Observations by David Robertson, 4/4/25

It was another big week so let’s jump right in.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

Expectations were high that “Liberation Day” would be newsworthy and those expectations were met and exceeded. The new tariffs issued were far broader and more punitive than expected and as a result, S&P 500 futures were down over 3% before the market opened on Thursday.

Economists, Democrats, liberals, and anti-Trumpers alike could barely contain their disgust at the policy revelations. That said, Robert Armstrong ($) captured their essence by saying, “the US has struck an almost grotesquely aggressive posture towards its trading partners”. John Authers ($) added, “This is not a serious way to proceed, and it’s insulting to put such huge restraints on allies’ trade with such weak explanation”.

One observation is this is a clear confirmation of my thesis that the Trump admin is not about making good public policy; it has other motives and priorities. Accepting that reality makes it easier to handicap investment scenarios.

Another observation is that this reality is only just becoming more widely realized with the tariff announcement. As indicated in this FT ($) piece, supporters are having a hard time reconciling their belief in Trump’s business shrewdness and the incoming evidence to the contrary:

“We never had an administration with this type of business-friendly acumen,” said Michael Speigl, dealer at We Auto in Michigan, during the livestream. “To think that they’re just going to drive us right off an economic cliff is, I think, maybe a little bit presumptuous. It just seems like there are a lot of other things that are going to play out between interest rates and taxes.”

Surely, there are potentially positive developments that can happen with interest rates and taxes, but how much will it take and how likely are they to happen? It looks like “Liberation Day” may have put the first serious chinks in the armor of the belief system that Trump is “good for business”. The big decline in the US dollar on Thursday suggests there is at least some truth in this.

Economy

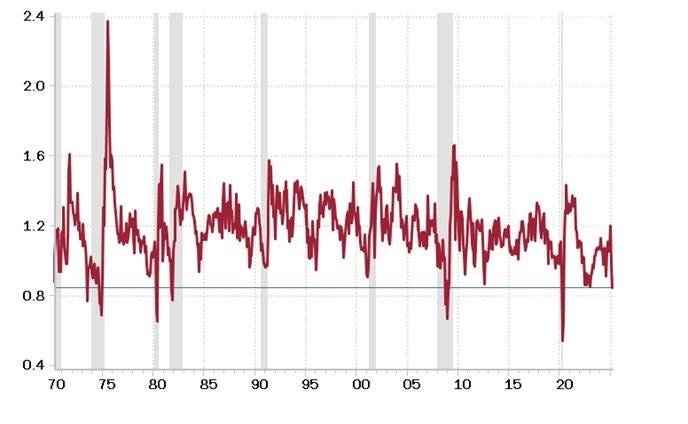

While the anticipation of more tariffs didn’t hurt the market through Wednesday’s announcement, it did get reflected in a number of economic statistics. The March ISM surveys showed weakness in manufacturing. The FT’s ($) Unhedged newsletter posted a chart from Rosenberg Research showing a ratio of orders to inventories is now commensurate with recession.

Job openings from the JOLTs report was also weak, both down sequentially and missing expectations.

Mike Green ($) also recently posted some important signs of increasing headwinds for consumer spending. First, the decent data from the last five years was all inflated due to pandemic forbearance. According to the New York Fed:

The 2020 forbearance marked all delinquent (but not defaulted) loans as current, causing a jump of 74 points, from 501 to 575, in the median score between 2019:Q4 and 2020:Q4 for those borrowers who were previously delinquent but not defaulted.

Forbearance also played an especially prominent role with the credit of student borrowers. Now that is about to change too:

Given these estimates, we expect to see more than nine million student loan borrowers face substantial declines in credit standing over the first quarter of 2025.

Similar stresses are being experienced in other areas as well. Car Dealership Guy reports, “Auto loan fraud tops $9 billion in 2024” and that number “was up a staggering 16.5% from 2023”.

The nature of the fraud is also changing. While stolen identities have been a problem, increasingly the problem is “real buyers lying about their income or employment to get approved”. Apparently, as consumers find it harder and harder to afford a car, they are increasingly resorting to cheating.

Investors are reading all of these signs and increasing their odds of recession. The 10-year Treasury yield dropped over 25 bps in front of the tariff announcements on Wednesday and another 15 bps after the announcement. The Atlanta Fed’s GDPNow alternative forecast, which adjusts for gold exports and imports, was at -0.8% on Thursday.

