Observations by David Robertson, 6/3/22

Newsflow slowed during the holiday-shortened week as traders and investors shifted into a slower summer pace. Or, perhaps, things just slowed down from the almost ridiculously frenetic pace that kicked off at the beginning of the new year. Regardless, let me know if you have questions or comments at drobertson@areteam.com.

Market observations

The chart below from themarketear.com ($) shows liquidity is currently plumbing the depths realized during the selloff in March 2020. There are two important practical implications of this. One is that relatively small trade volumes can move prices significantly. As a result, big price moves often have little information content.

In addition, because prices are so sensitive, it is virtually impossible for very large portfolios to make big changes without significantly moving the market. The result is they usually hold off - at least until they can’t. This creates conditions for forced selling when large positions must be liquidated to meet margin calls or for other reasons.

China

Another great tweet thread by Michael Pettis on China. Many investors are focusing too narrowly on individual signals to characterize the investment environment in China. It is too big and too complicated for that. Pettis provides useful perspective by outlining the big picture. In short, expect “much slower growth”.

Monetary policy

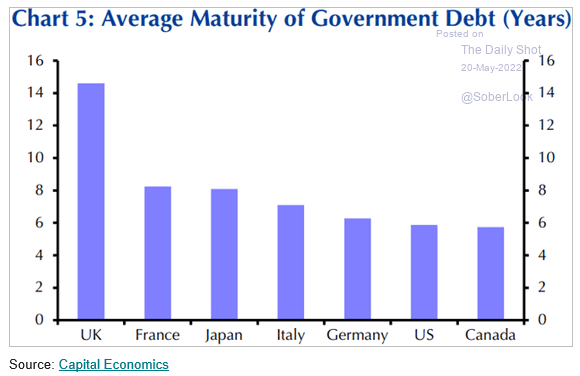

An important way in which to judge the risk of excessive debt is by the maturity profile of that debt. Longer maturities provide time to resolve problems before they become serious threats to solvency.

On this note, the maturity profile of government debt in advanced economies is relatively short-term. This presents a potential problem: If interest rates remain elevated over the coming six years, most government debt will have to be funded at much higher levels.

Since much higher interest rates would mean much higher interest costs, the budget deficits of these countries would explode and have to be funded somehow. As a result, it is fair to infer that higher rates in the US are being used as a tactical measure within a broader strategic need to keep rates fairly low.

In short, the Fed must raise rates to combat inflation, but cannot keep rates very high for very long. If inflation turns out to have staying power, and there are good indications it does, the Fed will face the incredibly difficult choice of either lowering rates to prevent a budget mess or continuing to fight the inflation battle with higher rates that eventually blow up the budget. Either way, over a longer-term horizon inflation will be higher for longer.

More immediately, the Fed’s quantitative tightening (QT) program will begin soon. The announced start of the program was June 1, but actual tightening won’t start until the next batch of Treasuries mature on June 15th. Regardless, all eyes are on the bond market.

The first point is this program will directly take money out of the financial system and therefore it almost mathematically implies lower asset prices. This is a point Lee Adler has repeatedly made in his excellent Liquidity Trader ($) newsletter. Without the Fed’s support, investors will need to buy newly issued Treasuries and mortgage back securities (MBS) themselves. In order to do so, however, they will need to sell something else. That something else can be a lot of things but almost certainly will include stocks. Here we go.

Inflation

Peak inflation (we hope) ($)

https://www.ft.com/content/1854f495-1138-42f5-aa57-3ec52d782bbd

The big news was the personal consumption expenditures price index, which the Fed prefers to the CPI inflation measure, as it covers more prices and adopts more quickly to changes in consumption patterns. On Friday the April number came in at 6.3 per cent, a decline from March. The core number (excluding food and energy) was down for the second month in a row:

Over the shorter-term, however, there are signs that inflation is peaking. The price index for personal consumption expenditures (PCE, and a favorite metric of the Fed) turned down and evidence of accumulating inventories suggests prices of some goods will need to be cut to clear the excess. Further, year-over-year comparisons start getting tougher later in the summer.

As a result, short-term trends are likely to present some appearance that the inflation “scare” is over. This could provide an interesting opportunity for longer-term investors to beef up on inflation protection at attractive prices.

