Observations by David Robertson, 4/11/25

It was crazy week for market volatility which made it hard to keep up with all the twists and turns. Nonetheless, let’s jump in and try to make sense of it all.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

The market was so wild on Monday one is left searching for superlatives extreme enough to do it justice. John Authers ($) at Bloomberg probably captured it best:

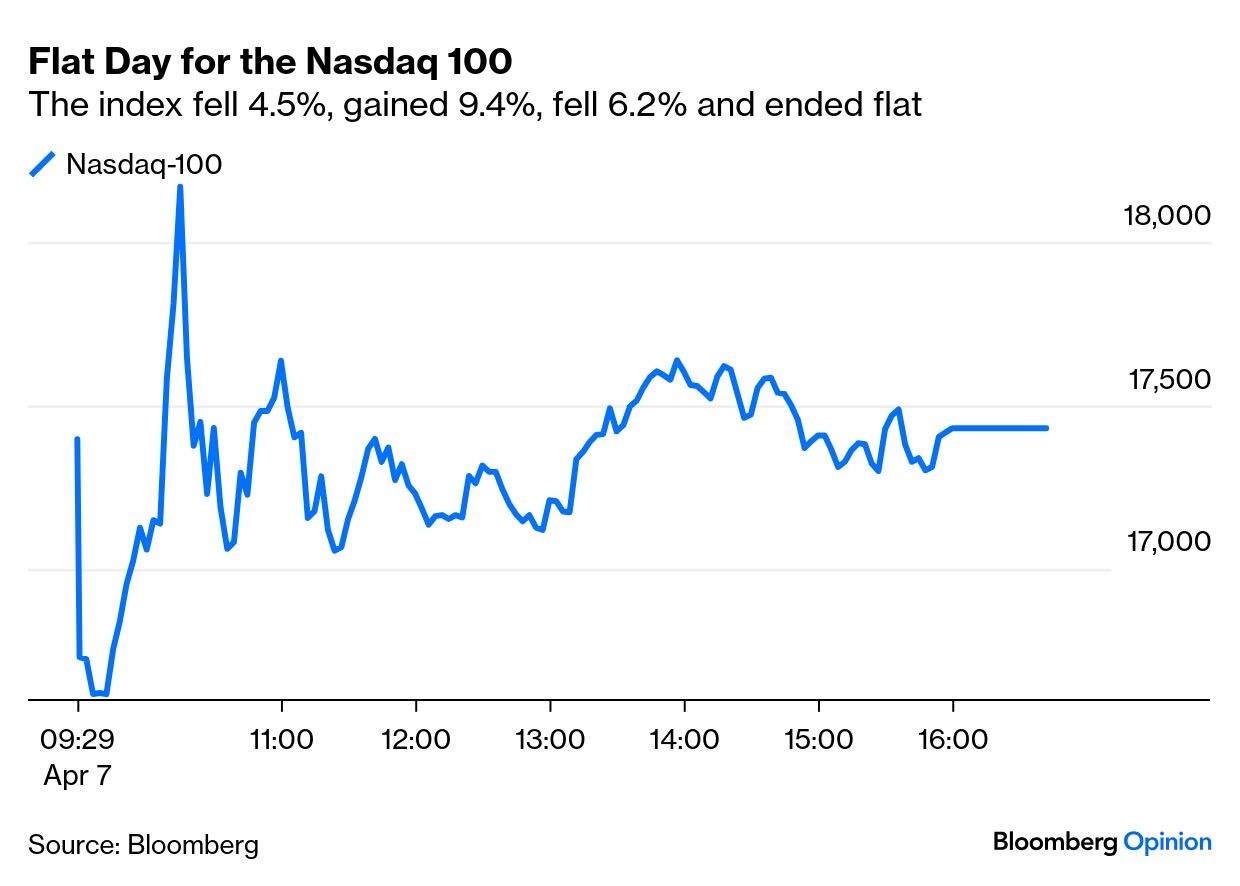

Call it Manic Monday. The US stock market started with another vertiginous crash, with the Nasdaq 100 dropping 4.5% at the open. Then it surged 9.4% on a story the White House swiftly denied that the administration was seriously considering a delay to tariffs to allow for negotiations. Then it fell 6.2%. That was all in the first hour of trading. The index ended the day up a mere 0.2%:

The mania continued. On Wednesday, stocks bounced around until President Trump announced a ninety day pause on all tariffs except those on China. In response, the S&P 500 shot up 10%. On Thursday, stocks were down 3.5%.