Th conditioned response of buying bonds amidst concerns about growth may be premature though. Even though tariffs appear likely to inhibit growth, there are indications they could actually worsen inflation. Just as Biden’s admission of inflation in 2021 served as a license for CEOs to raise prices, so too does Trump’s issuance of widespread tariffs provide credible pretense for business leaders to raise prices again.

Further, as I have noted before, inflation expectations are an important ingredient in the inflation equation and market expectations are pointing to higher inflation. As The Daily Shot shows, 1-year inflation swaps are popping:

For the time being, the market is not happy with the expectation of lower growth rates. If/when it also adds on the concern for rising inflation, it is likely to be even less happy.

Politics and public policy I

While President Trump’s polling numbers have been holding in, public displays of disaffection have been on the rise, especially as the effects of spending cuts and policy changes are experiences at the local level. Most notably, a great deal of pushback is coming from his own supporters.

For example, the FT ($) notes, “In many of the places where Trump is hugely popular, residents are increasingly reliant on income transfers from the government.” The article quotes political science professor John Mark Hansen: “As much as Republicans like to rail against big government, [their voters are] often its biggest beneficiaries.”

Cleo Fields, a Democratic lawmaker from Louisiana, explains that the “anger is understandable”:

“The vast majority of people who voted for Trump did not expect him to . . . take money away from their disabled kids,” he says. He believes Medicaid could be a rallying cry in the 2026 midterm elections, just as threats to make big cuts to healthcare paved the way for the Democrats’ victory in the 2018 midterms, during Trump’s first term.

Another group of Republican-leaning voters, farmers, isn’t happy about the changes so far either. The FT ($) reports:

A Trump administration proposal to impose stiff levies on Chinese-made ships entering US ports is sowing panic in the country’s agriculture industry, with farmers saying the added cost threatens to upend exports of wheat, corn and soyabeans.

This is happening on top of “retaliatory tariffs from China on big exports such as soyabeans and pork”. Higher shipping fees, which would also affect supplies like fertilizer, would amount to a “double whammy for the US farming industry”.

The energy industry is yet another core Trump constituency that is experiencing “buyer’s remorse”. Rory Johnston ($) highlights the potential for savings from a reduction in regulatory measures couldn’t begin to make up for the harm caused by a $50/bbl price target for oil. He lists some of the comments from the latest Dallas Fed Energy Survey to add color:

“The administration's chaos is a disaster for the commodity markets… Tariff policy is impossible for us to predict and doesn't have a clear goal. We want more stability”

“The administration’s tariffs immediately increased the cost of our casing and tubing by 25 percent even though inventory costs our pipe brokers less”

“I have never felt more uncertainty about our business in my entire 40-plus-year career.”

One might be inclined to think with friends like Trump, who needs enemies? Nonetheless, there just hasn’t been any glaring loss of support, loud disagreement, or acrimonious defections. At least not yet.

Politics and public policy II

As we all struggle to find ways to make sense of the stream of executive orders coming out of the White House, evaluating each policy individually has not been especially helpful. What has been helpful, as Jonah Goldberg ($) explains, is putting it all into perspective:

So, what’s the problem with taking each tree for what it is and ignoring the forest? The problem is the forest matters too. Trump’s invocation of the Alien Enemies Act, his scurrilous and sinister war of intimidation against law firms, his relentless pursuit of firing potential dissenters and installing loyalists—many appallingly unqualified for the job—throughout the government speaks to his actual motivations and worldview. Dividing everything into Good Trump and Bad Trump is an artificial distinction imposed on the organic whole of Trump. A Unified Field Theory of Trump ignores this artificial distinction.

As part of his “Unified Theory,” Goldberg delineates two key character traits of Trump. One is, “He craves. That’s his nature.” The other trait is, “He wants to dominate! To be seen as the master of things.”

This does help explain things. Why does Trump insist on using tariffs despite their well-documented policy shortcomings? Because he craves. Why would Trump impose tariffs on most of the world? Because he wants to dominate! This simple character profile really does help explain a lot of things.

It reminds me of the character Smeagol in the Lord of the Rings. After finding the gold ring, Smeagol becomes corrupted by it. As he becomes obsessed with the power it conveys, he becomes the more sinister character, Gollum. Similarly, as Trump is tasting the enormous power of the US presidency, he is becoming obsessed with it and as a result, increasingly controlled by his own cravings.