Investment analysis

This piece by Alf Peccatiello highlights some excellent points about managing money at a really important time. While the last thirteen years have been unbelievably amenable to risk-taking, they have also been an enormous anomaly relative to history. The bottom line is risk management is crucial to long-term success in any investment endeavor. This matters just as much for do-it-yourselfers (DIYs) and individuals who use an advisor as it does for professional money managers.

People who use advisors have often had a fraught relationship with them because the notion of “risk” that people have intuitively does not map easily to the notion of “risk” that most advisors use in their quantitative models. As a result, investor clients often do not fully appreciate the level of risk their advisor is exposing them to until something goes wrong.

DIYs suffer a similar but slightly different challenge with risk. DIYs often build up confidence and conviction by investing in an environment that suits their natural tendencies. The problem is when the environment changes, many of their vulnerabilities also get exposed. This is the same difference between amateurs and pros in general. Many amateurs are outstanding along one or two dimensions but not the entire gamut of skillsets required to go pro.

One of the biggest risks for any portfolio is that correlations among holdings either converge, or are already very similar, and this shortcoming eventually results in a big drawdown. Big drawdowns can be ruinous for any number of reasons, not least of which is because they can induce selling at inopportune times either through sheer panic or by contract when margin calls are issued.

Monitoring the environment for changes in correlations is one area where professionals, or at least students of financial market history, often have an advantage. Such students are better equipped to identify turning points based upon historically useful signals while other investors are often inclined to continue chasing performance. Even many advisors and asset allocators use historical averages with regard to correlations rather than adapting to real-time conditions.

The current change in regime from a disinflationary landscape to an inflationary one presents an important analytical challenge. First, active monitoring is required to be able to appropriately identify and characterize changes in investment regimes like this one. Second, and relatedly, correlations are often stable over fairly long periods of time, but they do change. It is not helpful to assume they remain static.

Finally, as with most analysis, it helps to have a strong knowledge of history to serve as guide to future possibilities. It also helps, however, to be open to brand new possibilities.

Risk management II

Start-up diary: 9½ weeks later ($)

https://the-blindspot.com/start-up-diary-9%c2%bd-weeks-later/

It turns out a lot of us have the ability to live, breathe and talk finance every day and still be utterly ignorant of the real issues at hand – because we don’t appreciate the difference between theory and practice. This is how cushioned and protected we are from it all in our steady salaried jobs and support networks.

But I see now that taking risk directly or living through some sort of business development experience (outside of a pre-existing corporate structure) is essential to developing a proper understanding of business, finance and the broader economy.

Unless you are living it, chances are you will be oblivious to the pressures, conflicts and – most important of all – the compromises one is often pressed to make as an entrepreneur or corporate leader.

I’m including these passages from Izabella Kaminska partly because they reflect my own experiences and sentiments so well and partly because they reflect an under-appreciated aspect of the entrepreneurial endeavor: It is an amazing way to learn.

The stylized view of entrepreneurship is a pathway to money and fame - and it can certainly be that. However, the broader reality, regardless of the degree of success one achieves, is that it imposes a need to learn a lot about how almost every aspect of business really works. The reason is that consequences matter more. If you are wrong, you lose your capital and/or your employment security. There aren’t a lot of gimmes.

As a result, when something goes wrong, you have a strong motivation to figure out why - or it might cost you again in the future. Conversely, when something goes wrong in a large organization, it is easy to pass the causes off to someone or something else or to write it off as an exception.

In addition, running a business is an amalgam of countless decisions and tradeoffs. There are exceptionally few absolute rights and wrongs. The best answer depends on unique environments, customers, services, capital, etc - and these keep on changing.

This creates a set of incentives that are excellent for learning. Further, just as running a business is a great way to learn about an industry, so too is actively managing investments a great way to learn about investing. When accountability is high, risk management matters. Conversely, when rewards are disproportionately high, it is a lot easier to do the necessary work.

As I have learned and grown since starting Areté thirteen years ago, one of the things I have noticed is how much more clearly I can identify people with an entrepreneurial mindset. Some people have it and are naturally able to hustle and scrap and figure things out. Others don’t. Whenever I see someone who absolutely refuses to budge on an issue or to listen and consider a different point of view, I see someone who has never had responsibility for running a business. Refusing to compromise on operational tradeoffs is an entitlement that few businesses can afford.

