Observations by David Robertson, 4/15/22

The big news of the week was the CPI report on Tuesday and something something oil and something something Russia. Maybe the holiday-shortened week will give people a chance to rest up and refocus. To that point, I hope you have a nice, relaxing weekend! In the meantime, let me know if you have questions or comments at drobertson@areteam.com.

Market observations

In general, the S&P 500 has remained fairly bouyant given an impressive array of headwinds. There have been cracks, however, and the action on Tuesday was indicative of the increasingly mixed sentiment.

Futures rose on the 8:30 release of the CPI report and opened up over half a percent. Positive sentiment then ran stocks up as much as 1.3% by 10:00. From there, however, sentiment steadily eroded through the day and stocks ended up finishing down .3% for the day.

One point is this microcosm of trading activity demonstrates that a fair bit of discretionary money is still betting on the most positive possible interpretations of news events. Another point is that unlike most of the post-pandemic period, pessimism is increasingly winning the day.

Portfolio construction, taking gains, selling early, disciplined exits were all concepts utterly alien to these people. I looked at one guy’s portfolio and asked, “why do you own so many consumer names?” The answer was; “why does that matter? They’re just stocks.”

The driving force for all of them was greed. Absolutely no regard for anything else except for how much money they have made. Selloffs are nothing but dip-buying opportunities created by “the weak-knees.”

This tweet thread provides nice insight into much of the base of retail investors. Based on this, it is not hard to understand where discretionary money is coming from or why it keeps going into stocks.

Blood in the water: who is being carried out this time? Apr 12 2022 at 02:00 ($)

https://themarketear.com/premium

Bodies will surface..."28 years ago, a 15% drawdown in Treasury futures ushered in the collapse of Orange County, CA. 5 years after that, it helped prick the internet bubble. Someone is being carried out this time, too, because this has every hallmark of forced selling"

Excellent point. Big moves often catch players who are either oblivious to the risks or insensitive to them. It’s always the forced selling that causes the most violent moves. Given how many investors seem to be offsides on rates and inflation, we could see a lot more of this.

Economy

Fed Losing Control As Gloom Spreads, Consumer Inflation Expectations Soar To A Mindblowing 6.6%

Unfortunately more than half a year later, things are just going from back to worse for the Fed, because in its latest Consumer Expectations survey, the central bank found that inflation expectations at the one-year horizon soared to a new all time high of 6.58% in March from the previous month’s 6.00%, a new series high and the third biggest one-month spike on record.

"More respondents reporting being financially worse off than they were a year ago. Respondents were also more pessimistic about their household's financial situation in the year ahead, with fewer respondents expecting their financial situation to improve a year from now."

The CPI report on Tuesday served as something of a Rorschach test for markets. Optimists saw core inflation coming in a little below expectations and overall inflation peaking and starting a downhill slide. Pessimists saw overall inflation pushing up towards double digits and “sticky” inflation on a rising trend.

One thing is clear: Higher prices are taking a big bite out of consumers’ pocketbooks. Since wage increases are not keeping up with inflation, higher prices for essential goods and services are taking away spending power for other goods and services and that erodes financial well-being.

Another indication of the increasing pressure inflation is placing on households is rising consumer debt. In age-old fashion, when US consumers run out of money they borrow. The huge uptick in February shows this process is happening quickly.

These things are all very relevant in regard to the economic forecast. For one, as long as inflation stays higher than wage increases, real income is going to decline, and that will lead to lower overall spending.

For another, the only way that trend can be reversed is to have wages rise faster than inflation. As soon as that happens, however, the “wage-price” spiral becomes engaged. As it does, the Fed must work even more aggressively to keep inflation in check. In other words, heads and the economy gets weaker or tails and the economy gets weaker.

