Observations by David Robertson, 3/14/25

It was another big week for market-moving news. Let’s dig in.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

Monday started off the week with an eye-catching decline of 2.7% for the S&P 500 and 4% for the Nasdaq. Perhaps most notable was the steady selling almost all day. Futures were down to start with but selling persisted until just after 3:00.

The hardest hit were Big tech and high momentum stocks. For example, MSTR was down 16.7%, TSLA was down 15.4%, and ARKK was down 8.7%. The chart by The Daily Shot pictures the damage:

While this kind of selling hasn’t been seen in US stocks for a while, there have been other signs things are getting shaken up. As Corey Hoffstein highlighted, notable moves also occurred in a number of different assets last week:

Some major market moves in the last few days...

3-Day Moves GBPUSD +2.5% (99th %-ile)

EURUSD +4.0% (99.9th %-ile)

German Bunds -3.0% (0.1st %-ile)

UK Gilts -1.9% (1st %-ile)

WTI Crude -5.0% (5th %-ile)

1-Day Moves Copper +5.0% (99.9th %-ile)

Stocks continued to lose ground on Tuesday and bounced around the remainder of the week and the volatility index eased considerably on Wednesday. What did NOT happen was a meaningful relief rally.

At the same time, the US dollar (USD) has dropped sharply since the end of February, but started ticking up again by the end of the week. Bond yields have been gradually working their way higher over the last two weeks.

Finally, despite a lot of drama about a government shutdown, Senate Democrats folded and allowed the Republican-orchestrated continuing resolution to pass. That forestalls an incremental bit of chaos for now but also begs the question of what the Democrats will be willing to take a stand on.

Oil

Amidst the tariff turmoil the last two weeks, a news item that received less attention than it should have was oil. Rory Johnston ($) provided a great summary in his Substack:

OPEC+ surprised markets by announcing that 8 core members would proceed as planned to begin gradually increasing production in April, though it was stressed that, as always, the schedule is dependent on market conditions and may not only be paused but even reversed as needed.

The current plan will see the producer group hiking output by roughly 2.5 MMbpd over the course of 18 months, split between an unwinding of a 2.2 MMbpd production cut and 0.3 MMbpd upgrade to the UAE’s production baseline.

OPEC+’s decision to finally go ahead with the much-delayed plan was widely unexpected but reflects (i) internal member pressure to lift output, (ii) external pressure from the White House, and, potentially, (iii) anticipated Iranian export losses while maintaining plausible deniability with Tehran.

More broadly, the producer group traded revenue for relevance, shifting OPEC+ from its current role as a monthly delayer of planned output increases to an active factor in monthly reassessments of oil market outlooks

So, just as President Trump promises to “Drill baby drill,” OPEC+ plans to massively increase output into a market that is reasonably well balanced currently? Obviously, there are a number of things going on.

One is simply the vanishing patience of Saudi Arabia to backstop OPEC+ overproducers by taking disproportionate cuts itself. As Michael Kao posted, “Atlas (KSA) shrugged and is no longer willing to hold up the Free Riders (rest of OPEC+). It was just a matter of time.”

Still, the timing raises questions. Perhaps the KSA (Saudi Arabia) foresees an improving supply/demand balance? That is certainly possible. In their latest report, Goehring and Rozencwajg said the IEA’s estimates for electric vehicle adoption were “wildly optimistic” and argued IEA systematically undercounts oil demand. Further, they claim IEA is also overestimating non-OPEC production growth. In short, they see a better than consensus supply/demand balance too.

Finally, there is probably a bit of both defense and offense in the KSA’s decision. For one, they want to defend against further market share erosion. However, they may very well see an opportunity to hobble the US shale industry by anchoring oil prices low enough to prevent further drilling from the shale companies. They’ve done it before; they crushed prices in 2015.

The result may well be a case of “beware what you wish for”. Trump says he wants low oil prices to keep inflation down. What if he gets oil prices so low as to prevent the US oil industry from investing in new growth instead?

Politics and public policy I

In my mind, one of the greatest challenges for investors is gauging the amount of political capital Trump has to effect some of his more controversial policies. If that capital is fairly limited, his worst impulses will be checked. If that capital is fairly abundant, we could see fairly significant erosion of our democratic institutions.

