Observations by David Robertson, 5/23/25

It was another week filled with important news for investors. Let’s dig in.

In the meantime, best wishes for a wonderful Memorial Day weekend - I hope you get to get out and do something fun!

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

The graph below from the Daily Shot shows retail buying, most notably represented by artificial intelligence names, continues to dominate marginal activity in the stock market.

Stocks were less the show this week than were interest rates, however. The 30-year Treasury (from the Daily Shot) is exceeding the level that inspired a policy response back in April:

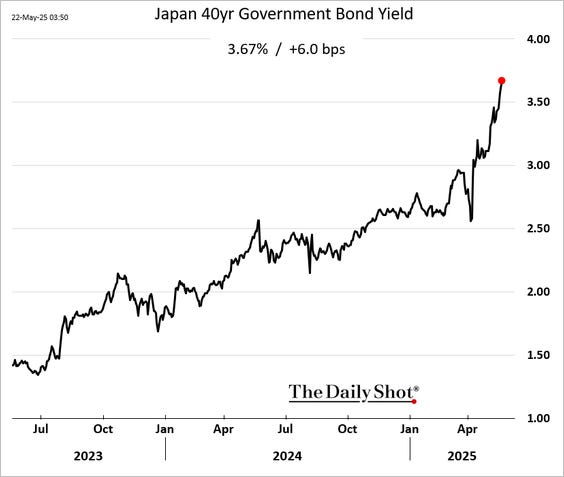

In addition, while overall long-term rates are lower in Japan, the climb higher has been steeper (the Daily Shot):

On Friday morning, just as everyone is getting ready for a nice long holiday weekend, news came out that Trump was threatening the Eurozone with 50% tariffs as well as penalties on Apple. Stock futures were down over 1%. Perhaps tariffs will be the lever to keep bond yields in check?

Politics and public policy I

How to Take Medicaid from Millions of Americans, in Less Than 72 Hours ($)

But the focus on the delays can be a bit of a distraction. Because right now the real question is not why the Republicans are moving so slowly but why they are moving so quickly—and what they don’t want you to see.

When they released an actual bill last Sunday evening, they announced at the same time that the Energy and Commerce Committee would take it up on Tuesday—not even two days later, and so quickly that the Congressional Budget Office wouldn’t have time to produce a full, detailed cost estimate.

As the budget bill has been getting more attention, much of the focus (including mine) has been on the divisions in the Republican party. Part of the reason for this is to gauge the degree to which legislators still have power to stand up to Trump and as a result, perhaps impose some stewardship on the budgeting process.

While it’s still too early to make a definitive assessment, the signs thus far are not encouraging. The Economist ($), for example, says the bill is “stuffed with even more largesse and accounting gimmicks than expected.” It also quotes Marc Goldwein of the Committee for a Responsible Federal Budget, who describes, “It’s just kind of a dumpster fire to be honest. I wish I could say nicer things about it.”

This raises another important, and under-appreciated, aspect of the budget bill highlighted by the Bulwark ($): It’s moving really fast. Retired Rep. Henry Waxman commented in a phone interview, “Republicans are rushing to get this legislation passed without giving it the time to get a full consideration of what it will mean”.

Just about any other time, it might be easy to dismiss such a claim as so much tactical gaming by politicians. However, with recent memories of Republican members of Congress avoiding in-person town hall meetings in order to avoid the wrath of their constituents, a pattern seems to be emerging. The intention here is to rule with power and to cram down policies some elites want but that are unpopular with the electorate, even Republicans.

This suggests another swath of tax cuts will pass that will further increase inequality, that there won’t be sufficient spending cuts to offset them so the deficit will remain at an unsustainably high level, and that as a result, the fiscal “emergency” will get worse, not better. Oh, and the political process is getting further and further away from being a representative democracy.

Politics and public policy II

While markets were happy to interpret Trump’s China “deal” on tariffs as an unalloyed positive, Shannon Brandao from China Boss ($) had a different perspective. In her view, “the deal reflects mutual economic strain—not mutual trust”. A big part of the reason for this less sanguine view is because “The tariff truce sidesteps core disputes—intellectual property theft, industrial subsidies, supply chain weaponization, and tech decoupling.” Good points.

Another good point is that China came away with some major wins in that negotiation. According to China Boss, Xi “avoided structural concessions, secured favorable terms, and preserved his leverage.” Not bad for a day’s work. The conclusion is that “Xi didn’t just outlast Trump’s tariffs—he changed the fight.”

I’m not quite sure I would go so far in that assessment of the China tariff deal but it does raise two important points about such deals in general.

First, perspective matters a lot in determining the outcome. Given the inherent bias to the US in most reporting, it’s really helpful to challenge those opinions with other perspectives. Often the truth is somewhere in the middle.

Another point is the whole concept of a “deal” is fraught with potential for deception. For one, it implies finality, when in geopolitics that is rarely the case. For another, it implies specificity, when in many cases the “deal” is merely at outline for dialogue. For another, it implies a scorecard where there are winners and losers. Finally, and as a result of all the above, it tends to vastly oversimplify the nature of the interaction.

