Observations by David Robertson, 7/8/22

Anyone who thought market theatrics may be calming down after a newsworthy first half would have been sadly disappointed by the first week of July. It looks like volatility is going to be more the norm than the exception so best to set that as the baseline expectation. As always, let me know if you have questions or comments at drobertson@areteam.com.

Market observations

One of the most visible changes in the last couple of weeks has been the decline in longer-term Treasury rates. After a strong upswing since the beginning of the year, the the 10-year rate broke cleanly below 3%. Much of this is related to the emergin narrative of imminent recession. After the FOMC minutes were released on Wednesday, however, it became clear that inflation is still job number one for the Fed and rates moved back up.

Another important observation is the strength of the US dollar. As the energy crisis wears on, Europe looks more and more vulnerable. By comparison, the US looks much stronger. Unfortunately, a stronger dollar also tightens financial conditions for much of the rest of the world and will be a factor on earnings calls with multinational companies.

Finally, there has been a fair amount of talk about a bear market rally. While such rallies are not uncommon, they aren’t the kind of thing that should interest long-term investors. Further, while Thursday’s performance was strong, it was led by the likes of MSTR, COIN, AMC, and GME - all veterans of my “Exuberance” watch list. In short, there is still ample appetite for speculation. Until this sentiment dissipates, markets are likely to remain extremely volatile.

Commodities

It’s not just longer-term rates that have come down with growth expectations, but also the price of a wide array of commodities. Copper and wheat are both important commodities that are indicative of the broader trend. After strong performances since the Covid trough, both have fallen sharply since the start of the second quarter.

Some of the decline is surely due to the aggressive tightening action by the Fed, but the fact that wheat is below its level at the time of Russia’s invasion of Ukraine seems strikingly dissonant with supply conditions.

In addition, oil got whacked especially hard on Tuesday but as Rory Johnston writes, it wasn’t due to any particular news item: “Who knows [what triggered the selloff]—and quite frankly, it really doesn’t matter. Ultimately, something started the selling and, from the looks of the ferocity of the resulting selloff, it triggered speculative participants (or their algorithms) to abandon their positions en masse.”

He goes on to conclude, “yesterday’s [Tuesday’s] price collapse had all the telltale signs of a positioning flush and much of the rest of the market appears firm.” In other words, there doesn’t appear to be any fundamental cause of the selloff. So, one takeaway is the longer-term case for higher oil prices remains intact. Another takeaway is to be careful - there is plenty of volatility in them thar commodities markets.

Geopolitics

The End of the World is Just the Beginning by Peter Zeihan (@PeterZeihan)

Back-of-the-envelope math using data from throughout the past quarter millennia suggests that reducing transport costs by 1 percent results in an increase of trade volumes by about 5 percent. One doesn’t need to run that in reverse for long before the trade-empowered modern world fades into a treasured memory.

Bottom line: the world we know is eminently fragile. And that’s when it is working to design. Today’s economic landscape isn’t so much dependent upon as it is eminently addicted to American strategic and tactical overwatch. Remove the Americans, and long-haul shipping degrades from being the norm to being the exception. Remove mass consumption due to demographic collapses and the entire economic argument for mass integration collapses. One way or another, our “normal” is going to end, and end soon.

This passage captures much of Zeihan’s argument for expected changes to the world order. In short, globalization and all its myriad benefits manifested due to the “overwatch” of the US military that facilitated safe transport of goods worldwide. As the US becomes significantly more selective in providing such protection, the cost of global transport is going to go up significantly. In doing so, it will very fundamentally shake up supply chains and business organizations.

This may seem like so much high level pontificating, but Zeihan makes a compelling case. Further, in walking through the implications, it is pretty clear almost everything is going to be harder than it was and is going to cost more. That’s the bad news. The good news is the US should weather the changes better than almost anywhere else.