An important pillar of support resides with support of Trump’s economic policy. At this point, only the heartiest of globalists would argue globalism wasn’t taken too far and failed to address important shortcomings.

Nonetheless, Trump’s own economic policies continue to confound. Frequent policy reversals combined with frequently harsh rhetoric not only increase uncertainty but have also undermined trust from allies. Steve Liesman, the economics commentator at CNBC summed up his analysis as well as anyone: “I’m going to say this at risk of my job but what President Trump is doing is insane. It is absolutely insane.”

While many of those who have been negatively affected have turned sour on Trump, many, surprisingly, have not. By and large, the stated plan of restoring the Main Street economy still garners wide support, even though the plans to achieve that stated end are either poorly developed or counter-productive. Although the primary economic goal is sound, the execution risk remains high.

Curiously strong support for Trump also continues despite a wide range of efforts to challenge and/or erode democratic norms. The Trump administration’s pandering to Russia, regular defiance of court orders, unconstitutional shutdown of approved spending, countless conflicts of interest, et al, almost seem designed to be as repugnant to democracy as possible.

Why are supporters so tolerant? Answering that question will go a long way in helping investors calibrate the amount of risk in the market.

Politics and public policy II

A good place to start is the recent Substack article ($) by Jonathan V. Last: “New Data: Republican Voters Want Authoritarianism”. He concludes “a growing number of Americans have become not just tolerant of, but affirmatively for, authoritarianism.”

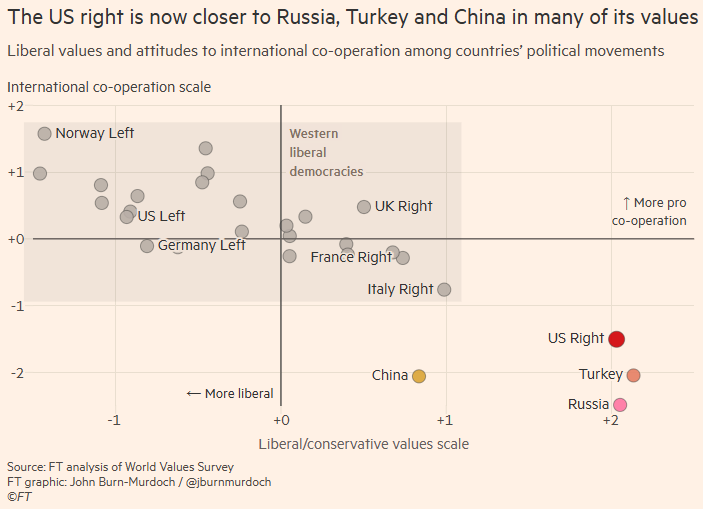

As the graph below from the FT($) illustrates, shockingly enough, “The right-wing European parties are closer to Democrats than they are to Republicans.” Last describes support for Trump originating not primarily from economic policy, but from the dog whistle cues of authoritarianism: “I do not know any way to assimilate this data except to propose that many Republicans chose Trump because they heard his authoritarian pitch, believed it, and voted for him to implement it.”

He goes on to explain where this tendency toward authoritarianism came from: “authoritarianism has been the bread and butter of the American South since the Founding.” Fellow Bulwark writer, Alan Elrod ($), expands: “Liberal democracy [never] put down deep roots in the South in the way it did across the rest of the country.” He continues:

The region never really abandoned its warped electoral politics and inclination to single-party cronyism, a Southern political instinct that helps explain how Democratic dominance transformed so completely into Republican one-party rule following the civil rights era.

In 2025, the Solid South remains. Of the eleven states of the former Confederacy, only North Carolina and Virginia are not currently governed by Republican trifectas.

Last picks up on the point and continues:

Republican voters have been like this with authoritarianism. They have, over the course of years, slowly changed their values to prefer illiberalism. The rest of us failed to notice, because the institutional Republican party was strong enough to prevent illiberal candidates from making it onto the menu.

This goes a long way in explaining the current political environment. Southern politics has always included a strong thread of authoritarianism, but that thread was masked for several years after the civil rights era by “institutional” Republicans. As both “institutional” Republicans and Democrats have lost their way, the force of authoritarianism has emerged as the more powerful force of the three.

