Observations by David Robertson, 4/22/22

Another week in market La-la land. The S&P 500 was up over 1.6% on Tuesday with NFLX up over 3%. After the close, NFLX reported weak subscriber growth (actually contraction) and the stock was down over 27% after hours. One of my new favorite phrases is, “no skid marks”. In other news, the market tanked by 1.5% on Thursday. Go figure. Let me know if you have questions or comments at drobertson@areteam.com.

Market observations

Market Has Reached "Exhaustion Equilibrium", Gamma-Hedging Flow Impacts Will Only Get Worse From Here

Finally, for the dip-buyers, SpotGamma warns that risks to the upside continue to remain muted, as significant volatility selling likely cannot commence without clarity from the Fed and/or a resolution of geopolitical risks (i.e. a Russian/Ukraine ceasefire).

Without getting too much into the arcana of derivatives, one big point is that market behavior continues to be driven by options. Another point is what Zerohedge describes as the “(embarrassingly) enormous popularity” of short-dated options. ZH goes on to explain that “over 50% of total SPX Options Volume is now btwn 0-5 days-to-expiration”. These are pure speculative bets.

So, when we see the S&P 500 pop over 1.6% on Tuesday on no news and in light of otherwise hostile signals like long rates going up further, it is fairer to ascribe the action to speculative retail behavior than to any improvement in market conditions. While dip buyers may still be on the loose, the potential upside is “muted”.

One phenomenon has been less equivocal; the market for early stage companies has cooled off considerably. As Almost Daily Grant’s reported on Wednesday, “Initial public offerings have ground to a halt with 37 new entrants raising a combined $4.1 billion during the first quarter, down 94% year-over-year and the weakest start to the year since 2016.” One less thing for investors to get excited about.

Companies

JB Hunt reported first quarter revenues for its flagship intermodal segment were up 36% yoy. Of that, 7% was due to higher volume and 28% due to a higher gross revenue per load. The higher revenue per load was attributed to “changes in the mix of freight, customer rates, and fuel surcharge revenues”.

This shows that not only is JBHT getting an offset for higher input prices in the form of fuel surcharges, but it is also getting higher customer rates to boot. As a result, operating earnings rose by 87%, far more than the 36% increase in revenues, meaning margins increased.

Results like this are already starting to prompt debate: Do they represent strong franchise value and therefore pricing power, or are they forms of profiteering from the inflationary environment? Stay tuned - this is likely to get a lot more attention.

Politics

Why the Past 10 Years of American Life Have Been Uniquely Stupid

https://www.theatlantic.com/magazine/archive/2022/05/social-media-democracy-trust-babel/629369/

The story of Babel is the best metaphor I have found for what happened to America in the 2010s, and for the fractured country we now inhabit. Something went terribly wrong, very suddenly. We are disoriented, unable to speak the same language or recognize the same truth. We are cut off from one another and from the past … But Babel is not a story about tribalism; it’s a story about the fragmentation of everything. It’s about the shattering of all that had seemed solid, the scattering of people who had been a community.

Social scientists have identified at least three major forces that collectively bind together successful democracies: social capital (extensive social networks with high levels of trust), strong institutions, and shared stories. Social media has weakened all three.

However, the warped “accountability” of social media has also brought injustice—and political dysfunction—in three ways … First, the dart guns of social media give more power to trolls and provocateurs while silencing good citizens … Second, the dart guns of social media give more power and voice to the political extremes while reducing the power and voice of the moderate majority … Finally, by giving everyone a dart gun, social media deputizes everyone to administer justice with no due process … When our public square is governed by mob dynamics unrestrained by due process, we don’t get justice and inclusion; we get a society that ignores context, proportionality, mercy, and truth.

This is a powerful article by Jonathan Haidt who also wrote the excellent book, The Righteous Mind. I highly recommend reading it because it helps explain so much of what we have experienced the last ten years - in politics and beyond.

The main point is that social media has unraveled the fabric of society in many important ways. By encouraging “dishonesty and mob dynamics” social media has been uniquely capable of bringing out “our most moralistic and least reflective selves”. In other words, social media brings out the worst angels of our nature.

