Observations by David Robertson, 3/3/23

It didn’t feel like there was a lot of news of note so more of the topics than usual this week are a bit more reflective. Sometimes, it’s good to have a chance to just think through things!

If you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

After a roller coaster ride in Monday, with stocks quickly shooting up 1.2% before finishing nearly unchanged, it was mostly downhill after that … before turning around on Thursday. Once again, much ado about nothing. While stocks still seem to be searching for direction, one ominous portent has appeared …

This is arguably one of the biggest developments this week and hasn’t even made headlines. Thus far, bursts in realized inflation have not translated broadly into higher long-term inflation expectations. The belief has been the Fed has got this under control and there is no need for investors to worry their pretty little heads over such a fleeting nuisance.

That view is changing. With inflation numbers in the US pointing up again and economic numbers coming in pretty strong, investors are re-evaluating longer-term price impacts.

This has big implications for financial assets. The more inflation gets built into longer-term expectations, the higher rates need to go up, the more the cost of capital increases, and the tougher it becomes for stocks to retain their heady valuations. Stocks have resisted this for a long time; perhaps that time has come.

Credit

The Return of Credit Risk

https://www.theinstitutionalriskanalyst.com/post/the-return-of-credit-risk

Because of the sharp increase in short-term interest rates, nonbank lenders from mortgage companies to commercial real estate conduits are facing negative carry on their assets. Many firms are simply choosing to liquidate positions and shut-down.

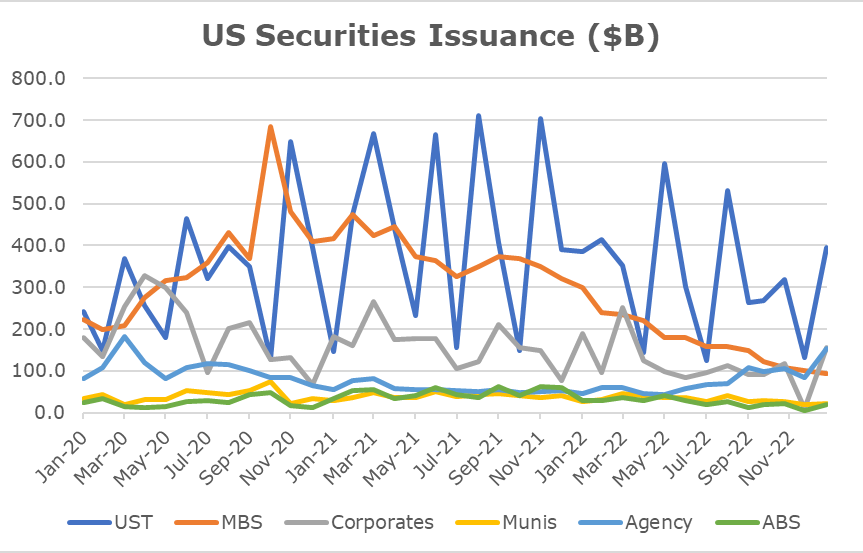

“A Brookfield fund delivered a small shock to the US CMBS market last week after it defaulted on two top-tier office towers in Los Angeles,” IFR reported. There are many more actual and maturity defaults coming in CMBS as issuers are unable to roll maturing debt. The decline in new asset-backed securities (ABS) issuance shown in the chart below includes all types of asset-based financing other than mortgages. The MBS series includes residential and CMBS.

While Chris Whalen can’t seem to control his vitriol for Lael Brainard, he does manage to home in on some important credit issues.

The main point is the world of asset-backed securitization is slowly, but surely and painful, eroding away. It is now three years after the introduction of lockdowns to manage Covid-19 but here we are. The industry is getting hit hard.

One point is this process is deflationary. When real estate funds default on properties, it means the debt goes bad which means money gets destroyed. Another point is this process has many parallels with the GFC in which many mortgage securitizations went bad as home prices declined. This time the problems are more focused on commercial real estate than residential, at least for the time being.