By this explanation, then, it’s not really that Trump supporters are tolerant of his “insane” policy decisions. That is an assessment that only makes sense with the assumption of liberal values. Rather, Trump retains fairly strong support exactly because of his “insane” policy decisions — because those are signals of autocratic rule. It seems like Trump supporters are mainly seeing and hearing a person decisively taking action — which is exactly what they voted for.

Politics and public policy III

So, it can be said Trump is divisive as a political figure, but to what degree? What are the limits to the kind of change he wants to implement? I suspect the answer we are arriving at in real time is, “A lot fewer than many of us had imagined.”

For starters, it helps to understand there is a history of widespread acceptance of authoritarianism in the South; it is not a passing phase or an isolated occurrence. In addition, beggars can’t be choosers. In many circumstances, especially in poor and rural areas, people don’t feel nearly as well served by liberal values. Perhaps most importantly, younger people who are struggling to find meaningful work and to afford homes, aren’t finding a lot of reasons to support the liberal, globalist order that has shut them out of the American Dream. In short, Trump support isn’t coming out of nowhere and its not going to suddenly vanish either.

It also helps to take a good hard look at the liberal globalist order itself. While beneficiaries of that order can smugly point to all the benefits it has provided, they are equally comfortable glossing over its hypocrisies and shortcomings. Primarily it involved a deal of expanded global trade and excessively low interest rates in exchange for a loss of manufacturing jobs, stunted growth in real incomes, and record high inequality.

Further, this extremely unhealthy (and unequal) outcome was generated through no small amount of corruption and self-dealing and a massive increase in debt that burdens future generations. At every turn when there was an opportunity to check this awful trend by reining in debt and fixing problems, beneficiaries pushed back, preferring to allow those getting hurt the most to suffer further rather than accept sacrifices themselves. The record of the liberal/globalist order is a lot less impressive on closer inspection.

This raises an important point. While Trump’s authoritarianism may seem repugnant to those with greater esteem for democratic ideals, how many fellow liberal/globalists share that same degree of advocacy and how many simply tagged along for the rising stock and housing prices? How many would be willing to fight and sacrifice for democracy? It may well be there are a lot fewer true advocates than imagined.

One thing to take away from all this is that any expectation that the Trumpian political movement is likely to implode on its own is likely to be disappointed. The measures of success are different for the two sides which makes it hard for opponents to really see the magnitude of support for Trump.

Another thing to consider is just how far Trump might be able to go with this authoritarian push. On that subject, more next week.

Investment landscape I

The proximate cause of Monday’s selloff was a series of comments made by the Trump administration over the weekend signaling that economic growth could slow. Trump refused to rule out the possibility of a recession when asked directly and Treasury Secretary Bessent warned that a “detox period” would be necessary.

While the comments certainly didn’t do anything to mitigate concerns about recession, they most squarely undermined the notion that a public policy “put” would be implemented if stocks fell too much. In the past when stocks turned down, either the Fed cushioned stocks with additional liquidity or the Biden administration turned on the fiscal hoses. Now, as Bob Elliott explains, “The new admin has increasingly signaled comfort with pain in financial markets in recent days.”

While this is probably a shocking change for a number of market participants, the decision has its logic. As I noted in the Outlook piece in January:

This suggests an interesting possibility. If the Trump administration simply allowed slowing economic momentum to take its course and for a recession to develop, it could blame the downturn on the Biden administration. Then it could harness the discontent to pave the way for Marco Rubio to unveil a new and improved industrial policy. That would be a relatively painless way (at least politically) to get from point A to point B.

So, as unfortunate as a market selloff might be, at least it would reset excessively high expectations to a more manageable level. In the meantime, Rusty Guinn suggests we’ll be seeing a lot of the following coping mechanism:

"A little pain is good if it gets us back on the right track" is a kernel of truth symbol that will be critical to identity/ego preservation for a ton of people. Expect it to go viral, and quickly.

I suspect he’s right.

Investment landscape II

In terms of political strategy, it makes perfect sense to reset market expectations lower and to more achievable levels. The biggest potential drawback of doing so, however, is that the market cannot be fine-tuned as if adjusting a dial. Rather, a significant decline in stocks could precipitate even bigger selloffs.