The result of all of these factors is a bias toward believing deals are good, culminating, certainty-creating events when in fact, they are often merely individual moves in a very long game of strategy.

Investment landscape I

Monday morning started off “hot” again with plenty of news to digest. PauloMacro ($) did a nice job pulling everything together:

Mon 19 May 2025... good morning! What a weekend. Starting first with Moody's downgrade … That clearly wasn't enough "uncertainty" so Trump came in hot with tweets bashing Powell and pressuring Walmart to "eat their tariffs" (similar to what I tell my kids about their vegetables). But the piece de resistance was Bessent's weekly rounds on Sunday TV, where on Meet the Press he gave an interview which was eye-opening for someone like me who traffics in narratives and flows. In a nutshell, by seeming to shill the current administration's approach, he all but abandoned the initial "three 3's" with zero mention of "detox" or spending sustainability. It was all about juicing nominal GDP because deregulation and tax cuts would set us free.

The first thing to recognize is that long rates matter a lot — and are not going to be resolved with any single announcement. There will likely be more moments when long bonds get challenged as well as more moments when fears temporarily subside. None of that changes the reality that pressures continue to build on overly indebted governments. Moments like this are signposts of movement along the trajectory, not indications of resolution.

Last week I also discussed long bond yields and highlighted Russell Clark’s observation that “the issue is when the market recognises the collapsing creditworthiness of US treasuries”. The Moody’s downgrade indicates growing recognition of that “collapsing creditworthiness”.

That creditworthiness is not always captured neatly by mathematical formulas. Some of the most important elements of credit, such as political adherence to the rule of law, are virtually impossible to quantify. In addition, just to add a degree of difficulty, political leanings and public policy direction can change, sometimes substantially, in short periods of time.

This is exactly what PauloMacro was referring to when he said Bessent “all but abandoned the initial ‘three 3's’ with zero mention of ‘detox’ or spending sustainability.” In short, after just a few short months, Bessent has completely changed direction from his original plan.

This is worrying on multiple fronts. If the reality he encountered varied so considerably from his initial base of assumptions, he was very poorly informed. If he is changing direction due to ulterior motives, such as getting the budget bill passed, he is being duplicitous. If he is changing tack simply because the old path was too hard, he lacks the strategic vision and persistence to provide credible leadership.

I’m sure there are other possible explanations, but for now, my bet is on the second option: Right now, he needs markets to hold up which will keep consumer spending up which will enable Republicans to force their budget bill through, with all its tax cuts intact.

Yet another factor investors should keep in mind in regard to bonds, though, is they can be affected by plenty of things outside the direct control of the current administration. Moody’s downgrade is certainly one indication of external influence, but others could come from other private entities or from other countries. The 15 bp spike in the 20-year JGB yield overnight Monday is a great example.

Investment landscape II

Four months into the new Trump administration and investors and commentators still struggle to make sense of not only the twists and turns in policy, but also in the stories told about those policies. Rusty Guinn from Epsilon Theory ($) uses the example of tariffs to describe a phenomenon he calls “narrative shopping”:

After a lull in campaign conversations about tariffs that accompanied the Biden-Harris switcheroo, Trump began to tell a new story that he had introduced only sparingly in the past: that tariffs are about the revenue they create and the potential to use that revenue to reduce income tax burdens election.

Almost as soon as the dust cleared from the election in November, however, the administration and its allies in media began actively promoting three other narratives that had been almost completely absent before: (1) that tariffs are about pressuring neighbors to secure their borders and get tougher on drug smuggling, (2) that tariffs are about pressuring other countries to lower their own tariffs, and (3) that tariffs are about getting countries to pay their fair share on global obligations like mutual defense.

But a funny thing happens when the real reason for pursuing a policy isn’t any of those second order effects or some made-up nonsense about non-existent first order effects, but some secret third thing: the person proposing goes narrative shopping.

In short, the frequently changing narratives about policies like tariffs don’t so much reveal changes in fact or analysis as an insidious ulterior motive which involves leveraging power purely for short-term advantage.

As Guinn summarizes, “Whatever you believe about tariff policy, you now have the blueprint for a reliable advance signal for every new protection racket policy about to be introduced in the age of great power for great power’s sake: Just watch for them to go narrative shopping.” In other words, “It’s about ‘who has the cards’ and literally nothing else.”

Investment landscape III

As the budget bill winds through the legislative process, its inclusions and exclusions reflect on the priorities of the Trump administration. Ed Luce ($) notes in the FT

To grasp a party’s true values, study its budget. By that test, Donald Trump’s Republicans loathe science, medical research, victims of overseas disasters, food stamps, education for all age groups, healthcare for the poor and clean energy. Each are severely cut. On the other hand, they love the Pentagon, border security, the rich and allegedly those for whom the rich leave tips. They have no desire to reduce America’s ballooning deficit. What Trump wants enacted is the most anti-blue collar budget in memory.

