Observations by David Robertson, 3/7/25

We had a bit of a break last week from the flood of news, but this week more than made up for it. Let’s take a look.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

On Monday, stocks took a tumble after Trump declared tariffs would go into effect on Tuesday. Interestingly, gold rebounded strongly in that environment, up about 1.5%, but gold stocks were down on the order of 2% or so. Clearly, the trading action had nothing to do with fundamentals. Perhaps a large owner was forced to sell? Regardless, gold is still holding up and ultimately, gold stocks should too.

Tuesday “was a wild ride in the stock and bond markets, with shares forming a reverse N shape (down, up, down again) through the day and Treasury yields forming a reverse hockey stick (flat, then sharply up)” according to the FT’s ($) Unhedged newsletter. Amidst the frenzy, little notice was given to China’s stern response to additional tariffs: “If war is what the U.S. wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end.”

On Wednesday, stocks rebounded on hopes the tariffs would be walked back. Indeed, news came later that autos would be exempted from tariffs on Mexico and China … for a month. Of course, that’s not nearly enough time to meaningful shift supply chains and production, but hey, we’re living day to day here. On Thursday evening, the Trump administration back pedaled even more.

Through it all, intraday volatility has been exceptionally high (per themarketear.com ($)):

Economy

Signals last week the economy was slowing down were confirmed this week. On Monday, the ISM manufacturing report produced a double whammy with new orders coming in well below expectations (and into contraction) and prices paid well above expectations and growing. On Wednesday, ADP employment came in weak but ISM services was strong.

Matt Stoller ($) writes that while aggregate measures of consumer health still look pretty good:

something about this doesn’t square with the misery that people feel in the economy, as 77% of the public thinks their income isn’t keeping up with inflation. Credit and auto loan delinquencies are higher than they’ve been since the 2008 financial crisis. How does this economy look good when people feel so bad? One reason is that our stats were collected premised on a reasonably equal society that no longer exists. Today, 10% of high earners account for half of consumer spending. That’s insane. There are actually two economies, one with high earners, and then everyone else.

Stoller goes on to describe, “This dynamic reminds me of how Ronald Reagan fired striking air traffic controllers, which was a green light to corporate America to break unions across the economy. DOGE, for better or worse, is the trend in America.”

Indeed, actions and statements coming out of the White House do send a signal to the rest of the country (and the rest of the world). Early in Joe Biden’s administration, he admitted inflation was too high. In doing so, he also signaled to every company CEO that it was OK to raise prices — because inflation! Now the signal is that it is OK to cut workforce — to increase efficiency!

The main point is that workers and consumers also hear these signals and react accordingly. If your government is sending notice to employers that it’s just fine to cut jobs, your income stream just got a lot more uncertain. No wonder so many people are unhappy with the economy. Oh, and by the way, inflation is still too high.

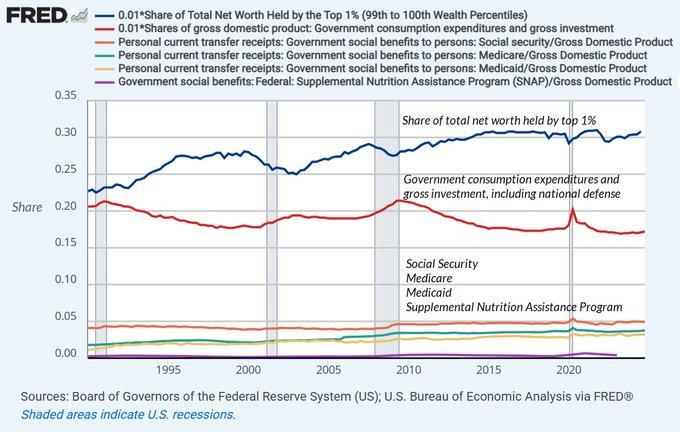

Of course, as John Hussman points out, the systematic favoring of the richest at the expense of the poorest has been going on for decades:

Monetary policy

In the seventeen years since the GFC, monetary policy has been a primary policy tool to drive growth. The costs of doing so were much easier to gloss over when inflation was low, but now that inflation is higher, those easy money policies are being re-calibrated. Andy Constan explains the consequences in a detailed thread on X.

