Observations by David Robertson, 4/29/22

Most news early in the week seemed to focus on Musk and Twitter. That whole circus overshadowed earnings reports and a market that seems to be losing its battle with schizophrenia - until Apple and Amazon reported on Thursday. Let me know if you have questions or comments at drobertson@areteam.com.

Market observations

Last week ended rough and this week started the same way on Monday. Stocks turned around midday and finished up. On Tuesday the beatings resumed and the S&P 500 closed down almost 3%. Thursday posted nearly a 2.5% gain. Friday morning futures are down. Clearly the market is becoming more “dynamic”.

One of the notable victims late last week and early this week was commodities, and oil stocks in particular. This was probably partly a correction of overly enthusiastic sentiment but was also partly due to concerns about increasing lockdowns in China (and therefore lower economic growth).

Relatedly, another very noticeable trend has been the striking rise in the US dollar. With many global commodities like oil priced in dollars, a strong dollar puts downward pressure on those commodities, all else equal. The dollar will be interesting to watch - partly for its effects on commodities, partly for its effects on non-US dollar debt, and partly for its geopolitical influence. With the dollar stealing the show, it has been crickets with regard to the weakening euro.

Finally, every big bubble seems to have a headline fraud. The tech bubble of 2000 had Enron and the financial crisis had Madoff. Will Bill Hwang be the headline for this bubble? Zerohedge provides a nice summary that describes “a brazen scheme to manipulate the market”. Surely there will be other candidates, but I suspect Bill has a lock on being a finalist at the awards ceremony.

Companies

Newmont Gold first quarter 2022 earnings report

Newmont continues to develop our mine plan utilizing a $1,200 per ounce gold price assumption.

In 2022, an additional 5% of cost escalation is incorporated into our direct operating costs related to labor, energy, and material and supplies.

A couple of interesting nuggets from the NEM report last week. First, the company continues to use $1200 gold for planning purposes, even though the current price is $1900. This degree of conservatism should facilitate a number of positive “surprises” in all but the most adverse conditions.

Another interesting piece is that a 5% cost escalator is being incorporated into their modeling of operating costs. This is exactly how inflation takes hold - when everyone expects it and plans for it.

Economy

Even as unemployment now sits at pre-pandemic lows, reports are starting to come in that not all is well. For example, Rana Foroohar ($) points out in the FT, “Residents of New York and New Jersey, for example, owe more than $2.4bn to utility companies (nationally, the number is $22bn) and some cities are warning about electricity shut-offs if bills aren’t paid”.

In addition, Lacy Hunt identifies “the largest twelve month decline in real weekly earnings of 3.3% since this series began in 2000” and “Real per capita disposable income now stands 1.8% below one year ago levels and has fallen for seven consecutive months” among factors suggesting negative growth ahead. Indeed, we didn’t have to wait long as the first quarter GDP print came in at -1.4% on Thursday.

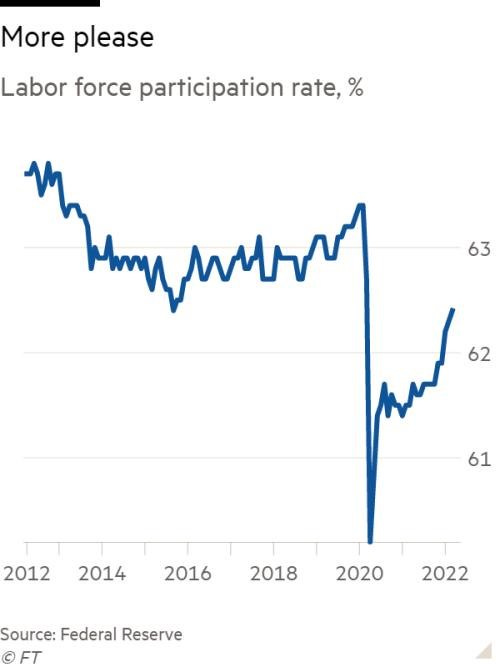

Interestingly, Robert Armstrong at the FT shows that higher wages are attracting more people back into the labor force, thus “closing the jobs-workers gap. Not only does higher labor force participation boost economic growth but it also helps soften inflation by offsetting upward pressure on wages.

In short, the economy is still in the process of normalizing from major disruptions from the pandemic. As it does so it is still a mixed bag that defies simple characterizations.

Commodities

The story of the economic recovery after the tech bust and 9/11 in 2001 was largely driven by China by way of its infrastructure growth and massive consumption of commodities. Even though China’s growth has slowed, it still comprises a dominant share of global growth.

For better and worse, and despite efforts to evolve, China’s growth model hasn’t changed a whole lot. As a result, it is still fair to associate China’s growth with demand for commodities. To this point, the graph below should provide an important wake up call. Yes, Russian supply matters, but so does Chinese demand.

