Observations by David Robertson, 5/26/23

With the debt ceiling x-date rapidly approaching I’ll be investigating the investment landscape more than usual this week. In the meantime, I hope you have a great holiday weekend!

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

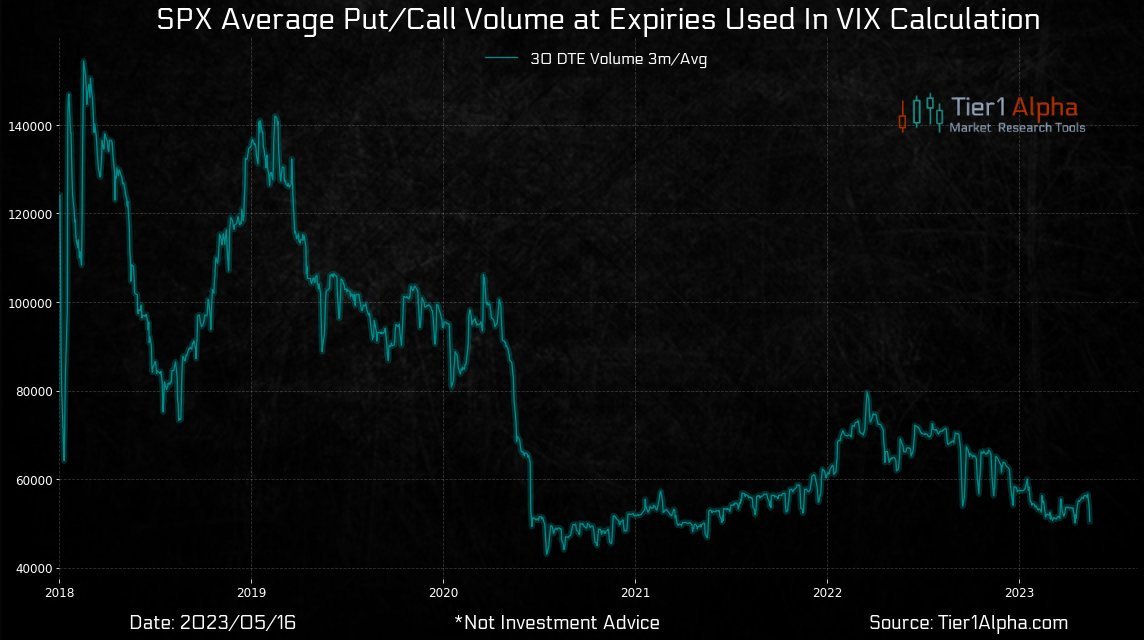

I’ve touched on this before, but Tier1Alpha appropriately raises the issue again: Volatility just “hasn't been the same since 2020”. The volume of options used in the VIX calculation has fallen by about half since then.

I haven’t seen any explanations for why this is the case although it certainly does coincide with the proliferation of 0 day-to-expiry (0dte) options. It’s also hard to tell what this may imply for markets other than that the information content of VIX is probably different (and lower) than it was before 2020.

