Observations by David Robertson, 8/16/24

While there was a fair amount of new economic data this week, people were mainly still trying to figure out what the heck happened the prior week. Let’s dig in.

As always, if you want to follow up on anything in more detail, just let me know at drobertson@areteam.com.

Market observations

After some initial hesitation on Monday, investors took the moderate producer price index on Tuesday as a good omen and continued to buy the dip. As Tier1 Alpha outlines, however, it is important to keep the volatility normalization in perspective:

The loss of AUM in these [volatility selling] strategies likely subtly changes market structure for the foreseeable future. Yes, we'll still see the $SPX rally as vol "normalizes," but the impossibly low realized volatility has likely retreated for good, just as we saw in 2018.

In other words, don’t expect volatility to continue sinking to ever-lower levels. Rather, watch it regularly spike, and then reset, to progressively higher levels.

The other side of the equation, i.e., stocks, is depicted by themarketear.com ($). It shows a regular crash, and then rebound, to progressively lower levels. This pattern could prove a useful outline of market activity for the foreseeable future.

In international news, Japan’s prime minister surprised people by announcing he would not run in the upcoming election. The FT ($) reports him saying, “Japan continues to face tough situations at home and abroad. It is extremely important that we tackle these issues with a firm hand”. While this probably refers in part to a “political funding scandal” that plagued his term, it also comes in very close proximity to the unwinding of the yen carry trade. The Bank of Japan being unable to raise rates to address inflation certainly counts as a “tough situation”.

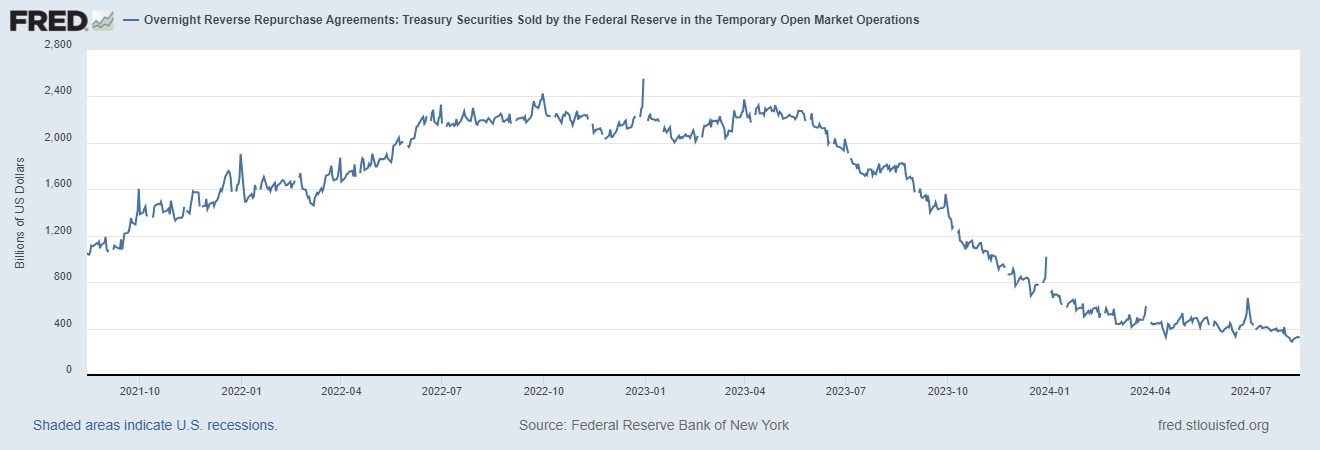

Finally, one of the ongoing stories since Covid has been the vast sums of money stored up in the Fed’s Reverse Repo Program (RRP). As shown in the graph, a huge portion of the funds have left the program, and the level has started declining again after a hiatus of a few months.

In the short-term, the exit of remaining liquidity will provide a beneficial influence for financial assets. Once the RRP is depleted, which looks to happen later this year, markets will lose an important tailwind. That could prove very telling.