It wasn’t just stocks that acted like a yoyo. Mohamed El-Erian noted that the wild volatility also applied to US government bonds, “where the 10-year yield has already traded in a 34 bps range”. As a result, bond volatility, as illustrated in the graph from The Daily Shot below, rocketed higher.

Notable too was the unusual turnaround in 10-year Treasury yields. After falling on the prospects of recession, yields started pointing higher late last week and continued their surge this week. Higher long-term rates tighten financial conditions — and higher they have been going.

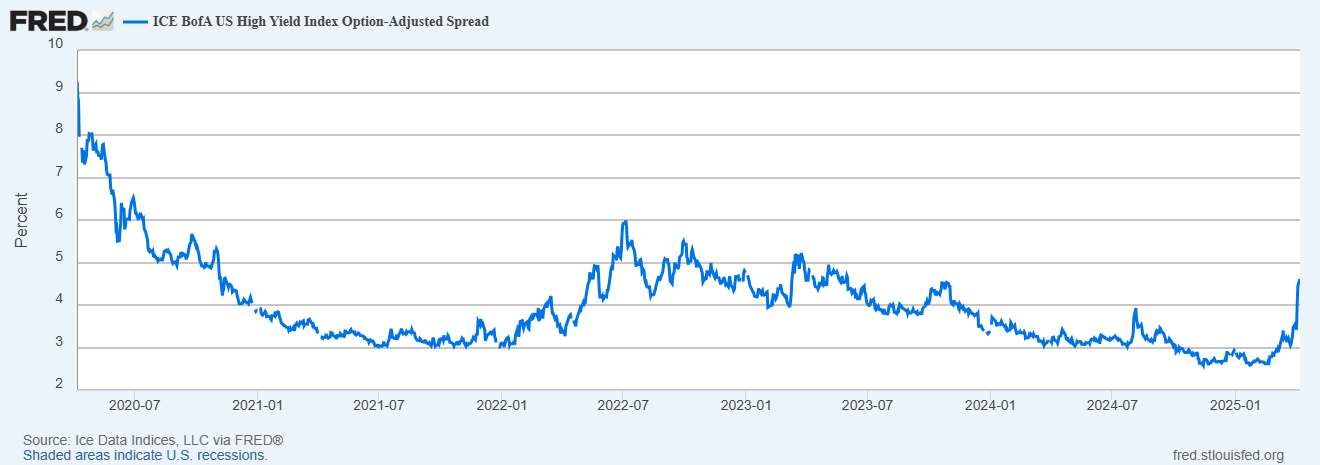

Yet another important element of recent market turmoil is the increase in spreads for high yield bonds. One point is the increase has been rapid which is an indication of the detrimental effects of tariffs on corporate cash flows. Another point is that even after the recent spike, high yield spreads are still below the peaks in 2022 and nowhere near those of the Covid highs. While we’re still a long way from any kind of disaster scenario, sometimes it can be hard to stop the snowball once it starts rolling.

Finally, and perhaps the most important move in the week, has been the significant decline in the US dollar (USD). After peaking just before the inauguration in January, USD has been on a downhill slide ever since. That slide accelerated noticeably in the last few weeks though. Normally a haven in volatile times, the weak USD provides an ominous omen for US assets.

China

As investors scramble to understand Trump and make sense of his policies, they would do well to apply the same effort to China. As Shannon Brandao ($) reports in her “China Boss” Substack, China’s leadership has its own fair share of unique quirks.

For starters, the environment in which China’s leaders hone their skills is different than in the US. Brandao explains, “Unlike liberal democracies, China lacks institutional checks and balances.” She goes on:

But without independent judicial power, personal security is precarious, and deterrence of bad acts elusive. This turns much of what Westerners assume about social order on its head.

As a result, the competitive environment for leadership takes on a different dynamic: “In China, the choice for ambitious individuals is often binary: predator or prey.”

Importantly, this dynamic applies every bit as much to political leaders as to business leaders. Brandao continues:

These aren't cautious bureaucrats or helpless lackeys. Among them you will find plenty of functional sociopaths, shaped by a 5,000-year political culture where power is seized, not shared—and where meekness invites elimination.