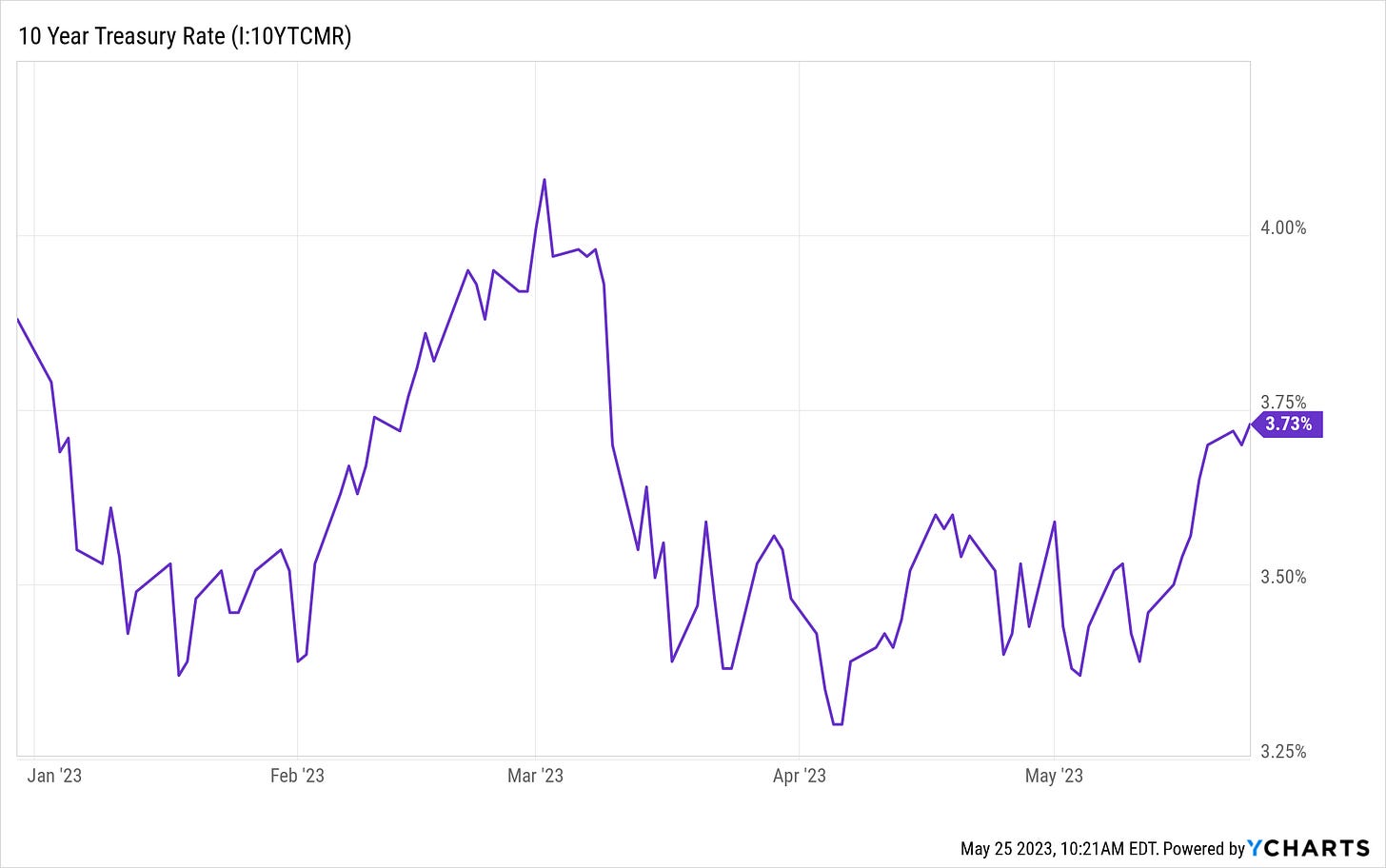

In other news, the 10-year Treasury yield has been perking back up recently. This could be because long-term inflation expectations are rising again, because expectations of a deep recession have eased to some extent, because the term premium is too low, because future supply may outstrip demand and force yields up, or simply because the peak of the banking crisis is over.

If the 10-year yield continues to run up, it will send a strong signal to other markets as well. Notably, higher long-term yields will be especially harmful to tech stocks. They could also signal stronger growth expectations - which could boost industrial stocks. This is a key number to watch.

Credit

We’ve already heard about credit problems piling up in commercial real estate. In addition, the number of bankruptcies is clearly rising as well.

What has mostly flown under the radar, but is every bit as important, is credit at Business Development Companies (BDCs). As Stimpyz insinuates in a Twitter post, the generous valuations of private credit are unlikely to persist much longer. Once the ice is broken, ripples will be felt throughout the credit space in the form of lower values and higher yields.

It’s useful to remember here that BDCs and a slew of other nonbank lenders exploded after the GFC when regulations forced banks to increase capital for risky lending. As a result, those risky loans migrated out of the banking sector and into BDCs and their kin. The other thing that’s useful to remember is BDCs are not regulated to nearly the same degree banks are. As a result, regulators care a lot less if they go bust.

Oil

Rory Johnston noted on Twitter that the “Oil market remains dominated by active policy choices more so than a gradual grind toward balance”. In other words, policy moves from releasing oil from the SPR “to price caps to continued sizable OPEC+ involvement to MonPol” create all kinds of room for errors in assessing the market. It’s not just about fundamentals; it’s also about constantly moving goal posts.

One implication is it makes trading oil largely a fool’s errand. As hard as it is to get one’s arms wrapped around global oil fundamentals, it is even harder to gain any kind of sustainable edge regarding policy moves by the various players. Further, governments are becoming increasingly inclined to intervene when they see fit.

Also, to an increasing extent, similar influences are affecting other major commodity markets as well. As much as it would be nice to be able to read commodities for insights into the global economy, public policy intervention is making it ever-more tenuous to do so.

Re: Oil-Deep Dive & The Supply/Demand Singularity Revisited. ($)

https://www.urbankaoboy.com/p/re-oil-deep-dive-and-the-supplydemand

Because Labor and Shelter markets remain tight for structural reasons, however, the Fed will be forced to stay “Higher For (A Lot) Longer” than many (certainly Risk Assets) anticipate, at least until something big breaks — like China.

The main reason for highlighting this piece by Michael Kao is to alert readers to a thoughtful and balanced analysis of the oil market. In particular, Kao does an excellent job of reconciling his long-term bullish view on oil with his shorter-term bearish view. As I have mentioned several times in the past, this is the heart of the long-term opportunity/short-term challenge with commodities in general.