Of course such themes are the bread and butter of mythology, and it is there we can turn for insights. Since absolute power is beyond the reach of human beings, the only real question is how the downfall happens. For one, other forces can rise and conquer. For another, the character can grow and develop into a better version of itself. Most often, however, the character falls as a result of his/her own hubris. Temptation causes the character to try something too risky — and fail.

This analysis allows one to see Trump’s unusual and eclectic set of orders and actions more as responses to a set of personal cravings than a platform of cohesive public policy. This helps explain why many of the policies seem so scattered — because from a policy standpoint they are. But is also explains something else investors need to know. The policies come from Trump’s cravings to dominate — which means he means it. They are not random.

This also means it is counterproductive to search for reasons to explain why policies make sense from an economic or public policy standpoint. They don’t; reasons and rationale are afterthoughts. It also means the harm to the economy, to civil society, and to liberal ideals will continue to accumulate.

Politics and public policy III

Another way in which it is important to see the “forest” and not just the “trees” is in regard to the political trajectory of the Trump administration. Again, it is easy to “divide everything into Good Trump and Bad Trump” as Goldberg puts it, but it’s hard to see what it means until one steps back and considers the whole.

One way to see the “whole” of authoritarianism is through the Friedrich Hayek book, The Road to Serfdom. In this case, the book establishes a “picture” of authoritarianism and various political activities are like individual pieces of a jigsaw puzzle. If you know what the picture looks like, it’s a lot easier to get a sense of how the pieces fit together. It’s also fairly easy to tell if the pieces are for the right puzzle or not.

Certainly a number of the Trump administration “pieces” fit the authoritarian “puzzle”. Broad expansion of executive authority, trespass on judicial authority, and an active propaganda machine are all recognizable elements of the whole.

Another subtle piece, though, is the control of information. As Hayek writes, “The most effective way of making everybody serve the single system of ends towards which the social plan is directed is to make everybody believe in those ends.” He also adds, “Everything which might cause doubt about the wisdom of government or create discontent will be kept from the people.”

It is with this is mind that a recent post from the Dispatch ($) caused me to perk up: “The Trump administration terminated two additional economic data advisory committees this week: the Bureau of Labor Statistics Technical Advisory Committee (BLSTAC) as well as the bureau’s Data Users Advisory Committee (DUAC).” The moves were justified on the pretense of efficiency, even though membership was uncompensated. Indeed, outside experts were united by “a conviction that economic measurement is super important, very interesting, intellectually, continually changing, and worth getting right, because the quality of the data affects the quality of decision making”.

Call me cynical, but the senseless dissolution of small, obscure, essentially volunteer organizations suggests something is up. If I had to guess, the Trump administration is anticipating a lot of really bad economic numbers and is preparing to hijack government statistics for its own purposes. As investors continue to fit in the pieces of the puzzle, we’ll just have to wait and see if the Trump administration looks a lot like The Road to Serfdom or something else.

Politics and public policy IV

Insofar as the Trump administration is more about a thrust to authoritarianism than a sincere effort to improve public policy (and I think this is the case), investors need to be able to gauge progress and to confirm or disconfirm the hypothesis. What are the indications the Trump effort is succeeding and what are its key vulnerabilities?

I’ve already touched on many of the areas where the Trump administration is advancing towards authoritarianism in previous notes but to recap, a couple of key factors include weak and disorganized opposition by Democrats and a combination of indifference, apathy, and resignation from the electorate. Clarification of the extent of judicial authority in a wide variety of cases and the full brunt of consequences of economic policies implemented thus far are still do be determined.

While efforts to promote authoritarianism in the US are worrisome, there are also reasons to be skeptical of the most extreme outcomes. For starters, virtually all of the Trump administration’s successes in advancing executive authority thus far have been through its own efforts, mainly through issuing executive orders, and not through a broader effort. Even with a majority in both the House and the Senate, Republicans have had little active participation in the power grab.

Interestingly too, voters are already expressing their displeasure where they can. The recent decision to pull Elise Stefanik’s nomination for US ambassador to the United Nations reflects increasing concern within the Republican party that it’s slim majority in the House of Representatives may be at risk. In addition, the Democratic candidate won a widely publicized contest for a Supreme Court seat in Wisconsin despite (or because of?) Elon Musk’s engagement and contributions. Voters have lots of ways to express their feelings and those messages do seem to be getting heard.