Unfortunately, there are several different mechanisms which could spawn such a process, all of which I have mentioned several times in the past. For one, flows into passive funds could subside. If and when the marginal buyer becomes more price-sensitive, prices could fall a lot. Fortunately, this isn’t happening yet according to the expert on the matter, Mike Green: “I get a lot of questions on signs of passive selling. None yet. Lots of rotation (money into Europe) and pod unwinds, levered ETF unwinds... but not seeing the ask yet on passive funds.”

Another mechanism which has the capacity to cause disruption is an unwinding of the carry trade. While carry trades can manifest in many ways, they are essentially short volatility trades. They are also leveraged trades. As a result, when they blow up, they blow up spectacularly; there is no gentle unwind of a carry trade. A sustained level of higher volatility would be sufficient to cause such an unwind.

In addition, US stocks and bonds have had the great fortune of receiving significant demand from foreign entities in both the public and private sectors. In the context of more acrimonious relations with the US and greater needs for investment capital at home, foreign countries are fundamentally reassessing the US as an investment destination. Because foreign entities own a lot of US assets, any incremental effort to sell could have a disproportionate impact.

Finally, all of the above dynamics have worked together to create a perception that there is no alternative (TINA) to investing in US assets. This was entwined with a belief system of US exceptionalism.

As Brent Donnelly notes, however, this condition is rapidly reversing:

The new regime brings a weaker USD, stronger EUR, and massive outperformance of global equities vs. the US as the years-long theme of American Exceptionalism has turned on a dime to “anything but the USA.”

So, while it is almost certainly a good idea to reset market expectations lower, the Trump White House is also running a significant risk of initiating a disorderly selloff by doing so. Is it overconfident in being able to prevent the market from spinning out of control? Perhaps. Will it place all the blame on the Biden administration if stocks sell off too hard? Almost certainly.

The main thing investors should know is that we are in a whole new regime in terms of public policy support for the market.

Portfolio strategy

With stocks trading down steadily over the last three weeks, traders are becoming increasingly uncomfortable. Buying the dip isn’t working and economic and market signals are mixed.

To alleviate some of the confusion, Brent Donnelly notes there is an important difference between trading within a market regime and trading a regime change:

You can see after a mega move, EURUSD keeps going. It’s a tell that the market is the wrong way. This is an important aspect of overbought that people don’t consider thoughtfully enough. When nothing is going on, and the thing gets overbought, sell it. When there is a regime change and the thing gets overbought, buy dips.

Overbought and oversold are regime sensitive indicators. In a strong trending macro regime, overbought is a signal of a strong trend.

To be clear, Donnelly adds, “For the dollar [USD], it feels pretty safe to say we are in a regime change here.” That suggests it is in a “strong trending macro regime” and as such, it is better to trade that trending regime than bounces within a channel.

Implications

As investors struggle to make sense of the Trump administration policy regime, it helps to consider that the confusion in economic policy circles is largely a function of confusion in political philosophy circles. As Gideon Rachman at the FT ($) expressed, “I don’t think Trump has a coherent plan. I think instead he has instincts and prejudices”. That’s true.

While that sounds appalling to globalists and advocates of liberal values, that’s kind of the point. As a result, any attempt to understand Trump’s policies must do so through the lens of authoritarianism and his prior vow to “Drain the swamp”.

So, while the conventional calculus of liberal economic and political values deem many of Trump’s policies as “insane”, those policies have a logic with the Trump political ideology. As usual, Bob Elliott captures the implications of this disconnect perfectly:

This "Wrecking Ball" approach combined with a slow moving Fed suggests the policy put so critical to the BTFD bid is struck far below what most expect.

While initial moves have taken out euphoria priced in to kick off the year, current levels are far from pricing an admin comfortable with sharp fiscal tightening and a delayed Fed response. Pricing in this "Wrecking Ball" reality requires a much more significant decline ahead.

How far can stocks fall before there would be public policy support? Hard to say. It could be a long way. It will probably be up to Trump’s “instincts and prejudices”. If that feels like a very different environment, that’s because it is.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.