Observations by David Robertson, 5/10/24

There wasn’t a lot of news this week and markets responded accordingly by hardly moving. Is it preparation for a lazy summer or the calm before the storm? Either way, let’s take a look.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

The story through the end of February was one of a continued run in stocks. The story since then has been one of being stuck in a trading range. As themarketear.com ($) observes:

Despite all the narratives, the SPX has done very little since mid February. We have traded inside a wide range, but we still lack the new medium term trend. Choppy is here to stay for some longer.

In addition, the interest rate volatility index (MOVE), has also been trading in a range for even longer. Trading recently has been at the very low end of the range. One impact of that lower volatility is that it increases liquidity indirectly by increasing the credit capacity of collateral. Whether the MOVE breaks out of the range or not, it will be telling for financial assets.

One group of investors that has been unfazed by the lack of trading direction has been retail investors. As the FT reports ($), retail investors were lapping up the riskiest ETFs just as stocks starting turning down:

“Market timing is often the Achilles heel of day traders, and this time was no different,” said Bryan Armour, Morningstar’s director of passive strategies research. “Most of the top ETFs by March and April inflows had their worst monthly performance of the year in April.”

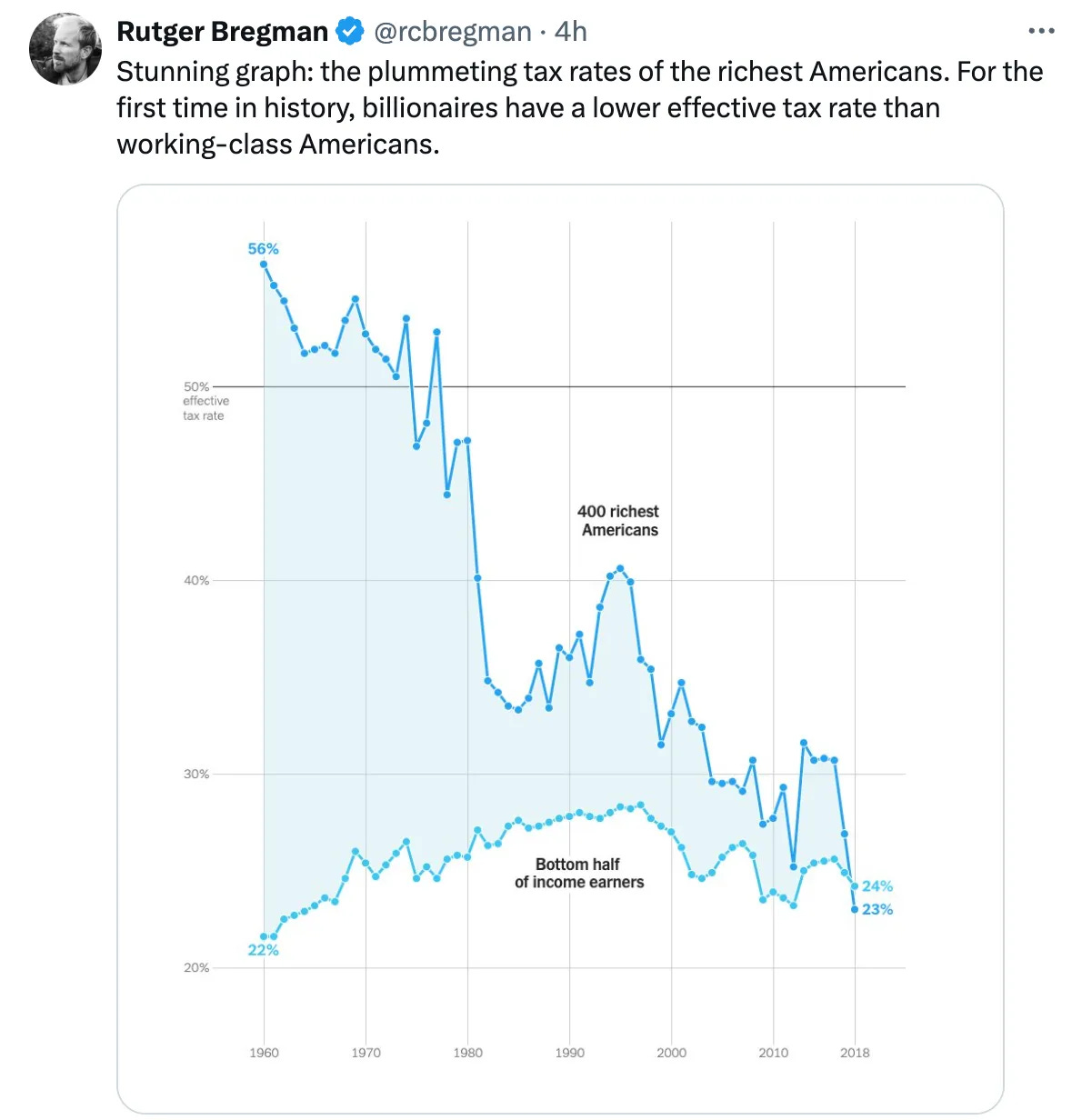

Finally, if you want to see the growing impact of the billionaire class on public policy in one graph (h/t Adam Tooze), here you go:

Labor

Last week, nonfarm payrolls came in a little lighter than expected and the whole market seemed to breathe a sigh of relief that employment was slowing down and the “soft landing” was coming together. As Matt Klein described:

But if the latest monthly numbers are not revised—and don’t turn out to be a fluke—the ECI [Employment Cost Index] might start to look a bit different in the quarters ahead. That in turn should affect the outlook for inflation and interest rates.

In other words, if the reported employment numbers are actually representative, which is decent-sized “if”, we might start seeing labor costs fall and that might cause inflation to decline further. Good to know, but also a lot of “ifs”.

On the other hand, Lee Adler reported in his Liquidity Trader letter from May 4, “Forget the modest increase in jobs reported by the BLS. Withholding tax collections were strong in April.”