There are also broader, political and sociological reasons why The Road to Serfdom playbook of centralized authority is likely to be less effective in 2020s US than in 1930s Germany.

For one, while I am no scholar of history or political science, it seems the widespread and deeply ingrained sentiment of anti-semitism was an important ingredient in Germany’s transformation to fascism. That precondition provided the necessary “other” for the rest of society to unify against. With the US today being so much more diverse, there simply are no similar analogues. One might consider “woke” idealists to be such an “other” group, but that phenomenon is recent and not deeply embedded.

Another reason to be skeptical is that 1930s Germany had a different value system than the US. This was captured by Hayek in a quote from the chemist Wilhelm Ostwald:

“Germany wants to organize Europe which up to now still lacks organization. I will explain to you now Germany’s great secret: we, or perhaps the German race, have discovered the significance of organization. While the other nations still live under the regime of individualism, we have already achieved that of organization.”

So, there’s the logic. In the German playbook, success comes from organization, organization comes from centralization … and centralization requires consolidation of power. This works when societal norms value organization over individuality. In the US today, however, just the opposite is true. Americans love their individual freedoms and get prickly whenever they are encroached upon. I seriously doubt many Americans would prefer centralized authority over their individual liberties if given a choice.

As a result, while many of the Trump administration’s flirtations with authoritarianism have been surprisingly successful, there is no need to go batsh*t crazy about every little move either. Current day America is a different place than 1930s Germany. Any full-bore effort to transplant authoritarianism into the country would likely be rejected.

Investment landscape

President Trump’s “Liberation Day” is all the news this week as investors have been waiting to gain some greater visibility on public policy and therefore the business environment. Even with the announcement, however, there are more questions than answers.

First, there is no evidence of a cohesive plan for tariffs. Trump had four years to plan various policies before getting elected. In some areas, namely in tearing apart government bureaucracy, the planning and organization has been obvious — and a distinct change from the first Trump administration.

The vacillations on tariff policy, however, suggest no such organizational effort was made, or at least adhered to. Nope, the uncertainty is there by design — which means it’s not going away any time soon, even with the announcements on Wednesday.

In addition, there will also be a great deal of uncertainty in the form of retaliatory policies. Countries on the receiving end of US tariffs have mainly been taking a “wait and see” approach. As more policy details get revealed, we will also learn more about the reaction function of trade partners.

Finally, insofar as uncertainty continues to cloud the economic skies, business leaders and investors will need to incorporate that reality into their decision making. That means a higher cost of capital and lower business values, all else equal.

Implications

The current bout of uncertainty investors are experiencing in regard to Trumpian policy is especially uncomfortable given recent history. From 2009 through 2021 investors could count on the Fed keeping rates low and providing excess liquidity. From 2022 to 2024 investors could count on fiscal spending to keep the money flowing.

Now, investors are eagerly awaiting similar policy dogma that they can latch on to. That is increasingly looking like a mistake though.

From the perspective of the Trump administration, it would be best to have markets lower (so as to reset expectations) but to avoid a sharp selloff (which could cause a disorderly disruption). The way to accomplish that is to maintain a higher base level of uncertainty.

Or, as the FT’s ($) Unhedged team put so presciently earlier this week:

The crucial issue is that no one seems to quite believe what Trump says, but at some point he will actually do something and keep doing it, at which point the market will be forced to price it in.

This new steady state of uncertainty is jarring investors in at least two ways. First, it represents a different playbook than most of the last sixteen years. Second, it introduces the distinct possibility that Trump actually means at least some of the crazy things he says.

In many ways, this is good for the Trump administration. It provides for a recalibration of expectations that was desperately needed. It also does so with minimal risk of disruptive market dislocations. If animal spirits perk up, a little more craziness can be injected. If sentiment falls a little too much, the “crazy” machine can be tuned down for a while.

Unfortunately, this arrangement isn’t nearly as beneficial for investors. In the absence of a clear path forward, the easiest path to take is to “wait and see”. This response (or rather lack thereof) is extremely vulnerable to an extended, grinding market decline though. It is also vulnerable to a sharp sell off. The sooner investors realize this, the better for them.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.