One of those consequences (which I have mentioned several times before) is that the Fed will be much more measured in using extraordinary tools in the future. In particular, Quantitative Easing (QE) will only be used as a last resort: “QE is a tool that is used when Fed Funds are zero and there is no other choice for the Fed.” This varies considerably from the widespread assumption the Fed will crank up QE at the first sign of market turbulence. That is wrong.

Another interesting point to come out of the discussion is the new playbook for monetary policy. Going forward, it looks to be a lot more like a generic central bank mandate of providing money supply to be compatible with moderate economic growth: “Trend long term GDP growth is 4%. that means the increase in reserves ‘needed’ to track GDP growth is 120BN per year.”

The biggest single takeaway is that the Fed’s days of being the market’s savior of first resort are over. It is now back to stodgy old ways. This will likely make for a hard lesson for a lot of investors to learn. Another takeaway is leverage is likely to come down as liquidity normalizes. Finally, without being able to rely on monetary policy as the driver of markets, investors will have to look for alternatives — like fundamentals.

Politics and public policy I

While Zelensky’s meeting with Trump was a week ago, it’s impact is still being felt and scrutinized. The Atlantic provided the following comments:

But baiting Zelensky into fighting in front of the media was likely the plan all along, and Trump and Vance were soon both yelling at Zelensky. (“This is going to be great television,” Trump said during the meeting.) The president at times sounded like a Mafia boss—“You don’t have the cards”

The sheer rudeness shown to a foreign guest and friend of the United States was (to use a word) deplorable as a matter of manners and grace, but worse, Trump and Vance acted like a couple of online Kremlin sock puppets instead of American leaders.

The behavior by Trump and Vance were widely recognized across the US as deeply unserious, immature, insensitive, and aggressive. Jonah Goldberg at the Dispatch ($) described it as “appalling and embarrassing for the country”.

Importantly, it was also recognized by others around the world. Alec Russell ($) from the FT, who had been in Ukraine, reported the White House ambush mainly served to bolster Zelensky at home:

The second factor is that Trump’s lambasting of Zelenskyy has given the Ukrainian president a fillip in the opinion polls. Time and again people have told me that it is absolutely fine for them to mock their president, not least because his government’s record is far from flawless. But, they add, it is definitely not OK for foreign leaders to lay into their war leader.

Meanwhile, still others viewed the occasion as an enormous opportunity. Ian Bremmer posted that it was a “big day for dictators with territorial ambitions”.

Politics and public policy II

In yet other political news, the Trump administration announced the intent to set up a strategic crypto currency reserve. This decision was made despite there being no excess wealth to manage and no strategic advantage of reserving cryptocurrencies. Further, there is a laundry list of conflicts of interest which prominently feature Trump’s cryptocurrency czar, David Sacks. Lastly, the timing of the announcement was auspicious as bitcoin (and other cryptocurrencies) had been tumbling hard.

For most outside observers the idea of a cryptocurrency reserve is absurd on any practical policy level. What’s especially interesting, however, is the clear inappropriateness of the policy is even causing a number of the cryptocurrency faithful to ask questions. Whether this amounts to meaningful political pushback remains to be seen, but this unique faction wasn’t formed on the premise of losing money.

Politics and public policy III

Finally, completing a trifecta of market-roiling policy announcements in the last week, Trump also announced tariffs on Mexico, Canada, and China would begin on Tuesday. Fortunately, Dave Rosenberg had already set the stage:

President Trump just gave Canada and Mexico a report card on what they each had to do to avoid the 25% tariff, and it looks like he gave them both an ‘F’ grade. Meanwhile, the equity market is playing the dual role of Alfred E. Neuman (What, Me Worry?) and Bobby McFerrin (Don’t Worry Be Happy). What these bulled-up investors don’t seem to realize is that if these tariffs go through, especially in the auto sector, there will be few places to hide beyond cash, bonds, and gold.

Bob Elliott also put out a detailed thread on his analysis of tariffs. He summarized:

Tariffs implemented today are just the start of suite of planned levies that would bring US tariffs to above the Smoot-Hawley days in just a few weeks. Even with modest retaliation by trade partners, these policies are shaping up to slice 2% off US real growth.

Stocks started shedding their Alfred I. Neuman and Bobby McFerrin roles and immediately turned south after the announcement on Monday. They continued sliding on Tuesday.