While I expect we will hear a rising chorus of wails from large real estate investors like Barry Sternlicht bemoan their crumbling empires, the Fed has good reasons to stay the course. Partly, it’s just good politics to try to help the “little guy”, but mainly it is serious business to regain control of money supply. The Fed cannot do that if almost anybody can bundle some assets and have that bundle be treated as money. This is ground-zero for the “2-speed economy”.

Politics

The cultural left has peaked ($)

https://www.ft.com/content/6f69ea55-32c6-477e-93d2-598bbd6e761a

Well, identity politics is another perverse fruit of success. The movement grew during the decade of economic expansion and peace that followed the 2008 crash. As those benign conditions fell away, so did the movement. It is hard to care that Augustus Gloop is called “fat” at a time of double-digit inflation. It is hard to deplore microaggressions while Ukraine is enduring a rather macro one. The cultural left hasn’t been defeated so much as demoted: in salience, in moral urgency. Grievances that once had force now seem beside the point.

While I am always leery of venturing too far into politics in this space, Janan Ganesh makes some excellent points that also ultimately bear on the investment landscape. I think he correctly diagnoses identity politics as a function of benign conditions - the “perverse fruit of success”. I think he is also right in characterizing identity politics as being more “demoted” than “defeated”.

In investment terms, this suggests when the economic going gets tough, relatively trivial concerns lose both their “salience” and “moral urgency”. This is consistent with what I observe. Most people don’t have the time or energy, or heart, to get angry about things that don’t really matter to them. Those who do are mainly just angry people.

What this means economically is political opposition to things like fossil fuels is inversely proportional to economic need. As need increases, opposition decreases. I see this as mainly a good thing as it facilitates more robust discussion around how to transition to cleaner energy, among other things.

The main point is economics usually wins out in the end. As resources become scarce, you get a more accurate reading of what people’s wants and needs really are.

Japan

Faulty Towers, Almost Daily Grant’s, February 23, 2023

https://www.grantspub.com/resources/commentary.cfm

The Bank of Japan’s struggle against market forces continues apace, as 10-year Japanese government bond yields once again breached the central bank’s 50-basis point line in the sand during yesterday’s session. Under the auspices of outgoing governor Haruhiko Kuroda, the central bank has committed to purchasing an unlimited amount of JGBs at that yield threshold to stimulate the economy and generate a proper, currency-shredding inflation.

Indeed, a policy reversal could carry major ramifications for the global liquidity backdrop, as the BoJ’s portfolio of government bonds ballooned by ¥19.3 trillion ($144 billion) in January alone according to in-house data, equivalent to 3.3% of last year’s nominal GDP and easily eclipsing the U.S. Federal Reserve’s $80 billion in balance sheet runoff over the same period. At the same time, Japanese investors have been repatriating assets at a record clip, as net foreign bond purchases reached negative $200 billion over the 12 months through November, the Daily Shot relays today, by far the most since at least 2005.

Japan has been the highway accident you just can’t not stare at. With the introduction of a new central bank head this spring, this could be the opportunity to set a new direction.

What we do know is Japan is often considered the “Saudi Arabia” of savings, though that can be interpreted somewhat differently:

If home becomes more hospitable for Japanese savers by way of higher rates, or less hospitable for offshore financial intermediation, the flow out of other places is likely to cause rates in those other areas to increase, all else equal.

So, Japan is the figurative elephant in the room. It’s hard to talk about destabilizing risks without considering Japan’s role, but at the same time, it has held out far longer than anyone thought possible. Will it finally allow rates to rise? This could be one of the most interesting and impactful stories to watch this year.

China

China’s economy faces a new wave of Japanification ($)

https://www.ft.com/content/ee9ef5bd-2e7d-4618-8f8f-952f721167a2

Back in 2003, Japan could no longer fool itself that all was well. The 1990s had pitched the country off a trajectory on which it once seemed capable of overtaking the US. Its subsequent mishandling of the bad loan mountain built during its 1980s vainglory days put paid to the notion that the country could easily recover.