This highlights a couple of points. First, given that the withholding tax data is collected directly, it provides the purest data regarding employment and therefore is the better measure of the two. Second, the market’s fairly strong reaction to the noisier nonfarm payrolls number indicates how desperate some investors/traders are to latch on to a story, regardless of how tenuous it is.

Geopolitics

Russia plotting sabotage across Europe, intelligence agencies warn ($)

https://www.ft.com/content/c88509f9-c9bd-46f4-8a5c-9b2bdd3c3dd3

European intelligence agencies have warned their governments that Russia is plotting violent acts of sabotage across the continent as it commits to a course of permanent conflict with the west.

While the Kremlin’s agents have a long history of such operations — and launched attacks sporadically in Europe in recent years — evidence is mounting of a more aggressive and concerted effort, according to assessments from three different European countries shared with the Financial Times.

It’s not uncommon to read of Russia being associated with acts of violence and sabotage, but it is a new development that “evidence is mounting of a more aggressive and concerted effort”, and that attacks are being directed on Europe.

It is certainly possible this is typical Russian disinformation. It is also possible European intelligence agencies have an ulterior motive in raising awareness of the risk. Regardless, these developments help shape opinions and increase awareness of the potential for broader global conflict.

Monetary policy

One of the interesting (if irritating) phenomena of recent years has been the regularity to which we get normalized to egregiously bad behavior and poor performance. Nowhere does this apply more appropriately than to monetary policy. For starters, Brent Donnelly has some choice comments about the Fed’s performance:

There has been no shortage of clownshow moments for the Fed during Powell’s tenure, most notably:

“We are a long way from neutral” in 2018. That was the high in yields.

2019 framework review and introduction of FAIT to let inflation “run hot” right before the biggest inflation explosion in decades.

“Inflation is transitory.” Continuing to stay loose and buy assets into 2022, goosing a prolonged 2-year inflation surge that led to 500 bps of hikes.

Top Fed officials resign after trading their own investment accounts around Fed announcements while America was locked down under the cloud of COVID.

Failure to understand, oversee, and properly regulate Silvergate.

Pre-announcing rate cuts in late 2023 despite inflation well above target, triggering a rebound in animal spirits and inflation.

Donnelly is not the only Fed observer with such sentiments; Jim Bianco shared similar thoughts about how the Fed is performing as an organization:

So how has the Fed done over the last four years with a near-century low in dissents?