While the removal of protective cover from public policy is unsettling, so too is the current foray into a policy space unfamiliar to virtually every living human being today. Brent Donnelly provided some interesting perspective on how far this administration is straying from traditional conservative economic policy and foreign relations with this quote from Ronald Reagan:

The expansion of the international economy is not a foreign invasion; it is an American triumph, one we worked hard to achieve, and something central to our vision of a peaceful and prosperous world of freedom.

The contrast in political philosophy from within the same party is striking. So too are the likely negative economic consequences striking. So too is the uncertainty caused by ongoing policy schizophrenia. And, so too is the market’s complacency through all of this — although that appears to be changing.

Investment analysis

For those of us in knowledge businesses, artificial intelligence provides both an exciting and a frustrating allure. It seems like it can do a lot of interesting things, but how can it improve MY work flow?

In his writing on Substack, Mike Green ($) provides numerous examples. For starters, he notes, “ChatGPT excels in summary”. That may include summarizing a book you haven’t read for a long time or one that is still on your reading pile. It may also include an open-ended question:

MWG: “Is Trump gutting democracy?”

Grok:

Whether Donald Trump is "gutting democracy" depends heavily on one's perspective, as it’s a question steeped in political interpretation rather than a clear-cut fact. Critics argue that his actions—particularly in his second term as of February 23, 2025—threaten democratic norms. They point to his rapid reshaping of the federal government, including mass firings across agencies, a barrage of executive orders (nearly 70 in his first month, outpacing predecessors), and efforts to centralize power by sidelining Congress and the judiciary …

On the flip side, Trump’s supporters argue he’s strengthening democracy by fulfilling the mandate of a duly elected leader. They view his dismantling of what they call an entrenched, unelected bureaucracy as a restoration of power to the people, not a subversion of it …

On a different note, large language models (LLMs) can also be used to build and test models. The following is a prompt Green used to construct a theoretical structured product. He ended up with a “fully executable code in VBA, which makes the process easily executable/auditable in Excel.” The potential is awesome.

Other ideas were presented in a recent FT ($) article entitled, “Time to deploy AI robots to rethink annual reports”. Perhaps the most intuitive opportunity is to use LLM tools to quickly scan through reports for “fine print” that could be meaningful.

The article also suggests “GAAP might evolve into a set of principles to ensure there is always enough data and metadata for AI to re-present the numbers on any basis an investor might like.” This presents an opportunity to leverage AI to make those same representations easier and faster.

Finally, the Harvard Business Review article, “Embracing Gen AI at work” ($) provided a few general tips. For instance, “intelligent interrogation” involves prompting LLs … in ways that will produce measurably better reasoning and outcomes. In addition, “Judgment integration” is about bringing in your human discernment when a gen AI model is uncertain about what to do or lacks the necessary business or ethical context in its reasoning”. Finally, “With reciprocal apprenticing, you help AI learn about your business tasks and needs by incorporating rich data and organizational knowledge into the prompts you give it, thereby training it to be your cocreator.”

As I am finding myself, the more I learn to use AI tools, the more helpful they become, the more productive I become, and the more fun the work is.

Investment landscape I

One thing that is becoming clear from Donald Trump’s recent actions is his embrace of using power to get what he wants. It is also clear he embraces a mafia-like style of leadership. What is also emerging, at least in my opinion, is that as much as he may admire gangsters, he missed some important lessons about using power effectively.

For example, it is dangerous to push people too far. Doing so tends to radicalize them, and even whole populations. Overly burdensome demands on Germany following World War I planted the seeds of World War II. You just create bigger future problems by pushing too hard today.

In addition, if you want to squeeze people, ideally you want the nuisance value to fall below the threshold of radical action. People may not like making “protection” payments, but if it’s not too much, it’s easier than bracing for a bigger fight. The same principle applies to hedge fund fees: If you charge too much, you lower the total lifetime value of the client, even if the client remains loyal.

Finally, if you make an offer that is “too good to refuse,” you have to keep it — or risk losing your reputation and your power. If you don’t stand behind an ultimatum, you will quickly be determined to be weak and therefore a target.

What all of these points have in common is the iterated nature of most strategic power games. In other words, there are multiple steps along the way. In order to optimize long-term outcomes, you need to think ahead to how others will react, or might react, many steps into the future.