This creates consequences far and wide. “When our public square is governed by mob dynamics unrestrained by due process, we don’t get justice and inclusion; we get a society that ignores context, proportionality, mercy, and truth.” No wonder a lot of people feel like they don’t get a fair shake. They don’t.

Further, since social media has been largely ungoverned, it has spread freely, enabling bad behavior to propagate. This means norms established online creep into everyday life and infect work and personal relationships alike. The end result is that all the online bickering not only wastes our time but also continually chips away at our trust - of almost everything. If you wonder how politics got so broken, this is an excellent primer. The silver lining is that proper diagnosis of the problem provides a pathway to improvement.

Social media

Elon Musk and the mirror Twitter holds ($)

https://www.ft.com/content/27ae38d6-ac8d-4750-bd70-a16793080f1d

you ignore Twitter at your peril. To paraphrase Trotsky, you may not be interested in Twitter but Twitter is interested in you. While you are walking the dog, doing your day job, or reading an actual physical newspaper, Twitter is where much of today’s conventional wisdom is being formed. That is particularly true for the elite media.

Twitter, on the other hand, has done very little for me. It doesn’t compensate me — that’s the whole point of surveillance capitalism; our tweets are free raw inputs for Twitter — and the fact that I have 32.4K followers seems to have no bearing on my book sales. I’ve tweeted a total of 6,674 times (which works out to roughly 11 times a week). Almost all of these tweets are simply links to the original content I create: my columns and my contributions to Swamp Notes.

Given Jonathan Haidt’s discussion of social media above (in the “Politics” section), it is serendipitous that Ed Luce and Rana Foroohar of the FT had a grown-up discussion about the same subject this week in their “Swamp notes”. They talk about Twitter in particular, but the points are broadly generalizable.

Luce finds “Twitter is full of interesting people with ideas to share and links to journalistic or academic pieces that I probably would not otherwise have found” but acknowledges it can be addictive and must be managed. Foroohar uses “Twitter basically as a news feed to make sure that people who care to get their content that way, get mine” and deliberately goes no further.

Personally, I appreciate both points of view. I agree with Luce that there are lots of interesting people and useful links. I also agree Twitter is where much of today’s conventional wisdom is being formed. This is all extremely useful in making sense of of market behavior, among other things.

I also agree with Foroohar, though, in that it is really hard to justify the time spent on Twitter based on immediate monetary rewards. I would also throw in that there are real costs of encountering the too-frequent exchanges that are dumpster fires of acrimony, partisanship, and small-mindedness.

The big point is this is exactly the kind of discussion we should all be having about all social media. There are positives and there are negatives, and there are opportunities to make the platforms much healthier. It has taken too long to get here, but this is good.

Commodities

Are Markets Better Understood Without Equality? ($)