Called inflation "transitory"

Watch inflation hit a 40-year high in 2022

Sat through a presentation that specifically told them Silicon Valley Bank was at risk and did nothing.

Had two FOMC members resign for trading their personal accounts as they were making historic monetary policy decisions.

And now it is not getting the confidence to cut rates after telling us for months that it would, and that cuts were coming.

I’m not reporting this just to dunk on the Fed. It has been operating in a difficult environment and it was no trivial exercise to raise rates or embark on Quantitative Tightening (QT). Rather, I am trying to provide perspective that suggests scaling back reliance on Fed forecasts for guidance.

For one, as the evidence above indicates, the Fed has missed a number of important calls. Clearly it does not have the combination of analytical ability and decision making prowess that ensures steady monetary leadership. It just does not have a good handle on what’s going on.

For another, it is on thin ice with credibility. Just like reputations take years to build but only seconds to lose, so too does credibility. With a number of serious question marks already hanging over the organization, it wouldn’t take much more for its credibility to tip the scales and quickly evaporate. As Bianco suggests, the Fed is probably overdue for a rethink of its policies and practices.

This is especially important given the growing discontent with the Fed among Republicans. There is some talk that a second Trump presidency would seek to disband the Fed altogether. While this is just talk at this point and I don’t have any good way of handicapping the possibility, markets are absolutely not discounting the kind of disruption that would result from disbanding the independent monetary authority of the global reserve currency. There would be consequences for everyone.

Finally, and on a slightly different note, there was a heavy schedule of Treasury auctions this week. The three-year auction on Tuesday went well and brought rates down modestly. The important ten-year auction on Wednesday was solid - as was the thirty-year on Thursday. Superficially at least, these are good signs that inflation is coming under control.

That is, unless someone has their thumb on the scales and doesn’t want Treasury yields to reflect real market rates. Interestingly, at the end of the week, gold popped again. That’s exactly what one would expect if investors don’t think longer-term Treasury yields adequately compensate for growth and inflation risks. It appears as if the US Treasury is practicing a form of yield curve control albeit in a fairly discreet fashion.

Public policy

One of the themes I have been highlighting over the last few years has been the increasing muscularity of public policy. Government policy has become more proactive, broader in scope, and greater in scale. Importantly, a majority of people seem perfectly happy with this.

This has created challenges for analysts and investors who rely too strongly on the assumption of free markets. Quite arguably, the trend toward growing influence of public policy is still in its early days. Here are a couple of recent examples:

The mortgage reform that could unleash the next big US stimulus ($)

https://www.ft.com/content/1d287e0c-afda-46f0-9961-9da157b50101

Last month, the government-sponsored mortgage finance agency Freddie Mac filed a proposal with its regulator, the Federal Housing Finance Agency, to enter into the secondary mortgage market, otherwise known as home equity loans. This was a smart move by Freddie, and the FHFA will do a lot of good by approving it. Despite the more than $32tn in equity on homeowner balance sheets, very little of it has been tapped through home equity loans.

This was a smart move by Freddie and the FHFA will do a lot of good by approving it. Despite the more than $32tn in equity on homeowner balance sheets, very little of it has been tapped through home equity loans.

There was a time, in the mid 2000s, when home equity loans were so popular people were using their homes as ATMs in order to fund incremental spending. Guess what has happened since then? Homes have gotten a lot more expensive/valuable and mortgage balances have come down in relation. This means homeowners in aggregate have a big, somewhat trapped, asset on their balance sheet.

The mortgage reform that Meredith Whitney highlights would make it much easier for homeowners to tap into that illiquid asset by packaging home equity loans in the same way as regular home mortgages.

In a separate but related note, Andy Constan posted his thoughts regarding Warren Buffett selling a big chunk of Apple stock:

Either Warren is selling $AAPL stock because of valuation reasons or due to the potential for an increase in capital gains tax and wants to take the gain now. Probably some of each. Now step back. If Warren is selling for these reasons and you think Warren is great. How does this apply to every stock in the market?

A key point here is that Warren Buffett, who in addition to being a great investor is also a great identifier of shifting political winds, seems to be flagging the potential for increases in capital gains taxes through his action to sell Apple. Remember, this is the guy whose favorite holding period is “forever”.