Thus far, the Trump administration seems to be relying heavily on the narrative that he is a master negotiator. However, it is becoming increasingly clear that he is not a good power strategist. The assessment of tariffs on Monday and the walk back on Tuesday is a great example. Brent Donnelly posted: “Trump folds as S&P 500 touches 200-day *LUTNICK: TRUMP MAY LOWER CANADA, MEXICO TARIFFS TOMORROW”.

Back pedaling was engaged in earnest by the end of the week which featured a delay in tariffs on Mexico and China, an executive order on cryptocurrencies that did not include any purchases, and a throttling of the DOGE effort to slash federal government headcount.

Such a capitulation is a glaring sign of weakness, not of strength. Stocks are testing this already and bonds are joining in too. If power is not used judiciously, it has a way of eroding quickly.

Investment landscape II

One narrative that has been at work is lower bond yields. After Treasury Secretary Scott Bessent highlighted lower bond yields as a policy goal, 10-year rates have dropped from 4.8% early in the year to 4.18% earlier this week. While increasing concerns about slowing growth have contributed to that rate decline, it is interesting to note that interest rate volatility has shot up in recent days (from The Daily Shot):

Sticky inflation may be contributing to interest rate volatility, but the big change recently is the increase in supply of bonds globally. The FT ($) reported, “Worsening public finances are a growing concern among big investors, with bond giant Pimco warning in December it planned to cut its exposure to long dated US debt due in part to ‘debt sustainability questions’.”

More specifically, Zerohedge ($) reported on the dramatic shift to debt-financed fiscal stimulus in Germany: “The leaders of CDU/CSU and SPD this evening [Tuesday] announced an agreement on an even more significant fiscal expansion than what anyone had expected at the beginning of the week.” The move was explicitly referred to as a "whatever it takes" moment.

German bund yields jumped on the news and quickly infected other bond markets. If the pressure pushing global bond yields higher keeps up, it will severely hamper Bessent’s objective of rebuilding the US industrial economy by way of lower rates. Of course, this shouldn’t be a surprise to regular readers since the potential for yields to bump up was noted in Observations three weeks ago. Nonetheless, investors will have to incorporate yet another dimension into their assessment of bonds.

Implications

While many of the Trump administration policy goals are laudable, there is little compelling evidence of plausible means to attain them. Worse, many of the plans appear to be ad hoc and even counterproductive over a longer time horizon.

In the short-term, that implies uncertainty will remain high, spending will come down, and the effects will be deflationary.

Over the medium-term, uncertainty and geopolitical pushback appears likely to increase frictions in a global trade environment that had operated fairly smoothly. That is likely to disrupt supply chains, increase fiscal spending in other countries, and will be inflationary.

The net effect is to increase the potential for stagflation. Worse, as troublesome as this scenario is, the Trump administration also appears to be overconfident in it ability to minimize the risks of both slower growth and higher inflation. While the Biden administration relied heavily on fiscal stimulus, Trump will be constrained in that respect if there is any hope of reducing the deficit. That means increased demand from the private sector will be needed in an environment of higher uncertainty and worsening credit. That is an uphill battle for sure.

The challenge is even greater than that, however. Presumably, Trump will rely on rate cuts to help reinvigorate growth, but if inflationary pressures persist, the Fed will be reluctant to accommodate. To the extent the Fed does cut rates, higher income consumers, which have been the primary supporters of economic growth, will see interest income fall — which will reduce their income. Further, any decline in asset values will also impair spending through the wealth effect. All in all, we could be in for a much bigger downturn that anyone has bargained for.

As Alyosha ($) summarized on Thursday:

The dams are breaking, friends. Long time frame ranges and trends in FX, fixed income and stocks are being selectively challenged by leadership markets. Changes in tax and trade policies, changes military alliances, the implied end of OPEC, libertarian populism everywhere, and so forth make technical data like support and resistance levels seem trivial.

Bob Elliott characteristically added some more insight:

The US is cutting back on spending and increasing isolationist economic and immigration policies, much of the rest of the world is picking up efforts to do just the opposite.

While there's been tactical shifts in markets in response to this news, global markets remain wildly offside long the US, even over just the last 5 years. Long-term divergences in policy stances like these risk being the spark creating a secular reversal in capital allocation.

It looks like markets could be challenging for a while, especially in the US.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.