This is interesting. The one huge, legislative priority of the Trump administration is almost completely antithetical to the entire body of its political rhetoric during the campaign. This is not a particularly biased assessment either:

Some Republicans, like Josh Hawley, the rightwing Missouri senator, warn that this budget could “end any chance of us becoming a working-class party”. Steve Bannon, Maga’s original conceptualiser, says the Medicaid cuts will harm Trump’s base. “Maga’s on Medicaid because there’s not great jobs in this country,” says Bannon. The plutocracy is still running Capitol Hill, he adds.

This presents an interesting possible interpretation. The budget bill is not really about economics, governance, or any kind of working class policy framework. Rather, it is about “who has the cards”. The wealthy elite have the cards and Medicaid recipients do not. End of sentence.

If this is true, and if Rusty Guinn’s framework is right, we are apt to hear a fair amount of “narrative shopping” in regard to the budget. It will also be interesting to see whether Trump can retain fairly strong support with his base when his “true stripes” work at counter-purposes.

Investment landscape IV

One of the lines that keeps running through my head is the statement by Russell Napier I quoted last week, “Nobody in our industry is in any way qualified for any of this”.

When I am confounded by market behavior, or policy decisions, or investment commentary, I always try to understand what causes the dissonance between the stated argument and my beliefs. Often, there is just a difference in assumptions, which is fine but important to understand.

Increasingly, however, I can’t reconcile many of the arguments I come across with my own beliefs and knowledge base. They make no sense to me. While I am always resistant to the possibility that other people just don’t know (because my own ignorance or obliviousness has proven itself too many times to count), I have to say the hypothesis that “Nobody in our industry is in any way qualified for any of this” resolves a lot of the conflicts. A number of arguments don’t make sense to me because they only make sense under selective and wholly unrealistic assumptions.

MBA-types are good at working with models and frameworks and within the confines of long lists of simplifying assumptions (I know this because I have one, same for CFAs btw). The problems start when those simplifying assumptions break down and worsen as the models become not only unhelpful, but downright counterproductive. I’m afraid a lot of models now are spewing out exactly the wrong investment advice.

This idea dovetails with the long time lament of Jim Grant that the industry had migrated from the gold standard to the PhD standard. In other words, the concepts of credit and trust, which implicitly entail human behavior (and therefore qualitative aspects), had become formulaic, methodical, and linear. In one sense, they had become over-engineered, but most importantly, they just failed to provide good representations of reality. In addition, they also happened to fail at the worst possible times.

I think what a lot of this boils down to is risk. It is quite typical during good times for investors to become cavalier about risk. By the same token, it is also normal during times of crisis for investors to discover exactly how cavalier they have been. One of the key elements of the GFC was the assumption that house prices in the US didn’t go down. When that assumption proved illusory, so too did piles of assets that were based on it.

During major turning points like the GFC, the conception and awareness of risk seem to take on an entirely different, and more holistic, character. This feels like one of those times. If you are closely watching developments on the risk front, it seems like it takes a long time to manifest. If you are oblivious to risk, it can come at you unbelievably fast, seemingly out of nowhere.

Either way, when risk shows its full face, it is the kind of thing that can absolutely crush investment returns and retirement portfolios. Because of the immensity of downside potential, it’s a good thing to have a handle on beforehand and to prepare for.

Implications

Economic data continues to roll in with modest strength which indicates US consumers, as a whole, continue to spend mostly in line with normal habits. Expectations for the future are split mainly along partisan political lines: Republicans expect new policies to generate an economic revival but Democrats see higher long-term rates and capricious policy strangling the economy.

In my opinion, both of these extreme viewpoints are forms of denial because they avoid the key issue. Both positions rely on the assumption that things are just fine so far as the other party isn’t screwing them up. That isn’t right. Both parties have been at least complicit over many years in allowing the fiscal deficit and overall debt to explode. That’s the problem. Neither side can claim innocence in that major transgression.

In the meantime, time is running out and the degrees of freedom for policy to forestall the eventual reckoning are also rapidly diminishing. Unfortunately, based on the experience thus far, the Trump administration is not particularly interested in addressing the key problem. Rather, it seems to be engaged in systematic narrative shopping, periodically toggling from one story to another, in order to create a fog of uncertainty and ultimately to buy time.

Insofar as this is the case, it presents an unusual challenge for investors: It’s hard to see how things get a lot better, but it’s also hard to tell when they might fall apart and therefore to reduce risk. Indeed, this is often the greatest risk for investors; there just isn’t any clear signal of the top.

From an investment standpoint there is likely to be a lot of frustration. Directional bets will only work for short periods and will keep changing within the context of a broader malaise.

From a political standpoint, this scenario will waste valuable time which will also gradually eliminate policy options. The only good news is that once the cold hard economic facts become so indisputably negative they are impossible to reject, political positions will converge on problem-solving rather than side-blaming.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.