Both of these ideas (the prospect of packaging home equity loans and the prospect of higher capital gains tax rates) are things that could have a significant impact on markets. They also both fall outside of the purview of normal macro factors. The main point is government policy has a way of regularly moving the goal posts. Those who focus exclusively on economic and financial factors run a big risk of being blindsided.

Investment landscape

Excessive debt is an endemic aspect of the investment landscape. Further, as Craig Shapiro points out, the reality is probably even worse than the perception:

There is an incredibly wide chasm developing between where the forward implied rates are for 10 year yields and where the CBO and OMB are forecasting interest rates to be from 2025-2034.

While implied forward rates are not a forecast per se, they do provide a more timely outlook than the government budgeting estimates. As such, they indicate a significant probability that the debt problem is worse than it appears because interest expenses are likely to be higher than are currently planned for.

This isn’t the end of the world or anything, but it is an indication that public finances are getting squeezed harder and faster than government is letting on. Don’t be surprised when it “suddenly” becomes a big deal.

Investment advisory landscape

A recent post by Ptuomov accomplishes several useful things in one go. It highlights a dissonance between most podcast content and what most investors need, it provides criteria by which to assess investment information, and it also provides some perspective on the ever-growing universe of investing podcasts:

My conclusion [after listening to a lot of investing podcasts] is that while a lot of nuts and bolts investing podcasts are truly great, macro podcast episodes of even good shows suck hairy scrotum.

Macro only matters to general investing if there’s (1) a world war, (2) a real estate bubble, or (3) a clearly unsustainable foreign currency denominated government debt burden. Ok, the central bank policy may also matter a little bit in the short run.

A macro podcast episode is only interesting from investment perspective if it reveals new information or variant perception about the above topics. And they almost never do. Instead, it’s usually some politically biased or outright untrue raging rant about things that don’t matter to investors.

One of the main points made in this post is that there is very little in terms of daily or weekly news items that really matter for general investing. True enough. And yet … it is every little zig and zag, every data report, every Fed decision that gets discussed and analyzed endlessly in macro podcasts. It’s not that it’s not useful to stay up to date on the market landscape, but most of these things should not induce action for long-term investors.

Another useful point is that the real value of a podcast, or any piece of research for that matter, is useful only insofar as it adds something to the discussion. New information or a variant perception do that. Rehashing well-known narratives does not.

Finally, while a number of podcasts can be entertaining to listen to, it is helpful to recognize their main purpose as entertainment and to not mistake them for valuable investment insight.

For some perspective, consider this quote from Warren Buffett posted by Geiger Capital:

Warren Buffett on valuations today… “I don’t think anyone at this table has any idea of how to use it [$189B in cash] effectively, and therefore we don’t use it. We only swing at pitches we like… today things aren’t attractive. We’re not using it at 5.4%, but I wouldn’t use it at 1% either. But don’t tell the Federal Reserve that.

I don’t mind at all, given current conditions, building our cash position. When I look at the equity markets and the composition of what’s going on in the world, we find cash quite attractive.”

The notions that no one knows how to use the cash effectively, only swinging at pitches they like, not minding building the cash position - these are all incredibly boring ideas, but also very good guidance for long-term investors. That highlights an ever-present conflict between media and investing: Media needs excitement to generate attention, but good investing ideas are often boring.

Implications

The mixed data on inflation, the lack of prominent market narratives, and the pattern of trading ranges for stocks, all point to an environment where very few assets are moving very much. Bulls can be frustrated the Fed just hasn’t been able to pull the trigger on lowering rates and bears can be frustrated that valuations remain buoyant despite uninspiring fundamentals.

While investors of all types look forward to escaping from this uncomfortable investment purgatory, they would do well to fight the temptation to find confirming evidence where it does not exist. Given the mixed economic environment and the shifting nature of the economy from being credit-driven to income-driven, a couple of data points here or there do not provide meaningful insight.

Investors will also do well to keep scanning the horizon for potential risks. The progression of the economy, inflation and liquidity are all important, but already receive plenty of attention. Picking up on signals from geopolitics and policy changes may not only prevent getting blindsided, but could also provide advance notice of major disruptions.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.