So, when challenges to China are issued, such as the unilateral imposition of significant tariff increases, it is extremely unlikely that the default reaction will be meek resignation.

Politics and public policy

One of the primary goals of Observations is to objectively capture market insights so as to be as helpful for investors as possible. Recently, many of the most important factors have been related to politics and public policy. In this endeavor, Matt Stoller ($) seems to be a kindred spirit:

Anyway, as regular readers know, I am not a fan of Donald Trump, but I think it’s important to understand the logic of what he is doing instead of dismissing it as crazy, stupid, or juvenile.

You bet Matt. Let’s start with the high level goal. The starting point is a global trading system that has been locked into a path of ever-greater trade deficits for the US. It absolutely makes sense to tackle this problem which Democrats have failed to do for some combination of lack of interest, lack of courage, and lack of political capital. In this context, Matt reviews the Trump administration efforts:

Taking on a very big problem like imbalances in our global trading arrangements is already very difficult and quite risky. The haphazard manner and lack of consensus building, and refusal to bring in allies, makes it even riskier. Without some significant shifts, I think it’s quite likely that this plan fails, Trump’s Presidency is shattered, and American living standards decline. But at the same time, trying to tackle this problem is not outlandish.

As Stoller suggests, a big part of the problem is not the goal itself, but the implementation. Constantly changing tariff pronouncements on tariffs sends an unintended message: You can’t count on the fact that anything said today will also be true tomorrow:

This flip flopping isn’t just embarrassing, it could sink the entire plan. The goal of implementing tariffs is to encourage companies to move production here. It takes years to set up a factory and reorient a supply chain, and lots of investment. CEOs won’t commit to that unless they think the tariffs are going to remain in place.

So, it is far more than just tariffs that are required to establish a fertile environment for domestic investment. Also required is a degree of policy consistency that can provide some degree of confidence in regard to long-term investment plans. Absent a sufficient level of stability, the easiest thing for CEOs to do is to “just raise prices and seek to out-wait this administration”.

In January, Observations reported an insight from John Ikenberry of Princeton University: “rather than supporting the international status quo, the US is poised to become the leading disrupter.” That is looking prescient.

In conclusion, this exercise with tariffs, as problematic as it is, is likely to be emblematic as well. As Stoller sums up, “In essence, Trump is proposing a sledgehammer to the world trading system, but not answering the question of what he is trying to build.” Yup.

Monetary policy

Monetary Policy As if Democracy Matters

https://kevincoldiron.substack.com/p/monetary-policy-as-if-democracy-matters

The U.S. Constitution gives Congress the power to create and regulate money. But Downey says the legislature - through an accumulation of small choices, or even non-choices - has gradually ceded that power.

While it might seem surprising for politicians to have willingly ceded power, it gives them the ability to criticize economic outcomes without taking responsibility. The Fed in turn professes to be above politics by focusing on data-driven outcomes like inflation and unemployment rates. Both sides can thus claim that markets, not politics, drive monetary policy.

At a time when the Fed’s role in guiding the economy is likely to come into the spotlight again, this perspective on the Fed is both useful and timely. The current system absolutely involves credit guidance, “it’s just done in the shadows”. While both Congress and the Fed can claim impartiality, that is only a convenient fiction. The truth is “Our current system protects the status quo,” and in doing so, suppresses volatility. This creates unhealthy feast and famine cycles in capital markets.

Alternatively, Congress could reassert its authority over monetary policy and therefore take a more active role in directing the flow of credit. While such a proposal would violate free market principles, those principles are already being violated anyway. The incremental benefit would be credit direction at the behest of elected officials rather than unelected ones. In other words, a more democratic monetary policy.

As investors start looking for someone to save the markets and the President looks for someone to blame, the Fed is increasingly likely to be in the middle of a number of policy debates. I don’t know where I stand on this “monetary policy for the people” idea yet, but I think it rightly challenges some stale conventions and at least offers an alternative to a system that has not done a very good job of what it is supposed to do.

Investment landscape I

At this point, it’s hard to say what to make of Trump’s tariff regime, but he certainly seems to have an interest in pursuing it. He has also made clear that he is perfectly willing to accept the consequences of severe market declines — which is a notable shift from past behavior. What is not different is there are clearly a number of different voices within the administration and they are not in agreement with one another.