China

Will the renminbi depreciation actually boost Chinese growth? ($)

https://www.ft.com/content/14763080-8475-4e85-b21a-ec7bc319d9b5

While a weaker currency would indeed increase China’s external competitiveness, it would also worsen domestic imbalances within the Chinese economy, and therefore reduce overall growth.

The reason many analysts have misunderstood how currency depreciation works in China is because they assume that a change in the value of a currency affects the economy mainly by changing the international prices of imports and exports. But in fact currency movements work more generally by changing the distribution of income within the economy.

A number of hypotheses are emerging as to China’s intentions with regard to major policy decisions. Is the government locking down major cities at least partly to reduce demand for expensive commodities? Is the renminbi being allowed to depreciate so as to make it exports more competitive?

As to the second question, Michael Pettis sets the record straight by explaining that the most important effects of currency movements come through changing the distribution of income, not by changing export prices.

Monetary policy I

There are so many pieces to the monetary policy puzzle right now that it makes sense to pull some threads together. First, for all the blathering and bloviating, the Fed hasn’t even really started raising rates yet. It’s coming, though, and it’s coming fast. By the end of July short rates should be about 2% as compared to 0.25% now. It starts next week.

This is where the rubber hits the road. Higher rates will affect both lending and borrowing decisions. While higher rates will slow economic growth, they will especially have an impact on businesses and transactions that rely on continuous, low cost short-term funding. As a result, spread-based financing businesses are likely to feel the pain first.

While an environment of Fed tightening bodes poorly for financial assets, the presence of about $1.8 trillion in the Fed’s reverse repo program (RRP) has been mentioned as a potential offset. Lee Adler ($) provides useful background in his Liquidity Trader newsletter:

As a result, many of those holders of the paid down T-bills, seeing persistent falling prices, and reason to expect them to continue falling, have the option of parking cash overnight in the Fed’s RRP fund. And rather than buy bonds and stocks, that’s exactly what they are doing. That fund has lately been hovering near $1.8 trillion, just a few billion shy of its all time record set December 31.

This provides new meaning to cash on the sidelines! One point is there is a lot of cash that is none too anxious to jump into stocks or bonds right now. Another is that cash won’t have to wait long for better opportunities in the form of much better short-term rates.

Finally, higher rates and lower spreads both serve to tighten financial conditions. Higher rates reduce the value of bonds which reduces collateral which reduces borrowing capacity. Higher short-term rates make highly levered spread businesses less economic and forces the least profitable ones to unwind.

If this sounds remotely familiar, it is because much of the crisis in 2008 and 2009 was due to collapsing collateral values and forced unwinding. As Izabella Kaminska ($) reports, “The situation is severe and could have the makings of a dollar-system shock akin to the one last seen in 2008”.

Monetary policy II

"Weaponising The FED" by Michael Howell of Cross Border Capital ($)

https://www.eri-c.com/news/940

Global Liquidity is the measure of balance sheet, i.e., the CAPACITY of capital NOT the COST of capital. It matters when debt has to be rolled over.

One of the huge points Michael Howell makes in this presentation, as well as in his excellent book, Capital Wars, is that the main function of today’s financial system is less a matter of allocating credit from scarce capital than it is of refinancing existing debt.

This distinction has enormous implications. One is that bank lending just has a much less important role than it did historically. Another is that capacity matters more in refinancing than cost. In other words, it is a bigger problem for the system to have too little high quality collateral than it is for rates to be a bit higher. This implies a different playbook than what has been used in the past - and one that is different from what the Fed describes in its communications.

Finally, the fact that the nature of financing has changed so radically over the last forty years or so has left some “experts” out of touch with the current reality. Many of them retain enormous technical competence within relatively narrow knowledge domains, but have antiquated mental models.

This presents a unique challenge for investors: These experts sound like they know a lot about markets - because they do. The problem is that their forecasts can be extremely wrong because they miss key changes and their implications. This phenomenon makes it especially important to gather insights freely, but also to make decisions independently. In addition, as a side note, this environment favors more generalist, holistic approaches to overly specialized ones.

THE GRANT WILLIAMS PODCAST: The End Game, Episode 31, Michael Kao ($)

https://www.grant-williams.com/podcast/the-end-game-ep-31-michael-kao/

So I’ve been saying that the real rug pull for a lot of risk assets is going to be a bearish steepening in our yield curve. Well, a bearish steepening in our yield curve, ironically, I think is going to wind up sucking liquidity from other countries. As our Fed untethers the longer term risk free rates here, it’s also going to make our bonds finally more attractive as yield vehicles, whereas they’ve been artificially suppressed for so long.

I don’t agree with everything Michael Kao says and I don’t know what kind of time frame he envisions, but he is both thoughtful and out of consensus which I appreciate. For the sake of argument let’s assume Kao is right.

