Observations by David Robertson, 4/18/25

After an exhausting few weeks there could hardly be a more opportune time for a long holiday weekend. Happy Easter to those who celebrate and best wishes for a nice enjoyable weekend to everyone!

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

The week started with relative calm for stocks. Perhaps investors were hoping to catch a break in front of the extended holiday weekend after a tumultuous few weeks.

That calm cracked noticeably on Wednesday afternoon when Fed chair Powell warned of a “challenging scenario” due to the likely impact of tariffs on both raising prices and inhibiting growth.

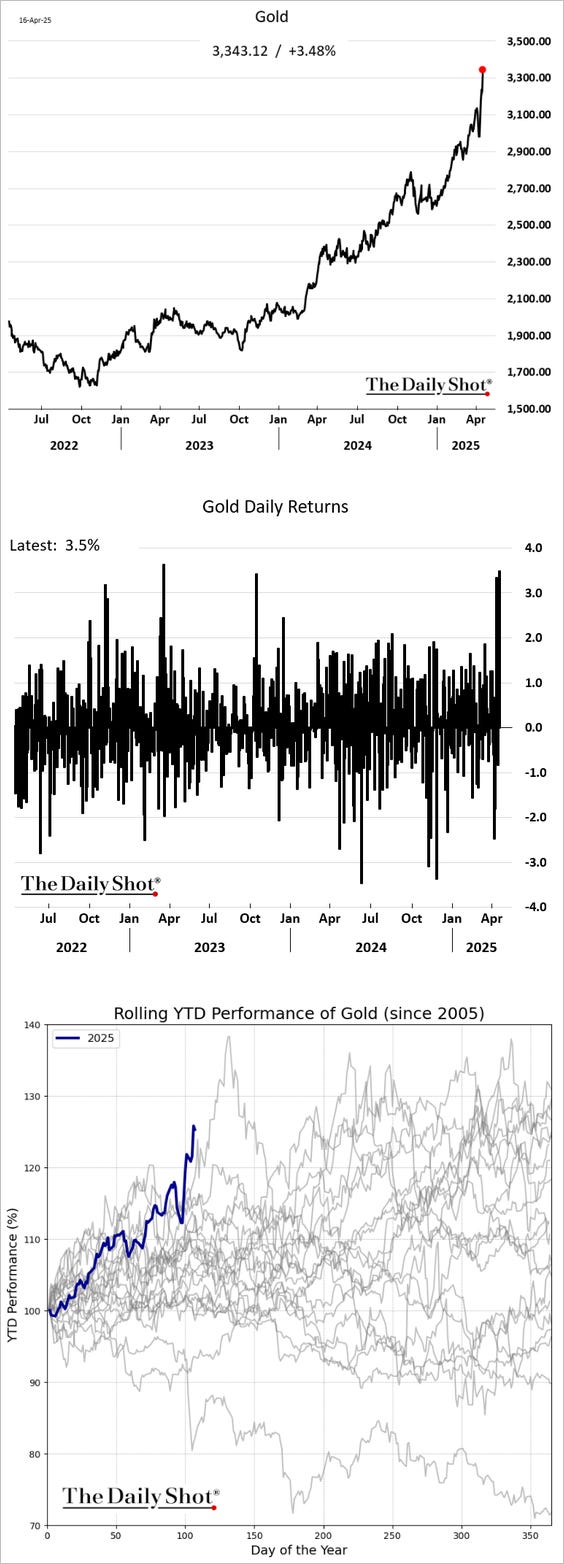

Perhaps the most notable observation of the week, though, was the continued runup, actually acceleration, in the price of gold. Somehow this is still not getting much attention and somehow it is mainly staying out of the news. The graphs from The Daily Shot provide some good perspective.

Surely, investors have plenty of things to worry about and get distracted by, but gold is making a bold statement, “There’s something happening here.” Best pay attention.

Monetary policy

With a lot of concerns about weakening growth, investors are increasingly looking to the Fed for possible policy responses. As Patrick Watson points out, however, the Fed is not in nearly as a strong a position to be able to help as it has in the past.