A post on Bluesky indicates there is a substantive thread of political support for tariffs:

Tommy Tuberville: "Wall St is one of our biggest problems. They're the ones that are really standing up and pushing back against President Trump. Wall St and the globalists -- they do not want change."

In other words, ruling party message to markets: We’re just not that into you any more.

Of course, there can be a wide gap between intended and actual outcomes and there are all kinds of reasons to believe Trump’s tariff policies will not work as planned. The poor design of those policies and the potential for retaliation are key reasons.

In addition, however, the potential for a reversal in trade balances to create an even bigger problem by also reversing capital flows could be one of the most damaging consequences. Russell Clark ($) explains:

The Trump tariffs should reduce good imports, but also reduce capital imports. If we look at the initial response in currency markets, key goods and capital exporting economies like Japan, Europe and Switzerland have seen their currencies appreciate, rather than decline as you would expect with the imposition of tariffs. This suggests capital flows were more important than trade flows. I find this very bearish for the US.

Finally, a dramatic change in policy direction, especially when completely out of sync with expectations, creates enormous potential for disorderly disruptions. Those can include hedge fund blow ups, bank closures, forced deleveraging, and a whole host of other damaging events.

Even this, perhaps, may not fully capture the downside risk. While it is generally assumed some combination of fiscal and monetary policy would protect the economy and markets from severe dislocation, one must wonder if Trump would give the go ahead to bail out an organization considered to be a political rival. If not, markets may need to significantly re-evaluate what risk means in practical terms.

As it happens, there is a considerable gap between the market-implied discount rate and US policy uncertainty:

Investment landscape II

One thing that has become apparent over the last week and a half of tariff troubles is that there is still a need for Trump to have advisors around to talk him down from his own worst tendencies. Scott Bessent was able to do that Tuesday morning and on Wednesday, but the fact such constraints are needed at all indicates the inherent precariousness of Trump administration policy making.

Indeed, the massive market moves and huge leaps in volatility are not random surprises but rather are indicative of the increasing tenuousness of the market’s ability to price the uncertainty of regime change in any meaningful way. As Zerohedge ($) reports, “spx implies a 2% move every single trading session between now and year end … get your rest”. In short, traders and investors are desperately searching for something, anything solid to anchor on to.

As challenging as this environment is, there is yet another adverse factor to add to the mix. As Robin Brooks highlights, the trade war could easily spill out into a currency war:

As Alyosha ($) reports, the potential for China to up the ante by bringing currency into the conflict is not remote:

If China hits the eject button on Yuan, gold is going to flow to China and Asia again. I’m not thinking a few weeks, more like months or more. They have stated their case. “Yield to our demands, or we will sell US Ts, debase the currency, and buy gold.” Round 1 is about to begin

Certainly, there are a very wide range of possibilities that can emanate from this type of interaction, but the pattern of mutual escalation is typical of a prelude to war.

Investment landscape III

Stocks shot higher on Wednesday on one of the biggest one day moves ever after Trump announced he was pausing implementation of most of the tariff increases. While the Trump administration spun the U-turn as an opportunity to negotiate, that is almost certainly a smoke screen.

Some analysts are hypothesizing that a Trump “put” is in play. After the severe selloff in stocks, the administration got squeamish and reversed course. This is a weak explanation as the administration has gone out of its way to express its comfort with lower stock prices. In addition, it comes just one day after Peter Navarro’s fire and brimstone editorial in the FT, “Trump’s tariffs will fix a broken system”.

Some analysts are hypothesizing a Trump “put is in play but in regard to bonds not stocks. This theory assumes 4.5% is a threshold level for 10-year US Treasuries beyond which it will intervene. This too is a weak explanation and sounds a lot more like a Janet Yellen theory than a Scott Bessent theory. That said, there probably is sensitivity in regard to how fast Treasury yields moved up.

That leaves a more sinister explanation: The policy U-turn was motivated by the rapid rise in 10-year US Treasury yields, combined with a massive increase in bond volatility and distress in liquidity markets. The combination of factors indicated that an unwind of leveraged bond trades was getting close to threatening Treasury market dysfunction.