Public policy

The tweet above from the President has been getting a lot of play - mainly as a target of criticism for bad public policy and/or frightening lack of understanding (or both). In regard to the latter, it is clear from the graphic by @SoberLook that Distribution and Marketing account for by far the smallest slice of the cost of gallon of gasoline. As such, it is silly to target gas stations in any kind of practical effort to lower gas prices.

As such, the suggestion (and gas stations is just one of many suggestions) begs the question - why talk about something that would be so transparently ineffective? The only answers I can come up with are the administration either feels powerless to do anything substantive about energy shortages, or it actually wants them to happen.

In the first case, the administration may simply be recognizing the futility of any major public policy in such a polarized and fraught political environment. It would be hard to blame them. As such, it is important to appear to be “trying” to do something for the sake of appearances, but little point in exerting serious effort.

In the second case, it is possible to imagine a bloc of progressives arguing for even more constraints on oil and gas supply in order to lower carbon emissions and improve the competitive environment for green technologies. In this case, the targeting of gas stations could actually be good news. It provides a token message to keep progressives at bay while shielding the oil industry from more harmful attacks.

An important observation here is that none of this is about actual problem solving; it is mainly political calculus. One point is that as frustrating as it is to watch a slow-motion train wreck in the US in regard to energy (and other major policy areas), the situation is far, far worse in Europe. That said, consumers and businesses in the US would do well to prepare for a regime of higher prices and less reliable availability.

Another point is that as this very real breakdown in energy infrastructure becomes more apparent, it is also going to become more apparent that green technology is not the answer to all problems. Some people are getting there …

Alternative energy

Chasing Utopian Energy: How I Wasted 20 Years of My Life

Utopian energy is an imagined form of energy that’s abundant, reliable, inexpensive, and also clean, renewable, and life-sustaining. But utopian energy is as much a fantasy as a utopian society. Seeking the fount of perfect energy allows us to pretend there aren’t real-world tradeoffs between, say, banning fossil fuels and helping people in impoverished nations or between using solar and wind power and conserving natural habitats.

If we’re serious about tackling climate change, protecting the environment, and helping people climb out of energy poverty around the world, we need to stop chasing utopian energy. Instead, it’s time to be honest about all the costs and benefits of every energy source—wind, solar, natural gas, coal, oil, and nuclear.

I often highlight authors who have changed their mind over time because it requires an open mind to be able to change and because it normally indicates the author is well aware of both sides of the argument. This is absolutely the case with Brian Gitt who pursued alternative energy sources for much of his career before realizing many of their shortcomings.

As he sums it up: “For years, I chased utopian energy. I promoted solar, wind, and energy efficiency because I felt like I was protecting the environment. But I was wrong! Feeling like you’re doing the right thing doesn’t mean you are.” Hopefully this can be a wake up call for people on both sides of the energy argument by being a call “to be honest about all the costs and benefits of every energy source”. Once we do that, we can go places.

Monetary policy

As I mentioned last week, this is the week we got the report on the Fed’s balance sheet (the H.4.1. report) that includes the all-important last day of the month for June. And, according to the latest report, the Fed’s balance sheet held $5.744T in Treasuries vs $5.770T on 6/1/22. That makes the decline in June about $26B. Since the Fed only reports ending balances on Wednesday of each week, we don’t know the exact amount of decline from 5/31 to 6/30, but $26B is certainly in the ballpark of $30B.

So, the main message is the Fed is not wildly off its pledge to reduce the balance sheet as some people have been screaming about. That said, the apparent shortfall relative to targets will be something to monitor as well as progress on mortgage backed securities (MBS).