Another reason for highlighting this work, however, is for the perspective it provides regarding economic scenarios. If Kao is right that the US dollar (USD) can remain strong even if it pauses on rates, that will have a debilitating effect on other economies in the world.

As a result, it may be “The Fed isn’t done breaking things”, as Ethan Wu suggests ($) in the FT, but maybe those things break in other places - like China. In fact, Kao goes so far as to suggest we may be “on the doorstep of Asian Contagion 2.0”. In that case, weakening prices for commodities like copper, iron ore, and oil, are more a function of concern for China than for the US, and concerns about a slowdown in the US may be overstated (though not misplaced).

Monetary policy

A nice post by Ed Bradford on Twitter here highlights a dynamic I have heard almost nobody address: The Fed’s Reverse Repo (RRP) facility is effectively fungible with bank reserves. That means any determination of bank reserve shortages that does not incorporate RRP is missing an important variable. Bradford quotes Brian Sack, former head of the New York Fed markets group:

Right, so we thought that the rates on the RRP facility and the rates paid on reserves should be relatively close to each other or even set equal to each other. The broad concept behind that was that the market can efficiently decide where it wants to allocate liquidity created by the Fed. So, when the Fed buys assets, it creates liquidity in the form of some overnight asset - one being bank reserves, one being overnight reverse repo transactions. That liquidity, to a large extent, has to be in one of those two forms. The RRPs were created because we wanted that liquidity to be able to be held outside the banking system.

As a result, I have a hard time understanding why so many prognosticators highlight rapidly diminishing excess bank reserves as a milestone for the restart of Quantitative Easing (QE). If banks start needing reserves, they will be able to attract them by offering rates alluring enough to attract money out of money market funds - which would then start depleting the RRP facility. The best reason I can conceive of the QE claim is that QE is associated with “market go up” which is what most investors want to hear.

Now, the details do matter. It may happen that the mechanics of transitioning from significant excess reserves to a more “comfortable” level is not smooth. In that case, one option would be for the Fed to step in to buy Treasury bills, but not longer-term Treasury bonds. While the Fed may not consider this QE ($) in a technical sense, it could easily send a signal to traders that the QE game is back on.

Landscape I

The United States of Bed Bath & Beyond (&)

The story of Bed Bath & Beyond is the story of grown men, weak men, making wagers that they lose over and over again.

The story of Bed Bath & Beyond is the story of grown men, rapacious men, whose nature is to bust-out the weak men as cruelly and certainly as possible, over and over again.

The story of Bed Bath & Beyond is our story, the story of the United States here in the fin de siecle of The Long Now, where our entire country has been busted out and stripped for parts by grown men, rapacious men, different from Tony Soprano only in that they plunder legally within a system of courts and laws and regulatory agencies.

It’s not going to stop because we are increasingly a nation of rapacious men, clever-edging men, men who discover early on that they’re damned good at playing the game of take-the-sap’s-money and never realize until it’s too late that the table stakes for this particular game is … well, being damned themselves. And I’m not talking about being damned in the religious sense, although yes that, too. I’m talking about a loss of humanity, where the rapacious man willingly gives away his very identity to a corporation or business partnership if they will just allow him to continue winning the game. Because in the end that’s all the rapacious man, the clever-edging man, has left. The winning.

Ben Hunt is a great storyteller and this masterpiece is the story of how a good deal of the business and investment environment looks like … a scam from the Sopranos. Specifically, it focuses on Bed Bath & Beyond and the way the company was looted for the purpose of enriching insiders while leaving other investors holding the bag. This particular instance, however, is but one extreme example of an ethos that has infected economic activity nearly everywhere.

No longer is there even much pretense of even trying to create value from economic exchanges. Rather, the goal is to play “take-the-sap’s-money”. The more you look, the more you see it. I’ve noticed it in the form of finding exceptionally few leaders from the business world whom I respect any more. I don’t want to be like them.

A big part of the reason to highlight this is to provide context for understanding what has been going on in the market. Crypto explosion? Scam. Meme stock rage? Scam. SPAC attack? Mostly scam. The problem is when rapacious people and degenerate gamblers get access to easy money — games will be played.

I also highlight this because I think it has started to influence monetary policy. The more games of “take-the-sap’s-money” that are being played, the less money money is going into productive investments. The logical conclusion is the gambling landscape is bad for future economic growth. If you want to change that, you need to keep money out of gamblers’ hands by making it more expensive to lose. You do that by keeping rates higher. It seems to me like this is the plan.

Landscape II

Exclusive Interview with Russell Napier: Save Like a Pessimist, Invest like an Optimist

The reason that I come to a capital expenditure boom is that it is, as far as I can see, the only answer to the political problems. My view is that countries don’t just use their own money to finance this; they use the banking system to finance this.