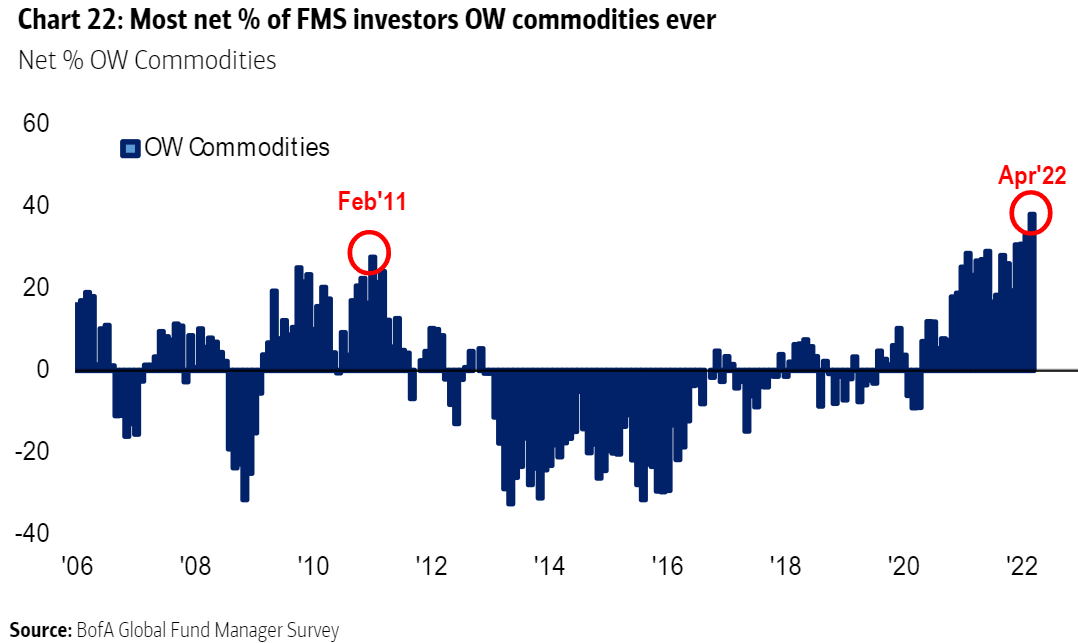

Commodity bull markets tend to sow the seeds of their own destruction. At the level of the physical commodities, higher prices bring forth more supply while reducing demand. And in futures markets, speculators take their profits. So it’s concerning to see that, according to Bank of America’s regular survey of global fund managers, investment institutions are now even more heavily overweight in commodities than they were at the top of the last bull market in February 2011:

John Authers makes some very useful points here regarding commodities. Commodities markets certainly do have a tendency to sow the seeds of their own destruction. Or, as other market participants prefer: The cure for high prices is high prices.

This point relates to another; commodities can be extremely volatile. That volatility can occur over short timeframes but also over longer ones. Either way, when things get overdone, it often portends a major reversal. As Authers points out, the last major commitment by investors to commodities, in 2011, turned out to be “a really bad time to buy commodities.”

The potential for exuberance in current commodities prices relative to those in the future is captured well by Alf Peccatiello in a recent Substack post. The key phrase here is “strong and temporary demand/supply imbalance”, with emphasis on “temporary”.

Well, spot prices of several commodities have accelerated sharply over the last few quarters but long-dated futures haven’t really moved to the same extent.

This has led 21 out of the 28 commodities tracked by Bloomberg into backwardation, a phenomenon occurring when the spot price of an asset is higher than prices trading in the long-dated futures market as a result of a strong and temporary demand/supply imbalance which is expected to fade away as time goes by.

None of this, however, means currently lower prices for future delivery are good forecasts of future prices or that things can’t change. At this time, we just don’t have a very good idea how much demand destruction will occur from higher prices.

As John Arnold explains in a tweet, long-term supply conditions are also extremely important in gauging future prices. As he also notes, financing future supply additions is an extremely risky endeavor: “The industry has lost so much money making midstream commitments that became liabilities when the call on supplies failed to meet expectations.”

In making this statement, he provides both a useful metric to watch and a public policy idea. The key metric is availability of financing for new supply additions. Until those channels open up, there isn’t much reason for private entities to take the risk. The policy idea is that governments could substantially improve the longer-term supply environment by subsidizing or guaranteeing loans. Not hard to do if it served the public’s interest.

In sum, commodities are a complicated proposition here. I am still constructive long-term. Short-term, I am divided between what looks like a crowded trade on one hand and a step function supply decrease that may not be fully discounted yet on the other. Either way, it is best to approach with eyes wide open.

China

China’s Governance Implosion

These [Covid] measures, now affecting the majority of China’s economy, look like the most colossal misstep any national government has made in decades, given the mismatch between the stated purpose, the evident tactics, and the visible outcomes

With its increasing centralization of power, China has trapped itself in an authoritarian feedback loop (much like Russia's).

Things seem to be going from bad to worse in China and Anne Stevenson-Yang rightly calls out bad governance as a core problem. This is an important story to follow partly because Covid has reduced the degrees of freedom Beijing has in regard to public policy. Too tight and lockdowns create social unrest. Too loose and economic activity exacerbates shortages which creates social unrest. Good luck.