Inflation

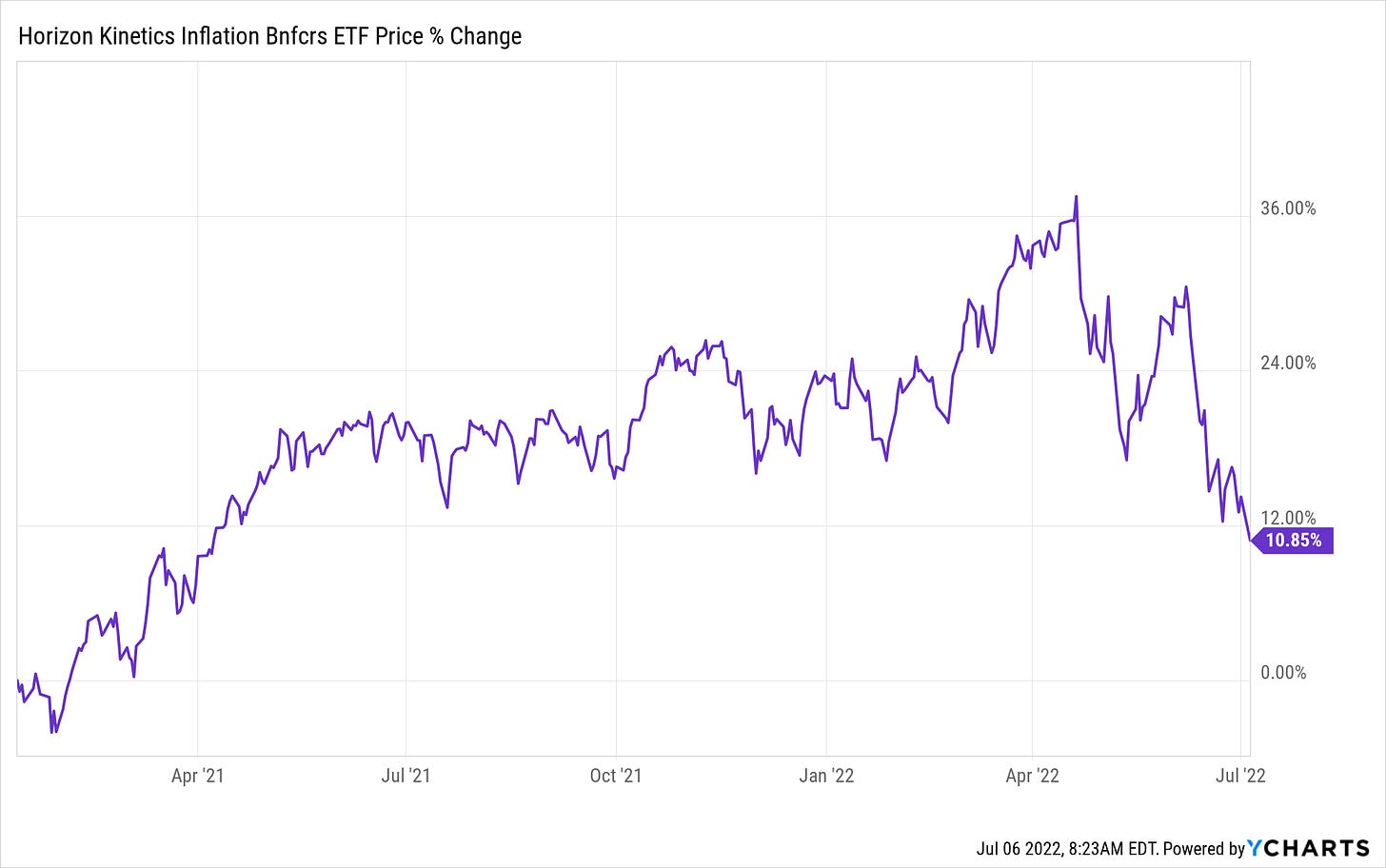

Back in early 2021, when the prospect of inflation was just starting to take hold, Horizon Kinetics introduced a new ETF, INFL, that was designed to be a useful inflation hedge. Horizon is known for its independent thinking and deep fundamental research and as such was very well placed to create such a fund. The idea was to find companies whose business models, pricing power, or other characteristics were likely to benefit from inflation. The timing of the initiation was terrific as the fund took off almost immediately - both in terms of price and assets gathered.