Geopolitics

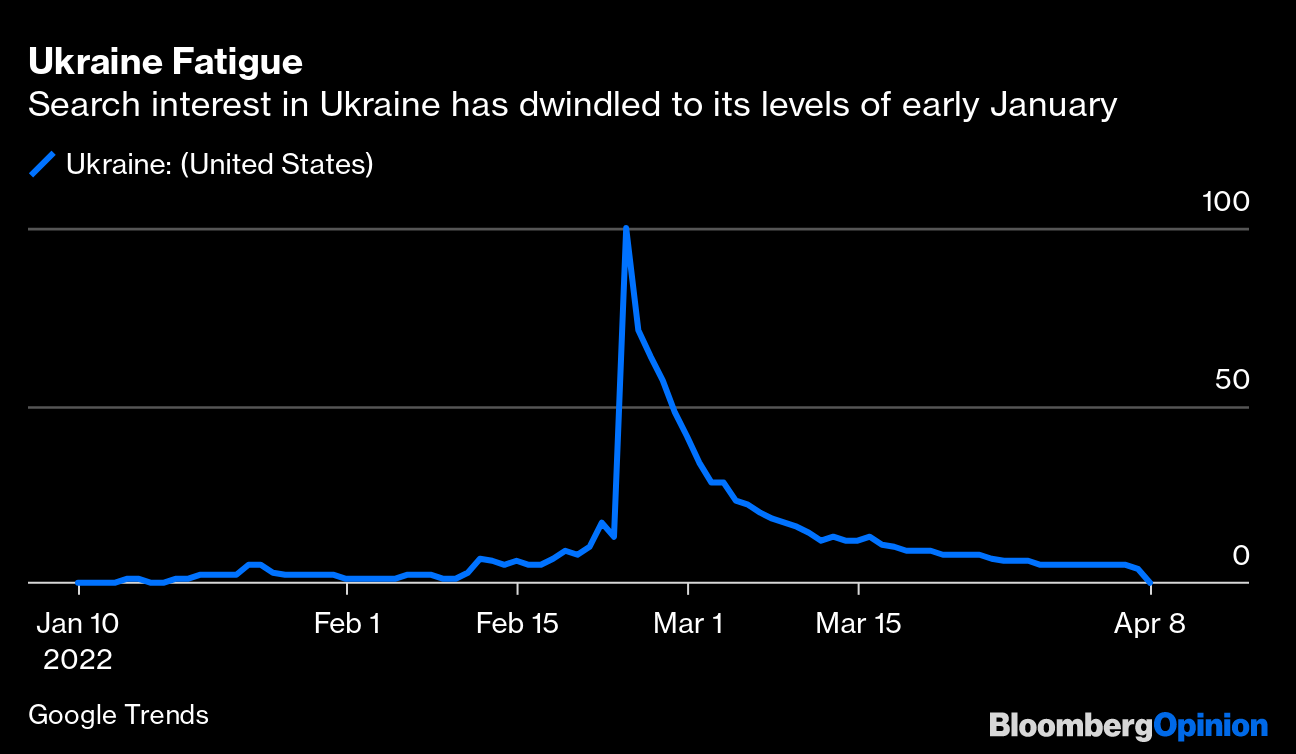

How ‘Ukraine Fatigue’ Is Taking Over Markets ($)

We’ve lost interest in the conflict even though the news continues to be dramatic, and shocking, and even as countries across the world face up to the dilemma over how much to help in arming the Ukrainian military resistance and in isolating Russia from normal economic activity.

John Authers makes a great point here that despite the enormous implications of the war in Ukraine, interest in the US has already faded considerably. This is a shame for at least two reasons. One is that Putin can leverage this ambivalence to his advantage. If he keeps the temperature low enough, attention levels will fall below the threshold required for difficult action.

Another reason, and one that is related, is the implications are extremely serious. In the absence of a clear, concerted, and coordinated strategy to deter Putin, the West may end up sleepwalking into another world war.

‘There Is No Reasonable Way for This to End’: Bill Browder on How to Stop the War ($)

https://www.nytimes.com/2022/04/09/business/dealbook/09db-browder-russia-santions.html

There is no reasonable way for this thing to end. There’s only an unreasonable way.

What’s the remaining 70 percent probability?

That he [Putin] and the Ukrainians and all of us are stuck in this low simmer. It’s not going to be at the same level of awfulness that it is right now, but at this low simmering conflict that just goes on and on and on for years.

This stark assessment of the war between Russia and Ukraine deserves special attention due to the quality of the source. The key points are this is not going away and anyway you look at it, it is going to be ugly. We might as well get used to it.

On a slightly different, but related note, Russell Napier hosted Stuart Graham ($) in a discussion about European banks this week. The highlights, in my mind, had less to do with banks and more with Europe.

Napier referenced moves by Macron in France to transition away from China and a speech by Germany’s Finance Minister, Christian Lindner. In the speech, Lindner explicitly noted, “We need to diversify international relations, including when it comes to our exports.” Napier characterized the direction and pace of geopolitical change: “The move away from China is galloping”.

Napier’s punchline is, “Cold war is coming at us hot and fast”. This may sound sensationalist to America’s ambivalent ears, but it is important to recognize the experience in Europe of this conflict is far more visceral. European countries have to act and they probably won’t all act in concert. This may very well be the start of the “slow dissolution of Europe”. If you aren’t paying attention, it is a good time to start; history is being made.

China

Omicron is dealing a big blow to China’s economy ($)

For a more timely take on China’s economy, some analysts are turning to less conventional indicators. Baidu, a search engine and mapping tool, provides a daily mobility index, for instance. Over the week to April 3rd, this was more than 48% below its level a year ago. The index is best suited to tracking movement between cities, says Ting Lu of Nomura, a bank. To gauge the hustle and bustle within cities, he uses other indicators, such as subway trips. Over the week ending April 2nd, the number of metro journeys in eight big cities was nearly 34% lower than a year ago. In Shanghai, where many subway lines are now closed, the number of trips was down by 93%, a worse drop than in early 2020.

To help avoid some of the traps, Mr Lu and his team watch “a bunch of numbers”. “If seven or eight out of ten indicators are worsening, then we can be confident that gdp growth is getting worse,” he says. Right now, he thinks, “something must be going very wrong.”

