Observations by David Robertson, 5/30/25

Although the week was short, it was still eventful. Let’s dig in.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

Markets opened the holiday-shortened week incorporating news of a pause on tariffs for the Eurozone. The S&P 500 shot up over 1% and gold fell over 2%. Interestingly, however, the US dollar (USD) barely rose at the opening and gold stocks barely fell. Maybe some markets are beginning to discount these all-too-frequent announcements?

In general, investors seem to be taking every opportunity to load up on stocks when they are down — for whatever reason. Almost Daily Grant’s (Tuesday, May 27, 2025) reports:

Vanguard Group’s S&P 500 ETF (ticker: VOO) gathered a net $20.1 billion last month, the largest influx in the $665 billion fund’s 15-year history. Year to date inflows reached $65 billion on May 21 per VettaFi, comfortably on pace to surpass 2024’s $116 billion figure (which itself more than doubled the prior full-year peak).

“During that period of tumult in early April, we saw a five-to-one buy-to-sell ratio,” Vanguard chief investment officer Greg Davis advised The Wall Street Journal over the weekend. Investors “know that if things are on sale, it’s time to put money to work.”

If this behavior seems perhaps just a tad bit aggressive, you ain’t seen nothin’ yet. PauloMacro ($) observes activity in the crpto space is every bit as maniacal as at past tops:

Lastly, I am shocked/not surprised by the rapid reemergence of the crypto nonsense and bad behavior, this time focused in the “me too MSTR” Bitcoin Treasury scams underway, from grifty Trump-related spacs to microcaps popping the equivalent of “giant follow-ons to buy crypto” that reminds me of fraudy Chinese reverse IPOs from 15 years ago... you have a stock listing you're not using? Great! Let's pop a giant follow-on to buy BTC and GO TO THE MOON.

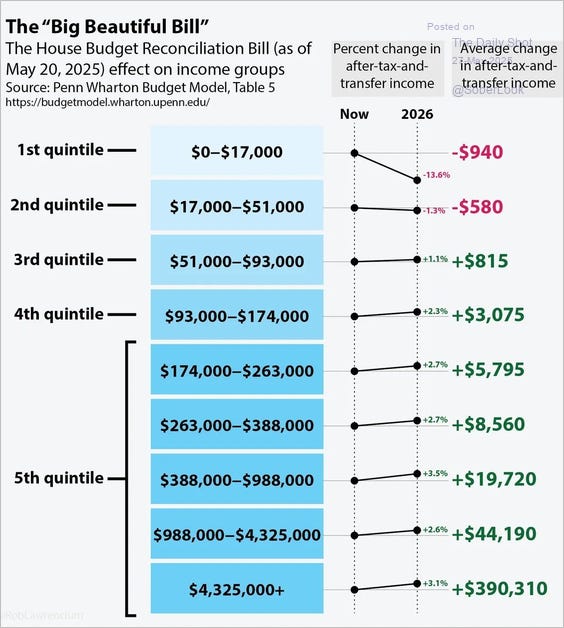

In addition, I wrote last week, “The budget bill is not really about economics, governance, or any kind of working class policy framework. Rather, it is about “who has the cards”. The wealthy elite have the cards and Medicaid recipients do not.” The Daily Shot shows just what the projected change in after-tax-and-transfer income looks like graphically:

Finally, on Wednesday, the US Court of International Trade found that the Trump administration did not have the authority to issue the broad set of tariffs announced in April. Of course, this won’t be the end of matter, but in the meantime it introduces a great deal of uncertainty. The 63 bp decline in the US dollar by Thursday afternoon is a warning shot for US assets.

Politics and public policy I

The Great Rebalancing: Trade, Conflict, and the Perilous Road Ahead for the World Economy - Updated Edition, by Michael Pettis ($)

Given the weekly (if not daily) twists and turns in tariff policy from the Trump administration, The Great Rebalancing, by Michael Pettis provides a wonderful antidote of economic analysis, historical perspective, and policy assessment.

For example, contrary to many of the outstanding narratives today, Pettis makes clear that tariffs are easy to understand and the consequences are straightforward:

A tariff raises the cost of foreign imports. Because real household income is a function of both the nominal amount of household income and the cost of goods and services that households purchase, raising the cost of a good, such as widgets, effectively reduces the real value of household income.

So there it is — tariffs reduce the value of household income. Bad for consumers.

Another point is the issue of trade imbalances has been around for quite a while now; they didn’t just become an issue in the last election.

We will more fully discuss China’s vulnerability to the trade surplus and investment later in this chapter, but with consumption so low, it would mean that China was overly reliant for growth on two sources of demand that were unsustainable and hard to control. Only by shifting to higher domestic consumption could the country reduce its vulnerability and ensure continued rapid growth. This is why in 2005, with household consumption at a shockingly low 40 percent of GDP, Beijing announced its resolve to rebalance the economy toward a greater consumption share.

