Observations by David Robertson, 6/2/23

Yay, the debt ceiling drama is almost over! OMG, what are we going to do when so much new debt gets issued? Tune in for the next episode of, “As the financial world turns …”

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

Tier1 Alpha pointed out on Tuesday that “Throughout this entire rally our models suggest NVDA has been under distribution, with more shares sold against the bid than the ask:”

What this suggests is “large lots are being sold (efficiently) and small lots are being acquired (inefficiently).” In short, it appears as if sophisticated institutions are adeptly selling shares to performance-chasing retail bag holders.

As such, NVDA is also likely to be a case of strong hands selling to weak hands. That means when the tide turns, it can turn hard and turn fast - there won’t be anyone to buy until much lower prices are hit. None of this is definitive, but it does suggest there is a lot less to the rally than meets the eye.

Economy

Discounters get discounted ($)

https://www.ft.com/content/0d8df4af-6965-4fb9-9c58-c8f949ee9ddb

The consumer continues to be under pressure. There are simply fewer dollars available to them, and those dollars are not going as far as they did a year or two ago. We are past the multiple rounds of government stimulus. Snap [food stamp] dollars have been reduced and tax refunds are running lower. These impacts, combined with persistent inflation, have more families prioritising needs over wants

The US consumer in aggregate remains a strong spender, and is absorbing price increases with little complaint. But as one looks across the discount spectrum — at the big box stores, warehouse clubs and dollar stores — it becomes increasingly clear that lower-income consumers are under pressure and are changing their spending habits meaningfully.

The first quote is Dollar Tree CEO Rick Dreiling discussing company results. The second is Robert Armstrong summarizing results across discount retailers. The picture, it is becoming increasingly clear, is lower income consumers are “under pressure and are changing their spending habits meaningfully”.

While consumers who still have excess savings to draw from are faring well, those who don’t are starting to suffer. As such, these experiences serve as a useful leading indicator for the rest of the economy. Continued inflation, and tighter credit are starting to bite.

The challenge facing lower-income consumers is also likely to be an important political topic. While wage increases during the pandemic helped, they haven’t happened fast enough or sustainably enough to prevent a lot of people from falling behind. Further, even though inflation has declined, it is still eating into pocketbooks and forcing a lot of people to trade down or go without.

Earlier in the year I discounted the chances of a deep recession on the basis public policy would cushion any blows if they were serious enough. I still believe that’s where the political tendencies are, but with the debt ceiling agreement capping a lot of spending, that thesis becomes more problematic. If current trends persist, it will be harder to avoid a fairly deep recession.

China

China’s state capitalists celebrate their soaring shares ($)

Across the board, China’s state-owned companies have enjoyed a renaissance—at the request of regulators. Stop focusing on profits, authorities have insisted. Instead, think about firms’ social contributions and their broader impact on the economy.

Now the firms should help investors understand their “intrinsic values”, Mr Yi has said. No method for doing this has been divulged, but investors speculate that these values include local employment and the hesitancy at many soes to lay off unproductive staff.

The concept called the “valuation system with Chinese characteristics” has parallels with ESG policy in the West. It embraces a more holistic view of business worth than simply profits or cash flows. As such, it too is an alternative to Milton Friedman’s claim that “The [only] Social Responsibility of Business Is to Increase Its Profits”.

As with many ideas, the pretense is valid, but it produces dubious manifestations. The fact that “intrinsic values” have not been defined suggests a fair amount of capriciousness could be involved in making such determinations. Further, the plan has all the earmarks of an authoritarian regime attempting to increase its ability to “guide investment flows”.

While it certainly cannot be claimed that governments in the West steadfastly avoid interference with business or capital markets, it does look like the heydays of entrepreneurial, capitalistic growth in China are over.

Michael Pettis has also written several posts about China recently and reveals a number of useful insights in them. In the first, he highlights declining employment, which could be a sign of flagging profitability:

“Since June last year, the average number of employees in major industrial companies has been declining year-on-year, with a sharp drop of 2.8% in the January-March period, suggesting that companies may be controlling costs by reducing their workforce."

In the second, he suggests the end is nigh for continued credit growth:

Although central authorities are still reluctant to discuss this very openly, 2023 seems to have become the year in which over a decade of unsustainable growth in provincial and municipal debt may have reached its limit.

In the third, he highlights the difficult policy tradeoffs:

Policymakers are increasingly having to choose between controlling debt and allowing near-term growth to decline to sustainable levels. Unfortunately I think it might take another 2-4 years before they are politically able to accept the latter.

