Observations by David Robertson, 8/12/22

The high temperatures are finally starting to break, around here anyway, but investment news flow remains hot. I hope you are staying cool and enjoying the summer! As always, let me know if you have questions or comments at drobertson@areteam.com.

Market observations

The biggest news of the week was the CPI report on Wednesday which showed headline CPI declining from 9.1% to 8.5%. The market took this as an “all clear” sign and immediately jumped over 2% as the volatility index (VIX) got hammered below 20.

The narrative for now is things are good. Recession is less imminent than before the strong jobs report and inflation is moving in the right direction.

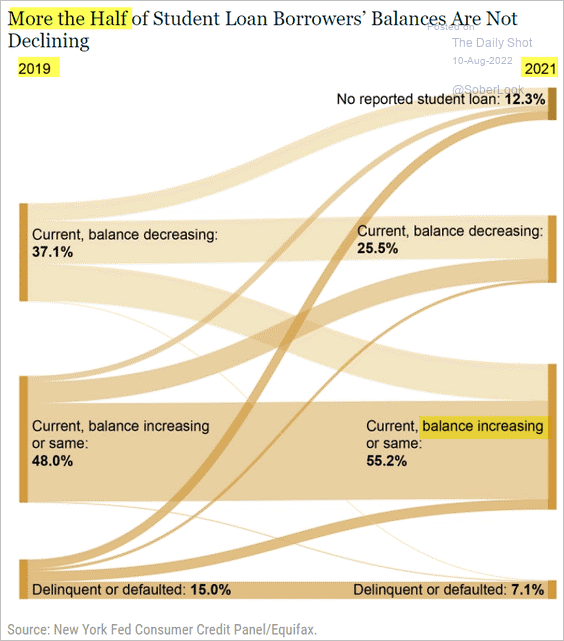

On a different note, the graph below caught my eye. Since 2019, more than half of student loan balances are not declining.

This may reveal something, or maybe not, but it does raise a lot of questions. Since 2019? Does that mean more than half of student loans stopped paying down even before Covid hit? How many of the non-decliners were doing so on a purely discretionary basis - just because they didn’t have to? Are similar patterns showing up with other kinds of debt?

Of course, it is possible the large number of deferments simply reflects a public policy initiative to ease the impact of Covid that many people took advantage of. Even if that fairly benign explanation is correct, it begs another question: Are consumers forming a habit of deferring debt repayment whenever economic hardship arises?

Energy

[FREE] Quick Context: US Gasoline Demand Data

https://www.commoditycontext.com/p/qc-us-gasoline-demand-data

Fears, and at worst conspiracy theories, about weekly [unadjusted] US gasoline product supplied (PS) data appearing lower today than the summer of 2020 are misplaced; instead, two compounding factors have tragically muddied the water.

With inflation on everyone’s mind, some striking data about gasoline demand has captured a lot of attention. Specifically, recent numbers show demand has fallen substantially which suggests high prices have indeed been demand destructive. As Rory Johnston highlights, however, the story is more complicated and less clear than that.

For one, the number being referenced for consumer gas demand is not actually gas demand, but a proxy for it - demand by gas stations. Not surprisingly, there are often short-term fluctuations between demand for gas by gas stations and by consumers. In addition, the weekly EIA reports are not corrected when better data comes in and that can distort comparisons.

This report is useful in a couple of ways. In a general sense, it is an excellent example of thoughtful and reasoned analysis. With so much data available it is easy to focus only on information which validates a certain claim. It is also easy to jump to conclusions. It is harder to broadly take a body of information in context and carefully disentangle the signal from the noise. This is a great example of the latter.

In a more specific sense, Johnston’s analysis illuminates an important part of the oil equation. Yes, demand for gas is falling due to higher prices, but it is still probably comfortably above the level in 2020. It is extremely important to have a good handle on this because it feeds right into the demand forecast for oil - which feeds into price forecasts for oil. Get it wrong and you get a lot of other things wrong too.

Data analysis

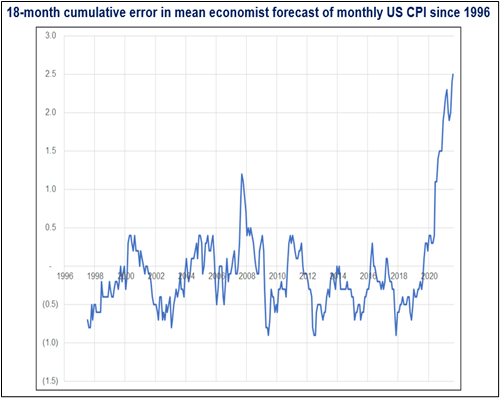

Excellent point by @donnelly_brent here. If your quest is to better understand real world dynamics, developing models can be an instructive exercise. An important part of that learning experience, however, is continuously comparing the model to actual results. When large, and or persistent errors occur, there is something wrong with the model.