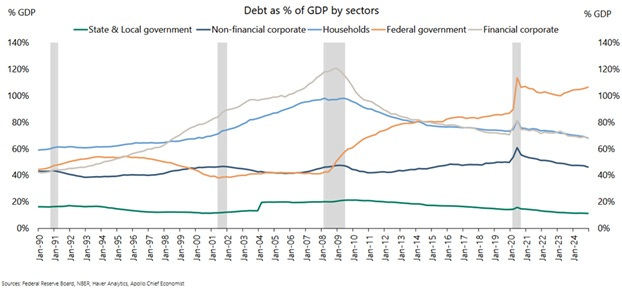

Watson goes on to explain that the Fed’s tools “relate to credit availability” and therefore “the Fed’s decisions disproportionately affect the most leveraged parts of the economy”. Importantly, those “most leveraged parts” have changed over time as the following graph from Apollo illustrates:

Most notably, Federal government debt has risen to be the largest component by far. As a result, “today’s economy is structurally unlike that of 1990, 2001, or 2008.”

The structural difference has extremely important implications for Fed policy. For example, “the stimulus effect [of rate cuts] on the private sector will be smaller than in previous recessions,” because the private sector comprises a smaller portion of debt. For the same reason, “higher rates won’t suppress private sector demand like they used to.” Regardless of whether unemployment or inflation is the bigger problem, the Fed’s policy toolbox is likely to be less effective.

While none of this rules out the possibility of the Fed deploying the tools it does have when the time comes, investors would do well to moderate their expectations of their effectiveness.

Currency

One of the recent phenomena that ranks right up there in importance is the steady weakening of the US dollar (USD). Edward Harrison rightly highlighted this recently:

The Swiss Franc is skyrocketing, up 3 1/2% against the US dollar as stocks melt down again. It's up over 1% against the euro.

It looks like the USD is losing its safe haven appeal in times of volatility. Look at the dollar in francs chart since the inauguration

Adam Tooze also picked up on the USD phenomenon and reported, “the market is re-assessing the structural attractiveness of the dollar as the world's global reserve currency and is undergoing a process of rapid de-dollarization.”

A weaker dollar is concerning enough on its own not least of which is due to the fact that it weakens the purchasing power of US consumers. However, a weaker USD is also the tip of the iceberg of bigger problems in the world of shadow banking.

These are the types of second- and third-order effects of a weaker dollar that Ann Pettifor explores in a recent Substack post. As she explains, “Within the shadow banking system, the Casino depends heavily on public assets for collateral. The most important and safest of these are US Treasury Bills (bonds).”

She goes on to recognize that, “Today confidence in the supposedly safest collateral produced by the United States ‘factory’ - the US Treasury - is fading fast.” As a result, a weaker dollar is also an indication of depreciating collateral in a highly leveraged shadow banking system. When collateral values go down, so too must leverage, either voluntarily … or involuntarily.

Pettifor ends the discussion with a question: “when will the falling value of public debt used as collateral, blow up the heavily indebted shadow banking system? Again?” In other words, the Trump administrations public policy announcements are doing more than just nudging growth slower and USD lower, they are also threatening the stability of the global financial system — and that’s a pretty big deal.

Politics and public policy

As we all continue to try to make sense of Trump administration policies, it seems like most efforts end up with more questions than answers. One of the most useful analyses I have come across was that of James Aitken ($) in an interview with Grant Williams:

But let’s break that answer down because people say to me, “What do you think of the Trump plan?” and I say, “Plan is a very strong word.” There’s an agenda.

Is there an underlying ideology that is driving this Trump agenda? Absolutely. There is this absolute determination to make America great again via manufacturing. There is this absolute determination, no bluffing, to make the rest of the world pay some kind of deposit to be on the right side of Mr. Trump. There is an absolute determination to extract a fee from foreigners who want to build and invest or invest, at least, in the United States.

They are absolutely ideologically driven about the rectitude of their course of action. They really believe that you must rebuild everything in the United States to prepare the United States for future conflict because if there was, heaven forbid, a war tomorrow, well, how do you get all the stuff you need?

So, there is a driving force behind Trump administration policies, but it is not a plan, it is an agenda. A key component of that agenda is Main Street vs. Wall Street.

Another element of the Trump administration ideology is that it is pure in the sense that its members really believe in it. It is not a matter of rational evaluation or equivocation. Therefore, as Aitken puts it, “The challenge for all of us during this mess is to focus on what these people believe.”