The China story is also important due to collateral damage: The picture below shows all of the ships waiting to get into Shanghai. Supply chain congestion problems are just getting started - and that will slow things down in all of China’s export markets.

If that’s enough and you want a more comprehensive (and sobering) overview of what is going on in China, check out this tweet thread.

Geopolitics

Putin’s dictatorship is now based on fear rather than spin ($)

https://www.ft.com/content/e58832c5-a35a-4bf4-8be7-359b4563c1c9

Putin’s centralisation of power promoted corruption and stifled competition, his economic model lost steam. After the recovery from the global financial crisis, Russian GDP growth slowed almost to zero. As incomes stopped growing, Putin’s popularity declined substantially as well.

Putin’s regime has completed its reversion from a 21st-century spin dictatorship to a 20th-century dictatorship based on fear. Unfortunately, this is what Russia will look like until he is gone.

While many people lament the messiness and inefficiency of democracy, it’s not like dictators have it so easy all the time either. This piece does a nice job of describing the playbook for authoritarian regimes in general and how that applies to Putin in particular.

The general insight, as described by political scientist Adam Przeworski, is that “authoritarian equilibrium rests on economic prosperity, lies or fear”. If the boost from one runs out, you move on to the next. Putin’s success in Russia started on the back of rising oil prices and economic reforms, but has since moved on to control of media and suppression of political opposition (lies) and intimidation, jail sentences, and outright murder in cases (fear).

One takeaway, then, is Putin is currently lodged in the “fear” mode - and it is hard to go back. Another takeaway is the same logic can be applied to China. After growth has slowed down, Beijing appears to be somewhere between lies and fear.

A final takeaway is this progression is exactly what makes authoritarian regimes so fragile. When you get to lies and fear, there are simply fewer levers that can be pulled to retain authority. As such, the natural tendency is for conditions to worsen. Eroding conditions combined with ever-tighter controls creates a powder keg of discontent. This will be extremely difficult for both Putin and Xi to navigate.

Investment landscape

US ruling on bond ETFs raises a market risk ($)

https://www.ft.com/content/44587d06-c086-4806-98c2-d7c170dc983e

Consequently, the discounts to NAV at which fixed income ETFs traded during the March 2020 crisis were massive because a very large number of outflows hit a very specific segment of the market that started to dry out completely.

If central banks had not stepped in to support the financial system more generally, bond markets would have suffered but ETF investors even more so.

The liquidity of ETFs is not a new issue but it is an increasingly timely one. There is an inherent asymmetry between ETFs that can be bought and sold in volume at any time and underlying securities which in many cases are not nearly so liquid. The risk is that waves of selling can overwhelm the liquidity of underlying securities and result in discounts to NAV.

This phenomenon was not a big issue when stocks and bonds kept going up and the Fed stood ready to support them if ever they weakened. Times are different now. As the report ominously concludes, “Unlike in March 2020, it is not clear whether central banks will be willing and able to intervene.”

Implications for investment strategy

One of the great challenges for investors right now is assessing all of the cross currents in markets and determining what it implies for their portfolio strategy. To that point, one of the messages I have tried to convey is the enormous importance of liquidity. When bundles of money come into the markets, prices go up and when they go out, prices go down.

On that note, when the Fed starts its QT (Quantitative Tightening) program in the near future, probably shortly after the FOMC meeting May 3-4, it will serve to remove liquidity. Most likely it will take some time for liquidity to materially tighten, but when it does, it will bite. I discussed this dynamic in letters dated 3/25/22, 3/4/22, and especially 2/18/22.

This leads to an interesting set up. Due to the “leave no skid marks” mentality of the market now (i.e., discounting no risk), stocks are likely to traipse through April and into May in fairly good shape. However, once liquidity starts getting pulled, the days will be numbered before stocks suffer in a meaningful way. This creates a window of opportunity for long-term investors to recalibrate their risk exposure (if they so desire) and for more speculative investors to take advantage of a significant mispricing of risk.

Thanks for reading!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.