That appears to be happening now with CPI forecasts, among others. As is often the case, models are developed under a certain set of conditions, but then those conditions change. People who are primarily interested in understanding the underlying phenomena and representing its behavior identify these errors and recalibrate the models. By inference, people who don’t adapt have a different agenda than figuring things out.

Inflation

Curb Your Enthusiasm on the Good Inflation News ($)

When discussing inflation it is especially easy to conflate different forces into the same phenomenon. John Authers does a nice job disentangling the key elements of ongoing inflationary pressure and relating them to this week’s CPI report.

First, the supply chain problems caused by Covid lockdowns and other associated policies are largely getting resolved. That is causing many prices increases to peak, although prices still remain at much higher levels than before Covid. While this is good news on the inflation front, it has still taken a chunk out of consumer spending capacity that won’t come back.

Second, broader measures of inflation are still showing inflation as being uncomfortably high. Whether it be the Cleveland Fed’s trimmed mean CPI or median CPI or the Atlanta Fed’s “sticky” inflation metric, they all continue pointing to higher inflation. In addition, housing is the biggest single component of the CPI and it continues going up as well.

Net/net then, inflation is coming down due to transitory factors working through, but continuing to rise due to ongoing pressures. This is especially worrisome because these are exactly the type of conditions that can lead to a wage-price spiral which makes inflation much harder to eradicate. Bottom line: We are still early innings in the inflation game.

An Update from Our CIOs: Transitioning to Stagflation

We are still in the early stages of this transition [of the economic environment], and the path will depend a lot on how central bankers play their difficult hand, so one should not be firmly committed to one scenario or another. But as things now stand, odds favor a stagflationary environment that could last for years.

In managing through this, we see them [central banks] toggling back and forth in their prioritization, trying to avoid both an unacceptably deep economic contraction and an unacceptably high inflation rate, culminating in a long period of too-high inflation and too-low growth, i.e., stagflation.

A couple of really good points jump out from this update from Bridgewater Associates that are germane to the discussion of inflation. First, markets appear to be “discounting one sharp round of tightening”, but that’s it. The assumption is that one round will do the trick and things will quickly revert to “normal”.

Bridgewater throws a bunch of cold water on that scenario. Rather, it sees a stagflationary environment that is “ripe for instability and volatility over the coming decade”. The problem is, “policy makers will be challenged to achieve their mandates with pressures on them coming from all sides”.

As a result, central banks will probably be forced to “toggle” back and forth on priorities (growth vs. inflation) in order to deflect criticism. This implies more than one round of tightening, and perhaps several. As such, this game won’t be over for quite a while. Unfortunately, none of these additional rounds are “discounted at all”. The eventual discounting of these additional tightening rounds, concludes Bridgewater, “presents the greatest risk of massive wealth destruction”. It’s coming.

THE GRANT WILLIAMS PODCAST: Episode 37, Peter Zeihan, PUBLISHED: AUGUST 8, 2022 ($)

https://www.grant-williams.com/podcast/the-grant-williams-podcast-peter-zeihan-2/

Globalization was never about economics. Globalization was a bribe. It was a security plan. When the Americans were emerging from World War 2, we realized that we lacked the military capacity to even theoretically contain the Soviets without a whole lot of help. And that meant we needed help from countries that were a lot closer and that were a lot more likely to bleed if there was a conflict. And so, they had to be induced to side with us versus the Soviets. Globalization was the bribe.

While Bridgewater makes a compelling case for stagflation based largely on a new monetary policy regime (the combination of fiscal and monetary policy), Peter Zeihan also does so but from the completely different perspectives of demographics and geopolitics. In short, globalization was a deal that served US security interests for many years after World War 2, but no longer does.

The better national security plan now, especially in the context of the Russian invasion of Ukraine and the increasing bellicosity of China, is deglobalization. As Zeihan frames it, what we are observing is something of a geopolitical OK Corral.

One of the consequences of this showdown is that it naturally leads to lower growth and more supply bottlenecks. As irksome as these things may be in the US, they are likely to be absolutely devastating for Russia and China. In the geopolitical calculus, it is a small price for the US to pay in order to retain world dominance.

An interesting element of this thesis is it provides a fresh perspective on cause and effect relationships. Inflation can be seen as a result of fiscal and monetary policy, which it is, but what if those policies are established to serve the interest of national security? If they are, stagflation will only end when the “contest” with Russia and China is won.