The problem, as a team of Citigroup analysts declared last week, is that China today looks “strikingly similar” to Japan in its post property bubble era. The countries’ respective demographic profiles, with China’s population now shrinking as Japan’s did years earlier, provide a reminder that after 1990, Japan’s housing price index fell as the 35- to 54-year-old cohort decreased. The report focuses its warnings on the potential risks for China’s banking system.

I’m not sure what compels the horde of China apologists, but hyper growth of debt, an unsustainable economic model, rapidly deteriorating demographics, and strict capital controls just don’t seem to take the shimmer off the opportunity for some people. Leo Lewis at the FT sees it differently; he suggests “if it is not careful, China may be on track for a new wave of Japanification”.

None of this should be a surprise. I wrote a piece five years ago expanding on the thesis of Jim Chanos that the most important asset class in the world is Chinese real estate. The problems were obvious then. The Japanese precedent was well-established. Lewis calls these “distinctly echoey times”

These structural impediments are now running up against a Chinese “re-opening” trade that was boosted this week by a stronger than expected purchasing managers index. So, whither China?

Once again, I believe the main thing for longer-term investors to keep in mind is the mid- to longer-term prognosis for China is fairly dark. It has major restructuring to do which will likely take decades, i.e., Japanification. That doesn’t mean its economic heft won’t be felt from time to time, however, especially when it comes to things like marginal demand for commodities.

Advisory landscape

SHOULD YOU (OR I) LAUNCH A HEDGE FUND?

In 2001, the Federal Reserve put interest rates at very low levels and for the next 2 decades, you rarely got paid anything for holding cash. . Meaning that holding cash also looked very unappealing. This combination of low interest rates and poor equity returns were fantastic tailwind for hedge funds.

When I look at the funds that have succeeded over the last ten years, I find that many of the systems use regulatory arbitrage to generate an edge. This creates two problems for me. One is that is extremely hard to replicate. And secondly, these models are always at risk of legal and regulatory change, which is very hard to judge.

This is an extremely insightful and succinct summary of the hedge fund business - that also captures many of the broader trends in the investment business. What really stood out for me was the view that many of the most successful funds over the last ten years used “regulatory arbitrage to generate an edge”. In other words, they cheated.

Well, maybe not cheating in a technical sense, but certainly in some ethical sense, especially as it relates to social utility. If you see a part of the market that doesn’t seem to work because of unclear, inconsistent, or nonexistent rules, do you A) do your best to help rectify the problem, or B) exploit the living crap out of it by leveraging up and create an even bigger problem? Success over the last ten years was based mainly on strategy B.

One point is strategy B was largely incentivized by excessively low rates. Probably not intentionally, but it was. Another point is regulatory arbitrage has virtually no redeeming qualities. It doesn’t make the economy more efficient. It doesn’t help allocate capital more efficiently. As a result, many of the best performers were, in my opinion, also the worst citizens of the investment world.

The practice of regulatory arbitrage could potentially help identify areas for greater regulatory scrutiny, or it might not (just look how long crypto frauds have been allowed to operate). Regardless, it will be nice when the best and brightest also have economic incentives to create value rather than just tweak the system for personal benefit. I think the time is coming.

Asset allocation

Commodity Futures as Inflation Hedge Have Their Moment

That hedge [against inflation] has long been perceived to be equities. But according to the Credit Suisse Global Investment Returns Yearbook 2023, stocks don’t in fact provide protection against inflation. And if the past 123 years of data is any guide, inflation has negatively impacted both bonds and shares. Equities have been hurt less, but that’s not the same as providing a true hedge.