In sum, as the post-Zero Covid landscape unfolds, the economic challenges and limitations of policy are coming into clearer focus. What is most clear is that economic growth in China is facing severe constraints. What is less clear is when those constraints will really start to bite. Regardless, a heroic rebound is increasingly looking like fantasy.

Technology

C.W. Howell posted a thread on a clever experiment he ran. Don’t tell students about the downsides of artificial intelligence; let them discover the shortfalls on their own:

So I followed @GaryMarcus's suggestion and had my undergrad class use ChatGPT for a critical assignment. I had them all generate an essay using a prompt I gave them, and then their job was to "grade" it--look for hallucinated info and critique its analysis.

*All 63* essays had hallucinated information. Fake quotes, fake sources, or real sources misunderstood and mischaracterized. Every single assignment. I was stunned--I figured the rate would be high, but not that high.

Their feedback largely focused on how shocked they were that it could mislead them. Probably 50% of them were unaware it could do this. All of them expressed fears and concerns about mental atrophy and the possibility for misinformation/fake news. One student was worried that their neural pathways formed from critical thinking would start to degrade or weaken. One other student opined that AI both knew more than us but is dumber than we are since it cannot think critically.

He reports many of the students went into the exercise with the impression ChatGPT “was always right”. As a result, they were surprised by the number of errors and lack of critical thinking.

On one hand I find C.W. Howell’s exercise a bit disappointing in that the majority of his students were so trusting of relatively unknown technology. While I am a huge believer in technology, I have been disappointed by too many exaggerated claims to have so much faith.

On the other hand, the students did the work and accepted the findings: the technology didn’t work as they had assumed. Hopefully, there are a lot more thoughtful teachers and open-minded students out there!

Geopolitics

This short Twitter thread by Michael Pettis succinctly summarizes his powerful thesis about global trade and the US dollar (USD):

Where I disagree with El-Erian slightly is on the value of maintaining and extending this international economic system. I think the accommodation of global imbalances in trade and capital creates exactly the kind of trading regime Keynes was so eager to avoid in 1944.

This is a trading regime in which implicitly mercantilist policies can be sustained by the long-term accumulation of US assets, and so they put the permanent downward pressure on global demand that Keynes warned about. It is this permanent downward pressure on demand that explains the surge in global debt needed to balance persistent trade surpluses. It also explains the migration of manufacturing from trade-deficit to trade-surplus economies. I don't think either is sustainable.

The world may be better off with a global, rules based system, but I think we need radical reform of the current trade and capital regime. Among other things this probably means shifting from a global system dominated by the dollar to one with no dominant currency.

I have referenced Pettis’ theory many times in the past but this is the clearest and most concise. Understand this and you understand the heart of the problem of global trade imbalances. As much as USD was an “exorbitant privilege” for many years, it has become more of an exorbitant burden. The way for the US to disentangle itself from unsustainable debt growth is to cede USD’s role as the dominant currency.

While that will take time and is almost certainly not on the short-term “to do” list, it is useful to appreciate what the longer-term goal might be. It is what makes me think gold is an incredibly important asset to own for long-term investors.

Gold

In Gold We Trust Report, May 24, 2023

https://ingoldwetrust.report/wp-content/uploads/2023/05/In-Gold-We-Trust-report-2023-english.pdf

First off, the “In Gold We Trust Report” which comes out in May every year is a must-read for anyone interested in gold. Yes, it’s 417 pages long, but it’s also free - and you don’t have to read the whole thing to get a lot out of it. It’s a great resource.

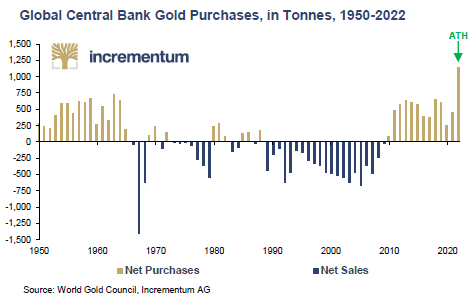

One of the big changes in the gold market, as illustrated in the chart, is the rapidly increasing purchases of gold by central banks. One of the ways to read this is as a continued countertrend to the indifference of central banks to gold during the late- 1960s to GFC era. Another way to read it is as a step-function increase over the post-GFC levels.

Ronnie Stoferle and Russell Napier addressed the issue on a recent podcast ($). In the context of the de-dollarization discussion, there was acknowledgement of a greater willingness to transact in renminbi. The question, however, is the vehicle in which transaction values should be stored. Since renminbi suffers severe constraints as a store of value, it was hypothesized that gold may be taking that role. In short, trade in renminbi, save in gold (rather than renminbi reserves).