In other words, the core problem today, that household consumption in China is quite low, was recognized by its own policymakers as a problem way back in 2005, over twenty years ago. Suffice it to say, if the problem had been easy to solve, it would have been solved some time over the last twenty years. As a result, it is reasonable to expect the path forward to be more slow and grinding than immediate and complete.

Finally, given the size and importance of the US and China to global affairs, any kind of conflict between the two countries will be felt around the world. Not only will global growth be impaired by trade restrictions, a whole host of other issues will put geopolitical security at risk as well:

There are many reason for opposing trade restrictions and other forms of trade war between the two countries—the two most important being, in my opinion, first that trade war will result in slower global growth than a negotiated settlement, and second that the importance of the U.S.-China relationship involves a lot more than economic issues. A troubled relationship between the two countries spells potentially bad outcomes for issues such as the environment, global terrorism, and nuclear proliferation. But the argument that restrictions on Chinese trade will have no impact on U.S. employment is simply wrong and should not be part of the debate.

In a recent post about tariff and trade, Pettis not only clarifies the issues, but demonstrates the timelessness of his 2013 book:

Tariffs may not be the best way to do it, but if that's what the US plans to use, their purpose should be to force surplus countries to take the necessary (even if painful) steps to rebalance domestic demand, i.e. to reverse beggar-thy-neighbor industrial policies.

Politics and public policy II

Graham, David A.. The Project: How Project 2025 Is Reshaping America, by David A. Graham ($)

In an effort to better understand the motivating forces behind the Trump administration, I am reading David Graham’s new book, The Project.

For starters, he describes the Project as originating with a “a small group of alumni” from the first Trump administration. Further, “Three-quarters of the authors and contributors worked in the first Trump administration, four of them—Vought, Ben Carson, Chris Miller, and John Ratcliffe—at the Cabinet level.” Graham describes Project 2025 as being “tightly integrated into Trumpworld”.

In addition, the ideology is radical, not conservative. The common belief was “Trump hadn’t failed, he’d been sabotaged.” The grander vision of this group was “that the only way to deliver the Christian, right-wing nation they desired was a carefully organized assault on the U.S. government as it existed.”

The radicalism of the movement runs even deeper though. The spirit is captured by the Flight 93 analogy: “charge the cockpit or you die. You may die anyway.” Graham writes, “This nihilistic view has found an audience in the growing number of voters who tell pollsters that they think the American system is so rotten they just want to burn it all down.”

Finally, just to make sure there aren’t any misunderstandings of what Project 2025 is about:

And [Kevin D] Roberts [president of Heritage] has framed both the stakes and his intentions for anyone who tries to get in the way even more starkly: “We are in the process of the second American Revolution, which will remain bloodless if the left allows it to be,” he said in a July 2024 interview.

In sum, the Project 2025 people are close to Trump, they are organized, and they really believe they need to burn it all down or they will die. No doubt, some voters believe this too. For everyone else, it’s important to not get distracted by daily Trumpian absurdities and to understand Project 2025 is a key driving force in this administration.

Politics and public policy III

While the people and ideology behind Project 2025 are revealing, so too are the policy positions.

First off, Graham writes, “Although Heritage boasts that its employees ‘always publicly advocate for a single, unified position’ on any issue, they make several exceptions [in regard to economics].” For example, the document includes “dueling essays”, one of which argues for protectionism and one of which argues for free trade. There is also “serious disagreement” in regard to dealing with the major tech companies.

This is interesting because, as Graham recognizes, “Trump won the 2024 election largely on economic issues.” And yet, economic issues are the one area where there is arguably the least cohesion, and therefore the greatest potential for disjointed and inconsistent policy.

In a more general sense, Project 2025 is about enforcing cultural homogeneity. Graham describes:

Project 2025 envisions an America where abortion is strictly illegal, sex is closely policed, public schools don’t exist, and justice is harsh, all in accordance with fundamentalist Christian principles that would form the explicit basis for policy.

And if that isn’t clear enough, Russell Vought spells out the goals of the group he founded after leaving the first Trump administration:

“The first priority ever of our organization is to regain a notion in this country, a consensus that we’re not a secular country, that we are a Christian nation as founded,” he said.

While these ideas may appeal to some Americans, in no way do they express an effort to unify or govern a large, diverse country. Perhaps this is why there is so little grass-roots support for the ideology: “When Heritage commissioned a poll in late July and early August 2024, it found that two-thirds of voters had heard of Project 2025, and only 14 percent supported it. Another 47 percent disapproved.”