One key implication is that belief in an agenda falls far short of competent implementation of that agenda. There is all kinds of room for logically conflicting ideas, just plain bad ideas, and unintended consequences, among others. We have seen this with tariffs, DOGE, and other major initiatives. Aitken summarizes, “And to be clear, just because they believe all these things … doesn’t mean they work and it doesn’t mean they’re right, but it’s what they believe.”

Another key implication is despite the multiple potential failings of this policy approach, there is little to stop it short of very aggressive push back. Because the strength of internal belief in the agenda borders on that of religious zeal, there is not likely to be any internal effort to recalibrate the approach even if it becomes quite obvious a great deal of harm is being caused. Markets are starting to realize this and are reacting accordingly.

Loyalty and ideological purity have their merits, but constructive conflict and coordination with different groups of people are not among them. The kryptonite of a governance approach based on these ideals is the set of consequences resulting from the failure to consider other perspectives. These include greater harm, due to poor diagnoses and therefore poor prescriptions, and greater isolation, since nobody wants to work with jerks. So, that’s what we have until it is forced to change.

Investment landscape I

While volatility calmed down this week, there are still echoes of the mayhem from last week. There is a lot of conjecture about what the causes were, and a lot of smoking guns, but no conclusive evidence.

In another passage of the Grant Williams interview, James Aitken ($) deduces that the extreme volatility was more the result of a generalized de-risking than of any singular cause.

And really what we’ve seen, fellas, over the past week since so-called liberation day is the market in its brutal efficiency has hunted down every crowded trade and taken it out. Every single one.

So, there were really two different things going on. First, there was a higher level of volatility induced by the uncertainty of tariff policies. Second, that higher level of volatility mechanically forced a deleveraging of crowded trades. In Aitken’s words, “we’ve had another dramatic reminder that risk intermediation capacity in a persistently high volatility world is just not there.”

This theory was also corroborated by EndGame Macro in a post last week:

What’s different now? We’re not watching a single institution fail we’re watching an entire framework of leverage, liquidity, and belief unwind.

But here’s the nuance: this may not be a top in rates but it likely is a top in volatility. Human beings traders, PMs, risk managers cannot manage risk when volatility gets this unanchored. You get forced unwinds, VaR breaches, and systemic risk triggers not rational price discovery.

Investment landscape II

As tempting as it may be to characterize last week’s wild volatility ride as a one-off, it looks too much like the beginnings of a carry crash process outlined in the excellent book, The Rise of Carry, by Tim Lee, Jamie Lee, and Kevin Coldiron.

One of the consequences of extraordinary monetary policy in the aftermath of the GFC was a systematic effort to suppress volatility. Low volatility, in turn, had the effect of facilitating ever-greater amounts of leverage. As long as policymakers jumped in in times of emergency, which they did, low volatility and increasing debt became a self-fulfilling prophecy.

This dynamic also fueled the phenomenon of “buying the dip”. Buying the dip works in an environment of volatility suppression because the odds favor a reversion any time there is a selloff.

Of course, the opposite is also true and that is what we are experiencing today. When volatility rises, the odds of a quick reversion go down. Traders can no longer rely on that quick, reliable profit. As The Rise of Carry explains:

What is the risk in buying the dip? The risk here is that there is a very large downside monthly return compared with the volatility of daily returns. The risk is that the market keeps falling, without bounces; that downside returns become serially correlated. The risk is that the market briefly enters a state in which, instead of declines being likely to reverse partially over longer horizons, declines now cause further declines. This, of course, is exactly what happens when leverage dries up in a carry crash.

To be sure, this is a process and it takes time to unwind. However, there are warning signs. Just like the failure of a couple of Bear Stearns hedge funds was a warning of the GFC, so too was the volatility last week likely a warning sign of bigger things to come.

At the end of the day, throwing public policy uncertainty into a highly leveraged financial system is like throwing gas on a fire.

Investment landscape III

Despite the ominous signs, many investors remain unconcerned due to expectations that policymakers will ride to the rescue if markets become too shaky.

For certain, authorities will react if markets wobble too much. Arguably, the primary goal of the Fed is to ensure smooth market function. If that gets threatened, the Fed will react.