A year and a half later, the picture is looking very different. After reaching a peak in April, just one month after Russia’s invasion of Ukraine, INFL has suffered a decline of almost 20%. This isn’t to pick on INFL at all, but rather to highlight just how tricky it can be to insure against inflation. Even with very well researched securities, it is important to get the timing right - on both the entry and the exit. Unfortunately, signs point to the inflationary puzzle being tough to crack for the foreseeable future …

Investment landscape

The End of the World is Just the Beginning by Peter Zeihan (@PeterZeihan)

Monetary expansion is inflationary. Endemic capital shortages inject inflation directly into finance. The falling consumption of an aging population is deflationary, while breaking supply chains are inflationary. Building new industrial plant to replace international supply chains is inflationary while the process is under way, and disinflationary once the work is completed. New digital technologies tend to be disinflationary, unless international supply chains are needed to keep them running, in which case they are inflationary. Currency collapses are inflationary in the countries that suffer them as everyone shifts from cash to goods they can hoard, but such collapses are disinflationary in the countries where fleeing capital seeks succor. Commodity shortages are pretty much always inflationary, but if the shortage is caused by a supply chain break, then they can be deflationary near the commodity’s source, which means lower prices, which leads to lower production, which leads to higher prices, which are once again inflationary.*

I really like this summary of inflation in Peter Zeihan’s new book. It provides a great sense of the multiple cross-currents and opposing forces and the vast number of permutations of possible future paths. As he concludes, and I believe rightly, “the future of the . . . -flations* will be different in every region, every country, every sector, every product, and will change wildly, based on a wide variety of factors that can barely be influenced, much less predicted.”

This week and last week the inflation narrative has been losing out to the recession/low growth narrative. That is by no means, however, reason to believe the issue is settled. Instead, I expect the inflation picture to get progressively more complicated - much as Zeihan illustrates. If your head isn’t spinning from the complexity, you are probably over-simplifying the situation.

Implications for investment strategy

So what was my process? Well before I gave back capital, I used to call it the three M’s. Macro, Micro and Market. In essence I was looking for investment ideas that were supported by these three individual levels. The elevator pitch would be I was looking for a turning point in the macro, supported by what the businesses were saying (micro) and then pulling the trigger on the trade when the technicals turned in my favour.

I realise that the key factor I needed was “Motivation”.

So what do I mean by motivation? Motivation is the underlying ideology which underpins the economy. It does not change often, but it does change. After World War II, the “motivation” was for government to act as necessary to create full employment and rising wages. If this required governments to nationalise industries, then this happened.

A lot of really good investors left the business in the 2010s when everything that had worked for them in the past stopped working. This phenomenon corroborates what Russell Clark is saying here: It is not always enough to know the mechanical in and outs of the market - you also need to know the “motivation”.

What Clark describes as motivation, I would call political zeitgeist, but the specific term is not important. What is important is such an overarching force can wreak havoc on investment processes - and results. The reason is these forces change the context from which rules and norms are practiced and enforced.

For example, the motivation of the 2010s, really after the GFC, was risk. The more risk the better. The reason was monetary policy was the “last game in town”. Therefore the last, best way to reboot economic growth was by artificially suppressing capital costs and backstopping risk. This created a very favorable environment for risk-takers, and a fairly hostile environment for managers of risk.

I agree with Clark that there is a change in the zeitgeist that favors labor over capital. I would also go a bit further and say the change in zeitgeist includes an embrace of government intervention to tackle problems. The two taken together will create quite a challenge for investors.

On one hand, labor costs are likely to go up which will continue to fuel inflationary pressures. This will persistently increase costs over time and likely erode corporate margins to a significant degree.

On the other hand, intervention is extremely difficult to predict. Even if we can assume governments want to help labor, we don’t know if whatever measures are enacted will actually achieve those ends. Further, it is absolutely possible government action will make things worse. Just look at the suggestions to hand out checks in order to help offset inflation.

As a result, while it is fair to expect labor to gain ground on capital for the foreseeable future, it is also fair to expect this path to be erratic.

Thanks for reading!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.