Since each of China and Russia and the Middle East run surpluses with the rest of the world, however, this scenario is not likely to move the needle much. If, however, these countries saved their surpluses in gold rather than US dollar denominated assets like stocks and bonds, that would make a difference. Regardless, there are good reasons central banks may want to stock up on gold and that makes this an important trend to monitor.

Monetary policy

With the House and Senate both voting the debt ceiling bill through this week, its passage is virtually ensured. As a result, investors and traders can move on to the next phase of analysis - determining how much and what kind of debt will be issued to fill the cracks and maintain the deficit spending.

I continue to believe large debt issuance, especially combined with ongoing Quantitative Tightening (QT), will put pressure on both bonds (higher yields/lower prices) and stocks. That said, the timing and magnitude depend on how the Treasury decides to implement the new issuance. Below is one trader’s perspective from Paulo Macro on Twitter:

Remember my views on the TGA: Yellen just needs a few bill auctions to bridge to June 15th, and given where bill yields are, she can attract a bit of RRP balances without disrupting market liquidity (RRP is really just a form of sequestered bank reserves).

And then she can slow walk TGA to August, which means liquidity can positively surprise expectations. Which also allows the bond long to work because the only reason this short is out there is specs are frontrunning/“making room” for expected issuance like a giant follow-on.

There are two things I really like about this analysis. The first is the nonconsensus view about rates. I have been saying for some time I think longer-term rates will go up once Treasury can start issuing debt again because there will be so much debt coming to market. I still believe that, but as Paulo highlights, there is a timing issue which could trip up traders.

The second point is that traders see markets through a different lens than long-term investors - and that can be helpful to be aware of. In this case, the speculative short positioning in long rates could backfire after the debt ceiling is lifted, which would actually send rates lower in the short-term. We’ll have to wait and see, but it is certainly true that trader positioning can distort the shorter-term path to a longer-term fundamental situation.

Landscape

With the debt ceiling interlude mostly over now, we can also resume regularly scheduled programming of “Volcker II Strikes Back”. In other words, we can get back to obsessing over whether the Fed will raise rates again, how long the Fed will keep rates up, and under what conditions will the Fed cave in and eventually lower rates.

I continue to believe the major policy response is more likely to come in fiscal spending form than in monetary easing form. While the Fed will almost certainly need to calibrate policy so as to maintain financial stability (e.g., provide emergency facilities to banks), it will also be severely constrained by its effort to reduce excess liquidity and regain control over money supply.

That means relief will most likely come in the form of fiscal spending. Of course, progressively greater deficit spending is no way to lower debt/GDP so there is only limited shelf life for this approach. Once that runs out, I expect an “oh s***t” moment when it becomes clear there is no way out but default through financial repression. This is the landscape Russell Clark describes below …

THE PARADOX OF US TREASURIES AS A RISK FREE ASSET

https://www.russell-clark.com/p/the-paradox-of-us-treasuries-as-a

In the UK and the US, public wealth is now negative. That is the combination of privatisation and then government spending has led the net assets of government to be negative. This seems to be the obvious end game for pro-capital policies. The question then, what is the basis for government bonds being risk free assets?

While I believe Russell Clark’s analysis above is somewhat overstated (there are lots of off-balance sheet assets as well), the broad point holds true: The characterization of US Treasuries as risk-free is increasingly tenuous. There are only two ways out, increasing taxes or cutting spending. Both are politically verboten.

He provides a clue to the way forward with the caveat, “absent some crisis that causes a sea change in domestic politics”. I think this is mostly right and points to some kind of “crisis”. Certainly there is a foundation for a crisis playbook in the form of pandemic stimulus checks and Fed emergency lending programs.

Implications

So, one important thing for long-term investors to keep in mind is there is not a nice, incremental way for things to continue mainly as they are. That means be alert for major change.

In addition, the magnitude of force required to overcome inertia and drive major change in policy is not possible politically without overwhelmingly compelling evidence, i.e., a crisis, or perhaps a rolling series of crises. A potential crisis might be a really deep recession. It may be a commodity price shock. It could be a credit shock. It could be a war. It could be any combination of these. The main point is it will be extremely disruptive and liquidity will be key.

Another implication is timing will be extremely difficult, but extremely important. Going into the teeth of a recession and credit downturn, commodity and industrial companies are unlikely to fare well. Even as longer-term prospects are good, there will be precious few buyers of such stocks with short-term headwinds.

That means investors will have to line up their prospects now, monitor the landscape carefully, and be prepared to pull the trigger fairly quickly as the crisis gets deep enough to prompt a policy response. Not easy, but that’s the gig.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.