Economy

Home Depot reported this week and cut its sales and profit outlook. A good summary report from zerohedge noted:

[CFO Richard] McPhail said, "Pros tell us that, for the first time, their customers aren't just deferring because of higher financing costs," adding, "They're deferring because of a sense of greater uncertainty in the economy."

"What our customers tell their pros is, 'Everything I read tells me interest rates will be lower in three to six months,'" the exec said, explaining," 'Why would I borrow to finance the project now rather than just wait a few months?'"

On one hand, it shouldn’t be at all surprising that large home projects that are often financed suffer when rates are higher. On the other hand, this whole account sounds fishy; it sounds like the CFO projecting his own wishes and concerns onto his customers.

For one, big box retailers like Home Depot have tons and tons of information on purchase patterns. They can infer all kinds of things from changes in average purchase size, frequency, trading up or down, etc. If they are relying on second hand, anecdotal accounts indicating a “greater uncertainty”, something else is going on.

In addition, the suggestion that projects are being deferred a few months until rates are lower also strains credulity. If financing costs are so prohibitive now, how much will 25 or 50 basis points matter anyway? Further, why wait just three or six months? If one waits a year or two, rates could be quite a bit lower. Why jump at the first rate cut? Why not let it play out for a while?

The retail sales report on Thursday cast even more doubt on Home Depot’s depiction of consumers. The report showed retail sales jumped nearly 1% month over month, the highest number in a year and a half. In aggregate, it’s pretty clear consumers are not struggling and in aggregate, are not deferring purchases. In this context, the musings by Home Depot’s CFO sound like a frustrated company trying to indirectly pressure the Fed to lower rates. It doesn’t sound like thoughtful insight into consumer welfare.

What this exchange does highlight is the way in which consumer welfare is gauged. Isn’t it interesting the CFO made no mention at all of higher median wages? As the economy transitions from being driven by credit growth to being driven by growth in real wages, credit growth will become progressively less important. Time for CFOs to stop whining and adjust.

Public policy

Whether it be in trade, monetary policy, or other aspects of public policy, there is a great deal of debate about what constitutes the right policy. As is so often the case, Michael Pettis offers a very different perspective and some unique insight. In a recent article he explains:

But under current circumstances, to argue whether or not the United States should subject its economy to trade and industrial policy mostly misses the point. Like it or not, the U.S. economy is already subject to aggressive trade and industrial policies, and has been for decades, only these policies have been designed at least as much abroad as they have been in the United States.

That is because in a hyperglobalized world, every country is affected by policies and conditions initiated abroad. When one country boosts its manufacturing sector relative to domestic demand, for example, as long as that country can freely export its excess production, its trading partners must reduce their manufacturing sectors relative to their own domestic demand. Supply and demand must balance globally, and that is the only way this can happen.

In other words, economic challenges are often the result of industrial policies implemented from other countries and transmitted through trade. This is the case with insufficient demand in China being transmitted to the US in the form of trade deficits that must be resolved through either higher debt or higher unemployment. The problem of America’s persistent trade deficit has less to do with America’s policies than it does with China’s.

This recognition raises an important issue. Namely, to what degree do the indirect effects of public policy measures established by foreign countries present a national security risk? In the case of China, certainly a case can be made. If China wanted to hollow out American industry in order to soften up the country for a future war, it would do pretty much exactly what it has been doing by subsidizing its own manufacturers and building an export-driven economy.

As geopolitical tensions continue to ratchet up, it is fair to expect autonomy of public policy to rise in importance. If/when this happens, the typical political reaction of cosmetic but ineffective measures will prove insufficient. Further, truly effective measures will almost certainly touch on some political taboos.

For example, one of the suggestions to address the US trade deficit is to impose a tax on capital coming into the country. While that could serve to balance trade, it would also ignite concerns and about capital controls. Similarly, China is struggling to fend off an ugly debt deflation, but is handicapped in doing so by relative high interest rates in the US and a desire to maintain a relatively strong currency. If it let the yuan devalue against the US dollar, it could pursue looser monetary policy to reflate is economy.

