Observations by David Robertson, 3/11/22

The news and events dial has been cranked up to “11” as updates from Ukraine continue to roll in and the fallout continues in financial markets. There is a lot going on here and it has all the makings of an historic moment. If you have questions or comments, let me know at drobertson@areteam.com.

Market observations

Oil shocks need not stoke inflation ($)

https://www.ft.com/content/f6db5ef9-789b-4eac-9cf3-d81b29ac0ebc

Shock and awe might not describe Russia’s invasion of Ukraine, but it certainly fits the reaction in commodities markets. Wheat prices are at all-time highs. Nickel is spiking. Oil brushed $139 per barrel yesterday, with some talk that it could yet reach $200.

It’s hard to find superlatives fit to describe activity in commodities this week. Oil is a big one, but other important ones such as wheat, nickel, and European natural gas have also exploded higher.

Commodities

As the tweet points out, rapid price moves cause problems in a financialized world. Such violent price moves compromise owners of hedges who must ante up more money to meet margin calls. And, if those hedge owners don’t have the money to meet the call, they either have to raise it quickly or they go bankrupt.

Earlier in the week Peabody Energy secured $150 million in financing for just this purpose. For the service, however, they will have to pony up a hefty 10% interest rate. They aren’t the only ones …

One Of China's Largest Banks Fails To Pay Margin Call After Today's Monster Nickel Squeeze

Bloomberg previously reported that Chinese entrepreneur Xiang Guangda - known as “Big Shot” - had a large short position on the LME through his company, Tsingshan Holding Group, the world’s largest nickel and stainless steel producer.

One implication is the fallout from margin calls can be unexpected - it isn’t necessarily players who are wildly aggressive. Poor risk management is plenty sufficient to get companies in trouble.

Another implication from large amounts of supply taken offline is longer-term prices are likely to be much higher. While excess oil and grains in storage provide a buffer between the current prices of commodities and the end products that use them, the buffers only last so long. The available supply of many commodities right now is way below current demand. As a result, if such supplies remain unavailable, there will need to be some combination of much higher prices and deliberate rationing. There just isn’t enough stuff.

Geopolitics

Is Putin’s end game the roll out of a domestic CBDC?

https://the-blindspot.com/is-putins-end-game-the-roll-out-of-a-domestic-cbdc/

Putin may well have realised that his current “managed democracy” is unlikely to survive continuing interactions with the Western countries – especially if Ukraine turns West.

He needs a software reset and that software is now available. And that is crypto. But not Bitcoin and similar. He will be using a “fiat crypto” – a central-bank digital currency which is used to replace cash across the Russian economy. China is already basically there with the digital yuan.

This is an interesting conspiracy theory/thought piece regarding Putin and his motives from Izabella Kaminska on her new news platform. The thesis is Putin’s natural tendency is toward control and the whole conflict with Ukraine, and resultant sanctions, may provide just the opportunity to impose more control through a digital currency.

The theory certainly fits the evidence. If it is generally correct, it will mean Russia becomes far more isolated from the West. As such, most of its commodity exports will also become more isolated from the West.

A new Europe is emerging from the tragedy of Ukraine ($)

https://www.ft.com/content/82323347-ebf6-49ae-9099-4e8d5c1c0930

Meanwhile, European leaders will also have to ask themselves tough questions. How could they have so badly misread Putin’s intentions? Why did they satisfy themselves with a ceasefire agreement hastily negotiated by then French president Nicolas Sarkozy when Russia invaded Georgia in 2008, then never hold Moscow to account for breaching its terms? Why did they not react more forcefully when Russia annexed Crimea in 2014, intervened in the Donbas and provided the missile that shot down a Malaysia Airlines plane?

Was it denial? Was it appeasement, that 20th-century European disease? Was it a false sense of security? Was it sheer disbelief, because we had built the EU precisely to ensure full-scale war would never return to our continent? The soul-searching has not yet started in earnest. But, as a new Europe is emerging from the tragedy of Ukraine, these questions will have to be answered.

These very relevant questions highlight the reality that the Russia/Ukraine conflict didn’t just come out of the blue. The answer is a lot of leaders and politicians have been considerably less than completely honest about the situation assessment for a long time.

The general issue is timely: You can’t sweep major problems under the carpet forever; sooner or later you need to deal with them. While the issues are most relevant to the EU right now, they are also very applicable to the US, to companies, and to voters and consumers.

It will be interesting to see what emerges from the soul-searching sessions. Early indications are that most people realize shortcuts have been taken. Will more honest tradeoffs receive the necessary political and financial support?