Further, a range of regulatory changes are being discussed that will increase domestic demand for Treasuries. Easing constraints on banks’ Treasury holdings is foremost among these. Greater demand for Treasuries will help offset some of the upcoming increase in supply.

So, it is fair to assume the reaction function of authorities to severe market stress will be to prevent catastrophic dysfunction. That, however, is a long way from saying authorities will backstop any losses.

Even more threatening is the distinct possibility that financial asset losses are completely acceptable, perhaps even desired, within a certain range. One can make a case that public policy is aiming not so much to manufacture an emergency, but rather to facilitate the right kind of emergency.

Indeed, this is exactly the case EndGame Macro makes:

However, they’re [Fed and Treasury] waiting and this is key for a market dislocation to justify action: a 20–30% drawdown in equities, a seizing repo market, or a credit event (think March 2020 or UK LDI moment). This would give them cover to act without torching the Fed’s credibility.

What would this accomplish? It would create a dramatic illustration that the Trump administration cares more about Main Street than Wall Street. In doing so, it would also “create a narrative bridge from market panic to ‘justified intervention’” that would prevent the US dollar from weakening uncontrollably. Further, it would provide a gateway for the Trump administration to take on a greater role in allocating credit across the economy. Doesn’t sound so crazy, does it?

Investment landscape IV

One of the phrases that keeps running through my head is, “if only there were signs”. I think about this because there are signs all over the place if you bother to look and aren’t so offended as to dismiss them. Yes, it very much appears as if a big economic slowdown is headed our way.

Exhibit 1 comes from 471TO@TOzgokmen on X:

The week-over-week drop in TEUs (twenty-foot equivalent units, a standard measurement for container shipping capacity) booked says it all: From the week before “Liberation Day” to the week of the announcement, capacity booked globally dropped by half. This is a cardiac arrest in ocean freight.

Exhibit 2 comes from Joe Weisenthal and shows “The outlook for new orders from NY Fed regional manufacturers literally hit the lowest level in the history of the survey.”

Exhibit 3 indicates how these effects are beginning to seep into the P&Ls of S&P 500 companies. The graph below from The Daily Shot indicates negative earnings revisions are the greatest since Covid.

The bottom line is that uncertainty is at a higher steady-state rate, public policy is putting steady pressure on economic growth, and the effects are just starting to show up in financials. In short, the storm is coming. While it doesn’t make sense to overstate the doom case, it’s not going to be productive to deny upcoming challenges either.

Implications

If we can step back from the dizzying array of array of headlines bombarding us over the last few weeks, a few bigger picture insights come into clearer view.

The first insight is this confused and disorderly state of affairs is here to stay. As EndGame Macro describes: “He’s right about chaos being the base case. But I’d add chaos isn’t failure anymore. It’s the operating system.” Further, “And those who survive will be the ones fluent in its logic.” So, get used to it, and learn how to use it to your advantage.

The second insight is that it’s really not that hard to evaluate public policy under the Trump administration. In his usual blunt style, Cliff Asness remarks,

Many seem to defend tariffs with the line of reasoning “the world is not coming to an end you’re being hysterical.”

Let’s be clear. That’s true (not the hysteria part). The US economy, companies, and citizens are resilient and will adapt.

It’ll just be worse. The job is to make it better. And instead it will be worse.

Both of these dovetail neatly with Ben Hunt’s analysis I mentioned last week: “We are on a road to a permanently lower ‘sticking point’ for growth, productivity, wealth, standard of living …”

Yet another insight is the recognition of a major political, geopolitical, and economic regime change. Once again, EndGame Macro provides some very useful perspective here and here:

We’re witnessing what looks like a 2025 variant of March 2020 except this time, sovereigns are the weak link, not just banks. Risk is no longer cyclical it’s institutional.

What we’re really watching isn’t a typical market cycle it’s a managed descent into a new monetary world.

This is the quiet stage before the narrative changes permanently from QE to yield suppression, from dollar dominance to multipolar settlement, and from monetary policy to geopolitical capital control.

I will have more to say on the implications in coming weeks and months, but for now it is sufficent to recognize we are in a major regime change. This is a process and has been going for years, but it is now accelerating.

While it can be scary for investors to contemplate such fundamental changes in the investment landscape, it is nonetheless important to do so. They present rare, but very significant opportunities for a material divergence in outcomes — for both better and worse.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.