In recent years, trade policy, industrial policy and other forms of public policy have largely been a function of cultural wars. Going forward, there is likely to be less room for politics and more need for effective policy. This could open the door for some surprising changes.

Inflation

It was a much-anticipated week for inflation data as new reports on the producer price index (PPI) and the consumer price index (CPI) were expected to solidly confirm a rate cut by the Fed in September. The actual results did little to sway opinion one way or the other.

The PPI report rose just 0.1% in July which is consistent with targeted inflation, but the goods component spiked to 0.6% which is troubling. The CPI report came in at 0.2% for July which was mostly in line, but also makes last month’s negative number look more like an anomaly than a new trend of disinflation.

All in all, the reports provided decent news on inflation, but came far short of providing resounding support for rate cuts.

In other news, Car Dealership Guy posted an interesting update on car prices:

The wholesale vehicle market is taking a big turn…

1. Wholesale vehicle prices have been on the rise for a few weeks.

2. Retail prices could follow suit in around 4 to 6 weeks.

3. Consumers are in increasingly weak position and can’t absorb any more price increases.

While cars are just one category of things people spend money on, it is an important one. With inflation easing across many categories this summer, it looks to be building here. Interestingly, used car prices were down in the July CPI report so that looks set to change.

As always, Bob Elliott does a really nice job of capturing the situation. As he recognizes, “Just looking at the CPI and PCE reports suggests a relatively rapid deceleration in inflation in recent months after a pretty elevated start to the year.”

However, as he also shows, “But when we scan through other measures of inflation that should pick up such an acute deceleration if it is real, there aren't really any signs of such slowing.”

This tells us two useful things. One is that analyses of inflation have focused too narrowly on a couple of inflation metrics, one being CPI. A broader, more holistic view is more informative. Another is that despite optimistic expectations, inflation has yet to be vanquished.

Investment advisory landscape

The financial services industry has been one of the most ardent marketers of “new and improved” products throughout its history. While there often is something new and/or improved in the services offered, what rarely changes are the excessively high fees attached to those services.

In the latest iteration of this exercise, a number of providers have developed and promoted “liquid alternative” strategies. These typically emulate some of the more exotic types of investments normally reserved for institutional and ultra-high net worth clients such as hedge funds, private equity, venture capital or commodity trading funds.

The good news is the these products often offer at least some of the functionality of their institutional brethren. The bad news, as Bob Elliott explains, is same ole, same ole - many of the new products are still burdened with high fees:

Blackrock keeps losing money from their multi-billion dollar multi-strategy products because the fees are too damn high given the anemic returns. Part of a broader trend from liquid alts investors sick of high fee mutual fund products to lower fee ETFs.

Investment landscape

The S&P 500 Carry Trade

https://kevincoldiron.substack.com/p/the-s-and-p-500-carry-trade

No other equity market comes close to this hyper-liquid ecosystem and this makes the S&P 500 the global epicenter for risk taking and risk hedging. S&P 500 volatility is therefore a proxy for volatility of risk assets everywhere.

Being liquid means having access to cash. For levered traders that means being able to quickly and cheaply sell what they own in exchange for cash. In The Rise of Carry we document how the world has grown ever more levered over time. Each year more actors need more liquidity. The S&P 500 ecosystem has grown in a symbiotic fashion to provide it.

Given the recent ructions caused by the unwinding of the Japanese yen carry trade, it is a great time for an update from the co-author of the book, The Rise of Carry, which I highly recommend for understanding today’s markets. The book describes how carry trades work and what the implications are. In short, carry trades are leveraged trades that “make money when nothing happens, when volatility is stable or falling.” Conversely, they fall apart quickly when volatility rises. The trading in the yen and Japanese stocks a couple weeks ago certainly fit the profile.