Finally, Ian Bremmer sums up the implications of all this as well as anyone …

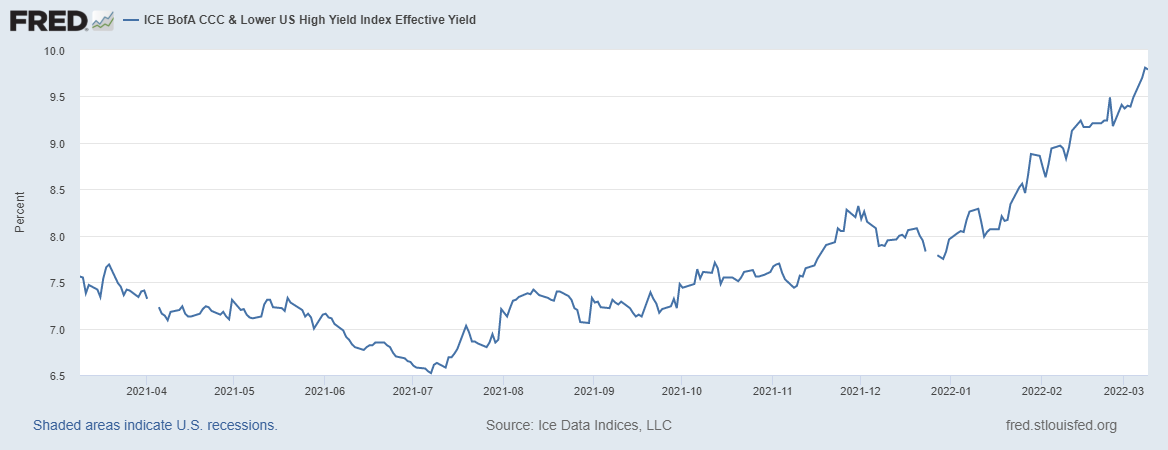

Credit

The IRA Bank Book Q1 2022 | Credit Risk Returns

https://www.theinstitutionalriskanalyst.com/post/the-ira-bank-book-q1-2022-credit-risk-returns

The end of forbearance schemes at the state and federal level means that the full cost of the credit dislocation of COVID will become apparent. Roughly one third of all government loans modified and re-pooled during COVID, for example, are likely to redefault in 2022.

If the Fed sticks to its guns and raises the target for federal funds a couple of percentage points during 2022, then residential mortgage rates will be at 5% by 2024 and the great mortgage correction of 2025 will be well in sight. Add to that picture the price inflation of war in Europe and 2022 becomes a year of growing credit risk.

Whether you believe the Fed will chicken out of raising rates for fear of hurting the economy or will find new religion in the effort to fight inflation, one thing that is clear is the changing environment for credit. Now that Covid forbearance schemes are finished, credit problems will be finding their way into the financials of banks and other creditors. At the same time, economic, political, and financial factors will all be putting additional pressure on repayments.

Credit is also likely to play a role in the fate of real assets. While tangible assets such as real estate can be attractive as a hedge against inflation, it is also true that the prices of many real estate assets have become inflated due to the prevalence of cheap credit. As a result, and as with any investment, purchase price is a critical determinant of future performance.

Inflation

The CPI report came out on Thursday and the overall figure was pretty much in line with expectations with a 7.9% increase on a year-over-year basis. Gas, shelter, and food were all big contributors. Again, comparisons go back to 1982 to find inflation at such high levels. In short, the report confirmed that inflation is proving to be fairly resilient.

Monetary policy

We are witnessing the birth of Bretton Woods III - a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.

Is there enough collateral for margin? Is there enough credit for margin? What happens to commodities futures exchanges if players fail? Are CCPs bulletproof? I haven’t seen these topics in the wide offering of Financial Stability Reports, have you?

I have talked several times about the global monetary system and how it is not sustainable as currently structured. Zoltan Pozsar takes the idea a step further by mapping out exactly how this major change will emerge out of the conditions of the Russia/Ukraine conflict. As he puts it, “We are seeing a regime shift unfold in funding markets.”

A useful way of framing the situation is by remembering “every crisis occurs at the intersection of funding and collateral markets”. In this case, Russian commodities are the new subprime housing - collateral that is suddenly worth less than the funding used to buy it. This will cause problems in the financial system and as is often the case, probably not the kinds of problems that were prepared for.

One point is the reformulation of the monetary system will take time so there won’t be discrete, identifiable changes in the short-term. Over the longer-term, however, expect bouts of disruption that can include the extremes of disorderly deleveraging as well as increasingly persistent inflation.

Investment strategy

This Is No Century for Optimists. Can It Change? ($)

A sweeping look at history confirms that this looks bad. A period of high inflation and rising rates, starting with negative real yields, is a time when we can expect returns for stocks to be about as bad as they ever are — while bonds should be even worse. Throw in war, and it’s worth avoiding combatant countries, and particularly those that seem likely to lose.