I’ve looked at all the recessions since World War Two, and they kind of divide into two camps: every recession up until 1990 and then every recession since. The recessions from ’45 to ’90 all came replete with inflation. Inflation came down in all these recessions, but there was no prospect of deflation.

A couple more important topics to discuss from Russell Napier’s interview include recession and capital spending. In order to fully appreciate his point of view, however, one must understand that it comes from a longer-term, strategic assessment of policy making than a knee-jerk response to short-term impulse.

More specifically, the overarching policy goal is to reduce debt/GDP. Higher rates are part of that recipe and that is leading to “the most expected recession ever”. Given the change in landscape and the change in policy direction, it shouldn’t be too surprising that Napier thinks “what we’re looking at now is a return to those 1945-to-1990 recessions, because as we saw in 2020, credit continues to flow through the recession”.

This is a different type of recession than those experienced in the last thirty years. The more recent ones were credit events. Credit markets would shut down and threaten growth until central bankers eased credit conditions again.

Earlier recessions were more directly functions of business cycle swings. They didn’t come with a “collapse in corporate earnings” so much, but rather with “higher inflation”. They were a function of demand running too hot for supply to keep up with.

So, if you have a structural shortage of supply, and credit continues to flow, you have excellent conditions for new investments in capital — which is the second topic. Further, if a number of those investments are deemed important for rebuilding productive capacity and/or national security, they will get access to the funding they need.

This scenario introduces a couple of interesting thoughts. One is that while higher rates are sure to be an incremental burden to companies that will hurt profitability, it may also be that the main victims will be “zombies” which have only been skating by on the benefit of artificially low interest rates. To the extent this is the case, a thorough cleansing of corporate detritus will enable capital to find more productive uses — and that would obviously be good.

Finally, one’s view of recession prospects depends significantly on one’s assumptions. If you believe economic growth derives primarily from credit growth, that consumer spending will be crushed with higher interest rates, and that public policy is highly reactive (vs. proactive), then there is a good chance you believe we are about to enter a deep recession. I happen to believe consumer spending will be fairly resilient due to wage strength and improving work conditions, and public policy has become proactive.

Landscape III

PauloMacro presents another really nice macro analysis on Twitter. The case he makes is the “pain trade” is higher. He provides a lot of useful rationale for the case and therefore it is something to consider seriously, even though my belief is there is very little time for such a case to manifest in a material way.

Another reason for highlighting the post, however, is illuminate just how little the trading environment reflects fundamental information. He mentions “liquidity”, “positioning”, “career risk”, and “Max Stupid” in his analysis. While all of these are useful to traders, none has anything to do with the underlying value of securities. But, this is a good description of the market we have today.

Implications

As the x-date for the debt ceiling rapidly approaches, you can almost hear the suspenseful mood music getting louder and louder. Of course, there is a lot of attention paid to the debt ceiling, and rightfully so, but the Fed’s actions through the ordeal and through the rest of the year will also be hugely important in setting the tone for the market.

A large swath of views on the Fed depend on whether Jerome Powell is considered to be more a hawk or a dove. I think this vastly oversimplifies the analysis and misses the main point. The main point is the Biden administration has an agenda and that agenda involves keeping rates higher for longer. The rationale is to regain control of money supply, pave the way for a new industrial policy, and facilitate national security. Each of these points are consistent with (and some even explicitly addressed) by National Security Advisor, Jake Sullivan.

So, I think investors would be better off focusing on Sullivan than Powell. Powell is merely the vessel through which Sullivan’s policy operates.

What does Sullivan’s policy imply? Foremost, it implies a financial system and industrial economy that works better for the middle class. That means no more zero interest rates and more focus on rebuilding productive capacity. That also means a significant shift in the economy from finance to industry.

Part of this transition will be eliminating the conditions under which the economy had previously prospered - low rates, asset-lite business models, and visions of significant future growth. This means many of the largest stocks will be set up to lose a great deal of value. It also means there will be some kind of denouement.

The window for the timing of such an event is narrowing. It should definitely be done and over with before it can become a campaign issue in an election year next year. However, it is also likely to come after the debt ceiling resolution. The Fed would vastly prefer to stay out of the political cross hairs and Treasury issuance can be used as a lever to maintain financial stability afterwards.

That means it will likely be upon us shortly — this summer, or fall at the latest. In the short-term, cash is better than stocks — until stocks get a lot cheaper. Later, industrial and commodities companies will be better than tech. The timing depends on the depth of the recession and the path of inflation. While economic deceleration and increasing credit problems are likely to weigh on industrials and commodities going into the downturn, there is a good chance they will rebound sooner than might be expected. Good luck!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.