This, I think, is the real “put”. Stocks don’t have a lower limit. Bonds can do what they will … with the exception of the market seizing up. Any threat to smooth Treasury market functioning, however, will induce intervention. Interestingly, this time around intervention is likely to come from the Treasury first, not the Fed.

If this theory is right, there are some important lessons investors can take away. One, the modus operandi for Trump is to make policies without regard to consequences. Move fast and break things is the adopted motto. Hopefully someone can fix things when they do break, but know there is no a priori effort to avoid breakage.

Two, the environment is much more hostile today than during the first Trump administration. Much higher debt and inflation mean there is far less room for maneuver in public policy. As a result, the potential for greater and more lasting harm is much higher.

Three, it appears Scott Bessent provided the guardrail this time around. However, all it will take for another big problem to occur is for another tariff discussion to happen when Bessent is not in the room. Investors got lucky this time. How lucky are they going to feel repeating this process over and over?

Investment advisory landscape

Investors should hold their nerve in shaky times ($)

https://ft.pressreader.com/v99e/20250403/281711210463332

When markets feel as shaky as they do now in the US, it is normal to ask: is this time different? … But anxious investors today should consider where the market was five years ago, and how well those who tuned out the noise performed.

When I talk with investors today, some point to government debt, global tensions or new technologies — all valid concerns. But history shows us that markets have overcome every previous “unprecedented” challenge.

This is one of those pieces about investment advice that makes me bristle. Is the idea that investors shouldn’t over-react to short-term market fluctuations good advice? The vast majority of the time, yes it is.

However, the notion that one can “set it and forget it” is the result of a poor interpretation of financial history. While the author bases his claims on “more than 50 years of working in finance,” those particular fifty years of US equity returns stand out as being anomalous across both history and geography. In short, his life experience has been blessed with extraordinary good fortune, but is not representative of the whole of financial history.

This biased perspective presents a significant risk to younger and older investors alike. Younger investors are at a much greater risk of experiencing the kinds of severe disruptions that impair stock returns simply by virtue of the fact those major disruptions have been avoided for so long. The much lower confidence younger investors have in the financial system and institutions in general also suggests their lived experience teaches very different lessons than those of the author.

Older investors, especially those near or in retirement, are also at risk. With little or no capacity to replace wealth in the event of loss, these people are especially vulnerable to big, long-lasting downturns. Again, the fact these have mainly been absent from the last fifty years only makes them more likely to occur in future years.

So, while it is true that long-term investors are best served by not panicking every time stocks turn down a bit, they also shouldn’t be so cavalier as to dismiss evidence that stocks are hugely overvalued.

Implications

In the context of roller coaster markets and news flow whiplash, it’s helpful to have some concept or idea to anchor to. Nobody I know is better at providing such context than Ben Hunt at Epsilon Theory. Here is an excerpt from his recent piece, “Crashing the Car of Pax Americana”:

Neither Donald Trump nor his key advisors believe that Pax Americana is a good deal at all, much less a damn good deal like I believe. They believe the United States is being cheated and taken advantage of without end, both internationally and domestically. They don’t want to fix the Pax Americana regime of coordination through multilateral rule-setting. They want to blow up the entire deal and replace it with an America First regime of competition through bilateral engagement.

I appreciate their frustration. I share a lot of it. But I am desperately opposed to crashing the Pax Americana car, Annie Hall style, because the America First system that this Administration wants to have as a replacement is not a stable system that is possible to have as a replacement.

There are two incredibly important points here. The first is the system Trump is trying to replace Pax American with is not a stable system, and as a result is not really a system at all. The second is that there is no going back. In Hunt’s words, “There is no reset button here.” In total, this implies:

But we can never return to where we were before! We are on a road to a permanently lower ‘sticking point’ for growth, productivity, wealth, standard of living … because that’s what the America First competition game brings.

In short, this is the beginning of a long haul down for markets but also for overall living standards. This is not to say mass poverty or Great Depression, but noticeably lower standards for many, many years.

As unfortunate as this is, it is going to be far less painful for those who realize it early and prepare accordingly. Those who hang on the hope of the past, who rely on high stock returns, who have large amounts of debt, who fail to reset living expenses lower, and who fail to build greater resilience, are going to be vulnerable to severe and permanent shocks to their lifestyle.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.