Investment landscape

Cryptocurrencies have fallen out of the headlines but there sure is a lot of churning going on under the surface. First things first. Sam Bankman-Fried (aka SBF), one of the most prominent names in crypto, is trying to downplay the wrongdoing regarding Luna by claiming everyone knew it was a Ponzi scheme.

If everyone knew this, then there would be no viable business model for it and he would have never listed it on his exchange, FTX. His response is disingenuous at best and as such, provides a pretty clear reflection of his character. He is not out to “democratize” finance or promote any other ostensibly virtuous goal; he is out to extract money from people who don’t know any better. Indeed, this is a pretty good characterization of many of the crypto pioneers.

A significant restructuring and reordering of the crypto universe is underway and is likely to be existential for large swaths of the industry. As the WSJ reports, litigation ranges from digital coins being “sold under false pretenses” to “pump-and-dump schemes involving celebrity promoters” to “unregistered securities” to “deceitful marketing”.

This will create two conditions relevant for traditional investors. One is the significant price declines in many cryptocurrencies is likely to spill over into stocks as margin calls force sales.

Another is that a serious retrenchment of the industry will force crypto innovation to focus much more on developments that can both disrupt inefficient corners of traditional finance AND emerge into viable business models. This could be just the kind of discipline required to make real progress.

Private equity cannot avoid the reckoning in markets ($)

https://www.ft.com/content/109a8d88-2c56-4cc0-bd90-1d3a9dff2966

Such optimism about the robustness of the asset class may, however, be excessive. Private equity valuations are updated much less regularly than for public investments. Indeed, historically, revaluations have tended to lag behind public markets by a minimum of six to nine months. Moreover, several of the factors that have recently undermined the public markets are also worrisome for private equity.

Another important element of the investment landscape is private equity which has vastly increased its profile. Low growth and low rates provided an environment extremely conducive to private equity, but now that inflation has taken hold and rates are increasing it presents two major risks to investors.

The first is that low rates facilitated high leverage. Higher rates will increase borrowing costs and slowing growth will make it even harder to cover costs with cash flow. The second is that private equity is highly correlated with public equity. Private equity can pull some strings with creative accounting and delayed revaluations, but it cannot do so forever. As a result, there is likely to be a fair amount of carnage in this space as well.

Recently, I realized that there was something else just as interesting [about the 1929-1932 Bear Market] and added new annotations to the chart. If we assume that a decline of over -20% is a bear market, and an advance of over +20% is a bull market, it is shocking how to realize how confusing that period must have been for investors. The decline from the 1929 top to the 1932 bottom was a secular bear market, but also within that period there were six cyclical bear markets and five cyclical bull markets. Eleven reversals in 32 months!

Finally, the investment landscape is always comprised of a balance of bullish and bearish forces. Even though a fairly clear direction may be evident, sentiment and incentives are rarely uniform.

This little piece by Rudy Havenstein reveals an important insight of how the interaction of these forces can manifest. If the question is, “How does a market go down almost 90% over three years?” an important historical example indicates, “By reversing eleven times in 32 months.”

In other words, while crashes are dramatic, major declines happen when optimism repeatedly fails to die. Certain investors periodically attempt to recapture the good old days but fail time and again. The market finally turns around when exuberance is dead and valuations are attractive enough to lure less optimistic investors into the fray.

After the big burst in stocks before Memorial Day weekend and the strong finish yesterday, it is useful to consider the 1929-1932 paradigm as a guide. Doing so implies multiple short-term trading opportunities (on both sides), but a very significant downside over a multi-year period.

Implications for investment strategy

With so many vectors of risk emerging as tangible threats to asset values, the overarching investment goal right now is to stay safe. There are certainly opportunities to play around on margin, but the bulk of investment portfolios should be anchored on the lower end of the risk scale. On that front, I consider the downside risk of stocks to be considerably greater than the threat of inflation right now.

As the environment gradually migrates from one of disinflation to one of persistent inflation, there will be lots of ups and downs along the way. There will also be a lot of other noise which will add confusion. Through the process, the best strategy for long-term investors is to stay focused on the longer-term horizon and use intervening market moves tactically to continue to improve positioning, especially in regard to stocks and uncorrelated assets.

Thanks for reading!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.