Observations by David Robertson, 6/24/22

After a wild and crazy week the prior week, it was nice to have a holiday on Monday to digest and regroup. That allowed everyone to be prepared for the wild and crazy week this week. Let me know if you have questions or comments at drobertson@areteam.com.

Market observations

Stocks exploded higher to start the trading week on Tuesday. All the normal signs of exuberance were evident, most notably cryptocurrencies and speculative stocks were the strongest gainers. Apparently, surviving the near-death experience of margin calls and liquidations in crypto-land over the weekend was so exhilarating it spawned a new energy for buying.

One of the drivers seemed to be a manifestation of “buy the dip”. In a desperate effort to find a “deal”, many buyers interpret lower prices as a sufficient signal to jump back in. Of course, another possible explanation for the rise in stocks is many large institutional portfolios are beginning to rebalance prior to the end of the quarter. Either way, it wasn’t fundamentals driving prices higher.

Another important and related phenomenon the last couple weeks has been the rapid decline in 10-year yields. From a recent high of 3.48% on June 14, the yield has dropped over 40 bps since to just a touch above 3%. While there is a very good chance this is just some short-term retracement, the 10-year rate is an important signal for markets and the economy.

Eurozone

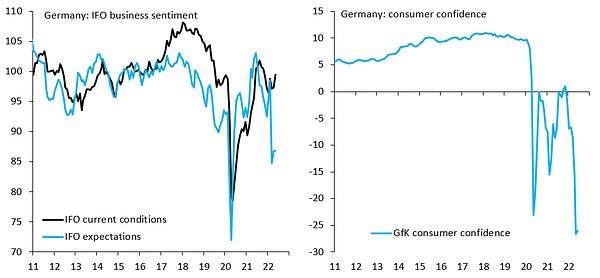

While we are not there yet, there is certainly no shortage of comments about the slowing economy in the US. Now Germany, the anchor of the Eurozone economy, is starting to get attention too. This shouldn’t be too surprising given the importance of Russian energy for many German industries and the attendant increases in producer prices. Add in the fact that China’s economy is struggling amid Covid lockdowns and a massive real estate restructuring and global recession seems like a reasonable forecast.

Oil

I have written about oil a number of times in regard to my ambivalence (positive long-term, cautious short-term) and to oil’s inherent volatility (like virtually all commodities). Recent market activity has validated both positions. Crude is down almost 17% from its recent high in mid-June and fell almost 7% on Wednesday alone.

@MrBlonde_macro provides some interesting perspective on the matter with the tweet thread above. As can be seen from the chart, oil has a history of staying too long at the party and crashing afterwards. As a result, there is good reason to be concerned the same thing may be happening this time.

Another point is that part of oil’s behavior seems to be related to momentum. This seems fair. Oil has been moving more with speculative stocks and crypto this year than with other major indicators. Indeed, this was one of the main reasons I ended up passing on adding some oil exposure last fall. If the selloff continues and oil catches down to copper, it could be a good time to restart the effort to add some exposure.

Banks, finance, crypto, and beyond

Banks are still not your friends ($)

https://www.ft.com/content/ad53c76c-b6f7-4394-9a47-027138449297

They [banks] provide month-to-month liquidity to consumers through credit cards at rates that remain high no matter what the Fed does. They make transfers needlessly difficult and expensive. They charge by the month to manage small-dollar deposits, and can’t quit the destructive habit of imposing huge fees on minor overdrafts. Something does need to fix banks. It’s just that crypto assets, crypto liabilities and crypto culture don’t seem to have been up to the task.

To be a better banker, unfortunately, you don’t need to be more innovative. You have to want to do good.

In one short article, Brendan Greeley makes the use case for an alternative to banks and at the same time, the non-use case for most of the existing crypto universe. It is true that banks do not do a good job of providing many basic financial functions and this creates problems for large swaths of society.

Unfortunately, much of the crypto universe has used “different” to justify its competitive position relative to banks when it should have used “better”. One point, then, is hopefully the crypto world can use the recent fallout as a teaching moment and recalibrate its offerings to be more competitive with banks. There are plenty of bank and non-bank customers who would love to see it happen.

Another point that Greeley highlights, that is even more broadly applicable, is that intent is hugely relevant to customer outcomes. As he puts it: “A bank can be your friend. But it’s not an innovation. It’s a choice.”

I see the same thing with investment advisors, money managers, and all kinds of financial “professionals”. Many, if not most, of them can be your friend and help you achieve better outcomes. Many, if not most, instead prefer to extract excessive fees at your expense. It’s a choice. I don’t see how things will change much until consumers start pushing back much harder on bad actors though. Perhaps the fallout in crypto is a start.