Triumph of the Optimists by Dimson, Marsh and Staunton is one of the must-read investment books. John Authers rightly refers to this classic analysis of financial asset returns over time and across countries in order to provide some perspective on current conditions. He also incorporates the current annual update.

One of the major points made in the book is that equity returns in the second half of the twentieth century, especially those in the US, stand out as being far higher than other times in history. As a result, investors should expect lower returns in the future.

Authers combines this outlook with the inconvenient reality that the current conditions of high inflation, rising rates, and war make the prognosis even worse. Long story short, equity investors have been warned.

Almost Daily Grant’s, Thursday, March 3, 2022

https://www.grantspub.com/resources/commentary.cfm

The West’s comprehensive financial response to Russia’s invasion of Ukraine has rippled far and wide, as the Moscow Stock Exchange remains shut and investors remain unable to value their positions, let alone exit them. Yesterday, MSCI and FTSE Russell announced that they will cull Russian assets from benchmark indices, following suit from Stoxx’s decision a day earlier.

Second order effects may be another story, as emerging market-focused managers unable to sell Russian assets were forced to raise cash elsewhere to meet redemptions. The Wall Street Journal reports today that some EM funds have weighed asking the Securities and Exchange Commission for a waiver on rules governing investor redemptions as well as the proportion of illiquid assets a fund can hold.

In addition to the long-term outlook for asset returns, another important consideration for investment exposures is liquidity. If you have a long horizon and are indifferent to interim volatility, lack of liquidity is not a problem. If you are counting on immediate access to proceeds, however, lack of liquidity can cause enormous problems.

While the problems with Russian assets caused by sanctions is an extreme example, the point is still the same. Waivers on redemptions and other forms of gating prevent investors from transacting freely. It is important to be aware of this possibility and to manage the risk.

Investment landscape

This excellent thread by Simon Mikhailovich is a good first draft of what the implications of the Ukraine/Russia conflict will be. He lists world peace, nuclear security, globalization, global internet, rule of law, international property rights, and food and energy security as casualties of the conflict.

This may seem like so much sensationalism but sadly it’s not. It is easy to trace how each of these things can manifest if events continue on a similar trajectory. While it is important to note such outcomes are absolutely not guaranteed, it is also important to note there is a very good chance we are going down a path that will radically change a lot of things. It is also a path we may very well not be able to retrace.

one can’t help but wonder whether we are on the cusp of an economic singularity in which the laws and bedrock beliefs that formed the foundation of international economic order for decades break down. The consequences are similarly unknowable, but we suspect a great reset may indeed be upon us.

This piece by Doomberg echoes many of the same themes as Mikhailovich: We are at a juncture in history in which a lot of things will fundamentally change. While calculating exact outcomes is impossible, the general direction will be that of fundamental change.

This insight is actually pretty helpful though. It means for a lot of things across a lot of dimensions, what has worked in the past will stop working. Conversely, strategies and philosophies that have not worked in the past will emerge as uncommonly successful. For example, in the investment world the passive 60/40 balanced portfolio is going to be confronted with a barrage of headwinds. But that is only the tip of the iceberg.

Implications for investment strategy

Weighing Up Risks of Stagflation and Armageddon ($)

Despite the risk of nuclear war, it makes sense to stay constructive on stocks over the next 12 months. If an ICBM is heading your way, the size and composition of your portfolio becomes irrelevant. Thus, from a purely financial perspective, you should largely ignore existential risk, even if you do care about it greatly from a personal perspective.

This piece of investment “advice” comes from BCA and is based on the premise that, “As a general rule, nuclear conflict is such an extreme risk that there’s little point even trying to assess it.” This is both fairly representative of many recommendations and colossally misguided.

The first big mistake in the line of reasoning is the conclusion that serious risks should be ignored if they are hard to assess. This is absolute hogwash. If risks are serious, as in existential, they should receive a huge amount of attention and focus. High levels of complacency and dismissiveness of risk management comprise the very essence of Hyman Minsky’s thesis that stability breeds instability. It is also an intellectual cop out.

The second big mistake is the line of reasoning conflates nuclear Armageddon with anything bad that can happen. This is totally wrong. The distribution of possible outcomes is not bimodal. Rather, it ranges from very positive outcomes to something we consider normal today to complete annihilation of the human species.

Between the points of “normal” and “complete annihilation” exist a lot of possible outcomes which would leave people worse off (at least economically) than today but still in a position where life goes on. In those situations, the most successful will make efforts to preserve resources and to be efficient with what they have. Those who gamble everything away will be relegated to a life of deprivation. Not just dumb, but so eminently avoidable.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.