China

I just started reading The Asian Financial Crisis 1995-1998: Birth of the Age of Debt partly because everything Russell Napier writes is interesting and useful and partly because it seemed like an opportune time. He describes the narrative told about Asia in the mid-1990s as being one of opportunity driven by hard work and entrepreneurial spirit. As he dug into the numbers, however, what he found instead was large inflows of capital chasing growth - and in turn, causing much of that growth.

In other words, the underpinnings of success were always much more fragile than widely perceived. For some nagging reason I can’t stop thinking some of these lessons are going to be extremely useful in evaluating China today.

For those interested in digging in a bit, Adam Tooze recently posted on Substack with some great background and @michaelxpettis is a must-follow on Twitter.

Business landscape

What Is the Purpose of Your Purpose? ($)

https://hbr.org/2022/03/what-is-the-purpose-of-your-purpose

Today’s business leaders are under pressure to come up with a corporate purpose, much as they were challenged to develop vision and mission statements in the 1980s and 1990s. Although this focus on the role of corporations in the economy and broader society has many positive aspects, a risk is that speed, shortcuts, and spin may take precedence over authentic action.

But despite its sudden elevation in corporate life, purpose remains a confusing subject of sharply polarized debate. Our research indicates that a primary cause of this confusion is that “purpose” is used in three senses: competence (“the function that our product serves”); culture (“the intent with which we run our business”); and cause (“the social good to which we aspire”).

While I don’t often discuss business strategy here in a broad sense, this is an opportune time to do so. This is so partly because many companies have started up on the basis of having a compelling purpose and because many incumbent companies have tried to replicate the effort. As business conditions tighten - in the form of less widely available startup capital and higher costs - many of the kinks in “purpose” get exposed.

More specifically, HBR reports what companies often get wrong about purpose is lack of clarity about tradeoffs being made. To what extent can a company with a brilliant cause continue to inspire when it lacks the competence to do business well and is a terrible place to work (culture)? Likewise, how good can a company culture be if it wholly lacks a cause to do anything worthwhile and competence to do anything well?

None of this is to say every company should try to excel at each form of purpose, but nor should they focus on one form at the complete expense of the others. Tradeoffs must be made and excellence in one form of purpose does not eliminate the need to be at least decent with the other forms.

While this certainly provides a challenge for management, it also creates an opportunity. One of the dirty little secrets of business life is that compensation is not always based purely on merit. Rather, a great deal of compensation is often a form of bribe to entice workers to tolerate the shortcomings of a job/company. The fewer major shortcomings there are, the less you need to pay. For job seekers, however, the higher the compensation, the better chance there are some serious hazards to beware of.

Investment landscape

This is a good thread to provide some context on how to think about market action the last several weeks and going in to the end of summer. The basic position is bearish, but with the recognition that there needs to be a major countertrend rally in order to inflict maximum discomfort on bears.

This discomfort comes in the form of “max stupid”. I’m not going to detail examples, but suffice it to say, there has been a lot of “max stupid” going on (hint: meme stocks).

The main point is a bear market is often comprised of many bear market rallies - and it appears we’re in one now.

Implications for investment strategy

Rallies are in the eye of the beholder and one of the more important challenges for investors now is to determine whether stocks have bottomed and are on their way back to onward and upward or if this is a bear market rally that should be avoided.

I remain in the camp this is a bear market rally that should be avoided. I can point to lots of reasons, most of which I have discussed in previous editions, but a big one is that monetary policy remains on the trajectory of tightening. The most important, and least appreciated, part of this program is quantitative tightening (QT). Not only is QT is widely misunderstood, but it is also about to have a much bigger bite.

When stocks start going down again, it will seem mysterious and a lot of commentators will offer various explanations. The very simple explanation is the best however: Liquidity drives stocks. Withdrawal of liquidity forces the sale of stocks (and other assets).

So, in the meantime, it is useful have some ideas on how to handle this bear market rally. The first priority for long-term investors is to not get sucked in to adding risk. That’s what bear market rallies do - provide temptation.

The other opportunity for long-term investors is to use recent strength to lighten up on stocks if their exposure is too high. If you have been praying and praying for stocks to come back, view this as a gift that will save you a lot of grief later.

Finally, this rally provides an opportunity for shorter-term investors and longer-term investors with some capacity for tactical moves to identify a point at which to take on some short market exposure. Of course, this is difficult to pull off and of course, the timing needs to be right and of course, it is speculative so it’s not appropriate for everyone.

But on the other hand, a lot of investors are completely misreading the Fed and misreading the risk to stocks. This just doesn’t happen very often and as such creates a unique opportunity to enjoy disproportionate benefit by betting the other way.

Thanks for reading this edition of Observations by David Robertson!

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.