Politics

Anarchy is a likelier future for the west than tyranny ($)

https://www.ft.com/content/38dfc217-742e-4d7e-b926-0fdc937f9be4

Worrying about strongmen will continue to make sense as long as Donald Trump ponders a comeback. But the larger trend of events is towards fragmentation and chaos.

The pioneer is, as ever, the US. In a nation that is not just split but checkmated, neither Democrats nor Republicans can build a lasting electoral hegemony of the kind that allowed the New Deal, the Reagan revolution and other necessary reforms in the last century.

Janan Ganesh makes a number of points that merit consideration in regard to the political environment. The first is that political extremism in the US is making the country nearly ungovernable in important respects. This is a theme Peter Zeihan also picked up on in his newest book:

Another excellent point is the obsession with autocracy by the political left overlooks a very different, but very real threat - that of no substantial governing authority at all:

The great dictators of the 20th century have such a hold on western thought as to numb it to other kinds of civilisational danger. If minds as fine as Philip Roth’s and Aldous Huxley’s assumed that a bleak future must be a totalitarian one, it is understandable that my lesser profession commits the same error. But not quite forgivable. True vigilance is the fear of under-government as much as of sinister government.

This is a fair assessment. While it would be unpleasant for much of the population to live under an autocrat with very different values, so too would it be unpleasant to live in a society in which much of the order we enjoy and rely on erodes over time. There is certainly plenty of room for active debate about what the best type of government should be. Lest we forget, however, Thomas Hobbes provided a bleak characterization of life without government at all:

Whatsoever therefore is consequent to a time of war, where every man is enemy to every man, the same consequent to the time wherein men live without other security than what their own strength and their own invention shall furnish them withal. In such condition there is no place for industry... no knowledge of the face of the earth; no account of time; no arts; no letters; no society; and which is worst of all, continual fear, and danger of violent death; and the life of man, solitary, poor, nasty, brutish, and short.

Monetary policy

Gradually Worse

https://www.mauldineconomics.com/frontlinethoughts/gradually-worse

And yet, despite their antipathy to inflation and the powerful weapons they could wield against it, central bankers have failed so utterly in this mission in recent years. In this paradox lies the anguish of central banking.

My conclusion that it is illusory to expect central banks to put an end to the inflation that now afflicts the industrial democracies does not mean that central banks are incapable of stabilizing actions; it simply means that their practical capacity for curbing an inflation that is continually driven by political forces is very limited…

Economic life is subject to all sorts of surprises and disturbances—business recessions, labor unrest, foreign troubles, monopolistic shocks, elections, and governmental upsets. One or another such development, especially a business recession, could readily overwhelm and topple a gradualist timetable for curbing inflation. That has happened in the past and it may happen again.

These comments by Arthur Burns, the Federal Reserve chair from 1970‒1978, are tinged with philosophical reflection - which may not be too surprising from the person who oversaw one of the worst bouts of inflation in the country’s history. As such, however, the comments are also quite instructive.

Mostly Burns’ reflections focus on differences between the tools at the Fed’s disposal and the Fed’s practical ability to deploy them effectively. One topic is that of gradualism. Given the policy goal of price stability, it is not surprising the Fed would naturally gravitate to policies that move slowly but surely. That tendency, however, sits uncomfortably with the frequent reality of unplanned events and the need to adapt quickly.

Another topic is the political context in which the Fed operates. While ostensibly an independent institution, the Fed and its governors, nonetheless, are also affected by broader political forces. In other words, even if the Fed is completely independent, monetary policy cannot be in any practical sense.

Finally, there are challenges truly outside the Fed’s control such as the war in Ukraine and hobbled supply chains. Powell has starting fessing up to these limitations, but only under duress; he had preferred to project an image of omnipotence. What all this means for investors is that unlike during swoons of the past twenty-plus years, now you are on your own. The reality is the Fed just can’t do much to help you, even if it wanted to.

Asset allocation

X-Rated Recession Risks Can't Be Covered Up ($)

A paper by DE Shaw Investment Management LLC shows that the overall correlation between bonds and stocks has not risen so much over the last decade — but the bond market’s influence over which stocks fall and rise has become profound.