This creates an interesting potential conflict. There is little public support for Project 2025 and yet it is bound and determined to storm ahead with its agenda. Stephen Miller’s response to Wednesday’s tariff ruling provides an ominous foreboding. He said, “The judicial coup is out of control.” That sounds like constitutional crisis is next up. Ouch.

Investment landscape I

Judging by market behavior this year, investors are 1) absolutely convinced public authorities will bail them out if anything bad happens and 2) ready and willing to trade on any daily announcement regarding tariffs or anything else.

This kind of complacency is understandable at least given the record since the GFC. Given recent political developments, however, it is considerably less so.

Regardless of what one thinks about Trump, the motivating ideas behind Project 2025 ought to cause at least some concern. After all, the beliefs that “the American system is so rotten that it should all be burned down” and that you need to “charge the cockpit (i.e., revolt) or you die” are not words of peace, stability, and strong stock returns.

Nor are those words emanating from just a couple of low-level firebrands. The very president of Heritage publicly called for a “second American Revolution” and added, chillingly, that the revolution would “remain bloodless if the left allows it to be”. This sounds more like the political foundation for civil war.

The way I am thinking about it is that Project 2025 is the operating system and the Trump administration is the buggy software on top of it. He’s the front man. Yes, the Trump administration has lots of flaws and gets almost all of the attention.

However, it is Project 2025 that manages the resources, provides common services, and dictates how things get done. Focus on that, and it’s easier to see through the daily distractions.

For certain, it is hard to tell how influential Project 2025 will be and how far the Trump administration will follow its direction. Nonetheless, it is a strong political force and one that appears to have no interest in stepping back quietly.

Investment landscape II

To date, much of the conjecture about Trump administration policies has been about their durability: Is he serious about making things like high tariffs stick — or is he just trying to negotiate a better outcome? As I noted last week, there is another alternative. All the flip-flopping is designed to buy time by creating confusion:

Unfortunately, based on the experience thus far, the Trump administration is not particularly interested in addressing the key problem [trade imbalances]. Rather, it seems to be engaged in systematic narrative shopping, periodically toggling from one story to another, in order to create a fog of uncertainty and ultimately to buy time.

Buy time for what? Well, to get the budget bill passed. Clearly, extending and expanding tax cuts is a high priority for the Trump administration (and Project 2025). Given the already-high fiscal deficit, it has been hard enough just to get the bill through the House, and there promises to be plenty of pushback in the Senate. In the meantime, any serious dip in the market would shine a bright spotlight on the fiscal irresponsibility of the bill.

This also explains the recent push behind the narrative of “running the economy hot”. In yet another case of narrative shopping, the story line started with paying for tax cuts with DOGE savings and tariff revenues. However, now that both of those initiatives have mainly failed, the story has evolved to it not being necessary to pay for tax cuts because the economy will set off on a higher growth trajectory and greater growth will pay for them.

Eventually, the bill will get passed. Once that huge priority is in the rear view mirror, there will no longer be the need to exert such great efforts to maintain a protective narrative. At that time, in my opinion, it will be easiest for the Trump administration to embrace the negative news flow and to blame it all on the Biden administration.

Implications

Investors have been assuming public policy will come in to support capital markets if ever they fall a tad too much. Certainly this was the pattern established in the GFC and the one that has continued since with only modest exceptions. More recently, it is the belief in the TACO (Trump Always Chickens Out, h/t Robert Armstrong at the FT) trade.

At the same time, the guiding light behind the Trump administration, Project 2025, continues to aggressively push ahead with its agenda. The letter and spirit of Project 2025 is to burn it all down. This driving desire does not rest harmoniously with robust capital markets and the dissonance reveals the fragile foundation upon which markets are perched.

In addition, there are a number of factors which work against the “run it hot” theme the White House is pushing now. For one, Trump likes tariffs. He’s not likely to give up quickly. For another, the Trump administration has already warned the public that a “detox period” is needed and has already sent out warnings about over-consumption. There is political utility in having a slowdown now when it can still plausibly be blamed on Biden.

To an important extent, the slowdown is already happening. As Bob Elliott posts, “the bottoms up view of companies, analysts, and economists all … remain quite pessimistic.” More specifically, “bottoms up analyst expectations of earnings in '25 and '26 continue to fall.”

Finally, by far the biggest financial/markets problem facing the Trump administration is the upcoming need to find buyers for boatloads of Treasuries. Typically, retirees are natural buyers of Treasuries, but Baby Boomers are hugely overweight stocks. What better way to shift preferences than to allow stocks to tank?

As a result, investors probably have some time to prepare for a downturn since it will take some time for the budget bill to be agreed upon and passed. After that, however, there will be few good reasons to add risk until better policies emerge, better prices appear, or both. It could be a while.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.