Much of the debate the last week and a half has focused on whether the yen carry trade unwind is completed. This misses a bigger point. As Coldiron explains, the “world is awash” with carry trades of all sorts. As a result, we should expect a lot more of these dustups whenever volatility spurts higher for whatever reason. For longer-term investors, this isn’t about whether the yen carry trade unwind is nearly completed or not, but rather that it is indicative of the still-existing minefield of other carry trades across the investment universe.

Relatedly, another big point that Coldiron highlights, and that has been passed over by other commentary, is that the biggest carry trade of all is the S&P 500. As a result, the unwinding of the S&P 500 carry trade will look very much like that of the yen carry trade, i.e., it will be quick and steep. Also, because the S&P 500 is much larger, it will be a much bigger event that will have sweeping consequences globally.

There are two things to keep in mind regarding this carry regime. One, because the S&P 500 is so large and so important, there will likely be public policy measures to mitigate the impact of carry crashes in the future. As a result, I don’t expect a catastrophic market event in the near future. I do expect a downward ratcheting motion as various carry trades unwind and volatility creeps higher.

Two, much like in the 2008 financial crisis, however, public policy interventions will merely forestall the ultimate extinction of the carry regime, they will not eliminate it. Ultimately, the carry regime gets blown up by systemically higher volatility, and that usually arises from higher inflation. This means any longer-term bet on stocks will eventually involve a detour through a pretty ugly phase that wipes out all the carry trades. This will quite likely involve the investment horizon of most of today’s retirees. Good to know.

Implications

Not surprisingly, there are some extremely important implications that arise from the S&P 500 carry trade. Because the S&P 500 is so large and liquid, its volatility “is a proxy for generic risk asset volatility”. This means the risk cannot be diversified away. As Coldiron puts it, “When S&P 500 volatility spikes there is literally nowhere to hide”.

One implication is that as S&P volatility spikes, “the value of having cash goes up”. With no meaningful way to offset S&P volatility, cash becomes an extremely important (and valuable) asset.

Another implication of the S&P representing generic risk asset volatility is that there are exceptionally few ways to diversify away from it. This means virtually every diversification scheme currently in use will prove completely impotent when volatility spikes. At that time, real estate, credit, alternatives, emerging markets, and virtually every other asset class will move down with the S&P.

In addition, because volatility is the catalyst for carry crashes, it becomes increasingly important to identify potential future sources of volatility. In a shorter-term sense, there are seasonal patterns to volatility and it is common for volatility to rise in the late summer and early fall months.

Longer-term, and on a broader scale, there are multiple potential sources of volatility. Debt and demographics have been exerting their influences, inflation is much more of problem today, market structure is more fragile, and politics and geopolitics present multiple opportunities for volatility spikes. Meanwhile, investor expectations still gravitate to relative calm. There seems to be quite a bit of room for disappointment.

Finally, and especially for those of us who have spent a lot of time and effort analyzing stocks, Coldiron reveals the S&P 500 as something other, and much more than an aggregation of individual stocks. It is a global proxy for generic risk volatility. As he puts it, “This isn’t your grandfather’s S&P 500. It’s the most important carry trade in a world awash with them.” Ironically, a lot of grandfathers own it.

Note

Sources marked with ($) are restricted by a paywall or in some other way. Sources not marked are not restricted and therefore widely accessible.

Disclosures

This commentary is designed to provide information which may be useful to investors in general and should not be taken as investment advice. It has been prepared without regard to any individual’s or organization's particular financial circumstances. As a result, any action you may take as a result of information contained on this commentary is ultimately your own responsibility. Areté will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Some statements may be forward-looking. Forward-looking statements and other views expressed herein are as of the date such information was originally posted. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Areté disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

This information is neither an offer to sell nor a solicitation of any offer to buy any securities. Past performance is not a guarantee of future results. Areté is not responsible for any third-party content that may be accessed through this commentary.

This material may not be reproduced in whole or in part without the express written permission of Areté Asset Management.