What's notable is that starting in about 2011 or 2012, the differences [interest rate sensitivities] became much wider. Overall correlations between stocks and bonds didn’t shift that much, but equities became far more rate-sensitive in one direction or another:

This piece by John Authers provides some nice nuance to the issue of stock and bond correlations. The headline phenomenon is that after a forty year period of inverse correlation between stocks and bonds, higher inflation is changing those correlations.

The nuance, however, is the change is not happening uniformly. Some indexes like the Nasdaq-100 have become extremely sensitive to rates. On the other hand, indexes like the Russell 2000 have actually become more negatively correlated. The bottom line is the level of diversification of a stock and bond portfolio depends significantly on the composition of stocks.

Investment landscape

We Knew QT Would Be Devastating, But You Ain’t Seen Nothing Yet ($)

https://liquiditytrader.com/index.php/category/monetary/

The Treasury supply line will begin rising in July. But the Fed POMO line will stay flat. That means that the performance of the stock and bond markets should actually get worse. That’s right, worse than they’ve already been.

As someone who founded their investment career on fundamental research and quantitative modeling, I have always been curious to learn about other factors that affect security prices. After the GFC, and after valuations became absurdly detached from fundamental reality, it became increasingly clear to me that central bank liquidity was not only such a “factor”, but increasingly “the” factor.

While I am always reluctant to oversimplify things (because the world is a complex place), in the current landscape nothing matters more to stocks (or bonds) than the Fed’s liquidity. And that liquidity is going away.

Lee Adler makes the point as clearly as possible. Due to Quantitative Tightening (QT), the performance of stocks and bonds is going to get worse. In this particular case, it really doesn’t make sense to over-complicate things.

Private Equity: Still Overrated and Overvalued?

https://verdadcap.com/archive/private-equity-still-overrated-and-overvalued

Valuations in 2021 for private equity deals were 10% higher than the S&P 500 and about double where valuations were in 2010! This has been a significant tailwind for the asset class. Leverage levels have increased proportionately, with debt levels reaching an all-time high.

The conclusion they came to was that, if high multiples were the price of entry, then the industry needed to shift focus from traditional industrial and cyclical sectors into high-growth sectors like tech and healthcare. Buyouts shifted toward growth equity, with software and healthcare going from 15% of transaction value in 2007 to ~40% of transaction value in 2021 according to Pitchbook, numbers that probably understate the shift.

This analysis of private equity by Dan Rasmussen (h/t Izabella Kaminska at the Blindspot) shines an important light on markets in general over the last few years. As stretched as private equity was four years ago, Rasmussen sought to understand why it continued to perform so well.

The answer is partly one of mix as the business base shifted materially from industrial companies to a much greater proportion of tech companies. Another part of the answer is that risk increased - both in the form of higher purchase multiples and higher leverage used.

Rasmussen concludes that the good times for private equity are probably over: “future returns look materially worse and future risks materially higher than when I wrote my original article in 2018”. I agree with the assessment. I also believe the same largely applies to the broader stock market: “future returns look materially worse and future risks materially higher”.

Implications for investment strategy

The Fed doesn't really have the tools to stop the inflation. That doesn't mean it can't do anything. It will do what it can and maybe it will work. We probably won't know this year. They can raise rates a few times and run down the balance sheet a bit, but next year the rubber will likely meet the road. As rates cross three or maybe four percent either the inflation will come down or the Fed will have to recognize it's out of bullets and capitulate to the inflation. It simply can't do much more because it must undoubtedly ensure that the Treasury can fund itself. When the Fed has to choose between fighting the inflation and supporting the Treasury, I think it has to pick the Treasury. Some are criticizing the Fed for tightening into a downturn, just wait until forced to loosen into an inflationary spike to support the Treasury. At that point, it's best to have some gold.

It is really easy to get overwhelmed by so many news items and crosscurrents as to lose sight of the bigger goal. This excerpt from David Einhorn very succinctly focuses on the key points for investors to monitor.

For one, since inflation is clearly a priority for the Fed, there are going to be strong headwinds for inflation hedges for some period of time. The Fed will continue raising rates and progressing with QT which will continue to reduce demand.

However, and it is a big however, the Fed does not have unlimited capacity to continue tightening. At some point higher rates will make the debt load overly burdensome and the Fed will most likely pull back. If that pullback happens before inflation is tamed, and there is a good chance it will be, then it will be a whole new world for inflation.

The key for long-term investors is to recognize this setup and to prepare to take advantage of the opportunity. For some period of time, inflation beneficiaries are likely to get cheaper, even as they are likely to prove quite valuable longer-term. This will provide a good chance to bulk up on investments that benefit from inflation.

Just for fun

Thanks for reading!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.