Imagine long US rates being considerably higher, say in the 4-6% neighborhood, for a considerable period of time. It would be great for savers and a radically better environment than the last twenty years. It would provide a headwind to gold. Money would flow to the US in search of much better yields and that would boost the dollar even further. This will put even more pressure on non-US dollar denominated debts and emerging markets in general.

If higher rates persisted, they could also provide a boost to manufacturing. Absent the potential for low risk growth through financial engineering, firms would have to re-invest in their businesses again by adding capital (and borrowing to do so). As such, banks would return to center stage in terms of economic and monetary importance.

All that said, I have serious reservations that strongly positive real rates can exist for too long in the US. High levels of debt make positive real rates very costly. I suspect the strong dollar is being used at least partly to achieve geopolitical goals and to help offset inflationary pressures. Once satisfactory progress is made on those fronts, I fully expect some kind of yield curve control (YCC) program to gradually but persistently erode the debt burden.

Investment landscape

"The Biggest Story No-One Is Talking About": Why Albert Edwards Expects "Something In The Market Is About To Snap"

Japan, that paragon of MMT crackpots everywhere, suddenly finds itself trapped in a lose-lose dilemma: intervene in the bond market and spark a furious, potentially destabilizing and uncontrolled plunge in the yen which would also lead to galloping (if not worse) inflation, which could collapse what little faith remains in the BOJ, or do nothing and contain the slump in the yen while risking far higher yields which in a country where the debt is orders of magnitude greater than GDP, could also spell fiscal and monetary doom.

As is often the case, the last line of defense for financial imbalances is currency. As Albert Edwards make abundantly clear, the long running experiment in Japan to paper over excesses with prodigious debt issuance and central bank intervention now finds the yen firmly in the market’s crosshairs.

The core of the problem is what Edwards describes as a “type of insane monetary policy divergence” in juxtaposing continued easing by the BOJ while the Fed is tightening. His conclusion is that the process “will clearly break something”.

What will that something be? It could be a lot of things but let’s just stick with Japan here. Japan has had too much debt for a long time. It has been fortunate to be able to defer the reckoning day but now the time has come. By some combination of higher rates (and greater funding costs) and lower currency (and higher inflation), Japan will finally be forced to pay for overspending that occurred years ago.

The net effect will be a lower standard of living in Japan. Of course, many of the same conditions exist in Europe and China and the process may not be so different in those regions either.

Why "safe assets" may not exist anymore ($)

https://the-blindspot.com/why-safe-assets-may-not-exist-anymore/

If everything can be weaponised, as would appear now to be the case: e.g. food, energy and raw material supplies: and sanctions and asset seizures are not just reserved for the worst form of criminals (be that rogue states, terrorists or murderers: people, drug or weapons traffickers), then there is in principle no such thing as a ‘safe asset’, and the underlying idea of free capital flows (which has long been an illusion) are exposed as a myth on which the world can no longer dine out.

While I believe the position laid out above by Marc Ostwald, of ADM Investor Services, is overstated, he makes two helpful points. For one, greater counterparty risk, especially on the US side, “is likely to result in fragmentation that fractures global payment systems”. In other words, the dollar cannot be considered as universally safe by other countries as it used to be.

As a result, it is fair to expect the future demand for offshore US dollars to decline. This won’t massively hurt the dollar, but it could open the door for some other currencies to establish a higher profile.

In addition, in a very general sense, safe assets underpin a great deal of finance theory and practice. If the consideration of safety becomes much more conditional, that is likely to have far reaching consequences across assets and financial businesses.

Implications for investment strategy

This is a very useful take on the market here. It’s true that the biggest negative impact from Fed actions thus far has been on duration - think long-term bonds and profitless tech stocks. As painful (and unique) as this has been, it is only the beginning of adverse effects once the Fed’s tightening begins to take hold.

When that happens, credit spreads will be negatively affected which will increase the cost of borrowing for lower quality credits relative to higher quality ones. Higher interest costs, combined with higher input costs, will reduce margins and earnings. Given the large number of “zombie” companies, i.e., companies that can just barely afford to pay interest, but cannot afford to pay down principal, bankruptcies will start to increase too.

All this implies that investors should favor high quality over low quality, shorter duration over higher duration, and cash over riskier assets. In addition, while it is probably too early to get too enthusiastic about bonds, higher yields will certainly create some more competition with stocks. This correction is going to take a while; it’s best for longer-term investors to avoid the worst of it and wait for firmer footing to re-engage on the long side.

Finally, I mentioned last week the potential for an interesting set up that could create an opportunity to reduce risk. Of course, that was before Friday’s rough close and Tuesday’s washout. Nonetheless, buybacks will be starting back up soon and liquidity conditions should remain relatively benign for the time being, even with the Fed raising rates next week. So, if there is a decent rally in the next few weeks, I would take that much more as an opportunity for long-term investors to reduce risk than a signal for a big turnaround.

Thanks for reading!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.