In what seems to be a massively underreported story, things are going from bad to worse in China. This is a big deal for a lot of reasons. Economically, the lockdowns and other restrictions will gum up supply chains across the world and in doing so, will also pull down gdp growth. Increasing signs of social unrest could have huge implications geopolitically as they force Beijing to re-assess various policy tradeoffs.

The ordeal in China is making very few headlines in mainstream media but is featuring on social media. The overall theme of various reports is consistent with the assessment that “something must be going very wrong”. Keep your eyes peeled on this one.

Monetary policy

Draining the RRP

https://fedguy.com/draining-the-rrp/

Dealers were borrowing $3t in repo on the eve of the GFC, but only $1.5t at the end of 2021. The decline is in part due to regulatory changes that penalize large balance sheets. At the same time, the supply of Treasuries has increased from $5t to $23t and counting. This suggests that the leveraged community will ultimately run out of financing even if they do want to buy Treasuries.

The QT timebomb is ticking. When it goes off there will be emergency liquidity operations, and we will move to the YCC end game.

Joseph Wang does a nice job digging into the important details of the Fed’s reverse repo program (RRP) that many other observers just gloss over. For one, he provides useful context: “Over the past 20 years, Treasuries outstanding rose 7 fold while daily cash volumes only rose from $370b to $620b”.

As he describes, this has led to a market with “steadily deteriorating liquidity”. Liquidity is challenged further by the fact that inflation is increasing the cash needs of investors as everything costs more”. The implication is, “any potential tremors will be magnified”.

Many have painted the RRP as something of a pressure release valve. It’s not something that will entirely relieve pressure on the Treasury market, but certainly something that will defer those pressures for some time.

Wang is far less sanguine. To him, the plan for Quantitative Tightening (QT) is a “timebomb” and the inevitable result is yield curve control (YCC). This means a major market event may be coming upon us sooner than many think. It also means monetary policy may be taking a major pivot sooner than many think.

Gold

A funny thing happened on the way to the forum. Gold, which does not provide any yield, is supposed to go up when real rates go down and go down when real rates rise. Despite a rapid rise in TIPS yields lately (a good indication for real rates) gold has remained unusually healthy.

At least part of the issue is one I explained before: It’s not just the direction of real rates that matters for gold but also the level. If the longer-term prognosis for real rates is negative, it makes some sense gold prices would look past short-term moves. As I said in February, “gold should be systemically attractive in an environment of sustained negative real rates”.

Increasingly this appears to be the case. As I mentioned in the “Monetary policy” section, there are good reasons to believe yield curve control is on its way. It looks like the price of gold is agreeing with that assessment.

Investment landscape

As global debt levels have significantly increased in this millennia, so too have the durations of bond indices … All other things being equal, if an investor in any of the above [major bond] indices began investing in 2005, they now have an exposure to a much longer duration product than they initially invested in, as yields declined to levels that have never before been witnessed by history. The ten-year US Treasury bond yielded 4.48% on March 31, 2005. At March 31, 2022, the same bond yielded 2.33%.

This is a significant asymmetry. As bond yields have declined, index investors have experienced a lengthening in their duration exposure as governments issue more bonds, meaning that when bond yields rise, they lose more than the returns they gained when yields were declining.

Bonds are the foundation of most investment programs for good reason - because they are “safe” assets and (generally) provide income. “Safe”, however, is a relative term, and that safety is significantly threatened by inflation. While this presents a real challenge for investors, at least it is a well known problem. What is far less appreciated is the risk that duration presents.

Duration is a somewhat technical concept but essentially indicates the sensitivity of a bond (or any investment for that matter) to interest rates. A bond with high duration goes down a lot more when interest rates go up than one with low duration. As it turns out, as interest rates have declined over the years, not only did bond prices go up, but so did duration.

As a result, many investments (like bonds) which are sensitive to interest rate increases, are now even more sensitive than usual. If investors haven’t figured this out yet, they will soon.

Implications for investment strategy

Scanning across news feeds and research pieces, it is clear that investors are concerned about protecting portfolios against inflation. Many investment shops merely broadcast a familiar menu of ostensibly inflation-fighting options such as stocks, real estate, or even private equity.

While these ideas make some sense on a fundamental basis since they at least have the potential to offset higher prices with higher cash flows, they overlook the important point of starting conditions. Just as with bonds, the duration of all these investments increased as rates declined. As a result, higher interest rates pose a significant risk to the value of each of these options.

That’s not the only concern, however. Investments such as real estate and private equity are normally financed with a fair amount of debt. As interest rates go up, the ability to make higher interest payments or to refinance debt when it comes due decreases. In short, these investments also pose a credit risk as interest rates rise.

In sum, investors are right to try to protect their portfolios against inflation and there are constructive ways to accomplish that. Many of the conventional “solutions” are likely to underperform, though, due to higher duration and credit risks.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.