 to that of today. Clearly if this recent history is any guide, there is more downside to come, albeit after a decent bounceback.

Thus far, the pattern has been one of begrudging realization of downside. Zerohedge captured this as “controlled demolition”. Indeed, while investors have put hedges in place to protect against downside, very few large investors have actually sold out of positions. The market has been too illiquid to make wholesale moves and therefore risk remains on the books.

The prospect that further downside is possible is a valid one then. Arguably, however, it doesn’t provide warning enough. Things are different this time. First and foremost, the Fed does not have the luxury of providing liquidity just to save the market when inflation is running so high. In addition, Russia’s aggression in Ukraine certainly highlights the reality of not just geopolitical risk, but risk of all sorts.

As a result, many investors have a lot more risk in their portfolios than they should have. Sooner or later someone will be forced to sell into an illiquid market and there will be a big air pocket down. That time is getting closer.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.