Why [do commodity futures serve as an effective “diversifier” in portfolios]? Because they are “negatively correlated with bonds, lowly correlated with equities and also statistically a hedge against inflation itself,” the authors wrote. Bonds, equities and real estate tend to be negatively correlated with inflation. Over the 152 years they examined, only commodities had a positive correlation, making them the only true hedge:

But nothing is simple. Commodities are, like stocks, often susceptible to deep and lengthy drawdowns. And because they are correlated with inflation, they have a penchant to underperform in periods of disinflation. The following massive number-crunching shows the excess returns you can expect from a basket of commodities in different situations for the US economy. The bottom line is while they’re a great hedge against inflation, they are absolutely not a hedge against recession

Some pretty meaty stuff here from John Authers and Isabelle Lee at Bloomberg. It focuses on the recent Credit Suisse annual update of the seminal work by Elroy Dimson, Paul Marsh, and Mike Staunton, Triumph of the Optimists.

One of the key points is stocks do not serve as an inflation hedge. The belief that they do is misplaced - and also widespread. Even Burton Malkiel extolled the virtues of stocks in his 1980 book, The Inflation Beater’s Investment Guide. Read carefully, however, and what Malkiel really liked was how cheap stocks were at that time. His thesis was more about value than inverse correlation.

Interestingly, one of the recurring themes of the investment adviser continuing education requirements I had to complete last year was the importance of stocks as an inflation hedge. So, regulators are forcing brokers and advisers to memorize something that is largely wrong, ostensibly to advise their clients accordingly. It would be funny if not so ultimately tragic.

A couple of important points fall out from this. One is there are exceptionally few good diversifiers for stock and bond funds. Gold and commodities (mainly futures) are the lonely holdouts. The question isn’t where to go so much as how to get enough exposure to matter.

This reality relegates many of the traditional forms of diversification to the pile of narratives that didn’t work. Real estate, emerging markets, private equity, and on and on are all too highly correlated to stocks and bonds to meaningfully diversify a portfolio. This is a big, and widespread, mistake.

Finally, the idea that commodities can be a good source of diversification often gets misinterpreted. It doesn’t mean spot commodities, which can help a little bit, but can face brutal drawdowns in recession. It also doesn’t mean commodity stocks - which are subject to both the vagaries of spot commodities and the business risk of finding and extracting them.

None of this means there can’t be opportunities in these other areas. What it does mean is investors often confront a lot of obstacles (in the form of false narratives) in their effort to establish truly diversified holdings. Dimson, Marsh, and Staunton do a great service to help show the way.

Implications

2022 never ended ($)

https://www.ft.com/content/a9057eec-eb93-4088-8ad1-627129eeaefe

The same damn thing, over and over

My plan for today was to write about what went wrong in markets during the week I was away. But looking at the data, it became clear that last week’s decline was simply a continuation of the decline that reaches back to the beginning of February, and that this decline is just another iteration of a repeating pattern that goes back to the market peak in the final days of 2021.

Investors are trapped in some sort of Greek myth. For their sins in life, they are doomed to a financial underworld in which the only thing that matters is the inflation outlook, which cannot be predicted. Every time they think they have it figured it out, the data reverses, and they are out of position again.

Great points by Rob Armstrong at the FT. He captures well the predominant sense I have been experiencing lately: Time is rolling by and not much of real note is happening.

This is frustrating for bulls and bears alike as stocks have remained range-bound and trends tend to reverse before gathering any steam. There’s a lot of “back and forth”.

For better and worse, this pattern is consistent with the thesis of “controlled demolition”. If you want asset prices lower, you can crush them with much higher rates. But then you break things. The better, more sustainable play is to drag things out. The more “back and forth” there is, the more investors start to lose interest.

One of the best plays for long-term investors, then, is to use this time wisely. Treasuries yield enough now to compensate you for your capital. For your time, the best compensation is probably learning. It’s a great time to catch up on reading, dig into a research project, or learn a useful skill for the future. That’s what I’m going to try to do.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.